Written by: The DeFinvestor

Compilation: JamesX

For the past few weeks, I've been working on a protocol built on top of GMX.

Here are the ones with the most potential:

First of all, briefly introduce the situation of GMX.

GMX is a DEX of perpetual contracts.

Anyone can provide liquidity to GMX by minting GLP.

GLP consists of an asset index and is used for swaps and leveraged transactions.

If you are new to GMX, I suggest you read this first 🧵.

1. @STFX_IO (launched on the Alpha mainnet)

STFX is a SocialFi marketplace for investing and trading.

STFX traders can share their trades by creating a vault.

Anyone can join these vaults and copy transactions in exchange for paying a certain fee.

STFX traders trade through GMX.

2. @UmamiFinance

Pioneer of the #RealYield narrative.

Umami is developing a suite of DeFi Yield Vaults.

Its first vault will automatically execute delta-neutral GLP strategies.

These will hedge against market volatility while collecting GLP yield.

3. @rage_trade

An ETH perp and #RealYield protocol.

It introduces an interesting concept:

80-20 Vault -- Allows external LP positions to be used to provide liquidity to Rage

Rage Trade's delta-neutral GLP vaults were launched in December to great success.

4. @dopex_io

An options DEX.

Dopex allows anyone to trade puts, calls and calendar options.

The team is currently developing Atlantic Permaculture.

The product will allow GMX users to trade with up to 10x leverage, without the risk of liquidation, in exchange for paying a certain fee.

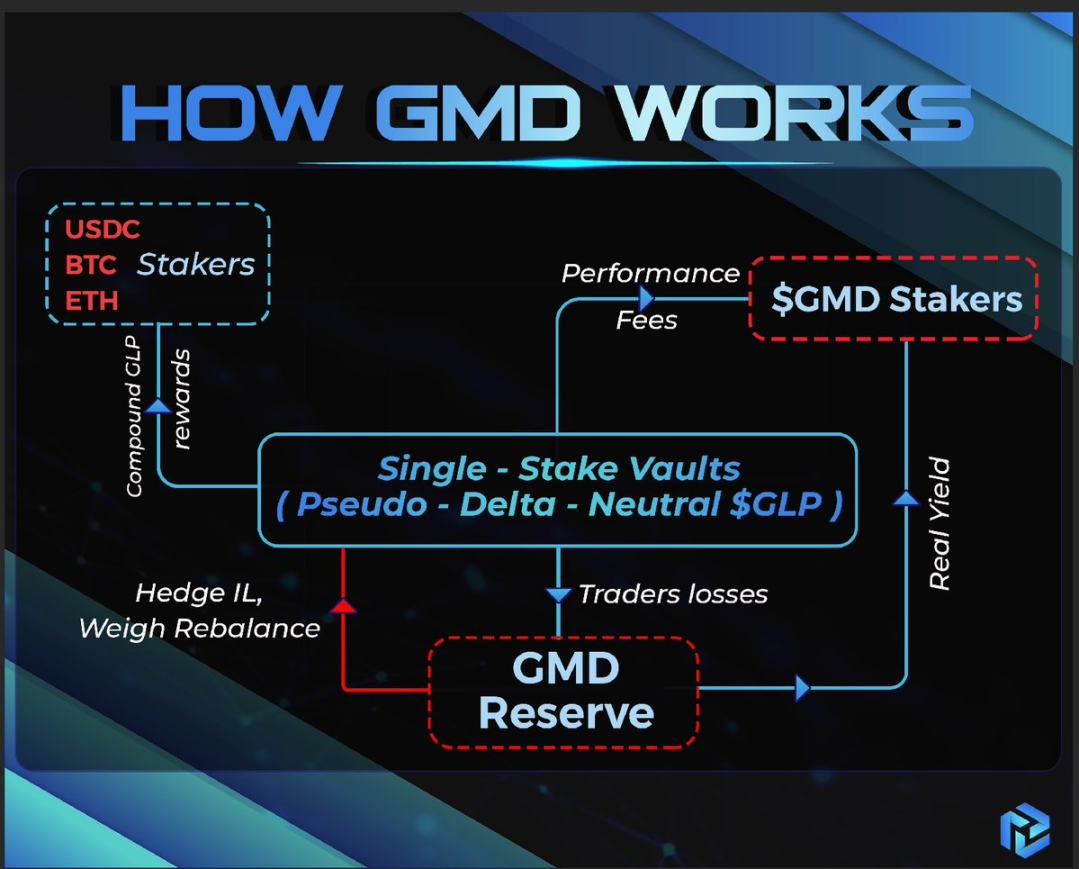

5. @GMDprotocol

A yield optimization platform built on DeFi applications deployed on Arbitrum.

