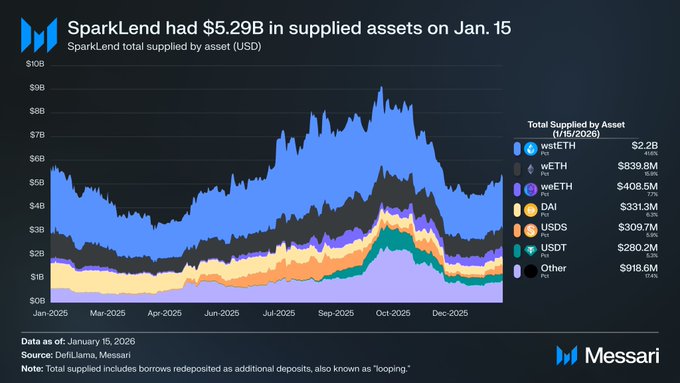

In this research report on Spark, Messari provides a detailed breakdown of SparkLend, which is based on AAVE but surpasses it. Although SparkLend uses a code fork of AAVE V3, it has undergone extensive customization, including compatibility with Sky and USDS, and optimization of its lending parameters and rules. The main differences are as follows: 1. Spark has stricter restrictions on blue-chip collateral than AAVE, accepting only BTC and ETH. AAVE, on the other hand, allows various long-tail assets, yield-generating stablecoins, and various packaged coins as collateral, many without segregation, resulting in higher bad debt risk and reserve ratios. 2.Spark Prime, which leads Aave in blue-chip lending, supports more assets, has deeper liquidity, and higher leverage. Spark's wstETH supply is four times that of Aave Prime, further demonstrating that Spark's maturity in supporting blue-chip assets is more attractive to users and funds. DAI, USDT, PYUSD, USDS, and USDC all use fixed prices hard-coded in their contracts, preventing price fluctuations even if the stablecoin deviates from its price range, thus avoiding oracle attacks. Aave, however, uses Chainlink to provide real-time market prices for its stablecoins. Furthermore, because Spark can borrow large amounts of USDS from its upstream provider Sky at a lower-than-market benchmark interest rate, it can convert this USDS into other stablecoins at a fixed price and inject it into SparkLend, achieving even lower lending rates than the market average. Because of its deep focus on blue-chip assets, combined with the low-risk, low-interest rates achieved through fixed stablecoin prices, Spark is very attractive to institutions. Therefore, Spark focuses on the institutional lending market, and its institutional custody service in partnership with Anchorage further enhances its client base.

This article is machine translated

Show original

Messari

@MessariCrypto

02-04

. @sparkdotfi is the leading institutional-grade, blue-chip money-market protocol in DeFi, beating out Aave V3’s Prime Market instance in market size, variety of blue-chip assets offered, and maximum leverage on a risk-adjusted basis.🔥

Our deep dive on Spark breaks down:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content