Survival is more important than gazing at the stars.

Written by Eric, Foresight News

Recently, Solana made a joke about Starknet, criticizing an L2 server with only 8 daily active users and 10 transactions per day for having a FDV of $15 billion.

While in hindsight, this seemingly sarcastic joke was intended to grab attention and lead to Starknet's token STRK being listed on Solana via NEAR Intents, the criticism of Solana wasn't unfounded. The proliferation of L2 tokens in the past two years has indeed resulted in a traffic crisis.

The most compelling recent example is the news on January 8th that Zero Network, the L2 network incubated by Web3 wallet company Zerion, had stopped producing blocks for over three weeks, yet it seemed to have no impact. The official response was even more nuanced: Zero Network stopped producing blocks on December 19th, 2025, but only announced on December 23rd that it would fix the issue. The last time the Official Twitter posted original content was in May of the same year.

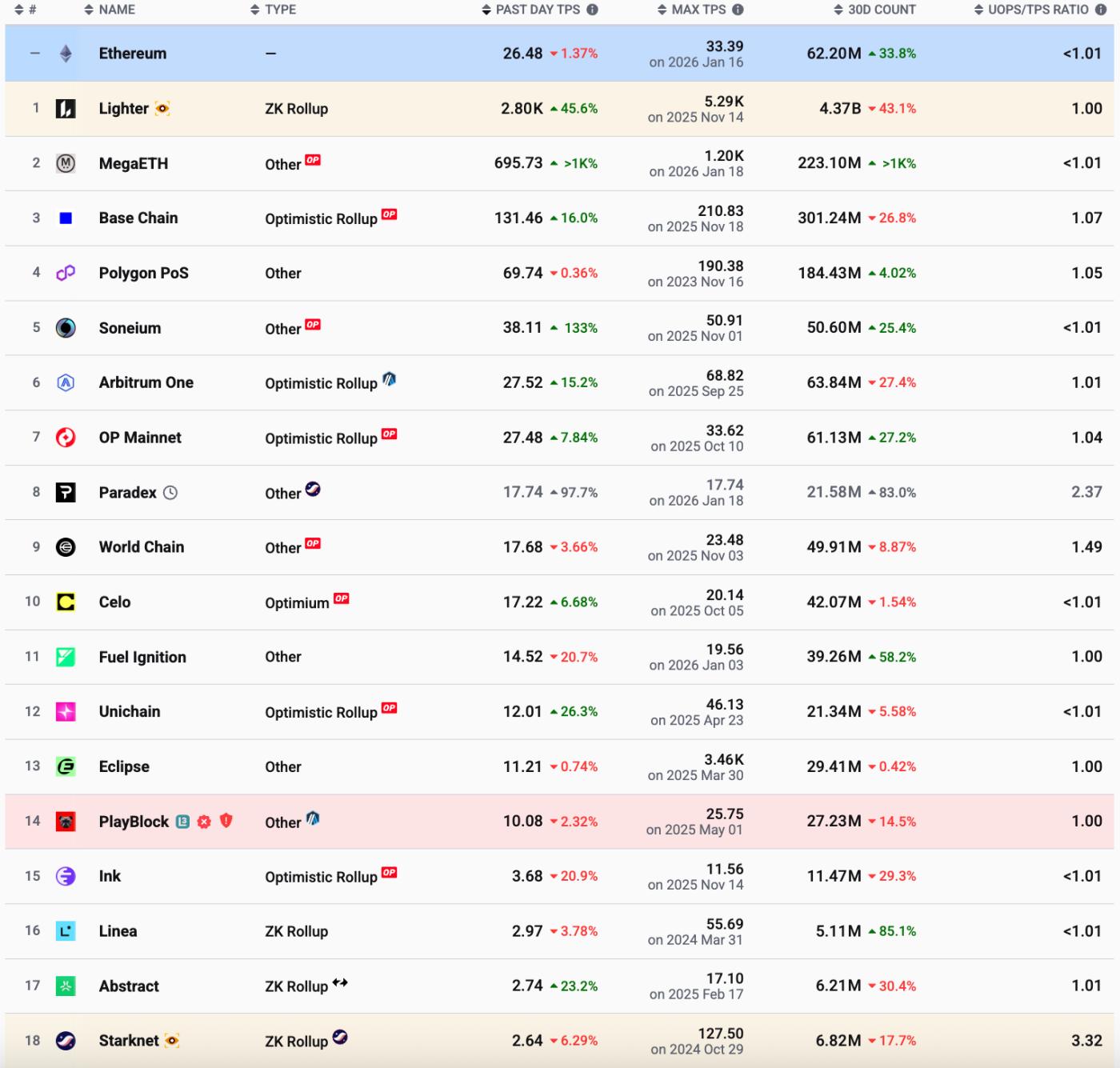

