A year ago, we wrote an article on Aggregator Theory in the Web3 Era. In the Web2 era, aggregators benefit from collapsing distribution costs , they bring together many service providers, platforms like Amazon, Uber or Douyin through hundreds of service providers (suppliers, creators or Drivers) provide services to users and make money from them, and users also benefit from this and have more choices.

For creators, using aggregation platforms can also increase the scale of influence. For example, I post on Twitter instead of Lens because my audience base is more concentrated on Twitter.

In Web3, the aggregator mainly relies on the fact that the cost of verification and trust collapses. If you use the correct contract address, you don’t need to worry about whether the USDC token you exchanged on Uniswap is the real USDC token. Such an NFT marketplace would also not have to spend resources verifying the authenticity of each NFT traded on the platform, since the network bears that cost.

Aggregators in Web3 can more easily check the price of an asset or find their listing location by examining on-chain data, and over the past year most aggregators have focused on aggregating on-chain data collections and making them available User Usage - This data could be about prices, yields, NFTs, or access to bridged assets.

The assumption at the time was that monopolies would be built in the form of aggregator interfaces by companies that scaled fast enough, I specifically cited Nansen, Gem, and Zerion as examples at the time, ironically, in hindsight my assumption was wrong , this is what I want to write today.

Weaponized Tokens

Don't get me wrong. A few months after publishing the first article, Gem was acquired by OpenSea, Nansen raised $75 million, and Zerion also raised $12 million last December. So if I'm looking at these things as an investor, my assumption is correct because each of these products is a category leader in its own right.

But what interests me in writing this article is that the relative monopoly I think they will have doesn't exist yet, instead they all face new competition that has emerged over the past year, which is also a desirable characteristic of a nascent industry.

So what happened in the years since? As I wrote in " Royalty Wars ," the relative monopoly of Gem (and OpenSea) has been called into question with the release of Blur on the NFT market; similarly, blockchain data platform Arkham Intelligence has combined Excited UI, possible token launch, and clever marketing strategies, including challenging Nansen with referral reward tokens; Zerion may be comfortable, but with the launch of a new Uniswap wallet, it may also eat into its market share;

Do you see the trend here? As some projects choose to offer tokens to users, aggregators who did not issue tokens and have grown easily with equity backers are now at risk . This concept of "community ownership" will be important as we progress deeper into the bear market, as the limited number of consumers who remain in the market want to maximize every dollar they spend. Also, getting rewarded for using the platform rather than paying for access is a novel experience.

