I think the @solsticefi x @Loopscale integration is actually kinda big.

you can structure a USX carry that’s asymmetrically safe if you manage it right.

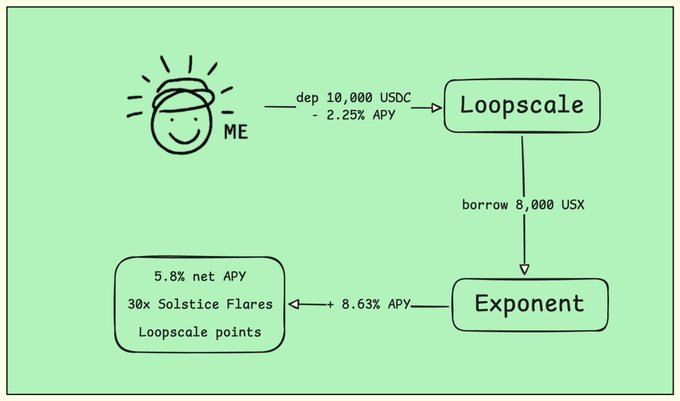

here’s what I play:

1/ deposit $10k USDC on Loopscale

borrow USX at 80% LTV (max LTV is 90%)

→ borrow 8k USX

→ cost: 2.25% APY

liquidation only happens if:

8k USX > $9k USDC → USX ≈ $1.125

so you only get liquidated if USX trades way above peg.

------------

2/ think about the risk correctly

for yield-bearing stables, real risk is downside depeg, not upside.

– if USX > $1 → just swap back to USDC and rebalance

– if USX < $1 → you don’t get liquidated

you can repay cheaper USX → unlock full USDC collateral

→ downside depeg actually benefits the borrower.

------------

3/ deploy the borrowed USX

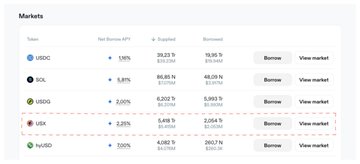

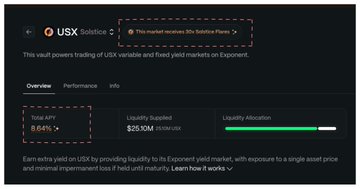

supply USX on @ExponentFinance

→ 8.63% APY

→ 30x Solstice Flares

→ Loopscale points

spread math:

8.63% − (2.25% / 0.8) ≈ ~5.8% net APY

on $10k USDC base, plus 30x flare point exposure.

------------

so what do you get?

– ~5.8% net APY

– 30X flare multiplier → $SLX airdrop

– Loopscale points → airdrop

------------

and the beauty of this trats is if USX depegs lower, you lose nothing structurally, you repay cheaper.

Now, your turn 👇🏻

Loopscale: loop.sl/i/xgABe

Solstice: app.solstice.finance/earn-flar... | code: 9oBM8kSg42

Exponent: exponent.finance/liquidity/usx...…

now this show how smart Kaff is

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content