This is a story about a bank that screwed up.

Original: Silvergate Capital: Fall from Grace

Author: DeFi Surfer

Compilation: Dongxun, the way of DeFi

Cover: Photo by Pramod Tiwari on Unsplash

Founded in 1986, Silvergate Capital Corp (ticker: SI, "Silvergate") was for decades a dormant community bank in La Jolla. This all changed during the 2020/2021 cryptocurrency bull run.

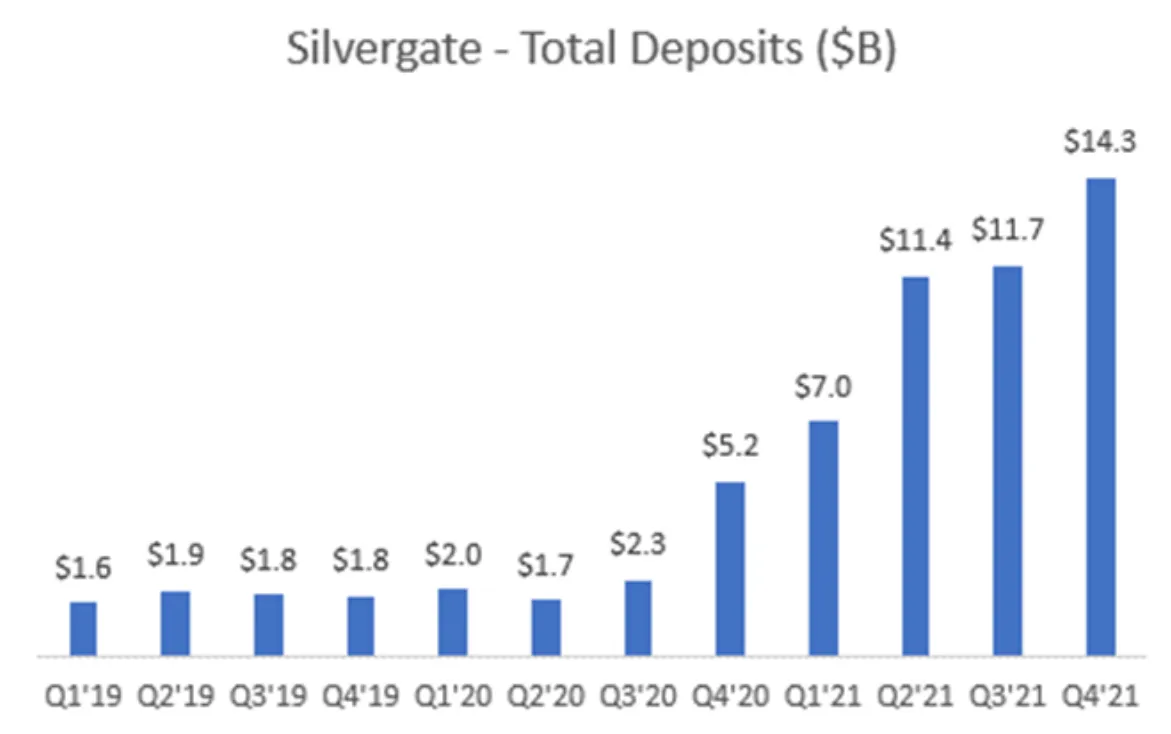

After Silvergate's 2019 IPO, the bank's deposits grew from $2 billion to $14 billion - a 7x increase! The bank's share price also rose from $13 to $220 per share, an astonishing 1600% increase.

But since peaking in November 2021, the stock has fallen 97% to $5, and the company is at risk of collapse. A swift fall from glory, all of which begs the question: What the hell happened?

This is a story about a bank that screwed up.

Introduction to Silvergate

Silvergate is a publicly listed bank known for its leading cryptocurrency franchise. The company's proprietary Silvergate Exchange Network (SEN) is a technology platform used to connect more than 1,600 cryptocurrency exchanges, financial institutions, hedge funds and retail participants. With 24/7 uptime and instant fiat transfers connecting crypto market participants around the world, SEN is the bank of choice for crypto-fiat needs.

Silvergate's SEN network has enabled the bank to achieve incredible deposit growth, growing seven-fold from approximately $2 billion to a peak of $14 billion in Q4 2021. Both Silvergate and Signature Bank 's Signet have seen massive growth, as they are effectively the only two U.S. banks bringing fiat to the global cryptocurrency ecosystem.

