Compiled & translated by: TechFlow TechFlow

Guest: Mike Ippolito, co-founder of Blockworks; Host: David Hoffman, Bankless

Key points summary

David Hoffman and Mike Ippolito discussed why 2025, while setting new all-time highs, seemed exceptionally challenging, and why this tension is crucial for 2026. They believe the crypto industry is entering a phase similar to the "2002 dot-com boom"—a period of diminishing speculation, rising fundamentals, and accelerated consolidation. The conversation covered the reasons for Ethereum's potential resurgence, the possible struggles with Bitcoin sentiment, the actual performance of prediction markets and perpetual contracts, and the key considerations for builders and investors as the crypto industry moves from hype to genuine value creation.

(This video is based on 27 predictions made by Mike, but it does not cover all of them; it only selects some key points for in-depth discussion.)

Summary of key viewpoints

- I hope that cryptocurrencies can have a greater positive impact on the world, and I'm tired of the crypto industry being labeled as "wild west" and "scam".

- Bitcoin will underperform gold in 2026.

- 2026 will be a very good year for DeFi.

- 2026 will be Ethereum's year, while Bitcoin may have a bad year, Solana will have a relatively quiet year, and Hyperliquid will face challenges.

- 2025 will be both the best and the worst year; we did not see the bull market that everyone had been hoping for.

- The cryptocurrency market is gradually becoming more rational and fundamentally based, moving away from its past wild west-like, irrational state.

- If you can identify projects with compound growth potential and choose the right agreements, there will be good opportunities in 2026 and beyond.

- In 2026, we are likely to continue to see consolidation trends across several key categories. Over the next three years, "survival is key" will be the dominant theme in the industry.

- The builders must be prepared to be as creative as possible, think big, and strive to achieve their goals. They will either be acquired or emerge victorious and consolidate their respective fields.

- 2025 and 2026 are the years for strategic planning. Without a frenzy, no one will suddenly become very rich because of cryptocurrencies.

- During a cycle, the best time to persevere is when people feel bored, tired, or worn down by the market.

- 2026 will be a year of consolidation for several key categories; another theme is the fusion of the stock market and cryptocurrencies.

- If there's one DATS worth watching, it's probably Tom Lee's.

- Traders want to be able to complete all their cryptocurrency and stock transactions on the same platform.

- Ethereum is more like a chain for asset issuance, while Solana is more like an on-chain price discovery venue for DEXs.

- Quantum computing is not just a cryptocurrency issue; it will have an impact on society as a whole.

- Centralized exchanges will expand downwards or upwards, depending on their strategic structure. We will see more acquisitions in the future, with both launch platforms and centralized exchanges actively participating.

Looking back at 2025: The best and worst year

David : Looking ahead to 2026, how would you assess or summarize the state of the cryptocurrency industry in 2025?

Mike : In my opinion, 2025 will be both the best and the worst year. The main reason is that we didn't see the price bull market that everyone was expecting. Although Bitcoin and some major cryptocurrencies hit all-time highs, the overall performance was below expectations, especially for investors in fringe Altcoin.

Ethereum and Solana broke all-time highs at different times, but the magnitude was very small, which is confusing overall. This may be the most difficult year for cryptocurrency investing.

I believe the crypto industry is more meaningful now than ever. A key theme this year is "cognitive dissonance." Many will find this situation illogical: the US regulatory stance on cryptocurrencies seems to have shifted to a "bear hug," we've seen the emergence of many brilliant projects, and we've gained a clearer direction. Logically, this should drive up asset prices, but the market hasn't followed suit.

The reason behind this is that the cryptocurrency market is gradually shifting from its past wild west-like, irrational state to a more rational and fundamentally-based one. This change was predicted before, but it's only now truly beginning to manifest. Many excellent projects in the market are constantly improving, yet their prices continue to fall. This phenomenon may become a theme in 2026, as the market gradually shifts from speculative valuations to fundamental valuations.

While many projects on the market are excellent, their pricing has been consistently underwhelming. I believe this will continue to plague investors until 2026. However, if investors can identify projects with compound growth potential and choose the right deals, there will be good opportunities in 2026 and beyond.

David : In a sense, while we did see all-time highs, the market didn't really feel the bullish atmosphere. Furthermore, 2025 didn't attract a new group of cryptocurrency investors. In fact, all cryptocurrency investors have been in the space for at least three years. This means that market participants' expectations for the industry had already formed, but those expectations were shattered this year. We are becoming more and more mature. Things are no longer the Wild West; the market's expectations for the Wild West haven't been reflected, and I think this has led to the sluggish market activity.

