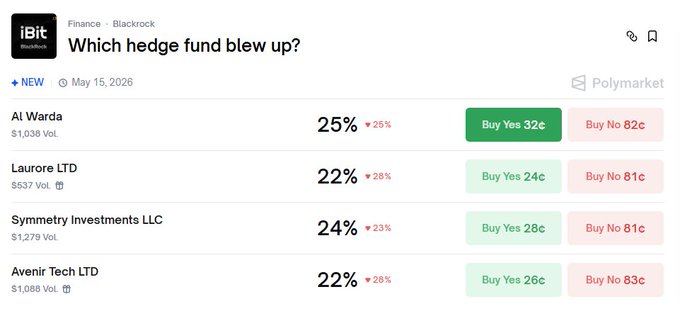

The new 13F quarterly filings are expected to be released as early as mid-May. If a fund holds hundreds of millions of IBIT at the end of Q1, but its Q2 filing shows zero holdings, then this speculation will be confirmed! Currently, trading is open on Polymarket. Based on previous disclosures, the four institutions heavily invested in $IBIT are: 1. Al Wanda, an entity under the Abu Dhabi Investment Authority, with $518 million. 2. Laurore LTD, a mysterious entity, possibly a shell company, with $436 million. 3. Symmetry Investments, spun off from the top Wall Street fund Millennium to invest in alternative assets, holding $730 million in IBIT. 4. Only Avenir, owned by Li Lin, is based in Hong Kong, disclosing $1.19 billion in $IBIT in November 2025.

This article is machine translated

Show original

加密大漂亮| C Labs | 招人

@giantcutie666

这是关于 $BTC 暴跌到6万最受认可的分析帖,主要内容是:

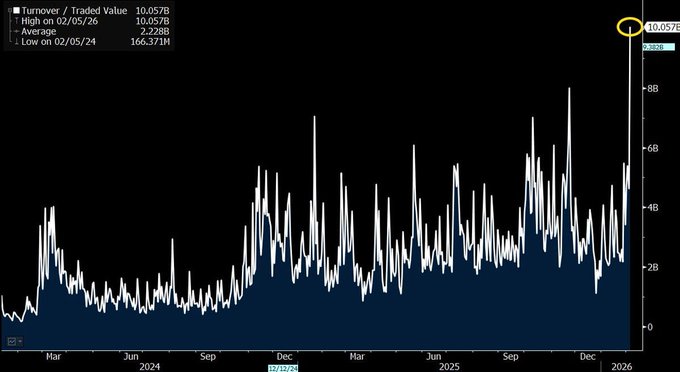

香港的对冲基金,本来不是专玩币的传统金融玩家。他们借了超便宜的日元,高杠杆买了BlackRock比特币ETF(IBIT)的看涨期权——那种赌比特币大涨的远期便宜“彩票”,杠杆很高。 x.com/TheOtherParker…

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share