Written by: Asif Khan

Compilation: Deep Tide TechFlow

Why do I think Polygon will be where DeFi innovation happens in the next 2-3 months? When people focus on the narrative - builders are always working on solving problems. This article walks you through a unique, novel protocol built on top of Polygon.

1. Timeswap Labs

TimeswapLabs, the first fully decentralized AMM -based lending protocol, offers:

- Oracle-less lending

- Not liquidable

- market driven lending

Finally, long-tail assets can be borrowed without the risk of oracle-based attacks.

2. Mantis Swap

Mantis Swap is a novel one-sided AMM for trading pegged assets. Promises to perform better than Curve or even Univ3 during certain liquidations. MantisSwap introduces three main features:

- Unilateral liquidity provision

- Shared Liquidity Mechanism

- Reduce Impermanent Loss

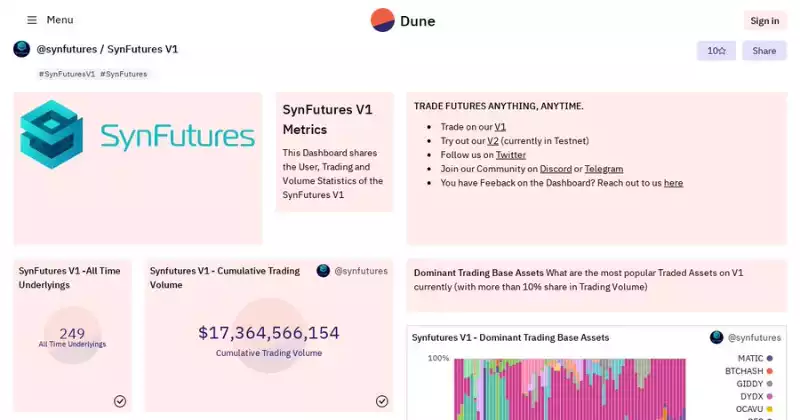

3. SynFutures

SynFutures is a decentralized derivatives platform and a real DeFi dark horse. While few people in crypto twitter talk about it, they have quietly done over $1.7 billion in transaction volume.

4. Bob

Bob is a multi-chain, multi-collateral stablecoin enhanced with optional privacy features.

Privacy-based stablecoins are what are needed to build a robust cryptocurrency payment system. You don't want to see suppliers looking at all your past transactions. It's also a problem when it comes to applying for or issuing grants, wages, etc. The team is already forming partnerships with various payment providers to bring organic adoption to the stablecoin.

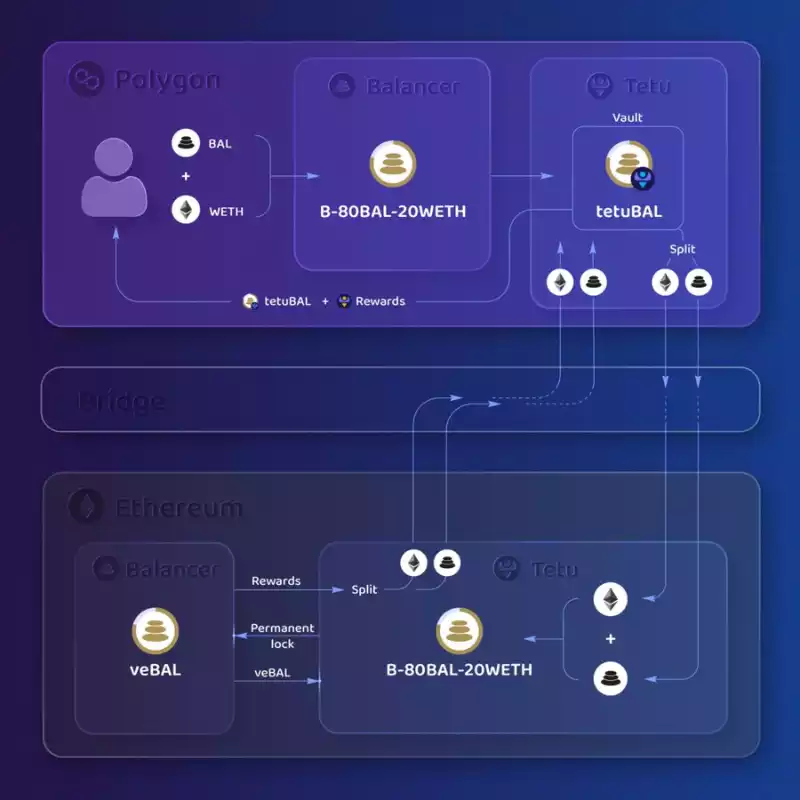

5. Tetu

Tetu is a quality team trying to build the most sophisticated library of yield strategies. They have been building since the past 1.5 years and are the true spiritual successor to Yearn Finance.

