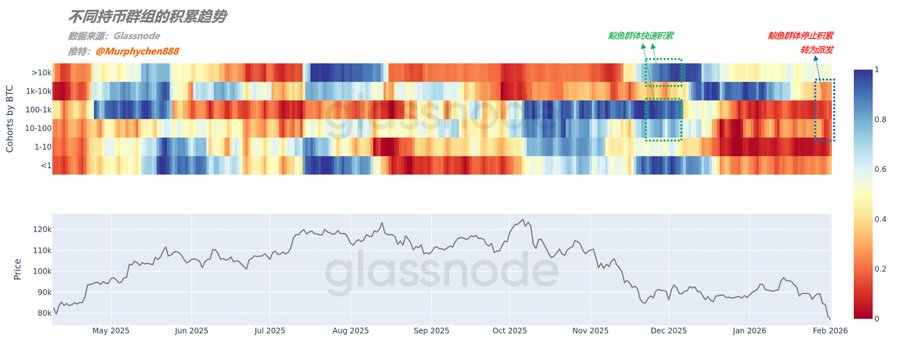

The behavior of whale cohorts has shifted from early accumulation and hesitation to now halting, or even distributing. This signals that major demand-side players are exiting the market at a pace you can literally see (see Chart 1). When whales start accumulating, it might not immediately show up in price action, but they’re absorbing excess supply and helping stabilize or boost market sentiment. However, this recent shift could have an even deeper impact on the market. (Chart 1) We’re seeing the same story in the AD-CDD indicator. Back on January 25, AD-CDD was at 0.2 (see reference), but now it’s dropped to 0.13 (Chart 2). That’s almost at the “low demand zone” we’ve seen in previous bear markets (the red shaded area). In other words, demand is still shrinking with no sign of a solid bounce yet. (Chart 2) So, from a macro perspective, there’s still no data to support a short-term reversal for BTC. If you’re not a high-risk taker, it’s wise to stay cautious about trying to catch the bottom. But remember, no reversal doesn’t mean no bounce. If you’ve got the risk appetite and healthy cash flow, you might consider playing the bounce if we see an oversold signal—just make sure to set your stop-loss. I’ll keep you posted on any bounce signals and expectations—make sure you’ve got notifications on. ------------------------------------------------------- This is for educational and communication purposes only, not investment advice!

This article is machine translated

Show original

Murphy

@Murphychen888

01-25

每一枚BTC被花掉时,都会“销毁”它累积的持有时间(CDD);币越久没动,一动,CDD就越大;为了尽量降低交易所内部转账、噪音行为的干扰,我们对原始CDD进行处理,不看“某一天有多大”,而只看“是不是高于长期平均”;高于均值,记为 1;小于均值,记为 0。 x.com/Murphychen888/…

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content