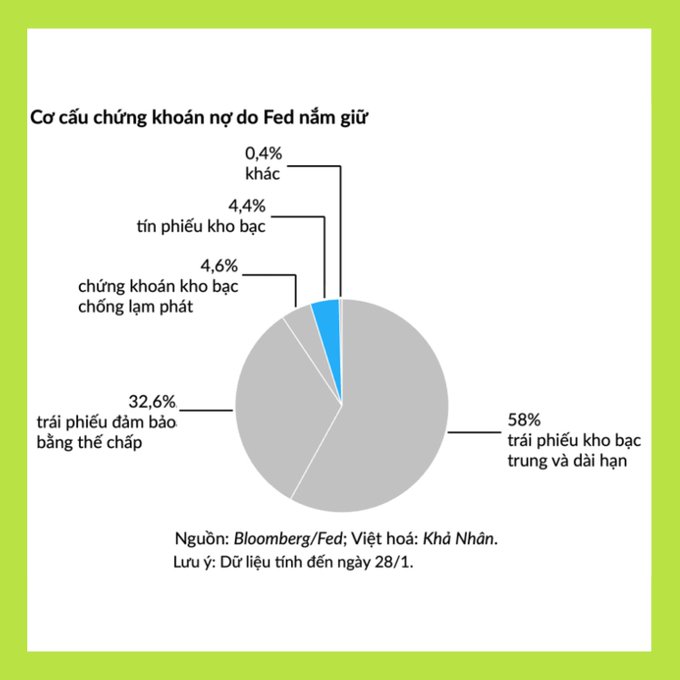

💥 Bold proposal from Fed Chair candidate Fed chairman nominee Kevin Warsh is drawing attention for calling for a new agreement between the Fed and the U.S. Treasury Department, raising concerns about the central bank's independence and the potential for disruption to the $30 trillion Treasury bond market. 📌 The central focus of the proposal is to limit the Fed's Vai in bond purchases, only implementing quantitative easing (QE) in coordination with the Treasury Department. Some scenarios also consider the Fed shifting its portfolio to short-term treasury bills, helping the government reduce the issuance of long-term bonds. Analysts warn: Monetary policy may become more closely tied to the budget deficit. Risks of interest rate volatility, expectations of rising inflation. The safe-haven status of the USD and US bonds may weaken. 📊 Although still at the conceptual stage, any changes in the Fed-Treasury Department relationship are closely watched by the market, as the impact could spread throughout the entire global financial system. (Vietnambiz)

This article is machine translated

Show original

Upside GM

@gm_upside

02-06

Người Trump chọn cho Fed: Chiếc ghế quyền lực nhất tài chính Mỹ lung lay?

Việc Trump đề cử Kevin Warsh không chỉ là thay Chủ tịch Fed, mà là dấu hiệu cho một bước ngoặt thể chế.

Khi chính trị tiến gần hơn tới chính sách tiền tệ, ranh giới giữa độc x.com/gm_upside/stat…

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content