Zoom out for a second. @Polymarket on @JupiterExchange isn’t a feature. It’s an execution re-route.

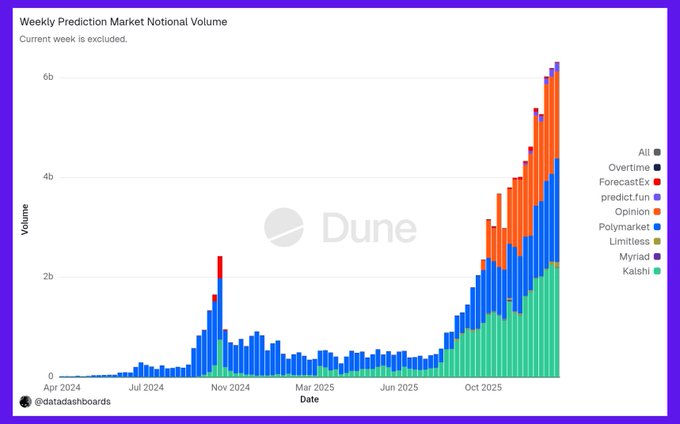

Prediction markets don’t need awareness. They already clear over $6B in weekly volume. What they’ve lacked is proximity to liquidity.

By embedding Polymarket contracts directly inside Jupiter, probability trades now clear on the same surface as spot execution. No context switch. No friction.

That changes the flow profile:

➤ Event risk clears alongside spot routing

➤ Conviction expresses as size, not commentary

➤ Latency drops, turnover rises

This isn’t narrative adoption. It’s mechanical adoption.

When uncertainty can be traded without leaving the execution surface, it competes directly with spot and perps for attention. That’s how volumes scale.

Infrastructure wins when behavior doesn’t have to change.

Infra always wins

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content