Mike : I'd like to give the audience an analogy, one that everyone likes to use in the context of the internet industry. I think we're currently in a phase similar to Web 2.0 in late 2001 and early 2002. During the dot-com bubble, there were many bold ideas, and everything seemed possible. But there were clearly problems with path dependence and time planning at the time, leading to over-construction of much infrastructure.

Recently, I've heard a lot of discussion about AI-driven technologies, especially regarding GPU usage. The situation with dark fiber optics between 2001 and 2002 was the exact opposite of today's GPU situation. Back then, the scale of submarine cable and bandwidth construction was enormous, but the problem was that this construction was severely overdone, ultimately leading to a massive bear market.

At the same time, a new generation of builders is entering the market. They recognize existing infrastructure and, based on it, seek new creative opportunities, building businesses that can be passed down through generations. This phenomenon illustrates an important theme—consolidation. In 2026, we are likely to continue to see consolidation trends across several key categories. Over the next three years, "survival is key" will be the dominant theme in the industry.

My advice is that builders should be prepared, be as creative as possible, think big, and strive to achieve their goals. Frankly, there are essentially two strategic options for builders: either be acquired, or succeed in their field and integrate. These are currently the two most viable strategic paths.

Looking ahead to 2026

David : I think 2025 and 2026 are very important years for strategic deployment, especially for Ethereum. As for Ethereum, I think its L1 protocol will perform quite well this year, for example, zkEVM, which is developing faster than we expected.

Perhaps we've already achieved a 1-2 year lead in zkEVM, which allows us to significantly reduce block generation speed by 2026. By the end of 2026, I expect Ethereum's L1 protocol to be better positioned to capture growth opportunities in areas such as tokenization and Wall Street.

Furthermore, I think we can talk about the Clarity Act, which hopefully will be passed in 2026, allowing the entire cryptocurrency industry to better position itself. Even Solana deserves mention. Solana has finally received integration with Firecanver technology.

I believe 2025 and 2026 will be quiet years of setup; there won't be any frenzy, and no one will suddenly become incredibly wealthy because of cryptocurrencies. We are collectively working to put all the elements on the table in the right way, preparing for potential value capture in the coming years.

Mike : There's usually a certain vibe when people talk about these things: yes, these things will eventually happen, it's inevitable. But at the same time, people also feel frustrated because they can't get 100x returns on Altcoin.

However, I would argue that, in the long run, building real wealth now may be easier than it was in 1995. In the past five years, almost no one has made money in the cryptocurrency space. The reason is that it's an extremely difficult investment environment.

Aside from Bitcoin, Ethereum, and Solana, almost all other assets are more like trading instruments than investment targets. I believe we've finally entered an environment where truly sustainable growth can be built, and the winners who can achieve compound growth will reap enormous rewards.

David : In the midst of a cycle, when people feel bored, tired, or worn down by the market, it's actually the best time to persevere. If you can weather those difficulties, you'll be in a favorable position. I remember in 2019, the situation was that almost everyone involved in the Ethereum ecosystem was only focused on Bitcoin and Ethereum.

For example, if you hold on and Ethereum positions itself reasonably, you can benefit from the DeFi summer. And you just need to weather the bear markets of 2017, 2018, and 2019 to get there, because everyone else has already left. The result is that the market becomes incredibly rich in opportunities. My feeling is that this will happen again because people are being worn down by the market, and the market isn't generating investor enthusiasm.

Mike : We will be testing or overturning some long-held notions in the industry. In the past, the crypto market was a relatively irrational, very early market, where creating real value was not a prerequisite.

In the past, it wasn't clear which ideas were right and which were wrong, but I believe that by 2026, many things will be clearly decided. I also think 2026 will be a year of integration for several key categories.

Furthermore, I believe another theme is the convergence of the stock market and cryptocurrencies. Cryptocurrencies will evolve towards a more fundamental and real-value-based approach, while the stock market will also adopt some characteristics of cryptocurrencies. I think this convergence has already begun.

Investor relations in the crypto space

David : This is a current topic—investor relations are becoming increasingly important. Investors will demand standardized financial disclosures. The community management of investor relations may merge with traditional stock markets, and traditional stock markets may also realize this and think, "We need to do the same."