It all sounds good: Silvergate has been a hit during the bull market. So where did it go wrong?

First, let's take a quick look at how banks make their money.

how banks make money

(Skip this part if you are familiar with banking models)

At the most basic level, banking is simple business. They absorb capital in the form of equity + liabilities (mainly deposits) and acquire assets (such as making loans and buying securities).

- Equity + Liabilities : Banks start with the equity capital of a group of investors and take deposits up to a certain multiple of equity capital (approximately 10 times; regulators set strict limits on capital adequacy ratios for financial institutions). Banks attract deposits by providing services to retail and business customers, such as checking, savings, bill payments, loans, and more. Specialist banks such as Silvergate attract deposits through unique products such as the SEN network. Banks also attract deposits by paying deposits, offering deposit yields. These are called interest bearing (IB) deposits. IB deposits are considered to be of lower quality compared to non-interest bearing (NIB) deposits. IB deposits have lower margins than NIB deposits and are generally more volatile as they seek out the highest bidder.

- Assets : Banks use this equity and deposit capital to make loans to businesses, real estate projects (such as mortgages), or consumers (such as auto loans), or to buy securities such as Treasury bonds, municipal bonds, mortgage-backed securities (MBS), or high-value securities. Rating corporate bonds. Banks generally steer clear of "risky" securities such as junk bonds and stocks. As a highly leveraged business (ie 10 to 1 equity capital), the bank could not afford to take a serious loss on its balance sheet assets. Asset losses would at least damage the bank's equity capital and, at worst, could damage depositor obligations.

Putting the obligations of depositors at risk, banking regulators will have it shut down very quickly. Please keep this in mind.

The rate of return a bank earns on its assets minus the cost it pays on deposits equals the bank's net interest margin (NIM). Banks also earn income from other services, such as wealth management or underwriting fees. However, net interest margin is usually a bank's largest source of income. After deducting labor costs and other indirect expenses, and then deducting taxes, the net income of the bank is obtained.

Below is a simple balance sheet and income statement for a $100 million bank. Note that the biggest drivers of a bank's profitability are the size of its deposit business and its net interest margin, which is the spread a bank earns after subtracting the cost of deposits from its return on assets.

A bank with fast growth and a cheap deposit base is great value.

Silvergate fits perfectly into this model during the cryptocurrency upgrade cycle. Crypto savers flood the crypto ecosystem with cash and are willing to hold Silvergate’s fiat currency for free in exchange for access to the bank’s proprietary SEN network. Significant growth in cheap deposits has caused SI's profitability and share price to soar in 2020 and 2021:

How Banks Are Rewarded: A Credit Collapse and Duration Mismatches

Banks take deposits, make loans, and buy securities. It's so simple... how could anyone screw it up?

Banks run into trouble when they have impairments on the asset side of their balance sheets and are forced to take losses on shareholders' equity. Fraud aside, banks can do this in two ways: (1) Credit Blow Ups and (2) Duration Mismatch.

1. Credit collapse : Banks may make bad loans or buy bad securities. In other words, acquiring assets from bad counterparties that are unable to meet their obligations, resulting in losses. Huge losses on loans and securities created the Great Financial Crisis, forcing the Federal Reserve to bail out many large financial institutions or risk the global financial system collapsing.

Shareholders of banks and financial institutions with the worst loans and securities, such as Lehman Brothers, Countrywide and Bear Stearns, due to losses on assets on their balance sheets that were far greater than the banks' equity capital was eliminated.

2. Duration mismatch: Duration mismatch means that during a bank run, banks are forced to sell assets at a loss in order to satisfy depositors' redemption. Sell enough assets at a deep enough discount and the bank's equity could disappear in the blink of an eye.

The duration mismatch during the bank run was what led to Silvergate's collapse after the FTX crash.

