This article is machine translated

Show original

How does the mysterious Debridge maintain its operations without retaining any protocol revenue or dumping its tokens?

┈┈➤No Dumping

BTC experienced a continuous decline within a week, with a maximum drop of 18%. Most altcoins hit new lows.

However, "Northeast Man" $DBR not only avoided breaking the June lows but even tested them multiple times in recent days. This indicates that the team did not engage in "taking advantage of the situation" by dumping their holdings.

┈┈➤All Protocol Revenue Used for Buybacks

On the other hand, @debridge uses all protocol revenue to buy back $DBR.

So the question arises? Since debridge doesn't retain any revenue and doesn't dump $DBR, how does the protocol pay the team's salaries and maintain its operations?

┈┈➤The Operation of the Debridge Foundation

╰┈✦The Funding Sources of the Foundation

Actually, debridge started the buyback in June. Protocol revenue before June, along with a portion of the tokens allocated to the T Foundation, together constitute the debridge Foundation. @deBridgeFdn

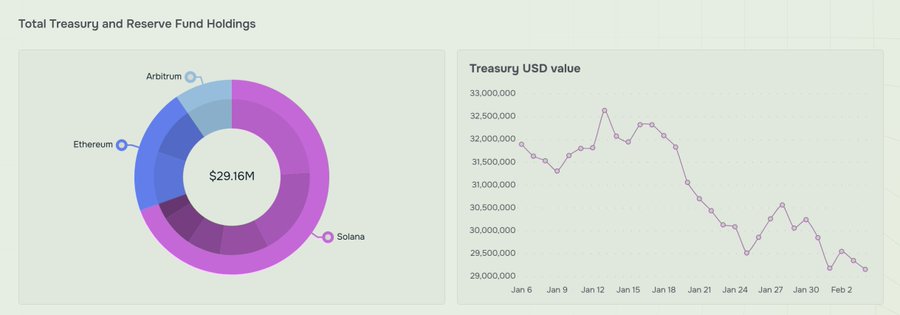

This portion of funds is currently valued at $29.16 million, having peaked at over $32.5 million.

Given this scale and considering the economics of the DBR token, the vast majority of the funds allocated by the foundation remain within the foundation's liquidity pool.

╰┈✦DeFi Returns from the Funds

This portion of funds participates in the Solana and Ethereum DeFi protocols in the form of DBR, SOL, ETH, and USDC.

Calculations show that the foundation's annualized return, based on current prices, is approximately $1.003 million. The current price is essentially at a low point. The debridge foundation's annual return is around $1 million, roughly equivalent to monthly expenses of $100,000.

This funding is generally sufficient to maintain the operation of a distributed, rational, and efficient Web3 team.

┈┈➤In Conclusion

Based on the debridge foundation's fund size and return data, two conclusions can be drawn:

Firstly, regarding returns, the debridge team's goal is sustainable operation, focusing on continuous returns rather than one-off high returns.

Furthermore, during the market crash, DBR experienced almost no selling pressure, demonstrating the team and community's confidence in Debridge's future.

On the other hand, regarding costs, the Debridge team's cost-to-expenditure ratio is relatively rational, avoiding unnecessary wasteful spending.

Compared to some large-scale projects plagued by interpersonal conflicts, Debridge boasts efficient operations and a high cost-effectiveness ratio.

@deBridge_CN Debridge's lesson for retail investors is that projects with high funding and large scale may, due to their size and number of employees, actually have relatively low operational efficiency, resulting in a potentially low value-to-cost ratio. In the market, this can also lead to market pessimism and a lower market capitalization/funding ratio.

Conversely, smaller, more focused projects tend to operate more efficiently and can grow gradually, offering greater potential for growth.

TVBee

@blockTVBee

01-29

市值启示录:两个项目,三种维度,一场关于回购的博弈

1月初,JUP联创一条推文,引发了市场对代币回购的讨论。

2025年1月以来,项目方开始回购 #JUP ,但是仍然未能阻止币价一路向下。

而 #DBR 的回购与JUP形成了对比,DBR从25年6月开始回购,可以效果立竿见影。

一方面是回购后币价向上。

Northeasterners are awesome!

Yes

🫡🫡

The bees are still contributing during the bear market, awesome!

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content