In the last 24 hours, the market has plundered $679 million, leaving 198,830 people with nothing – a truly brutal loss. While the main bulls have been wiped out, Bitcoin and Ethereum are currently trending downwards across the board. However, after this wave of decline broke through key support levels, a second test of the bottom on the 1-hour chart should bring the 1-hour chart to a reasonable level.

Next, we need to see when the 2-hour/4-hour charts will resonate during the low-level consolidation. At this moment, the 5-minute/15-minute charts are in the process of oversold rebound. There is no need to chase the highs or lows at this time. What we need to do now is to quickly eliminate the risk of the weekend orders!

BTC

After Bitcoin broke below its daily ascending channel pattern, I was waiting for it to break through and hold above the important support level of 90,000. However, it experienced a false breakout and continued to fall. Going forward, shorting on rallies is the best strategy, as the bulls are too weak.

Without clear positive macroeconomic factors, it will be difficult for large funds to drive up the market. The overall strategy is to sell on rallies, and it is unlikely that the market will reach 90,000.

Trading strategy: Short at around 88721, with a stop loss above 90,000.

ETH

ETH broke below the wedge pattern and then made a false break below 2800, but the closing price did not fall below 2800, so it's not considered a true break below 2800 and is currently safe. For an upward move, it must return above 2900; otherwise, it won't be able to rise significantly.

The short-term resistance zone is currently at the 2925 level, while the short-term support is between 2830 and 2799 (monitor closely and trade quickly). The long-term support level is between 2652 and 2560 (1:2 limit order, valid for 30 days). Other internal levels will be tracked separately.

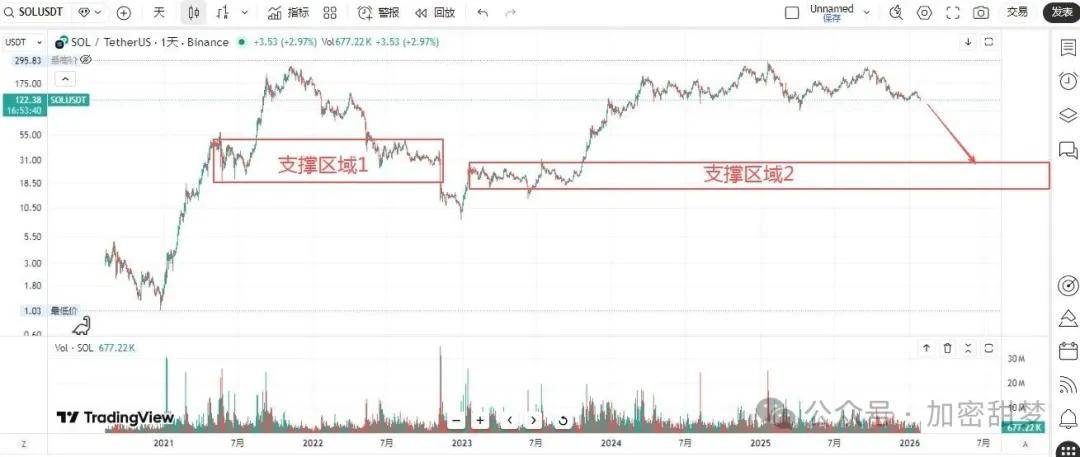

SOL

SOL has fallen even more sharply than I expected! It has already tested the key support level. Now we'll see if it can form a bottom at the current position. If it does, it will rebound to the 138-142 range; otherwise, it will go down to the 2-series $SOL.

PLAY

The technical structure of PLAY patterns is irregular, but local price movements show signs of strong control by major players. Regardless of future price action, the major players currently have a need to distribute their holdings. Avoiding chasing rallies is a key operational skill; here are a few key points (see chart for details):

1. The current short-term support level has been reached; short positions should be closed for profit.

2. Pay attention to the price resistance effect in the range of 0.077~0.082 (please refer back to the previous text).

3. The large deviation rate may lead to a spatial pullback. The first effective support level is at 0.065~0.061 (reached by a slow decline). If there is a sharp drop, the support level to consider is 0.054~0.048.

SKR

SKR prices continue to decline and are unlikely to perform well in the short term. In addition, the overall market has been weak recently. If you are holding spot SKR, it's not a big problem, but please do not trade futures contracts.

However, the total pledged amount is still rising, currently reaching 3.9B, accounting for 68.4% of the total circulating supply (5.7B). So the circulating supply is actually getting smaller and smaller. Let's wait for the big players to continue accumulating shares.

If you are bullish on the market in the long term and have already staked your coins, I suggest you pay less attention to the price in the near future and wait for it to consolidate.

CHZ

This year is the World Cup year. As the leading stock in the sports sector, CHZ often experiences demand far exceeding supply during the World Cup. We should pay close attention to its future actions. Currently, we plan to temporarily see if there is an opportunity at 0.04.

Market conditions change rapidly; entry and exit points should be determined based on real-time market conditions. Follow the trend after a breakout! Regardless of your confidence level, strictly adhere to stop-loss and take-profit strategies! That's all for today! Follow me to stay on track! If you're unsure about future market strategies, follow Sweet Dream on WeChat: RFGH8689