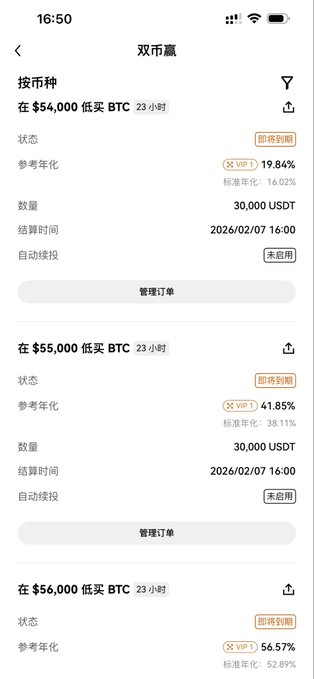

I often use OKX Dual Investment as a tool to execute my planned DCA (dollar-cost averaging) strategy. Its biggest advantage is flexibility in terms of timing. Plus, when comparing similar strike prices and time frames, its yield is also pretty competitive. For example: If I plan to start building a long-term BTC position in the $56k-$50k range, I can leverage OKX Dual Investment’s “Buy Low BTC” strategy. I just pick the nearest settlement date, select the strike prices I’m targeting—like $56,000, $55,000, $54,000, etc.—and input the amount I want to buy (basically splitting up my orders). Then, by 4pm tomorrow, if BTC is below any of the selected strike prices, the system will automatically buy BTC for me at those prices (with the yield settled in BTC). If BTC is above the strike price, I get my USDT back plus interest. Put simply: If I don’t buy, I earn interest; if I do buy, it fits my original plan perfectly. Usually, I avoid picking a settlement date that’s too far out—I want to stay flexible and avoid situations where the price hits my target before settlement, or the date arrives but the price has already moved up, which could mess up my entry timing. Of course, you can also play around with different combos based on your own plan, allocate your funds, and balance time and yield to find the strategy that suits you best.

This article is machine translated

Show original

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content