How Silvergate blew it: Forced to sell long-term assets at huge losses

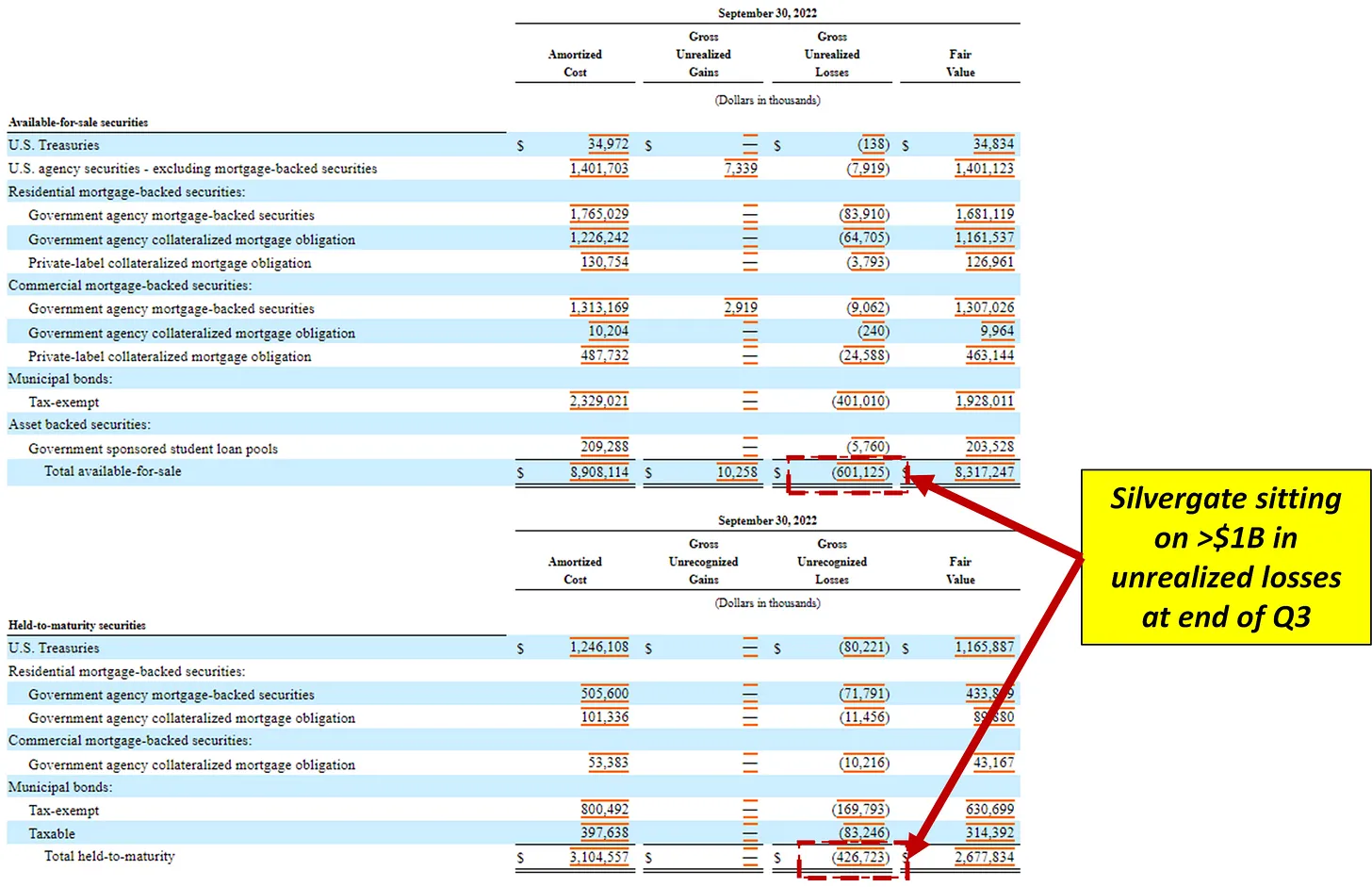

As Silvergate's balance sheet grew rapidly during the cryptocurrency bull market, the company acquired billions of dollars in long-term municipal bonds and mortgage-backed securities (MBS). Unfortunately for Silvergate, interest rates have risen rapidly throughout 2022, significantly reducing the value of Silvergate's portfolio of securities.

(For an overview of the relationship between interest rates and bond prices, see here ; TLDR long-term bonds fall in value when rates rise.)

As of the end of the third quarter of 2022, Silvergate's securities books had unrealized losses of more than $1 billion. The bank apparently acquired Long Duration Assets at a historically unfavorable time.

Either way, the loss was unrealized. As long as Silvergate depositors keep their funds on the platform, and Silvergate can hold their bonds to maturity, everything will be fine...right?

