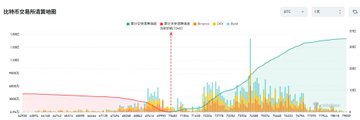

[xjb Analysis] With BTC falling to this level, it wouldn't make much sense for the major players (market makers) to continue dumping it. The next wave of selling pressure is likely to come primarily from retail investors and ETFs. In the spot market, prices have already fallen to the previous high, and the bottom may not be far away. The main players (market makers) have large amounts of capital, and this position is no longer suitable for them to trade in waves. As the experienced investor said, there's nothing left for long positions to liquidate. Of course, there are no signs of the market stopping its decline yet. Next, some panicked retail investors may sell their spot holdings. Additionally, there might be some pullback in US stocks, and ETFs could also experience some selling pressure. After all, ETF traders aren't particularly interested in crypto-specific indicators like BTC's rainbow chart or support levels from previous highs. They tend to place more faith in macroeconomics, US stocks, and technical analysis. But there's no need to panic too much. BTC often reacts more quickly than US stocks and has already fallen first. ┈┈➤Major buying has not yet entered the market, but trading volume is still not large. The current trading volume is not as high as it was during the decline in April and October-November last year, when major buying had not yet entered the market. ┈┈➤xjb predicts short-term trends based on the daily chart during the US session and whether the weekly chart will show a high-volume close. After a weekly chart showing a high-volume close with a bearish candlestick, there might be a slight rebound, similar to the second half of 2022, but it will mainly be a sideways consolidation. This isn't about rigidly adhering to outdated methods; bear market declines rarely see V-shaped reversals and require a relatively long recovery phase. Finally, there will be a second probe, the extent of which will depend on the impact of the events at that time. However, this should not happen at the end of the year; it may be related to the recent US-Iran conflict, or around May or June when Walsh takes office, or around September. Some of his remarks and policies may trigger some negative factors. In conclusion, my personal opinion is that the liquidity black swan event will be extremely severe. In fact, the BCH fork hash power war at the end of 2018 was due to both event-driven negative factors and liquidity negative factors, because both BCH and BSV were selling BTC to compete for hash power. The collapse of Luna and the bankruptcy of Three Arrows in mid-2022 were both negative factors related to liquidity. The collapse of FTX at the end of 2022 was also essentially a negative factor related to liquidity, as FTX indirectly misappropriated user funds, leading to a run on the bank and bankruptcy. Regarding the liquidity risk in this round, I've roughly reviewed MicroStrategy's financial reports. There shouldn't have been any issues six months ago, but I'm unsure about the second half. Conversely, YiLiHua's ETH leveraged futures might carry a greater risk. Whether Warsh's policy is loose or loose is also a very important factor affecting liquidity. As for events like the one between the US and Iran, which do not involve negative factors related to liquidity, their impact is relatively limited.

This article is machine translated

Show original

币圈老司机

@NB

说个搞笑的事情

我刚才看清算地图才发现

现在 多单已经没有东西可以爆了

比特币跌破 6.5 万美元,多单清算强度 7.8 亿

比特币突破 7.3 万美元,空单清算强度 9.3 亿

之前清算强度都在10亿以上,现在连10亿都不到了

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content