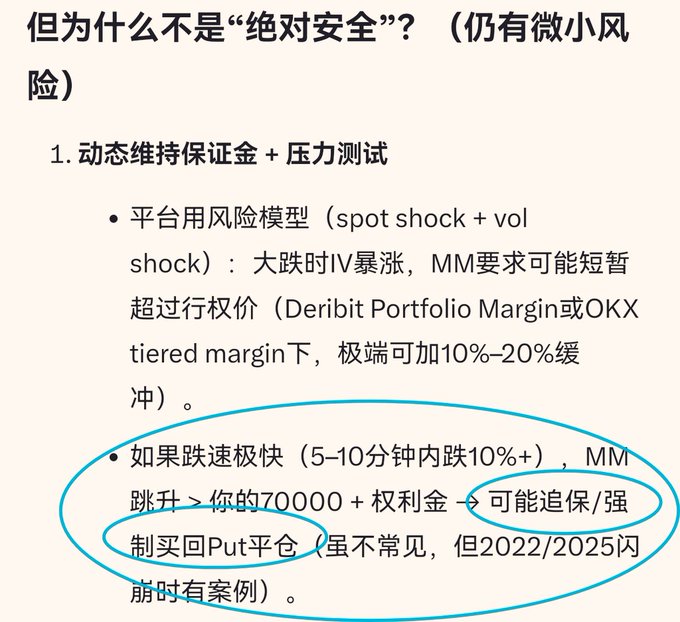

Selling a put option, for example, at a spot price of around 70,500, and then selling a put option at 69,500, even with a full margin of 70,000 plus the premium, and even if the final price is 69,500, there's still a risk of significant loss due to the rapid price drop in the short term. Forced repurchase of the put option to close the position, however, could result in very poor liquidity and high slippage, leading to substantial losses. Selling a put option corresponds to buying low in both currencies; the potential profit is greater than buying low, but the risk is also much higher.

This article is machine translated

Show original

TingHu♪

@TingHu888

我发现很多人在说期权的时候都不说这个大坑➮时间也是金钱。

比如,2000你看涨,中间跌到1000,最后回到2000,你是有可能血本无归的,或者只剩一个渣渣,而不是不赚不亏。

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content