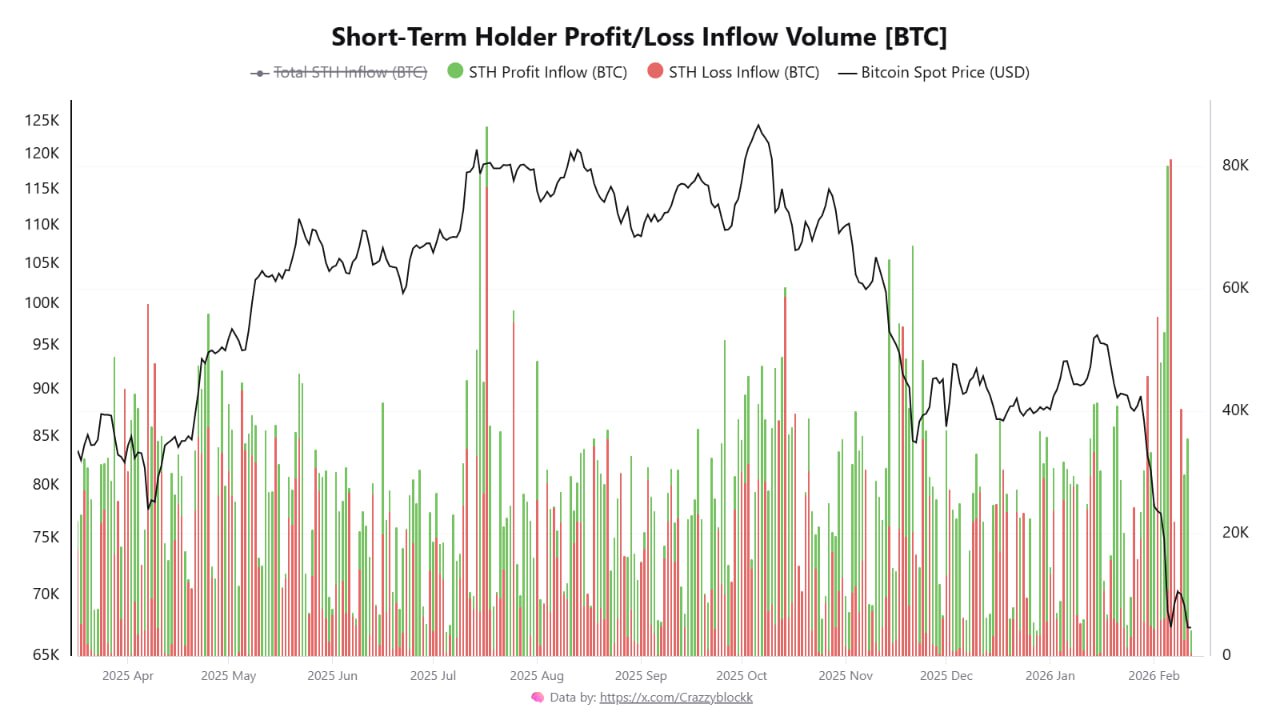

🔗 Original | Author Crazzyblockk 📈 View Chart “#BTC $57K Plunge: Fear is High, but Confidence is Quiet” Bitcoin's plunge from $124K to $67K shook the market, but on-chain data shows a clear divide. Short-term investors are selling in fear, while long-term investors are largely unfazed. This is a different dynamic than in 2022. During the peak last October, short-term investors were extremely optimistic, sending approximately $8.3B in profits to exchanges in a single week. However, the sentiment has now completely reversed. As of mid-February, deposits from short-term investors in losses surged to approximately $399M on February 11th alone, with some days seeing losses of up to 99%. This is a typical sell-off pattern. However, the scale is lower than the confirmed daily loss of approximately $1.5B recorded in August 2024. Fear exists, but it's not as extreme as during past sell-offs. The behavior of long-term investors paints a starkly different picture. Even during the price plunge, long-term investors' inflows to the market remained minimal compared to short-term investors, with most of the inflow coming from gains. Even on February 11th, when short-term investors sold off, confirming losses of $399 million, long-term investors' losses amounted to only about $23.8 million. This is a significant reduction compared to the period in early 2024, when losses exceeded $225 million in a single day. Currently, long-term investors are effectively holding onto their positions. This discrepancy is significant. During the 2022 bear market, even long-term investors sold off their positions, enduring losses for months. However, this time, long-term investors are refusing to sell during losses. While the fear of short-term investors appears significant, the quiet confidence of long-term holders, who have experienced multiple cycles, suggests that the bottom may be closer than fear suggests. ✏️ One-Line Summary Short-term investors are selling, but long-term investors are refusing to sell at a loss. The current #BTC decline shows a different structure than 2022, and the possibility of a bottom is also open. [Sign up for a free CryptoQuant membership] Sign up using the link above to enjoy a free week of the Advanced Plan. Analyze market trends in-depth with on-chain data! ✖️ Official CryptoQuant X (🇰🇷Korean) ✈️ Official CryptoQuant Telegram (🇰🇷Korean)

This article is machine translated

Show original

Sector:

Telegram

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content