CoinFound and ME News jointly present the RWA Gold Weekly Report, reviewing noteworthy information from the stablecoin sub-market over the past week:

Article author: CoinFound

Article source: ME News

I. Market Overview

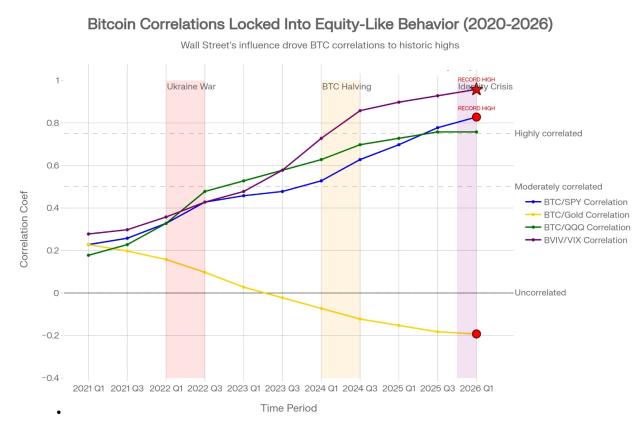

- The Gold RWA (Real-World Asset Tokenization) market has demonstrated extremely strong "digital safe-haven anchor" attributes. Amidst the dramatic fluctuations and pullbacks in the broader crypto market (BTC) and crypto-related stocks (MSTR), Gold RWA not only achieved a V-shaped price reversal but also took a crucial step forward in its institutional development.

- While MSTR plummeted during leveraged liquidations and BTC hovered around the $70,000 mark, gold RWA quietly held its ground at around $4,900. However, regulatory uncertainty, the unclear location of the underlying gold storage for some gold tokens, and the liquidity crisis caused by token redemptions due to market volatility are all potential risk factors.

II. News Review

- Tether's 2025 annual report revealed that its gold reserves reached $17.4 billion.

- The controversy surrounding Section 404 of the Clarity Act has impacted interest-bearing gold products.

- The Ondo Finance New York Summit established a hybrid treasury standard for "gold-US Treasury bonds".

- BTCC exchange reported a daily trading volume of $301.7 million, with silver dominating trading (81%), reflecting geopolitical uncertainty and increased industrial demand.

III. Summary

This week's gold RWA market can be simply summarized as "a hard landing after a peak jump, accompanied by painful corrections due to the resilience of the underlying assets." After gold prices broke through $5,000 and reached a peak of $5,600, they suffered a single-day plunge (gold -9%, silver -25%) due to the uncertainty of the Federal Reserve's policies. Although the liquidation was severe in the short term, the continued increase in holdings by institutions and whale also indicates that the market is shifting from "speculative trading" to a long-term allocation stage driven by "underlying asset value," revealing the coexistence of the long-term attractiveness of gold RWA as a safe-haven tool and its high sensitivity to macroeconomic policies.