Nevertheless, the claim that only 8 users executed 10 transactions in a single day is an exaggeration. According to L2BEAT statistics, Starknet's TPS yesterday was 2.64, meaning there were over 200,000 transactions on the network in a single day. However, this number is still ridiculously low; even the Ethereum mainnet's daily transaction volume is 10 times that of Starknet.

Data shows that, apart from Base and Polygon, even Arbitrum and OP Mainet's TPS among general-purpose L2 cryptocurrencies did not significantly exceed Ethereum's. Linea and Starknet's TPS were less than 3. Other cryptocurrencies not shown in the screenshot include Scroll, with a TPS slightly exceeding 1, and ZKsync and Blast, with TPS less than 1.

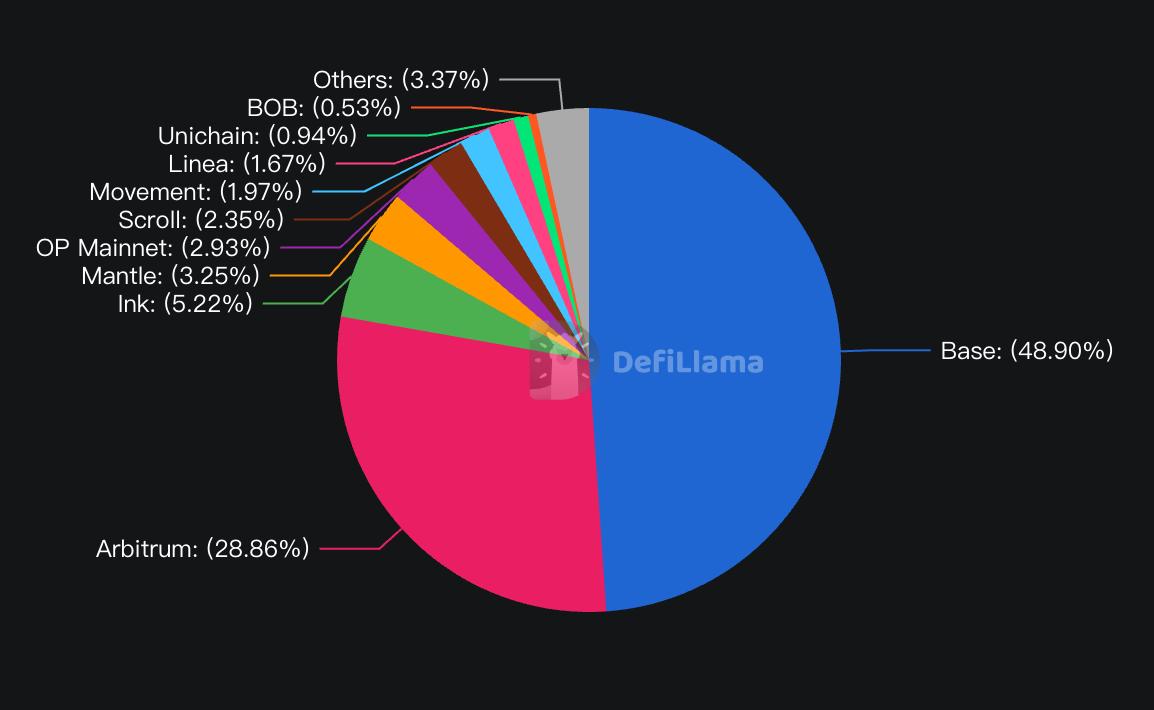

According to TVL data compiled by DefiLlama, Base and Arbitrum together account for nearly 80% of all L2 TVLs. The remaining L2 companies not classified as Others have a combined valuation of nearly $10 billion in private financing, but their total TVL is less than $2 billion.