Mike : I think people need to build a mental model. When a business doesn't have a publicly traded financial instrument, it only has one product. But once it launches a publicly traded financial instrument, like a token or stock, the business founders actually have two products: one is the business, and the other is the financial instrument. This means you need to constantly tell the market the story of this asset.

You need narrative management; businesses can't expect "just build it and they'll come."

I've also observed how the stock market operates, and some aspects are very well done, such as standardized financial reporting systems (like GAAP). But at the same time, there are also some things that seem very outdated.

A few years ago, CoinShares, a European-listed company, used Twitter Spaces to release quarterly earnings. Now, we're starting to see protocols and companies like EtherFi adopting a similar approach. Vlad Tenev stated that they are rethinking Robinhood's investor relations, planning to make it more community-driven. Therefore, I think the crypto space will adopt certain principles, such as standardized processes, but in the long run, the stock market may realize this and begin to rethink how it operates.

David : We've seen Coinbase and Robinhood hold Apple-style product launches this year. We need to take control of our narrative. This approach allows us to directly reach people interested in Robinhood. I recall Coinbase holding at least a few similar events, such as the Base launch, where they directly introduced the content to their audience and explained why these products are worth investing in.

Mike : I think this is a big change this year, and I have two related predictions. I think there will be a lot of discussion about GAAP accounting standards this year.

This joke illustrates the significant flexibility in accounting practices. Even among the many data providers in the crypto space, standards are highly inconsistent, with different companies reporting vastly different revenue figures. This necessitates a universally accepted standard to clarify how revenue is handled, how costs are calculated, and how this data is aggregated into the cash flow statement.

Of course, accounting practices offer a degree of flexibility, but there are also certain rules. However, for cryptocurrency companies, the burden remains too heavy, making it extremely difficult to meet such standards. While some lightweight solutions may emerge, I anticipate a lot of discussion about GAAP accounting standards this year, but the industry as a whole is still far from reaching that level.

There has been much discussion about dual-token equity structures. My long-term prediction is that in 90% of cases, this structure is simply not feasible. It's merely a legacy structure originating from the SEC under Gary Gensler, and even predating the J. Clayton era. Essentially, it's a remnant of an attempt to engage in some form of regulatory arbitrage.

We've already seen many public disputes, such as the Aave case. I think such disputes will continue. Meanwhile, I think Uniswap deserves high praise in this regard. They've taken a very brave and difficult step. I don't expect all these issues to be resolved by 2026. We might start hearing some discussions, and some protocols might quickly follow Uniswap's lead. But I think most protocols will likely remain hesitant.

However, I do believe that investors will begin to publicly question these protocols and may develop a negative view of those that employ dual-class and token structures.

The Evolution of Income Discussions

David : The discussion about revenue will gradually shift towards durability and quality. Companies that can generate more predictable revenue will gain market recognition for the first time. Enterprise software will become popular in the crypto space. Could you elaborate?

Mike : I'm glad to see that our industry is starting to focus on revenue discussions. Not all revenue is created equal. In the stock market, certain types of revenue are given higher valuation multiples, and this is usually related to the quality of the revenue.

So, how sticky is the revenue? Is the revenue repeatable? Does 80% of the revenue come from a single customer? Is the revenue highly cyclical? All these different characteristics will be broken down and analyzed to assess the business moat.

We've often made the mistake of overvaluing the peak of cyclical income. For example, a counterintuitive phenomenon is that cyclical stocks are actually cheapest when they appear most expensive, and most expensive when they appear cheapest.

I believe investors will gradually stop trusting this unreliable income model, which is actually a good thing. This will drive the entire industry to focus more on sticky and high-quality revenue streams. This revenue model is actually quite rare in the crypto space.

Future Development of DATS

David : Fifth prediction: DATS will essentially do nothing. Some companies may try to make acquisitions in the infrastructure sector and attempt to transform into operating companies, but these efforts will not actually be very successful.

Mike : I do believe DATS will face considerable challenges in 2026. However, I think the only possible exception is Tom Lee's DATS. He has an extremely high level of credibility on Wall Street. I also believe this is closely related to the natural recovery of Ethereum's core metrics.

I also think you'll see some DATS try to transform into revenue-generating operating companies.

