Bitcoin dominated ETF inflows after launch in early 2024.

But that lead is no longer expanding.

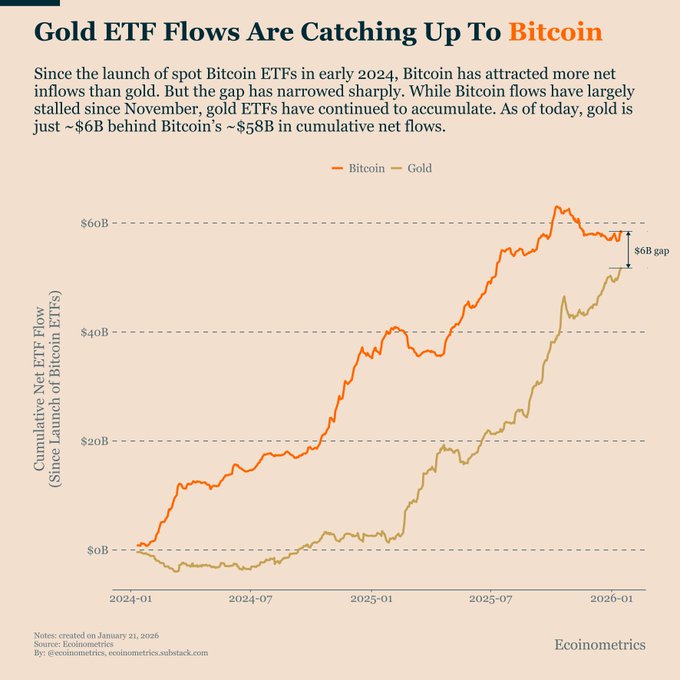

While Bitcoin ETF flows have largely stalled since November, gold ETFs have continued to attract capital. The result is a rapidly narrowing gap: cumulative gold inflows are now just ~$6B behind Bitcoin’s ~$58B.

This isn’t a price story. It’s an allocation story. As macro uncertainty has picked up, capital has increasingly favoured defensive exposure through gold rather than expanding risk via Bitcoin.

The key takeaway is not that Bitcoin demand has disappeared, but that it has stopped leading. In a defensive macro environment, Bitcoin is still competing with gold for capital, and right now, gold is winning that rotation.

Until Bitcoin-specific demand reasserts itself, upside

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content