The recent sharp liquidations in the gold and silver markets are reminiscent of the massive turmoil in the cryptocurrency market last fall, injecting tension into the market. Amid this volatile market, Goldman Sachs' chief trader, Louis Miller, raised a "$2 trillion question" that will determine the future direction of the market.

At the heart of this issue is the fate of large-cap technology stocks, especially the "software sector".

◆ The software sector, which has lost $2 trillion... Is it a "falling knife" or a "spring poised to burst"?

The U.S. software sector recently lost up to $2 trillion in market capitalization from its peak, delivering its worst weekly performance in nearly four years. Investors are avoiding the sector, which is also the area most heavily short on major brokerage books since the beginning of the year.

The market is deeply skeptical. Is the current decline in the software sector a "falling knife" that could lead to huge losses for those who rashly buy in, or is it like a beach ball being pushed into the water, preparing for a strong "spring rebound"?

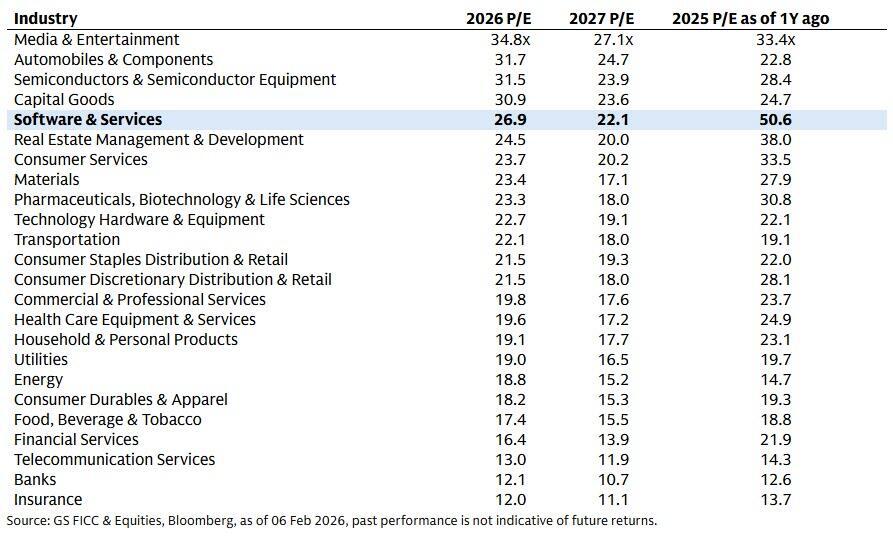

Valuations based on price-to-earnings ratios have fallen from 51 times a year ago to around 27 times currently, similar to the overall market level. However, Goldman Sachs analysts believe that the sector may still be expensive relative to earnings per share growth, and due to fears that artificial intelligence will disrupt existing industries, bargain hunters have not easily flocked to it. News such as Anthropic releasing new AI tools has further fueled these concerns.

Ultimately, where the stock prices of large companies like Microsoft will bottom out, and how quickly AI-induced market disruption will occur, are expected to be key variables in determining the answer to this "$2 trillion question."

◆ Alternative options lie in the "real economy"...focusing on banking, real estate, and security themes.

Given the significant uncertainty in the software sector, Goldman Sachs suggests shifting focus to the "real economy" theme. This is because, during periods of high volatility, investing in real economy sectors not exposed to momentum factors may be sensible.

First, regional banks in the United States . A combination of factors, including a steep yield curve, deregulation, and the potential for increased M&A activity, makes them a promising investment option.

Second, the UK property market . With the increasing likelihood of an earlier interest rate cut by the Bank of England, the property market, which has lower valuations, is expected to benefit.

Third, the theme of national security and onshore production . Amidst geopolitical shifts, major countries such as the United States, Germany, and Japan are working to protect their domestic industries and strengthen national defense, leading to a reassessment of related traditional economic sectors. In particular, expectations are high for Japan to strengthen its economic security policies ahead of the snap election this weekend.

◆ A seasonal opportunity not to be missed: Chinese New Year trading

On the other hand, unrelated to the current turmoil in tech stocks, there is a noteworthy seasonal investment opportunity: the "CHEERS trade" targeting the Chinese New Year.

Historical data analysis reveals that the Chinese stock market recorded positive returns during the Spring Festival period in 18 out of the past 25 years. This is because investors tend to take on risk during this time. This could be a good way to diversify the current volatility risks in the US and European markets.

Next week, the US will release important macroeconomic indicators such as non-farm payroll data and the consumer price index. The market is expected to pay close attention to the impact of AI on employment and inflation trends.