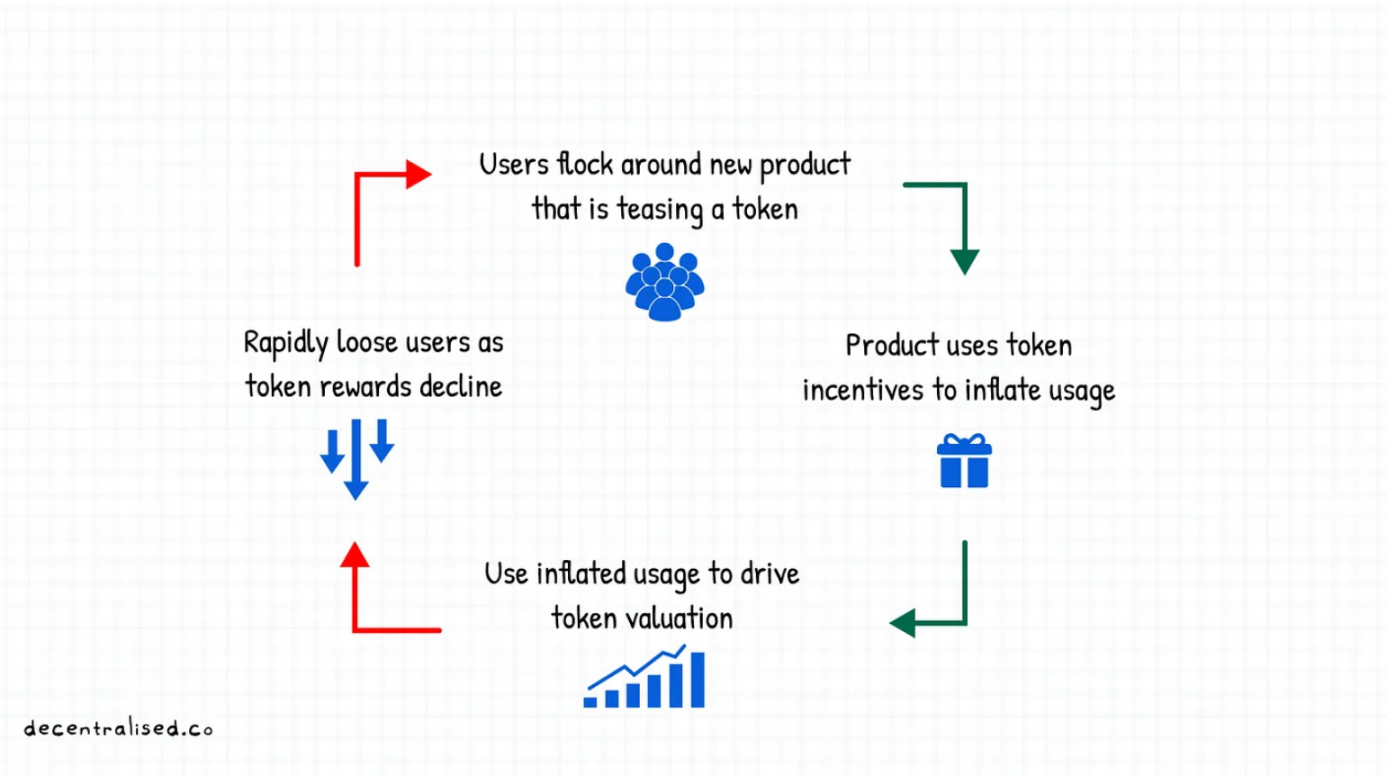

So, on the one hand, companies that are cash flow positive in the long run will see their revenues decline, and on the other hand, they will see users flock to their competitors. Is this sustainable? Absolutely not, here's how it works:

The project side launched a product that implies the issuance of tokens, and it would be even better if it was linked to a referral program. For example, Arkham Intelligence provides tokens to users who visit their platform, and considering the possibility of AirDrop, more and more users will spend time on this product.

It’s an incredible way to stress test your product, reduce customer acquisition costs, and channel network effects into your product. But the challenge is retention, users often move on to other products once token rewards are no longer offered, so most developers who "hint" that they will issue tokens don't know how broad their user base is.

The man pictured below sums up the philosophical underpinnings of the average person in crypto today so profoundly that it symbolizes the egoism that drives our world:

