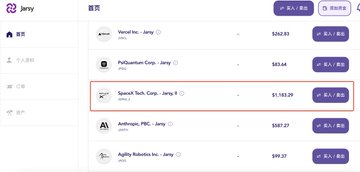

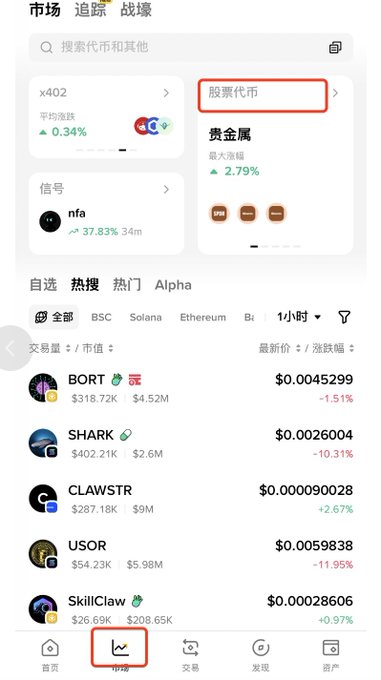

Recently, everyone's been saying that SpaceX, Elon Musk's company, is expected to IPO in June. ❓So, where are the profit opportunities for Chinese retail investors before SpaceX rings the bell? This article compiles all the low-threshold + conventional paths to help you participate quickly: 1️⃣ Buy pre-IPO shares in advance on relevant private equity RWA platforms. For example, @JarsyInc can directly buy related equity share tokens. Republic also has Mirror Tokens corresponding to SpaceX's returns. 2️⃣ If you don't know how Web3 works, there are 3 other ways to participate in this wealth opportunity, somewhat like what Wall Street calls shadow trading: 1. Buy shares from its parent company, "borrowing a boat to sail." Although SpaceX hasn't gone public yet, its shareholders have. Many people don't know that Google's parent company, Alphabet, has already heavily invested in SpaceX, with an estimated shareholding of around 7%~8%. What does this mean? SpaceX is currently valued at $1.25 trillion, and Google has made a fortune from this single investment. The logic is simple: buying Google now is essentially buying a search engine + AI business + a call option on SpaceX. How should Chinese investors proceed? They can directly purchase Google RWA tokens through the stock token module of Binance Wallet (@binancezh @cz_binance). These stocks support 1:1 custody, 24-hour trading, and real-time settlement, making them very attractive and convenient. Path: Binance Wallet - Markets - Stock Tokens = Search for Google. Alternatively, those with overseas accounts can directly buy Google stock. Those without overseas accounts can directly purchase Nasdaq 100 or S&P 500 funds. Google is a super-weighted stock in these indices. Once SpaceX goes public and its stock price surges, Google benefits, directly boosting the Nasdaq. 1. The funds held by everyone will rise accordingly. 2. This has a slightly higher threshold, but you can "take a roundabout approach." It's called participating in QDII funds. Some domestic QDII funds, which focus on overseas technology (public or private funds), have already indirectly held SpaceX-related assets through the pre-IPO market or private placements. Your homework is to review the annual reports of those QDII funds that heavily invest in US high-end technology manufacturing. You can pay attention to domestic fund products that have Baillie Gifford's holdings. This is a fund that heavily invests in SpaceX; currently, SpaceX accounts for about 11% of its portfolio. Although there will be a discount, it's safe and compliant. 3. Grasp the reflection effect of A-shares. The biggest significance of SpaceX's listing is telling global capital that commercial spaceflight has become profitable. Once it goes public, its valuation will skyrocket, and the corresponding commercial spaceflight sector in the A-share market will immediately revalue them. What exactly should you look at? Don't look at those stocks that are just hyped up. To identify promising stocks, firstly, look for leading domestic suppliers of specialized metals to the aerospace industry. Secondly, focus on communication modules for new satellites, PCBs, and phased array radars. Given Starlink's success, China's StarNet project will likely accelerate. These suppliers are the direct beneficiaries. In investment circles, this is called benchmarking logic; even if the top players reap the rewards, the second and third-ranked players, though only getting scraps, will see their valuations double. ➡️ SpaceX's IPO marks a watershed moment in humanity's transition from a planetary economy to a space economy. Whether through indirect ownership via Google, investing in the Nasdaq and reaping the benefits, or investing in the aerospace industry chain in the A-share market, the most important thing is to participate.

This article is machine translated

Show original

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share