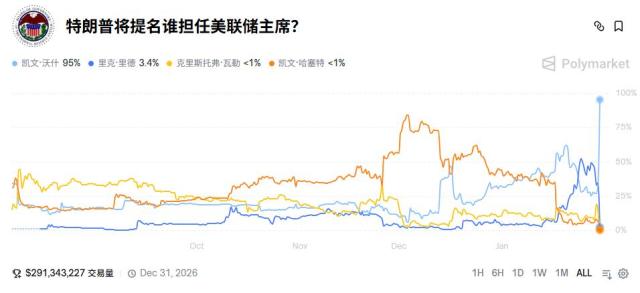

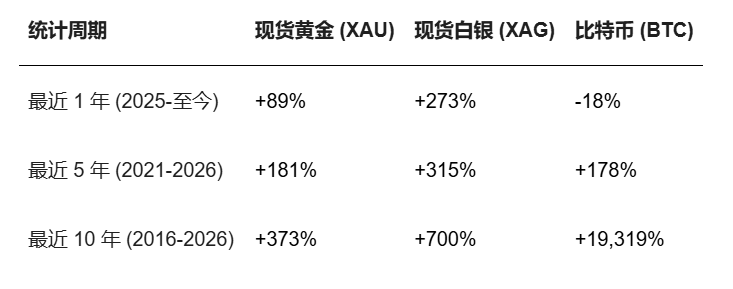

[1/2] [Crypto/TradFi Merge Update] 2026-01-29 16:00 (Beijing Time) ━━ Important News ━━ 1. The Federal Reserve kept interest rates unchanged at 3.50%-3.75%, and its post-meeting statement was cautious; the cryptocurrency market experienced a brief decline. The FOMC held rates steady, which the market interpreted as continued vigilance regarding inflation; after the decision, BTC briefly fell below $88,000, triggering a short-term concentrated liquidation (mainly by long positions). Precious metals continued their strong performance, with gold and silver prices maintaining high volatility. (BlockBeats | TechFlow) 2. The U.S. SEC clarifies its rules on "tokenized securities/tokenized stocks": tokenization does not change the security's nature; "synthetic stocks" will be strictly investigated. The SEC emphasized that tokenized securities remain subject to federal securities laws, and their issuance and sale require registration or exemption; it also noted that many retail-oriented "equity tokens" may only offer indirect or synthetic exposure, and regulators will increase scrutiny. (CoinDesk | The Block) 3. Reuters: The White House plans to convene a closed-door meeting with bank and crypto industry executives to push forward the Clarity Act and focus on "interest/yield" clauses for stablecoins. The report states that the meeting aims to push both sides to reach a compromise on "whether stablecoins can provide users with interest or other benefits"; crypto institutions believe that the yield mechanism affects customer acquisition and product competitiveness, while banks are concerned about deposit outflows and financial stability risks. (BlockBeats | Foresight News) 4. The Central Bank of the UAE approved the first USD stablecoin, USDU, under the PTSR framework. USDU is issued and managed by Universal Digital (regulated by ADGM FSRA), with reserves held 1:1 in a protected account within the UAE. Partner banks include Emirates NBD, Mashreq, and Mbank, and Aquanow participates in global distribution cooperation, aiming to improve the efficiency of digital asset settlement. (CoinDesk | BlockBeats) 5. The UK government requires banks not to refuse services outright because of "crypto business". The UK government instructed banks and financial institutions to assess crypto companies/clients that meet regulatory requirements on a case-by-case basis and not to deprive them of basic banking services simply because of their industry characteristics; at the same time, it emphasized that AML/CTF obligations will not be relaxed. (BlockBeats | PANews) 6. Russia plans to establish comprehensive crypto regulation: the framework is aimed to be completed by July 2026 and take effect in July 2027, and retail limited participation will be allowed. Reports indicate that it will differentiate between "accredited/non-accredited investors". Ordinary investors may need to pass a test and have an annual purchase limit of about $4,000. Unregistered exchanges/illegal intermediaries may face fines or even criminal liability, and anonymous cryptocurrencies may be restricted. (Foresight News | DLNews) 7. European Central Bank: Will accept DLT-issued assets as eligible collateral for the Eurosystem. Starting March 30, the Eurosystem will accept tradable assets issued in the CSD using DLT as collateral for credit transactions, provided that they meet the collateral eligibility and management requirements and can be settled in a T2S-connected settlement system. This will be implemented in phases. (Foresight News) Market Analysis 1. Glassnode: Key support levels for BTC are $80,700–$83,400; $96,500 is the "bull-bear dividing line" for short-term holders' costs. The report states that if the price falls below $83,400, it may retreat further to around $80,700; the options market is leaning towards a defensive stance (bearish skew is increasing, short-term implied volatility is rising), while the 30-day moving average of ETF selling pressure is close to zero, and there are signs of improvement in spot buying on the Binance side. (TechFlow | BlockBeats) 2. Deribit: A large number of BTC/ETH options are about to expire on January 30. BTC is under pressure around $90,000. BTC and ETH options with a notional value of about $9.697 billion will expire at 16:00 on January 30. Among them, BTC has about $8.387 billion, with a maximum pain point of $90,000; ETH has about $1.31 billion, with a maximum pain point of $3,100. (Foresight News) 3. US Spot ETF Fund Flows: BTC Slight Net Outflow, ETH and SOL Net Inflow. On January 28th (Eastern Time): BTC spot ETF saw a net outflow of approximately $19.65 million (IBIT saw a net outflow of approximately $14.18 million, while FBTC saw a net inflow of approximately $19.45 million against the trend); ETH spot ETF saw a net inflow of approximately $28.1 million (ETHA contributed approximately $27.34 million); SOL spot ETF saw a net inflow of approximately $6.69 million. (SoSoValue | Foresight News) 4. CoinDesk: Stronger gold, silver, and oil prices may boost inflation expectations, diverting attention from BTC and posing downside risks. CoinDesk points out that rising precious metals and crude oil prices may boost inflation expectations and make rapid interest rate cuts more difficult, causing macro trading to take over again; traders also warn that continued strength in gold may divert market attention from Bitcoin. (CoinDesk) ━━ Project Updates ━━ 1. Bloomberg: Bybit plans to launch a bank-like account called "MyBank," positioning itself for institutional custody and RWA tokenization, and is exploring a US market entry. "MyBank" plans to support fiat currency balances such as USD and provide IBANs, allowing transfers in/out of 18 currencies, with an expected launch in February 2026; fiat currency can be directly exchanged for crypto assets upon arrival. Bybit also plans to launch a new custody product for institutions that supports RWA tokenization and is exploring the possibility of entering the US market and a long-term listing. (Bloomberg | Foresight News) 2. Optimism pilots OP buyback program: Over the next 12 months, it will use 50% of Superchain sorter net revenue to buy back OP. The buyback is expected to begin in February, and the proceeds will go into the Optimism Collective treasury. The subsequent use of these proceeds (staking/incentivizing/burning, etc.) will be determined by governance.

This article is machine translated

Show original

Telegram

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content