However, I believe many cryptocurrency companies are experiencing something similar. Some of the most high-profile categories once enjoyed huge speculative premiums, but as they attempt to transition to more fundamental models capable of creating real value, they must reassess their performance against new metrics. The performance charts for most DATS in the market don't look promising.

However, I still believe it will take some time for the market to start rewarding this structure. There's a completely different story to tell beyond "I am Soul plus lots of extra Beta ETH plus extra Beta".

VC investment trends

David : Your sixth prediction is that VC investment will be weak. It is predicted that investment will decrease slightly in 2025, from $25 billion in 2025 to $15 billion to $20 billion.

Mike : It is indeed declining, with 2021 being a local maximum. We are still recovering from much of the excess from the past. Venture capital is not behaving exactly like traditional models in equity financing and crypto.

In the crypto space, this logic doesn't necessarily hold true, because you can quickly gain liquidity, and very few token projects generate genuine long-term value. In fact, the opposite is true. The earlier you get in, the less risk you take. But I think the current situation is that with so many tokens available, investors have much higher expectations for projects than before.

Frankly, I think speculative money is shifting to other areas. The responsibility now lies in truly creating value, and winners will continue to win. In major categories like prediction markets, exchanges, lending protocols, and DEXs, the strategy will shift from "Uniswap has taken off, and now there are Uniswap clones on Solana, Avalanche, and Sui; I'm going to fund these projects and flip these tokens" to "I'm going to bet on Uniswap because it has a moat; they will continue to win because the competition is becoming more difficult and the barriers to entry are higher."

Prediction Markets: The Victory of Existing Firms

David : When it comes to prediction markets, Kalshi and PolyMarket will continue to dominate. Other DEXs will try to enter, but no new players have been able to make a real breakthrough. I think existing players will win here, and Robinhood will hold the majority of the prediction market share.

Mike : I also have a prediction related to prediction markets, namely that they will continue to be successful in 2026, but I expect sentiment to shift. I think there will be a lot of criticism regarding sports betting, and as a cultural phenomenon, it may receive negative coverage. Nevertheless, overall trading volume will continue to grow.

I believe the concept of a "know-it-all" app will become very powerful. I think Coinbase, Robinhood, Hyper Liquid, and some Asian exchanges are all considering this direction. We've seen SEC Chairman Paul Atkins mention similar "know-it-all" apps like Alipay in China multiple times. For example, we've seen Robinhood leverage Kel She's advantages, but frankly, they have far more leverage in this arrangement than Kel She did. Furthermore, Coinbase also plans to enter the prediction market space.

I admire Coinbase, but I think Robinhood has a stronger focus and execution in product development. At the end of the last cycle, Coinbase made many different attempts in multiple directions. For example, they launched an NFT project similar to OpenSea, but it wasn't successful. I think they are indeed trying to consolidate these attempts and focus their efforts. That's why I'm slightly less optimistic about Coinbase's prospects in the prediction market space, but I think Robinhood's capabilities should not be underestimated.

Perpetual Contract

David : My ninth prediction is that Hyperliquid will continue to perform well, but its growth may slow, while the perpetual contract market will become highly competitive. New trading platforms, as well as existing exchanges like Coinbase, will successfully capture some market share. My tenth prediction is that although equity perpetual contracts will receive widespread attention in 2026, their development will be relatively slow. They are expected to outperform DEXs on centralized exchanges, and perpetual contract trading volume is not expected to exceed 5%.

Mike : Perpetual contracts are indeed a very hot area, but it's difficult to pinpoint its competitive advantage, and the competition is fierce. DEXs already have very strong existing competitors, such as Binance's advantage in CEXs.

Regarding perpetual equity contracts, while there's a lot of anticipation, I think their widespread adoption and adoption may still take time. For traders, this approach is very intuitive, as they may not want to trade cryptocurrencies and stocks separately on multiple platforms, but rather want to complete all transactions on a single platform.

However, I believe changing the habits of many people will not be easy. Furthermore, frankly, I still trust crypto trading platforms less than I do traditional ones. Therefore, I think this shift may be much slower than expected. My prediction is that this sector will still be in its early stages of development until 2026.

Ethereum's resurgence

David : Eleventh prediction: Ethereum's Layer 1 will experience a resurgence in 2026 and dominate the real-world asset issuance market. Why do you believe Ethereum L1 will experience a resurgence?

Mike : I think 2026 will be Ethereum's year, while Bitcoin may have a bad year, Solana will have a relatively quiet year, and Hyperliquid will face challenges.