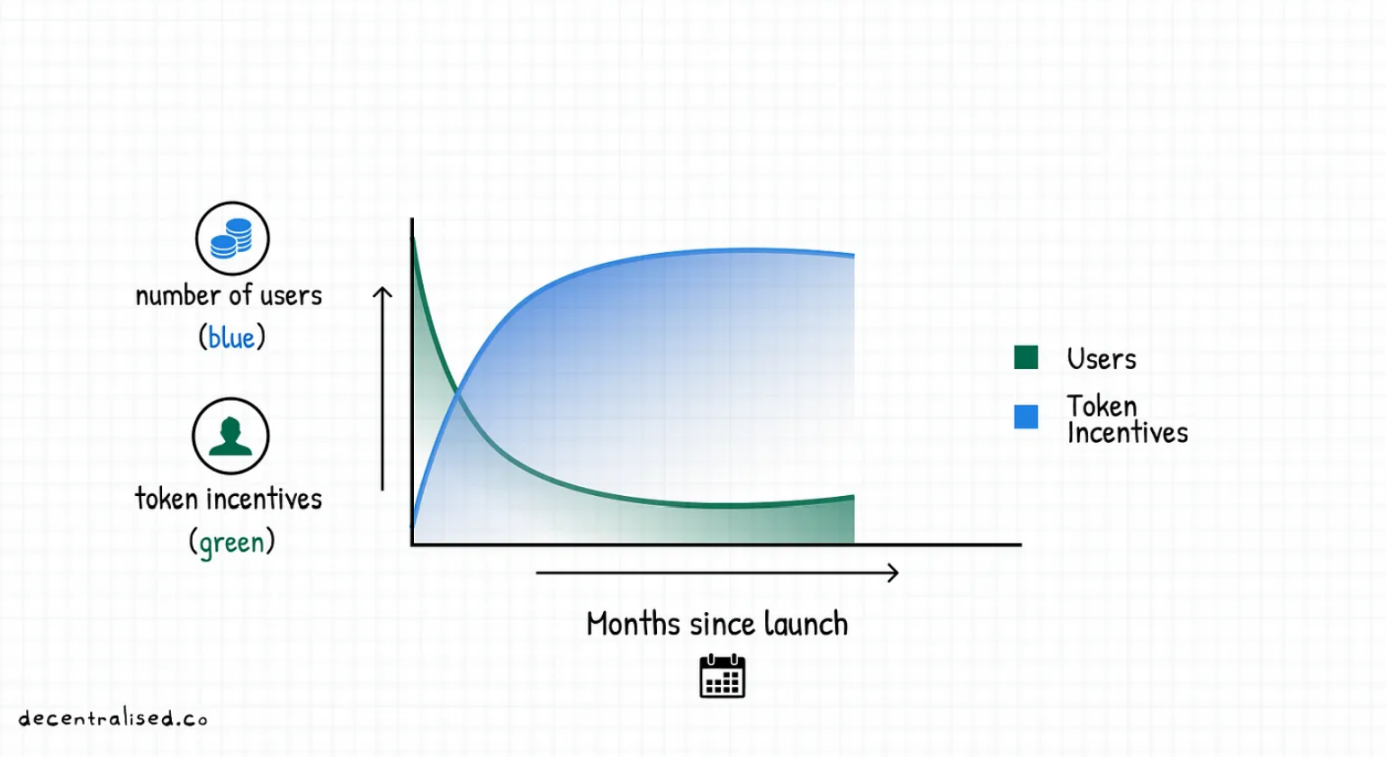

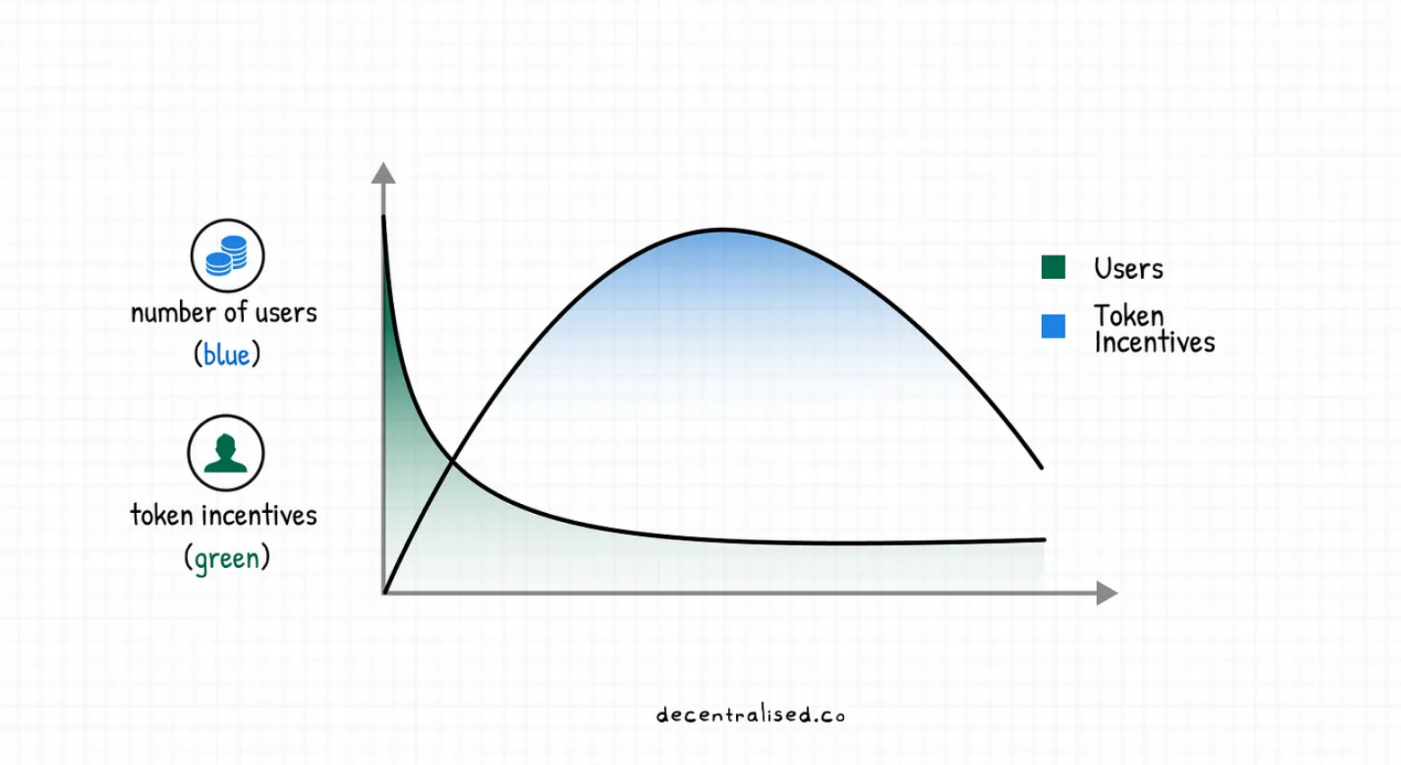

Regardless, there has been a historical tendency in the past for users to abandon token-issuing projects, a pitfall that comes from the fact that founders (probably) believe that users acquired through token incentives are sticky . Under ideal conditions, the graph between token rewards and product users should look like this:

But the reality is that the initial influx of users has almost completely abandoned the project as token incentives have dwindled . There is no reason for them to continue contributing to products without the incentives that attracted them in the first place, a phenomenon that has plagued DeFi and P2E projects for the past two years.

Users who accumulate tokens and hold tokens are new "community" members who want to know when the price of an asset will surge high enough for them to exit (assuming market participants are rational actors acting in their self-interest) .

My original view was to simply consolidate the feature sets of multiple products into one interface, using the blockchain as the infrastructure backbone to act as a durable moat, but this could be wrong, so I wonder why in Web3 Leaders with relative advantages lose to others.

For example, Binance toppled Coinbase, and in turn they faced competition from FTX; OpenSea received competition from Blur; Axie Infinity developer Sky Mavis may also face pressure from new entrants like Illuvium.

Why are users leaving Web3 over time? How can we retain users for a long time?

What can be a moat in Web3 when everyone can release a version with an embedded token? I've been thinking about this a lot because we live in a narrative-shifting market where there's a new "hot" thing every quarter, which is why the VCs I follow went from telecommuting experts overnight to An expert in managing geopolitical tensions.

Of course, this works if you're trading assets (which, by the way, is the "use case" for most cryptocurrency users). But if you want to build an underlying asset that grows over time (like a stake in Google or Apple), trading frequently is probably a bad idea .

If you ultimately want the time, money, or effort spent to grow without active management, the only way to do that is with a product that does two things:

- First and foremost, retain existing users;

- Secondly, actively expand and avoid competition from other projects to erode your market share;

How do you do that (you know, when people start thinking about moats and retention, it's a bear market)?