Looking at the earnings from the agreements, only the top 7 earners in the past 24 hours earned more than $1,000. Daily earnings in the triple or even double digits may not even be comparable to the interest some large investors receive by keeping their money in the exchange.

These data vividly illustrate the current predicament of L2: Given the lack of application narratives, expecting a killer application that doesn't require an application chain and is willing to operate on a general-purpose L2 platform has become a pipe dream. Regarding the question of how to find an application scenario that can provide stable transaction data, L2 platforms have found the same answer: cryptocurrency cards.

Pavel Paramonov, founder of cryptocurrency research firm Hazeflow, has criticized cryptocurrency cards, arguing that they are not truly "cryptocurrency payments" but rather fiat currency payments, and therefore do not genuinely promote cryptocurrencies. However, he also noted that many projects or public chains launch cryptocurrency cards out of necessity, with the sole aim of keeping users within their ecosystems.

Many cryptocurrency cards currently offered by exchanges are "custodial" cards. Users' assets are held in custodial accounts with the exchange or an institution, and settlement is handled by the exchange, the off-ramp company, and the card issuer during transactions. The settlement chain for these cards is typically Tron, Solana, or even the slightly more expensive Ethereum. This is because these chains have a large enough stablecoin asset pool, and some cards reduce costs by using batch settlement instead of transaction-by-transaction settlement. For institutions, liquidity and stability may be more important than the low cost of L2 cryptocurrencies.

