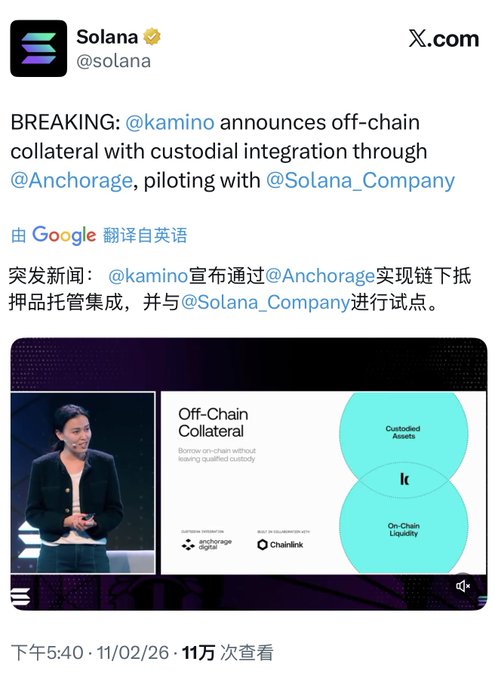

Looking at Kamino's recent actions, we can see the future evolution of DeFi/on-chain lending. We discussed this before: if there's a greater supply of high-quality assets in the future, the scale of on-chain lending and derivatives will expand to a massive size, far exceeding the current level. Kamino's actions in recent months have already hinted at the nascent form of this future DeFi/on-chain lending model. Kamino Finance is now essentially the largest lending protocol on Solana, and also a super gateway combining liquidity and leverage. Its TVL is close to $2 billion, and it has deep integration with almost all Solana ecosystem projects, including Raydium, Orca, Jupiter, and Jito. In mid-December 2025, @kamino announced the launch of "Next Chapter," expanding the platform to an infrastructure layer supporting institutional finance and tokenized assets. Six new products are worth discussing: 1) Fixed Rates: Allows borrowers to lock in borrowing costs for a specific period (similar to fixed-rate loans in traditional finance). This is a foundational product for institutional on-chain lending. It addresses the issue of highly volatile DeFi lending rates, providing predictability. 2) Borrow Intents: Users post their desired loan terms (amount, interest rate, term, etc.) on-chain, and lenders "fill" the order book, achieving true price discovery. Similar to an order book-style credit market, it optimizes matching efficiency and targets large/customized lending needs. 3) Off-Chain Collateral: Institutional assets can participate in DeFi without leaving custody, allowing the use of off-chain assets in qualified custody as collateral for on-chain lending. It integrates with Chainlink and supports Anchorage Digital on day one. This greatly expands the range of collateral, bridging TradFi and DeFi. 4) Private Credit: Private Credit Pool Targeting institutional-grade private lending, especially for lending needs backed by high-value assets such as BTC-backed. Connects with institutional borrowers, providing privacy/customized credit channels. 5) RWA DEX: RWA-Dedicated DEX A dedicated market/exchange for real-world assets, with built-in support for lending and trading of tokenized assets (such as real estate credit, fund units, bonds, etc.). Currently, RWA assets such as PRIME, USCC, and fBTC have been directly integrated. This will be the core infrastructure for RWA on Solana. 6) Kamino BuildKit: A developer toolkit (API/SDK that allows other apps/wallets to easily integrate Kamino's yield/borrow functionality). This greatly facilitates third-party dApps, wallets, and protocols integrating Kamino (such as embedding Multiply or Lending Vaults), enabling Kamino to truly become a composable DeFi layer. Just this week, the US-listed Solana Company (stock code HSDT) became the first borrower, using its assets held in custody at Anchorage (mainly SOL)... Using collateral (or related digital assets), users can borrow stablecoins on Kamino. This case can be considered the practical debut of Kamino's institutionalization strategy. Starting with Solana Company (HSDT), it achieves a seamless bridge of "asset immobilization, on-chain lending" through Anchorage + Chainlink, efficiently utilizing treasury capital to obtain liquidity without sacrificing custody compliance. Since 2025, the entire DeFi lending sector has been shifting from "pure crypto overcollateralization, floating interest rates, and high-leverage speculation" to institutional-grade, hybrid on/off-chain, and structured credit infrastructure. Kamino's "Next Chapter" product line (Fixed Rates, Off-Chain Collateral, Private Credit, Borrow Intents, RWA DEX, BuildKit) has almost pieced together all the key pieces of this trend. Just like in the fourth quarter of last year, AAVE announced support for new collateral asset classes, covering stocks, ETFs, and real estate, all of which signify that DeFi is entering the institutional era. Previous reports from a16z, Grayscale, and other institutions have consistently concluded that the growth engine of DeFi in 2026 will shift from retail leverage to institutional funding + RWA. This is also my previous point: x.com/qinbafrank/status/196963...…聊过Defi近几年略有停滞,核心原因就是原来链上优质资产太少,借贷、衍生品一直都是围绕着大饼,以太以及少数几个主流大币展开,其余的小币跟本不能成为优质合格的抵押品和底层资产。缺乏合格抵押品和优质底层资产,才使得defi的体量停滞不前。可以想象如果未来有更多的优质资产供给,链上借贷和衍生品的规模会扩张到巨大的体量,远远高于现有的体量。 As TradFi and DeFi become increasingly intertwined, and more and more high-quality real-world assets are added to the blockchain, on-chain lending will no longer be simply crypto revolving leverage, but will resemble a traditional credit market with fixed interest rates, private lending, off-chain collateral, and predictable returns. Of course, purely retail overcollateralized lending (such as Aave and Compound Classic pools) will not disappear; it will remain the foundational layer and source of liquidity for DeFi. However, future incremental growth will most likely come from new directions such as institutional and hybrid lending.

This article is machine translated

Show original

qinbafrank

@qinbafrank

10-19

AaveV4将支持新抵押资产类别,涵盖股票、ETF和房地产等,这个意义还是很重大的:之前有聊过Defi近几年略有停滞,核心原因就是原来链上优质资产太少,借贷、衍生品一直都是围绕着大饼,以太以及少数几个主流大币展开,其余的小币跟本不能成为优质合格的抵押品和底层资产。缺乏合格抵押品和优质底层资产 x.com/qinbafrank/sta…

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content