competition is loser's game

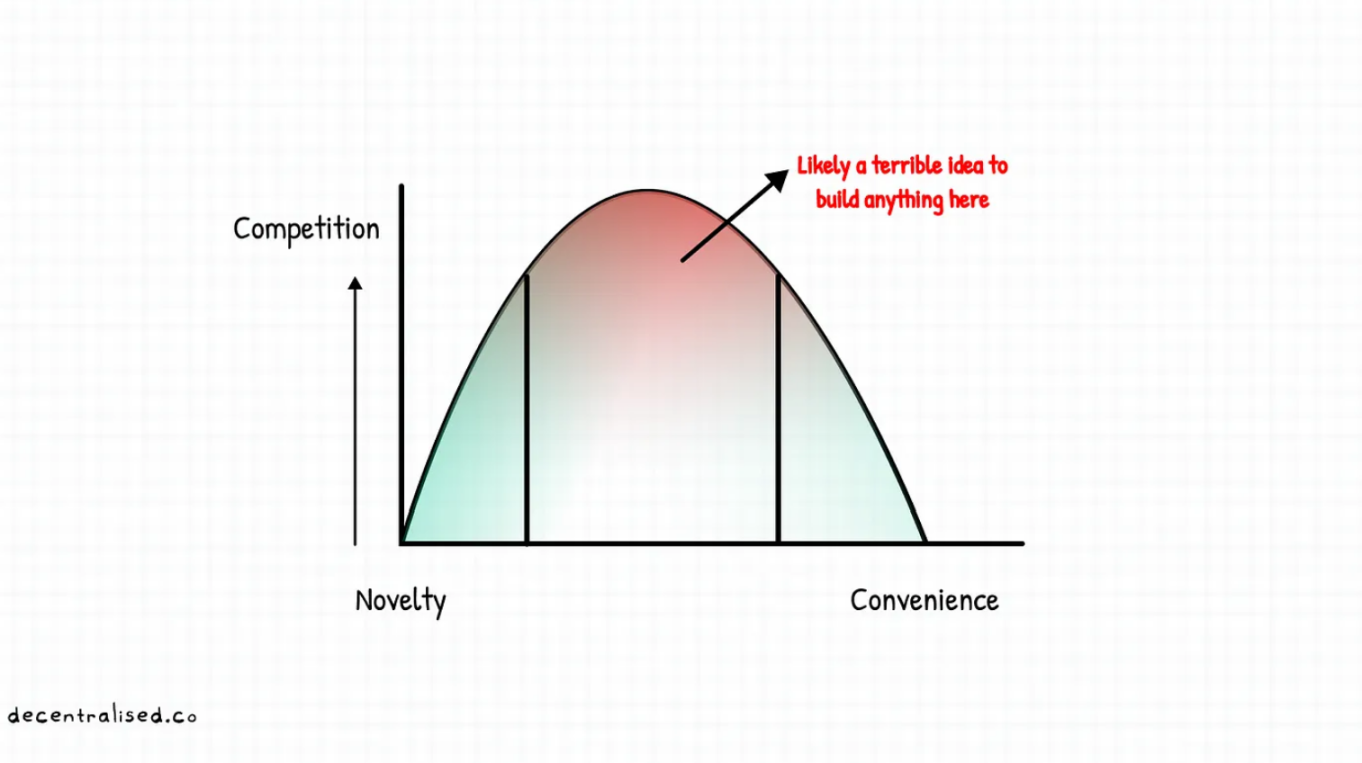

Part of the explanation for this phenomenon is ranking the company on a spectrum between novelty and convenience. In the early days, primitive tools like NFTs were novel and attracted people who wanted to try the product at all costs.

We're happy to handle the wallet's Seed Phrase and process fiat deposits because the novelty of using "digital currencies" is enough to entice us. If you notice the user's curiosity about "Ordinal", you will realize how patient the user is.

Part of this patience is due to the profit factor of early trends, where speculation and the profit motive drive users to put up with a rough experience .

At the other end of the spectrum are the highly accessible tools we rely on every day. Amazon is a prime example of an aggregator that has us addicted to convenience, consumers may benefit from buying from niche stores not on Amazon, and certain sellers on Amazon may be pricing wrong.

But when making a decision, Amazon frees us from worrying about payment methods, delivery times, or customer support, and this “saving” in mental labor translates into higher spending (attention or capital) on the aggregator.

Many sellers come to Amazon precisely because they understand the behavior of consumers in the marketplace, which is different from what users would see if they went directly to the store to shop.