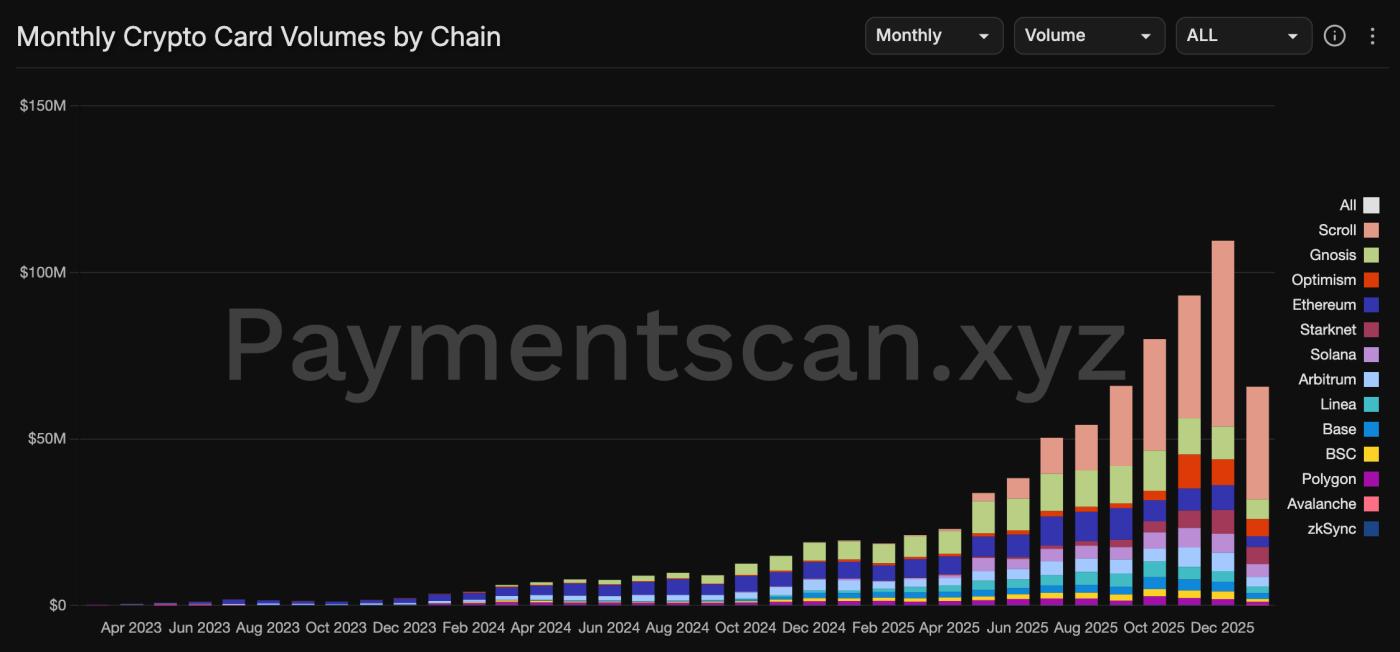

The crypto cards favored by L2 developers are various forms of "non-custodial cards." Before using such cards for payment, the assets reside in the user's own wallet, and each payment is settled separately, which can effectively increase on-chain activity. Typical examples include Scroll (an Etherfi card settlement chain), Gnosis, and Linea (a MetaMask card settlement chain).

In September 2024, Etherfi announced that its payment cards would use Scroll as a settlement layer. Scroll would enable Etherfi to achieve "gas-free transactions" and provide higher cashback rates through SCR token subsidies. In addition to the traditional direct use of assets on Scroll for spending, the Etherfi card also has a special mechanism: users can borrow fiat currency for payments using interest-bearing assets on Scroll as collateral. Supported assets include eETH, weETH, wETH, and eBTC.

Gnosis, a sidechain that has long lacked presence, has successfully made a comeback in the payment card market, with its Gnosis Pay card primarily operating in Europe. Users can connect to non-custodial wallets such as MetaMask and Gnosis Safe through the Gnosis Pay App. When making a purchase, Gnosis Pay converts the user's wallet's supported assets (partially Euro, British Pound, and US Dollar stablecoins) into Monerium's Euro stablecoin EURE, and then converts it 1:1 into Euros for payment.

MetaMask's encrypted cards use ConsenSys' L2 Linea as the primary settlement network, and also support Solana and Base. Before making a purchase, users need to deposit assets (various USD or EUR stablecoins) into their MetaMask wallets. During payment, the user's assets are transferred to an off-ramp service provider, converted into fiat currency, and then paid to the merchant.

Because of the transaction-by-transaction settlement nature of non-custodial cards, each user transaction corresponds to an activation contract to verify the remaining asset amount and on-chain asset transfer. In this way, L2 can maintain a certain level of on-chain activity by relying on the absolutely high-frequency and sustainable scenario of payments. According to Paymentscan data, Scroll has captured a considerable market share in card payments through its partnership with EtherFi and SCR subsidies. However, this data is not entirely accurate, as many card payments may not involve on-chain transfers but rather settlement within the institution. Nevertheless, it is an undeniable fact that L2 has found a practical application scenario through payments.

It's not just emerging L2 blockchains that are anxious; Polygon, which can't be strictly considered an L2 blockchain, recently shifted its strategic focus to payments. By the end of 2025, non-USD stablecoin transfers on Polygon exceeded $11.1 billion, with the new stablecoin XSGD reaching $2.24 billion and the Australian dollar stablecoin AUDF reaching $2.46 billion. Furthermore, Polygon has become one of the main chains used by Stripe for stablecoin payments; its announcement on January 13th of the $250 million acquisition of cryptocurrency payment infrastructure Coinme and blockchain development platform Sequence further underscores its "all-in" approach to payments.

After being bombarded with various concepts, L2 systems have come to terms with reality. While they are still looking forward to novel applications, their immediate priority is to survive by leveraging their low-cost and high-efficiency features and utilizing payment methods.