This article is machine translated

Show original

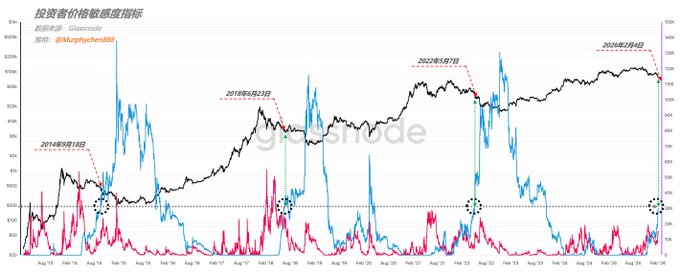

Long-term holders’ price sensitivity keeps rising! If we’re “carving the boat for a sword” here, the time it took to reach similar levels in the last 3 cycles was:

2014.9.18, 2018.6.23, 2022.5.7, and the upcoming 2026.2.4. Around these timestamps, certain events pushed BTC deep into bear territory:

🚩 Sept 18, 2014: The aftermath of Mt. Gox collapse kept brewing. After September, the Chinese government announced a crackdown on BTC and crypto.

🚩 June 23, 2018: China fully banned crypto exchanges and ICOs; top Korean exchange Bithumb got hacked.

🚩 May 7, 2022: The Luna ecosystem imploded, FTX went bankrupt.

As the saying goes, “Tops are a process, bottoms are an event” — maybe where we’re standing now, all that’s left to hit the bottom is one last black swan.

That final shakeout, where LTHs capitulate under high sensitivity, might just mark the end of this downtrend!

What will happen in 2026...?

(The good news: if you “carve the boat” and buy now, then diamond hand it till the next cycle, there’s a 99% chance you won’t lose money.)

Murphy

@Murphychen888

01-24

别再忽视这个信号!痛苦转移,LTH敏感度飙升

有多少小伙伴还记得“投资者价格敏感度”这个指标?其核心逻辑就是量化在BTC价格下跌时,让不同投资群体所产生的“心理压力”或承受的“痛苦程度”。

在去年12月我写过一个对2026年如果出现“牛转熊” x.com/Murphychen888/…

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content