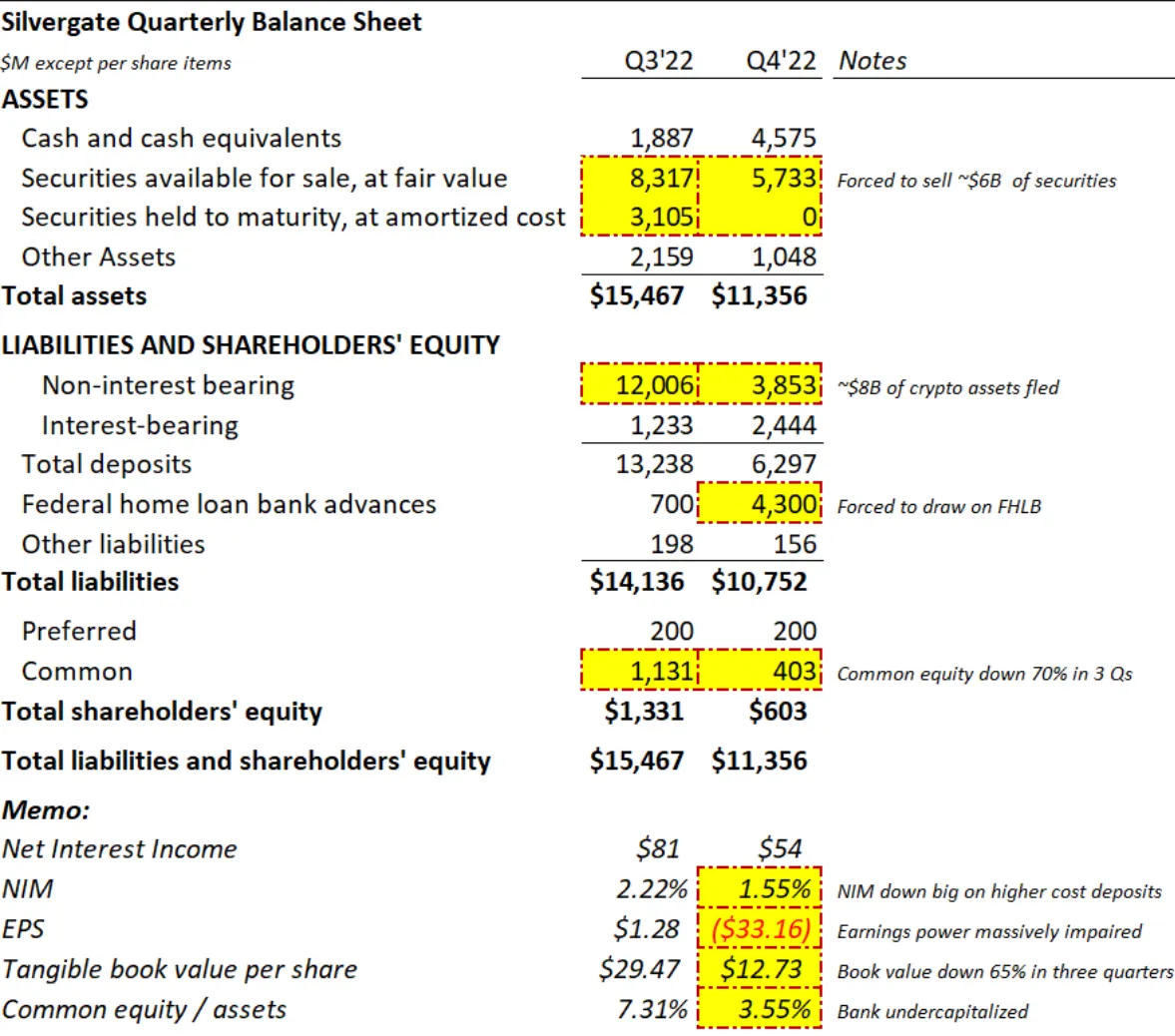

However, after FTX went bankrupt in November 2022 , Silvergate depositors panicked and withdrew their funds. In the fourth quarter of 2022, Silvergate deposits fell by $8 billion, a 68% decline in a single quarter. It was a textbook bank run .

To satisfy depositors' redemption demands, Silvergate was forced to sell $6 billion of securities it had struggled to acquire over the past 1-2 years at a cost of about $7 billion. As a result, the company realized a securities loss of approximately $900 million , losing 70% of Silvergate's common stock in the process.