I have a personal theory that nothing is truly universal. I think we're starting to see a divergence between Ethereum and Solana, with Ethereum becoming more of a chain for asset issuance and Solana becoming more of an on-chain price discovery venue for DEXs. I think Ethereum just went through a very difficult period, but it has pulled through. I believe Ethereum has found a use case that truly fits the market.

As for Bitcoin, I think the price may need to adjust here for a while. However, Bitcoin also faces some real challenges, such as quantum computing. I believe quantum computing will be a major threat to Bitcoin this year.

I believe Bitcoin will underperform gold this year because gold typically performs better in these economic environments. We are currently facing a depreciation trend, but this depreciation is more like an economic slowdown or even stagflation, and gold tends to outperform gold during periods of monetary easing.

Bitcoin may perform even worse in stagflation years. The outperformance of gold, a natural correction in Bitcoin's price, and the threat of quantum computing could all contribute to a depressed sentiment for Bitcoin this year.

As for Ethereum, as a base layer, it supports many modular builds. Its mistake lies in path dependence and capacity requirements, which ultimately leads to a very complex situation, making it difficult to determine whether to build on L1 or L2.

Nevertheless, Ethereum still demonstrates strong market fit. Especially in the RWA-related field, many developers want to build on Ethereum, making it very attractive in this important category.

I think Solana will face some challenges this year, given its poor performance in the Memecoin space and competitive pressure from Hyperliquid. I believe 2026 will be a quiet year of building for Solana, with little hype and no significant changes.

As for Hyperliquid, I think they will face some difficulties against well-organized competitors like Robinhood, but will continue to compete with other projects around the world. Maintaining market share will be very difficult.

The quantum threat facing Bitcoin

David : Your 17th prediction is that quantum computing will become a very real threat and will attract widespread attention this year because Bitcoin Core developers may delay responding.

I believe the discussion about quantum computing has already begun and will become increasingly real. This is because quantum computing itself isn't actually a direct threat in 2026; the concept of quantum mechanics is the potential threat.

Some experts believe the first quantum computer capable of having a real impact on the crypto industry is expected to emerge around 2032. That's six years from now. So, I predict we'll see a surge of discussion about quantum computing, but the real quantum threat may not materialize until the early 2030s.

Mike : I think this concern manifests as market forward-thinking. Even though 2032 is still a long way off, it's not that far off either. Bitcoin's price may experience a mean reversion. When price adjustments happen, people usually look for narratives to explain them. Therefore, I think the market may use quantum computing as an excuse.

However, I don't usually worry too much about these long-term threats. Risks almost always come from unexpected places. People really shouldn't be complacent about such long-term threats, but should seek information from more qualified expert sources than myself.

David : One of my predictions for 2026 is that quantum computing will not just be a cryptocurrency issue; it will have an impact on society as a whole. Other sectors, such as the internet, can use these updates to address the quantum threat. So it won't just be the crypto industry that's paying attention to quantum computing; society as a whole will be focused on this issue.

Integration of blockchain infrastructure

David : Prediction #20: The end of this new layer of blockchain transactions is finally here. The network effects of Ethereum and Solana will become increasingly apparent, leading to a reassessment of their valuation multiples. Why do you think this layer of blockchain transactions is dead?

Mike : The demand for block space is decreasing. We've over-built block space, so the current demand isn't that high.

Furthermore, the barriers to entry have become extremely high. New general-purpose chains require payments to service providers, block explorers, and various integrations, all of which are very costly, making it extremely difficult to attract market attention. Therefore, I believe that launching these general-purpose ecosystems (whether L1 or L2) is now more difficult than ever before.

Existing businesses benefit whenever entry barriers rise, typically achieving compound growth. As these fees accumulate to token holders through burning mechanisms or staking, the cyclicality of these fee flows decreases, and they are viewed as a very durable, high-quality, annuity-like dividend.

I think what's happening here is very similar to what happened in 2018 and 2019. Back then, there was a lot of hype surrounding custody, prime brokerage, and decentralized finance lending, but revenue didn't actually materialize, ultimately leading to consolidation. I think a similar situation will occur again.

I think overall, people tend to think that these ecosystems should be vertically integrated and centralized under one platform.

