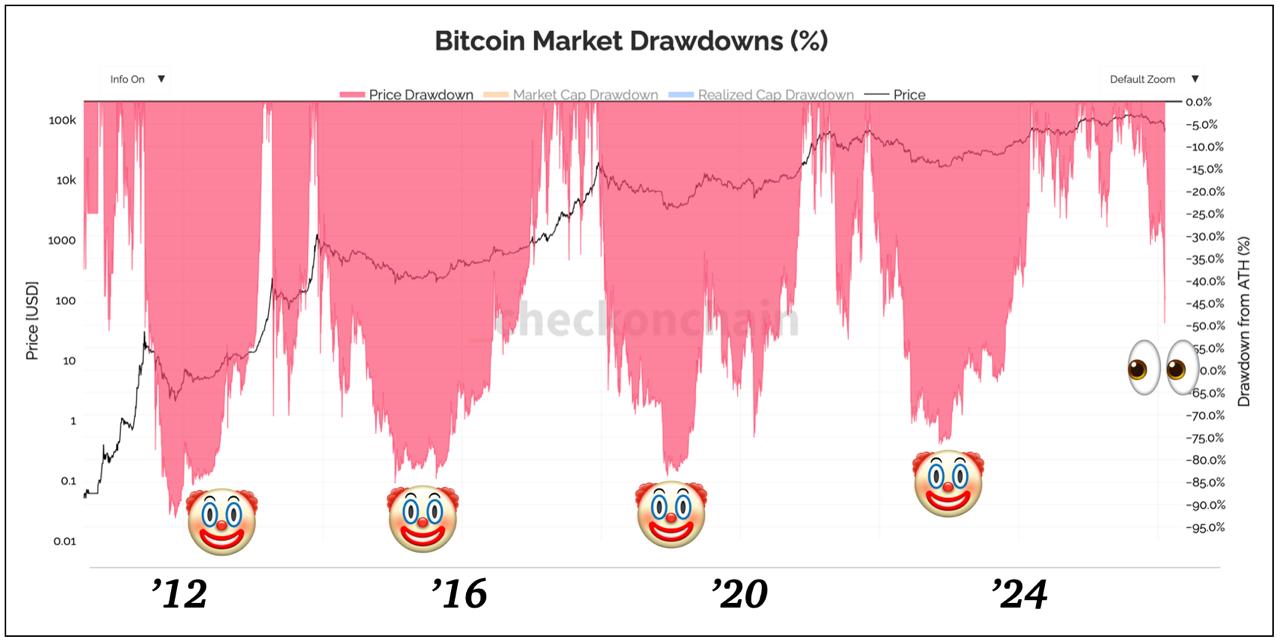

Oh my, why does the coin market keep crashing? Now that I'm at it, let's figure out why. There's been a lot of talk about the four-year cycle of the coin market, but in February 2026, the market plummeted again, seemingly following that cycle. Some say it's due to the issue of Trump's nominee for the new Federal Reserve Chairman, or the Satoshi Nakamoto theory mentioned in the Jeffrey Epstein document. However, this plunge was too rapid, too structural, and too simultaneous to be a simple price correction. I believe it's due to the inherent vulnerabilities of the market structure itself. I'd like to share my analysis of the specific causes of the plunge. First, I believe the recent plunge was caused by a self-induced crash in the options market. Indeed, at the peak of the bull cycle, options open interest (OI) was at an all-time high, while spot trading volume was declining. Due to the structure of options, market makers change hedges when prices fall, and when hedges are changed, spot is forced to sell, further declining prices. We call this phenomenon "Gamma Unwind." Second, there was no influx of new stablecoins into the coin market. While the coin market appears complex, it ultimately boils down to the question, "Are new dollars coming in now?" Since 2026, the net issuance of USDT and USDC has slowed, some exchanges have seen stablecoins leave, and even OTC desk trading volumes have decreased. This means that existing positions are maintained, with no new buyers appearing. Third, miners' mining operations have become increasingly strained. For miners, rising electricity costs, a growing debt burden from facility investments, and significant pressure to refinance their BTC-collateralized loans have led to significant selling pressure. This has led to shorter price rebounds, creating a price structure with lower highs. Fourth, Bitcoin still appears to be "immature digital gold." Frankly, it remains a risky asset for large funds. At the same time, the presence of high-growth tech assets like AI and safe-haven commodities like gold and silver has led to a diversification or even a shift away from the cryptocurrency market. Unfortunately, while Bitcoin may still be philosophically digital gold, it remains a high-risk asset within a portfolio. Finally, and perhaps most importantly, the market seems overly confident in one direction. After the price peaked in October 2025, there was a common sentiment that the market wouldn't experience the same crash as before thanks to ETFs and that this cycle might be different. Every asset market becomes particularly vulnerable during these times, and I believe the recent plunge is ultimately the result of this structural vulnerability created by this confidence. In conclusion, the cryptocurrency market's plunge is attributed to a combination of market participants' greed and the clear inability to compete with narratives like AI. What's different from past down cycles is not the fear of individual investors, but rather the adjustment of institutional leverage and derivative structures. Just as past down cycles were more of a rebalancing to move into the next phase, my conclusion is that we should stay in the market for the time being and wait for greater opportunities to emerge! #KillMeWithoutPain

This article is machine translated

Show original

Telegram

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content