The sharp decline in deposits and a realized securities loss of $900 million impacted Silvergate's shareholder equity and profitability:

The company also drew $4.3 billion from the Federal Home Loan Bank's (FHLB) emergency loan program. In addition to taking advantage of expensive sources of financing, Silvergate's bank run has upset regulators, according to conversations I've had with industry insiders. Putting customer deposits at risk is a major no-no for banking regulators.

Recent news that Silvergate had to sell more securities and shut down its SEN network in the first quarter may indicate that regulators are putting an end to Silvergate's cryptocurrency ambitions.

Does Signature Bank face similar risks? Not too possible

Silvergate’s crypto banking peer Signature Bank(ticker: SBNY ) is often rumored to be the “next shoe” in the crypto regulatory crackdown.

I think a bank run and regulatory shock like the Silvergate event is unlikely for the following reasons:

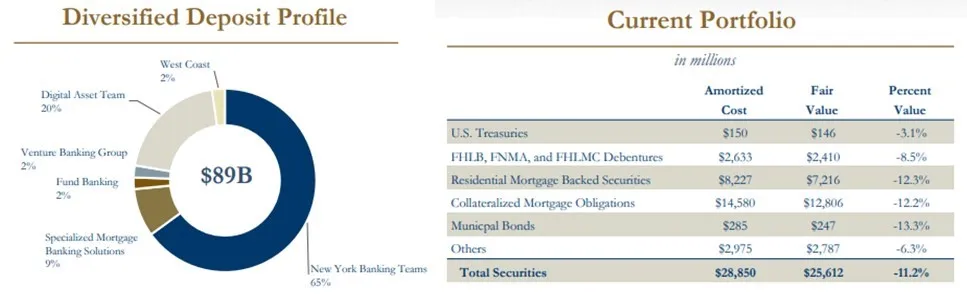

Signature banks are much larger and more diverse. Signature had $110 billion in assets at the end of the fourth quarter, compared to Silvergate's $11 billion (or 10x more). Of its $89 billion in deposits, only about $18 billion, or 20%, are tied to cryptocurrencies. In contrast, Silvergate’s deposit franchise is effectively 100% cryptocurrency.

- Signature Bank is much larger and much more diverse . Signature had $110 billion in assets at the end of the fourth quarter, compared to Silvergate's $11 billion (or 10x more). Of its $89 billion in deposits, only about $18 billion (20%) is tied to cryptocurrencies. In contrast, Silvergate's deposit franchise is effectively 100% cryptocurrency.

- Signature's balance sheet is more Liquidity . Signature has $34 billion in liquid assets ($9 billion in cash plus $26 billion in fair value securities). That's nearly double Signature's $18 billion exposure to crypto deposits. In the event of a cryptocurrency deposit run, Signature will be able to redeem with minimal loss of securities.

- Signature has a longer history of working with regulators . This is more of a guess, but I believe the bank won't get the same regulatory hit as Silvergate. As the company highlighted in response to a Wall Street Journal article, Signature has a long history with the Federal Home Loan Bank (FHLB) and regularly leverages its loan servicing. In contrast, Silvergate used FHLB in a panic.

Signature has around 20% cryptocurrency deposit exposure and 2x the Liquidity of its deposit exposure.

Conclusion: Don’t Fund Long-Term Assets With Fickle Crypto Deposits

Silvergate could have avoided this unfortunate outcome had it used customer deposits for cash and short-term Treasury bills instead of long-term municipal bonds and mortgage-backed securities. The mismatch between highly volatile cryptocurrency deposits and long-term assets that are sensitive to changes in interest rates led to significant losses for Silvergate. With cash and T-bills, Silvergate could have met customers' redemption needs, avoided a severe equity impairment and didn't have to tap into FHLB's emergency lending program.

It’s worth noting that the risk of crypto deposit flight is exactly why USDC constructs its reserves using extremely Liquidity 20% cash/80% 3-month Treasury bills (T bills).

Disclaimer: As a blockchain information platform, the articles published on this site only represent the personal opinions of the authors and guests, and have nothing to do with Web3Caff's position. The information in the article is for reference only, and does not constitute any investment advice or offer, and please abide by the relevant laws and regulations of the country or region where you are located.