Furthermore, I believe these new vertically integrated entities will likely operate in a similar manner to Red Hat's role in the Ethereum ecosystem. People may no longer view these new vertically integrated L2 platforms as an ecosystem, but rather as tools. Developers will choose to use zkSync's full-stack solution, or Optimism's full-stack solution, or Arbitrum or similar platforms. I think L2 frameworks are the natural winners here, but it will be a war of attrition, and ultimately, this integration will produce some huge winners.

Based on this, there are two other potentially controversial predictions.

First, I think Base may experience some ups and downs in 2026. People will continue to question its place within Coinbase's business model. Furthermore, Base needs to find a true product-market fit.

While I've made negative predictions for many sectors, I think we can jump to one area I'm very bullish on: DeFi. I believe 2026 will be a very good year for DeFi, primarily due to the influx of RWAs. I see the Ethereum mainnet completely dominating this market. From an L1 perspective, I think 2026 will see the rise of the RWA cycle.

This is very similar to a very common strategy in traditional finance, such as leveraging safe assets to obtain higher returns. I believe this trend will extend to government bonds and other high-yield assets.

However, bringing RWA on-chain faces many challenges. Circular operations are far more complex than atomic assets. Therefore, I believe some clever protocols will find solutions.

Furthermore, I believe this is a very important year for Vaults in the DeFi space. I think credit funds will be a significant part of the story. Credit funds will solve several problems. For example, liquidating RWAs is a very unique challenge because RWAs, unlike atomic assets, cannot be traded within a single block.

I believe that as more stablecoins flood the blockchain, many struggling venture capital firms are likely to launch credit funds in the coming years. This will all be driven by Vaults. Modular infrastructure like that developed by Morpho, I think, is the right direction.

Nevertheless, I dare not predict that Vaults' assets will grow rapidly from the current $5 billion to $20 billion, due to the uncertainty of the current interest rate environment. However, I predict that Vaults' assets will grow significantly, perhaps from the current $5 billion to $15 billion by the end of next year.

David : The core elements of DeFi (Ethereum, DeFi, Morpho, modular risk Vaults) are on-chain yields and leveraging to increase actual returns—these are behavioral patterns we are already familiar with. Perhaps we need some new assets—tokenization.

Mike : I think stablecoin trading volume, or stablecoin market capitalization on Ethereum, will perform well. The main reason is that I see a lot of product-market fit around capital formation that brings new types of yield assets onto the chain. I think this series of events I've described will happen on Ethereum, which is part of why Ethereum is having such a successful year.

Enterprise Chain: A Fiery Start and a Cold End

David : You mentioned that enterprise blockchains will be a major topic in 2026, but the results may be mixed. For example, Tempo Chain will cause a sensation, but then gradually decline. Circle's Arc Chain will basically not gain any adoption, and Robinhood Chain's trajectory will be similar to Base. In addition, four to five new enterprise blockchains are expected to be announced, including BlackRock's blockchain launch.

Mike : We've moved from the assumption that "everything should be modular" to that "distribution is the only thing that matters." Companies with distribution capabilities will vertically integrate the entire supply chain.

Therefore, I predict that next year will be a significant year for enterprise blockchains. Robinhood will want to control the entire technology stack, while Tempo will attempt to launch its own L1 chain.

I believe the crypto space will go through a similar process. Many companies may try to launch their own L1 chains, but ultimately realize it's extremely difficult. They may be unwilling to maintain the entire ecosystem or keep up with all the dynamic changes in consensus mechanisms and DAOs. Therefore, they will move towards L2 infrastructure. I think enterprise chains may achieve some success, but they won't become independent L1 chains.

That's why when I heard that Tempo could achieve many great technical features, I felt these weren't important. If all the value is focused on distribution, and settlement and the DAO don't have much value, then why focus on those?

However, Tempo will face challenges in the long run because their branding issues have led them to be perceived as profit-maximizing entities. I think people can look back at Visa's history to see how this organization evolved from a DAO-like structure.

As for Circle, I don't think the whole stack concept makes sense for them, and I don't see how they'll drive their activities. I think USDC should continue to develop on-chain, but I'm not sure if they'll be able to migrate their activities to their own chain. As for Robinhood, I think they'll try to launch their own chain, but may ultimately make another choice. If Robinhood decides not to build its own chain and instead continues its activities on Arbitrum, that would be very beneficial for Arbitrum.

