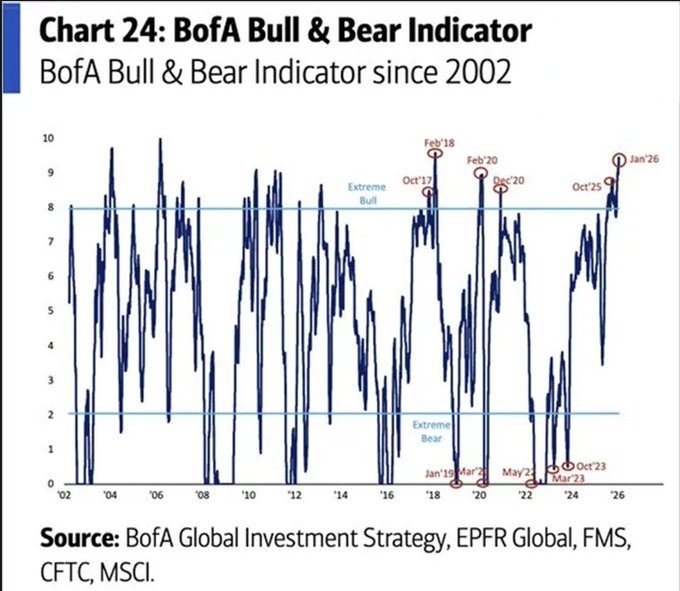

Investors have rarely been this bullish this century:

Bank of America's Bull & Bear Indicator is up to 9.4 points, the highest since February 2018.

This measures equity and bond flows, hedge fund and fund manager positioning, and market breadth.

The gauge is now at its 4th-highest level in 24 years, signaling extremely positive market sentiment.

This comes as 5 out of 6 indicator components show bullish and very bullish sentiment, with only bond flows at neutral.

The most recent increase has been driven by rising global stock market breadth and fund manager cash at a record low of 3.2%.

Investor demand for equities is exceptionally strong.

BofA Bull & Bear at 9.4 is screaming. Last time it got this high was right before the Feb 2018 correction. Everyone's positioned for up when the macro data is softening underneath. I'd be watching for a flush before the next real leg higher.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content