It currently has 3 single-coin collateralized GMX vaults for ETH, BTC, and USDC.

All of these provide pseudo-Delta-neutral GLP strategies.

How these vaults work is shown in the diagram below:

6. @DeltaPrimeDefi

An under-collateralized lending platform deployed on Avalanche.

Borrowed 💰 can be used across integrated DApps.

DeltaPrime <> GMX.

DeltaPrime users will be able to:

- Borrowing with GLP as collateral

- Exchange GLP for LP tokens

- GLP with YieldYak Investment Multiplication

7. @yieldyak_

An easy-to-use platform for increasing Avalanche profitability.

Yield Yak's GLP strategy automatically compounds the rewards of GLP.

Based on recent performance, the strategy has returned 41.7% annually on GLP.

If there is no compound interest effect, its annual rate of return will reach 34.8%.

8. @vestafinance

Vesta is a stablecoin protocol on Arbitrum.

Its users can borrow $GLP and $GMX with $VST stablecoins.

All deposited $GMX and $GLP will be deposited into the GMX regular investment system.

80% of all ETH yields generated in this way go to depositors.

9. @DAOJonesOptions

A yield aggregation protocol for DeFi strategies.

The team is developing 2 new vaults.

The GLP treasury will borrow USDC to leverage GLP and obtain magnified benefits.

No risk of liquidation!

The USDC vault will generate income by lending to the GLP vault.

Estimated launch time: Q1 2023

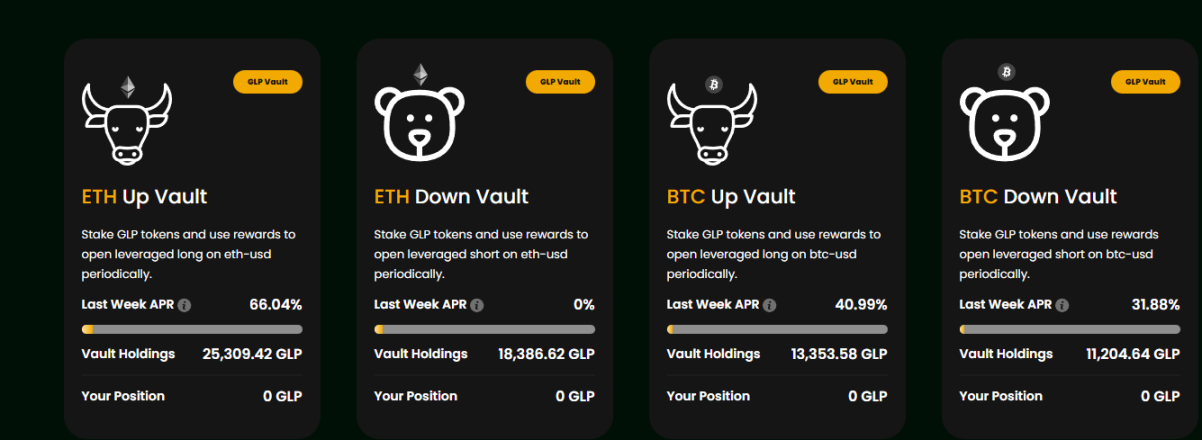

10. @VovoFinance

Vovo is building DeFi structured products.

Their GLP vault allows users to choose market direction.

For example, BTC goes up, ETH goes down

Vovo will use GLP rewards to open highly leveraged transactions.

If you pick the right market trends, you will get an enhanced yield.

Other projects worth keeping an eye on are:

- @PerpyFinance: A Social Trading Protocol

- @lyrafinance: An options AMM that will leverage GMX for hedging

- @Neutrafinance: A protocol with delta-neutral GLP vaults

- @tender_fi: A protocol that allows borrowing against GLP collateral.