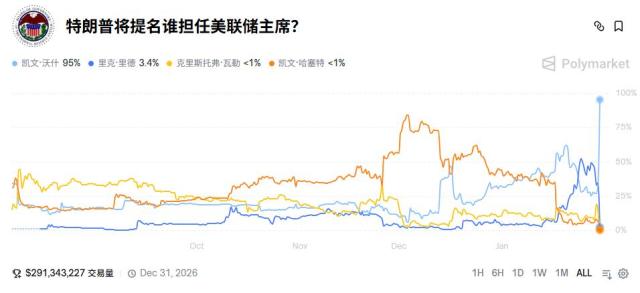

[1/2] [Crypto/TradFi Merge Update] 2026-01-30 16:00 (Beijing Time) ━━ Important News ━━ 1. Crypto market plunge triggers chain liquidations: Approximately $1.68-1.75 billion in liquidations occurred within 24 hours, with long positions dominating. BTC once dropped to about $81,000 and ETH fell below $2,700; the total liquidation across the network reached about $776-778 million within 1 hour, with the largest single liquidation occurring in HTX's BTC-USDT, at about $80.58 million. (BlockBeats | Coinglass | CoinDesk | Decrypt) 2. Trump is close to announcing the next Federal Reserve Chairman: Kevin Warsh's probability on Polymarket has risen to 90%+. Macroeconomic and crypto assets fluctuate with the news. Many interpretations suggest that Warsh's emphasis on "monetary discipline/Federal Reserve independence" may push up expectations of tightening real interest rates and liquidity, thereby amplifying volatility in risky assets. The White House schedule shows that Trump will sign an executive order and attend a meeting, but it is still unclear whether it will directly involve the nomination. (The Block | CoinDesk | BlockBeats | PANews) 3. Binance adjusts SAFU fund: Approximately $1 billion in stablecoin reserves are planned to be gradually converted into BTC within 30 days, and regular checks/audits will be conducted. Binance stated that if the market value of SAFU falls below $800 million due to BTC volatility, it will be replenished to $1 billion; multiple media outlets have also mentioned strengthening disclosure and audit arrangements. (Binance Blog | CoinDesk | The Block) 4. U.S. SEC Chairman Paul Atkins: Supports allowing cryptocurrencies into 401(k) status under "prudential protections"; "crypto innovation exemption" may not be introduced in the short term. Atkins stated that exemptions related to tokenized securities and DeFi are being handled cautiously and may await legislative progress from Congress; it also disclosed that traditional financial institutions have expressed concerns about the potential economic impact of these exemptions. (Odaily | PANews) 5. Hong Kong Financial Services and Treasury Bureau: Will implement a crypto asset reporting framework and promote the automatic exchange of cross-border crypto tax information by 2028. Hong Kong will promote the implementation of a crypto asset tax information reporting and cross-border automatic exchange mechanism to strengthen compliance and information sharing. (Odaily) 6. The U.S. Department of Justice finalized the seizure of approximately $400 million related to the Dark Web money mixer Helix. The Department of Justice stated that it has legally obtained final ownership of the relevant assets, which are alleged to be linked to the illegal flow of funds on the Dark Web. (The Block | Decrypt) 7. The U.S. Senate is advancing the CLARITY (Crypto Market Structure) Act, but partisan differences remain significant. The Senate Agriculture Committee advanced the relevant sections along a 12-11 partisan line, and further coordination with other committees and the Senate as a whole is still needed. (Foresight News | Cointelegraph) Market Analysis 1. Risk sentiment and funding conditions weakened simultaneously: The Fear & Greed Index dropped to 16 (extreme fear), and data on significant net outflows from spot ETFs showed that the BTC spot ETF saw a net outflow of approximately $818 million in a single day, and the ETH spot ETF saw a net outflow of approximately $156-178 million in a single day. The BTC ETF has recorded net outflows for several consecutive days. (CryptoRank | Foresight News | TechFlow) 2. Tightening liquidity explains the decline: Arthur Hayes stated that dollar liquidity has decreased by approximately $300 billion in recent weeks, while TGA has increased by approximately $200 billion. Hayes believes that the government may be stockpiling cash in advance of a potential shutdown (pushing up TGA), and the drop in BTC is not surprising given the tightening liquidity. (X/Arthur Hayes | PANews) 3. Hedging activity intensifies in options trading: Monthly notional expirations approach $9 billion, BTC DVOL rises to 44+, and IV increases. The biggest pain point for BTC at maturity is around $90,000, and for ETH it is around $3,000; the rise in implied volatility indicates increased hedging demand, but the overall sentiment is "cautious rather than panicked". (TechFlow | GreeksLive/X | Odaily) 4. Deleveraging may not be over: forced liquidations were almost entirely driven by long positions, and funding rates remain positive.

This article is machine translated

Show original

Telegram

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content