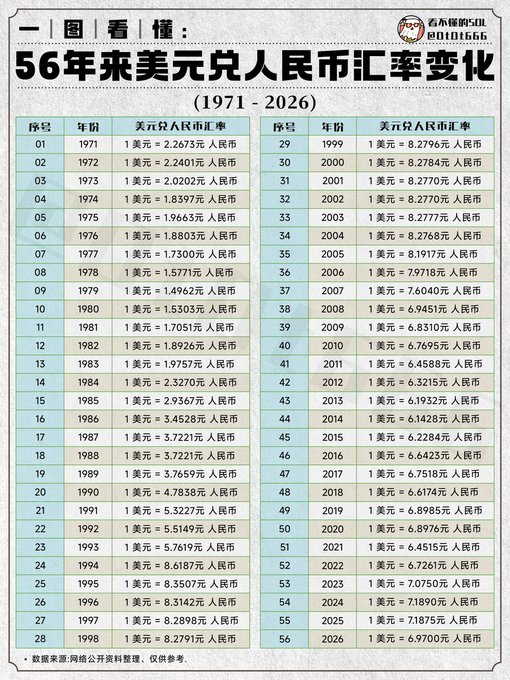

6.90! Breaking news! Today, the offshore RMB exchange rate against the US dollar reached 6.9, setting a new recent high. At the end of November last year, the offshore RMB exchange rate was approximately 7.12 yuan to 1 US dollar, appreciating by more than 2,100 basis points in three months. When Trump announced the "reciprocal tariffs" in April 2025, the exchange rate was approximately 7.428 yuan to 1 US dollar. Due to interest rate changes, we are currently experiencing a 3% unrealized loss. Will our losses continue to shrink? If you exchanged your currency for US dollars last April and deposited it as a fixed deposit in a Hong Kong bank, you could have earned a 4% annual interest rate. Due to interest rate changes, you're currently down 3%, and the same applies to my U-shares. I've personally lost the equivalent of two Mercedes-Benz G-Class cars, while the Shanghai Composite Index has risen 35% during this period. Therefore, many investors who exchanged their money for US dollars are now kicking themselves. Some people converted their US dollars back into RMB early on and entered the stock/ crypto. Many people find this round of currency appreciation unbelievable: with the economy feeling so weak, shouldn't it be depreciating? Why is it going against the grain? The main reason is that after the pandemic, developed countries in Europe and the United States generally engaged in massive spending, resulting in severe inflation. The US CPI reached a staggering 9.1% in June 2022. The Federal Reserve subsequently raised interest rates rapidly, but has not been able to completely contain inflation. Starting in September 2024, the United States began a cycle of interest rate cuts, with inflation exceeding 3%. Anyone who has visited the United States in the past two years has noticed a significant difference in prices compared to the end of 2019. Prices, including those for human services, are outrageously expensive. During this period, we experienced deflation, and prices in the two countries diverged in a K-shaped pattern. However, Chinese manufacturing has made a remarkable transformation in recent years, becoming more competitive. If there were no major changes unseen in a century, and Sino-US relations returned to what they were before 2013 or 2012, the exchange rate would be 5 yuan or 4.5 yuan to 1 US dollar. Of course, if the two countries engage in fierce competition, it is possible that 8 yuan or 8.5 yuan could be exchanged for 1 US dollar. The situation that followed was basically the same: a fierce tariff war broke out in April, and an agreement was reached at the end of October, taking only six months. However, this agreement suspends the imposition of tariffs on each other for one year, expiring in November 2026. So there are still some uncertainties this year. Trump is highly likely to visit in April, and may return the visit before the end of the year, suggesting that G2 relations have entered a period of stability. If this is the case, the continuous and slow appreciation of the RMB will likely continue for some time, and it is not impossible for it to reach 6.5 RMB in two to three years. The logic behind the appreciation is mainly: 1. China's economic transformation and upgrading are progressing smoothly, and its competitiveness is continuously increasing; 2. The exchange rate was previously undervalued; 3. The Federal Reserve will continue to cut interest rates, narrowing the interest rate differential between China and the United States; 4. Hot money continues to flow into China's capital market; 5. A slight appreciation is beneficial for combating involution and balancing relations with trading partners. Of course, if you are a long-term investor, you don't need to worry about exchange rates; time will tell.

This article is machine translated

Show original

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content