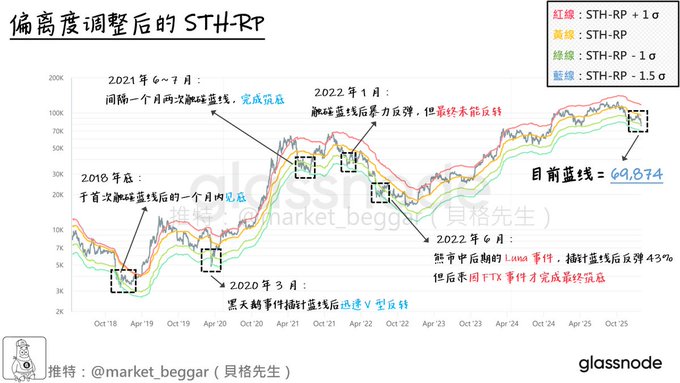

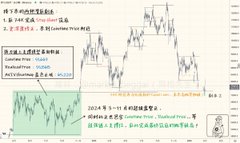

“The Power of the Blue Line”: Let’s Talk BTC’s Key Support Below & Historical Recap 📊 As mentioned in yesterday’s analysis (see quote below), BTC has now formed fresh equal lows around the $74.5K level—a clear liquidity cluster. This makes me believe there’s a high probability we’ll revisit $74.5K soon. Continuing from that, let’s dive into the most relevant model-based support near current price 👇: The chart uses a “Deviation-Adjusted STH-RP” indicator. Quick refresher on the logic: ➡️ Calculate average and standard deviation for STH-MVRV since 2018. ➡️ Multiply STH-RP by “STH-MVRV average ± n standard deviations.” ➡️ Data post-2018 is used because STH-MVRV has shown clear mean reversion since then. 🟥 Red line = STH-RP × (STH-MVRV avg + 1 SD) 🟨 Yellow line = STH-RP 🟩 Green line = STH-RP × (STH-MVRV avg - 1 SD) 🟦 Blue line = STH-RP × (STH-MVRV avg - 1.5 SD) 📖 Full model explanation: x.com/market_beggar/status/190...… // 📊 Current blue line is at ~$69,874. Why highlight this? Simple: as I said yesterday, if we play out the “74K Stop Hunt” scenario, the wick low during that liquidity sweep is very likely to tag the blue line (🔵), creating a strong confluence. To help you understand how the “blue line” has performed historically, I’ve marked every time BTC hit this level since late 2018. Here’s a brief rundown: 1️⃣ End of 2018: First touch of blue line, bottomed out within a month (cycle low). 2️⃣ March 2020: Black swan COVID event—BTC nukes to the blue line, then V-shape recovery. 3️⃣ June–July 2021: BTC tagged the blue line in both June and July, forming a local bottom before new ATH. 4️⃣ January 2022: Dropped to blue line, then bounced up to 46%, but ultimately became a dead cat bounce. 5️⃣ June 2022: Luna crash—BTC dumped to blue line, chopped for ~2 months, maxed at 43% bounce, but FTX event dragged it further down. // Notably: Since the Luna crash in June 2022, BTC hasn’t touched the blue line again—barely even the green line. Based on these historical cases, some clear takeaways: ➡️ Touching the blue line = high probability of a bottom. ➡️ Could be a cycle bottom or just a local bottom. ➡️ Sometimes it reverses instantly, sometimes it ranges for 1–2 months before bouncing. ➡️ Every single time, a significant rally (bounce or reversal) followed after tagging the blue line. My personal bias: If BTC breaks below $74.5K, tags the blue line, and completes a stop hunt—then consolidates for 1–2 months (ideally without leaving liquidity below)—the odds of a solid bottom skyrocket. That’s when I’ll fully deploy my remaining spot allocation. Frankly, I’d prefer a prolonged chop over a V-reversal, letting weak hands get shaken out and positions rotate. That’d set a much firmer base in current market conditions 📈 // I don’t know if BTC will bounce or reverse after hitting the blue line. But if there are enough bottom signals, from a cycle trading perspective, buying that dip is +EV. Side note: When BTC hits the blue line and doesn’t immediately moon, I guarantee people will ask: 👶 “Wasn’t this supposed to be strong support? Why isn’t it pumping?” 👶 “We’re at the blue line, but it feels like the dump isn’t over.” 👶 “Is the blue line invalid now?” As above, history shows a high chance for a strong bounce from the blue line—but not always instantly. It can chop around the blue line for 1–2 months. Bookmarking this for future reference when the FUD starts 🚬 // Lastly, since so many people have asked, here’s my game plan: As long as the $74.5K liquidity (equal lows) isn’t taken out, I’m not going all-in with my spot stack. To reiterate: Because of the equal lows, I’m convinced BTC will revisit $74.5K. If we don’t sweep it and just pump straight up, I’ll do nothing until that liquidity is gone. Full logic is in the quoted post below—check it out if you’re interested. That’s it for today—hope this helps 🫡

This article is machine translated

Show original

貝格先生

@market_beggar

02-02

「74K 必到」:新的流動性引力區已然形成⚠️

🪧前言:

本文將結合「Liquidity 分析」和「鏈上分析」的邏輯,

和各位分享我對於後市的 bias,同時附上接下來的完整交易計畫。

週末突如其來的暴跌,再次引燃了市場的悲觀情緒;

但或許你沒發現:新的訊號已悄然而至,74K 的獵取已成高概率事件 ...👇: x.com/market_beggar/…

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content