6. Synquote

Synquote is trying to bring the most liquid and price-efficient options to DeFi, a true on-chain option.

The protocol uses an RFQ architecture where orders placed by users are filled by market makers. The on-chain collateral for options is fully collateralized.

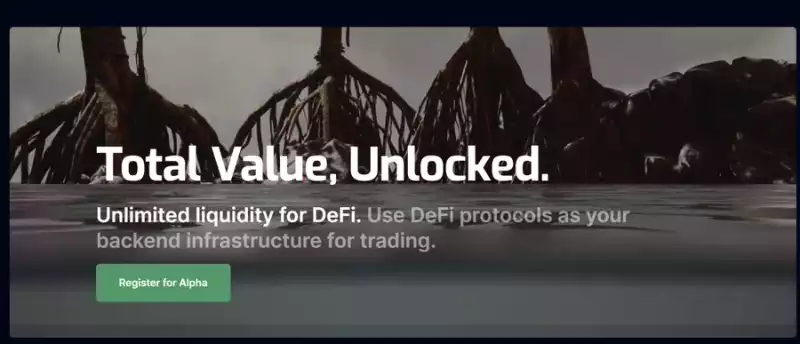

7. Mangrove DAO

Mangrove DAO, a new-age DeFi primitive, has soft-launched on Polygon.

It is an order book-based DEX that allows liquidity providers to issue arbitrary smart contracts as quotes. This new flexibility enables liquidity providers to issue quotes that are not fully provided.

Mangrove promises that liquidity can:

- Simultaneous sharing, borrowing, and lending of liquidity;

- Appears on Mangrove's order book and is readily available if and only if a quote is available.

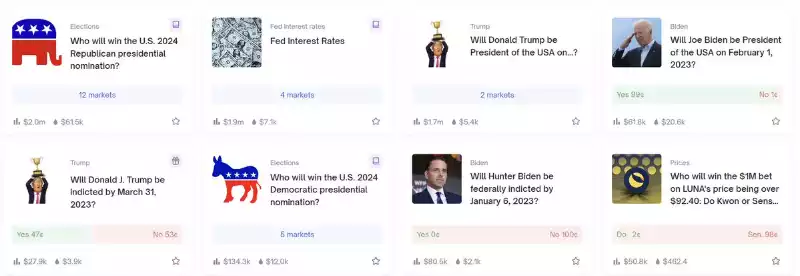

8. Polymarket

Polymarket is probably the most interesting betting app in this space. It's showing healthy volume throughout 2022 and continues to make for the most interesting bets.

9. Vi

Vi is a pioneer in the dynamic risk framework for lending markets. v2 promises to liquidate dynamic interest rate curves based on ever-changing DeFi markets, which is critical for liquidations, potentially addressing events like the recent Avi AAVE Curve market attack.

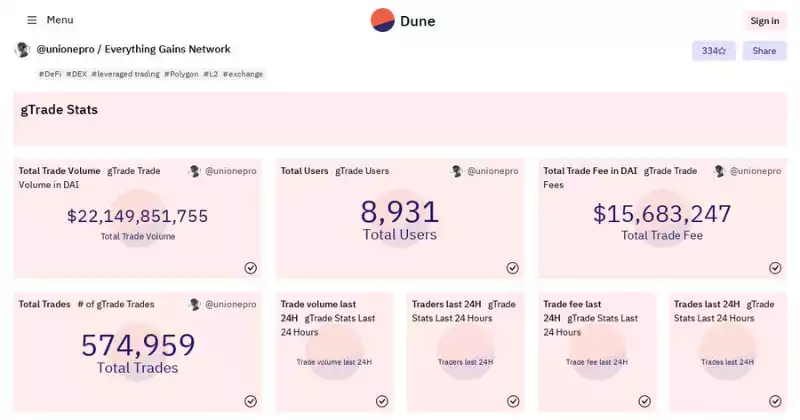

10. Of course, GainsNetwork is not to be missed:

- OG Perpetual Protocol for DeFi

- The team has been building since the past two years

- Has completed more than $22 billion in transaction volume

- Market leader in AMM risk management, maybe 1-2 years ahead

- The current pioneer of on-chain foreign exchange