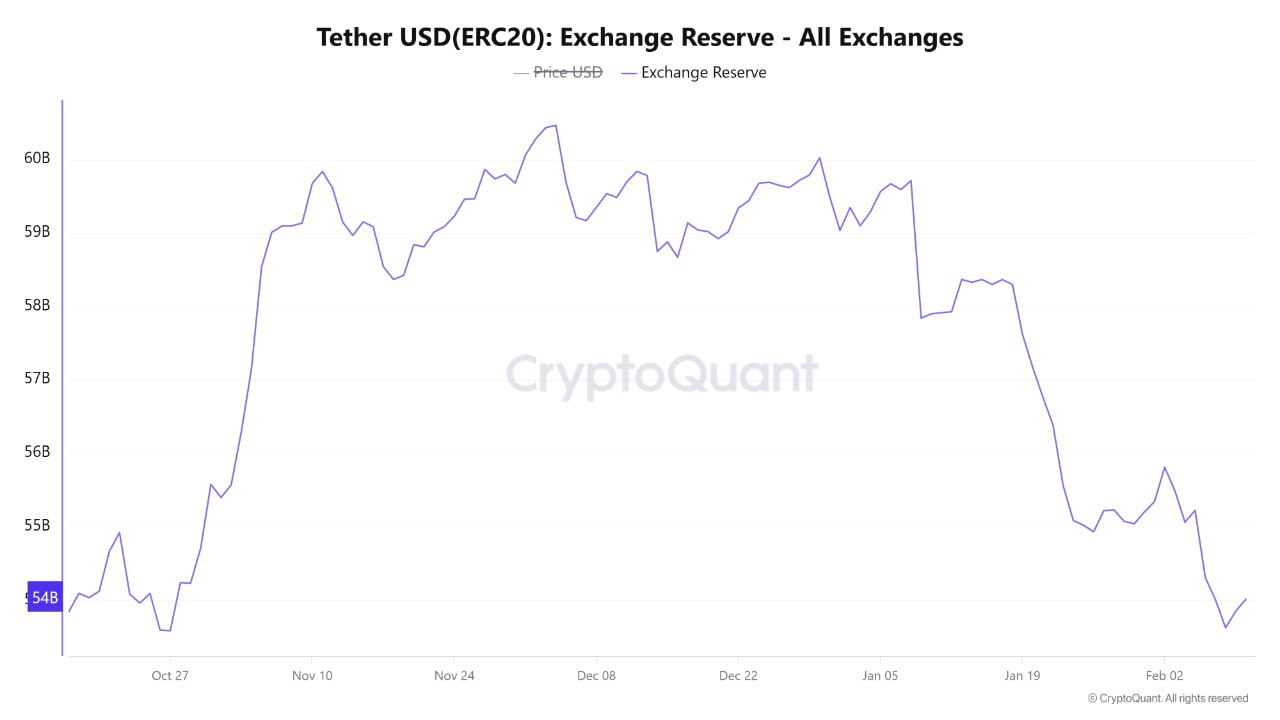

🔗 Original | Author CryptoOnchain 📈 View Chart “#BTC Buying Power Weakens, USDT Reserves Plummet Compared to December” Recent on-chain data reveals concerning trends in market liquidity. Tether USD (ERC20) reserves across all exchanges have declined significantly since late December, returning to levels observed in October. This decline in stablecoin liquidity coincides with a Bitcoin price correction, suggesting a weakening of immediate buying power. Specifically, exchange-based USDT (ERC20) reserves, which stood at approximately $60 billion on December 30th, have now fallen to approximately $53 billion. A significant portion of this decline occurred on Binance, where USDT reserves have decreased from approximately $43 billion to $38 billion. This outflow of over $7 billion in stablecoins coincided with the Bitcoin price correction from approximately $93,000 to $69,000. Typically, during a healthy correction, investors tend to hold stablecoins on exchanges, waiting for a dip. However, this time, the simultaneous decline in Bitcoin prices and the decrease in USDT reserves suggest that funds are leaving exchanges rather than being held. This suggests they may be being converted to fiat currencies or moving to other areas like DeFi. Stablecoin reserves are the "fuel" for the next uptrend. The current trend indicates a lack of aggressive buying demand at the current price level. A meaningful market reversal requires a resumption of USDT inflows to exchanges and the rebuilding of buying power to absorb selling pressure. ✏️ Summary USDT exchange reserves have decreased significantly compared to December, weakening the buying power of #BTC. A sustained rebound requires a recovery in stablecoin inflows. [Sign up for a free CryptoQuant membership] Sign up using the link above to receive a free week of the Advanced Plan. Analyze market trends in depth with on-chain data! ✖️ Official CryptoQuant X (🇰🇷Korean) ✈️ Official CryptoQuant Telegram (🇰🇷Korean)

This article is machine translated

Show original

Telegram

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content