End

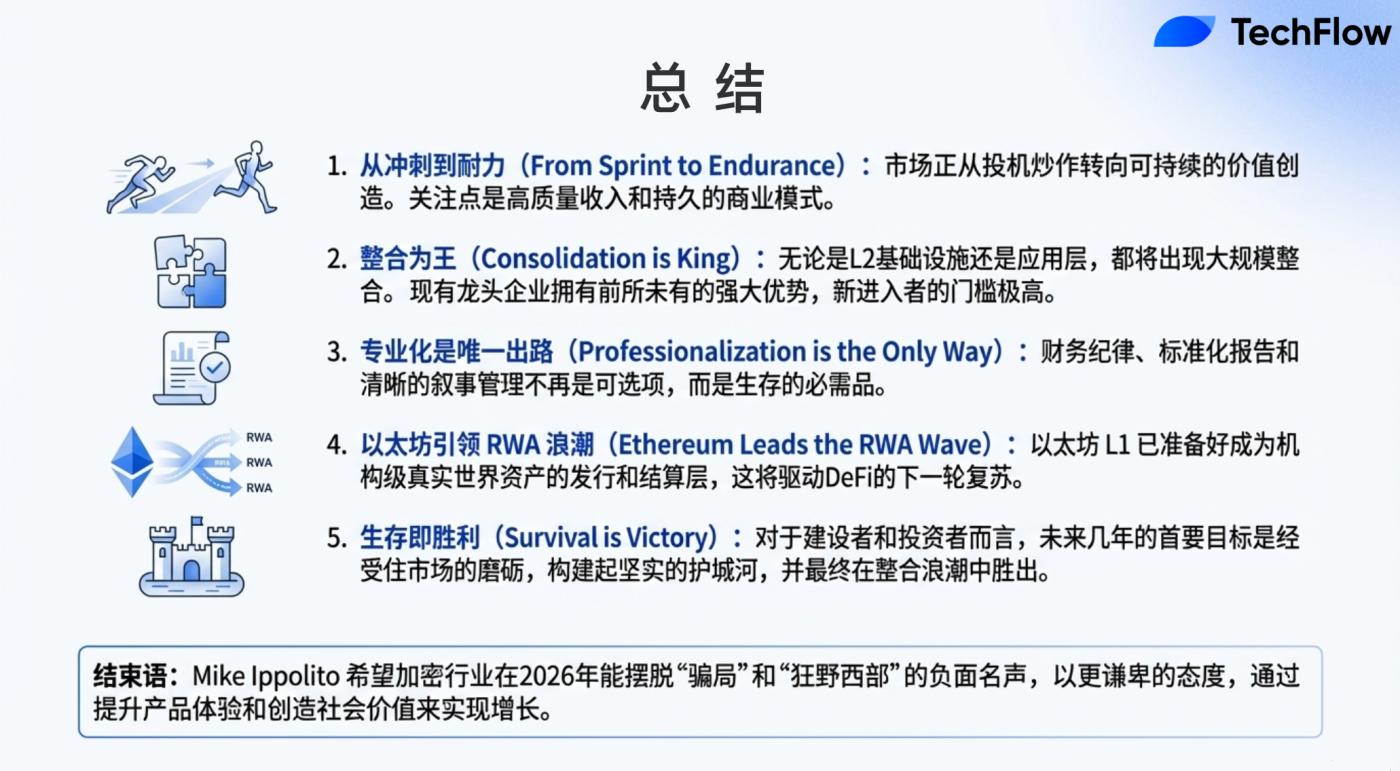

Mike : I hope cryptocurrency can have a greater positive impact on the world, and I'm tired of the crypto industry being labeled as a "wild west" and a "scam." Our negative image as an industry remains very strong; it's time for a change.

I find it fascinating to observe the development of artificial intelligence and cryptocurrencies. I'm a user of AI, but I can't say the same about cryptocurrencies. Therefore, I believe this is a crucial moment; we've passed through a speculative boom, and now we must truly focus on creating value.

The crypto industry has scoffed at some of the principles of Web 2.0 in the past, but I think we shouldn't be like that anymore; instead, we need to be more humble. I believe we are moving in the right direction.

I believe ICOs will experience a slow recovery, and projects like MetaDAO interest me, but I'm unsure if this is the final form. I think centralized exchanges are more likely to take action. I anticipate more similar acquisitions in the future.

Centralized exchanges will expand downwards or upwards, depending on their strategic structure. I believe we'll see more acquisitions in the future, with both launch platforms and centralized exchanges actively involved.