Tim Wu's 2018 article sums up the effort people make for convenience:

We are certainly willing to pay a premium for convenience, even more than we realize. For example, in the late 1990s, music distribution technologies like Napster made it free to get music online, and many people used this option. While it's still easy to get music for free these days, no one really does it anymore. Why? Because the introduction of the iTunes store in 2003 made buying music more convenient than downloading it illegally, and convenience beats free .

Going back to the spectrum I mentioned initially, new technologies often pay users to try them out, in contrast to highly convenient apps that can make users pay top dollar if it meets the user's desire for convenience eager.

The challenge with most consumer-facing apps today is that they sit in the middle of the spectrum , what I call the "valley of death." They're neither so new—not so new that people want to try what they've built, nor convenient enough—not so convenient that users don't need external support and just rely on them.

Skiff, Coinbase Card, and Mirror do well on this end of the convenience spectrum as alternatives to their traditional competitors.

But take games, lending, or identity verification tracks as examples, and you can see why these topics are currently not scalable on-chain.

Most apps in the middle make the fatal mistake of competing with each other . They first increase user acquisition costs and hiring costs through advertising and recruiting, and then compete with each other through toxic memes and adversary-oriented narratives. As Peter Thiel said, competition is a loser's game .

When startups start competing in small, specialized markets, there are usually no winners. In his words, the only way a startup can transition from the struggle for survival is to have monopoly profits, but how do you get there?

new moat

If companies in Web3 want to move away from tokens as a growth lever, they only have three levers they can focus on: cost, use case, and distribution . There have been a few of these in the past, let me explain each one.

cost

Stablecoin have become a killer use case for cryptocurrencies as they provide a better experience than traditional banking across the globe. For example, India's UPI innovation might be more cost-effective for domestic payments, but to move funds between Southeast Asia, Europe, or Africa, or simply transfer balances between US bank accounts, it would be wiser to use on-chain transfers.

From the user's perspective, incurring costs not just in the amount spent on the transfer, but in the time and energy allocated to moving the funds, debit cards are to e-commerce what Stablecoin are to remittances: they reduce The cognitive cost of making a transfer.

If you compare this to most consumer-facing yield-generating mobile apps - you can offer a point or two of yield in dollar terms, but value considerations are irrelevant when you factor in the risk of bankruptcy.

distribution

Distribution can be a moat if you amass a niche user in an emerging field. Think about how Compound and AAVE opened up a new lending market? Few people think that spending $100 of ETH to borrow $50 is valuable, but many people ignore that there is a kind of market that is not served-mainly those crypto billionaires who do not want to sell their assets in a bear market.

So if you think DeFi lending volume is being driven by people in emerging markets who don’t have access to credit lines, you’re wrong, it’s the crypto affluent, the previously unbanked population that’s using it. So focusing on these can become a "hub" in a niche area, allowing you to focus on a single function. Coingecko and Zerion are two companies that have done a good job in this regard.

Iterating and adding new revenue streams to the product itself becomes cost-effective, given that the marginal cost to a project of onboarding users to a new feature is next to zero . This is why players like WeChat (in Southeast Asia), Careem (in the Middle East) and PayTM (in India) tend to do well.

When players like Uniswap release wallets, they are actually trying to bring users together in an interface where more functionality (like their NFT marketplace) can be pushed at lower cost.

Example

Tools like ENS, Tornado Cash, and Skiff have carved out their unique user base who rely on the product for desired functionality that today's traditional alternatives cannot provide. For example, Facebook will not link your wallet address to your identity, and your bank will not provide the privacy protections that Tornado Cash provides.

These are products with user stickiness, and there is usually no other alternative that can match the level of this product. First movers in new use cases will take a while to educate users and understand what the utility does, but they also have the advantage of capturing a large new market.

Like in the early days of LocalBitcoins, it was the only place for peer-to-peer trading, which helped them pool Liquidity in emerging markets like India, and kept them on top until 2016 (LocalBitcoins RIP, read more " Bitcoin OTC King's Curtain Call: Revisiting the Rise and Fall of LocalBitcoins for a Decade ").

It is difficult for a bear market to scale by focusing on any of these levers, and the examples I mentioned above have been through multiple market cycles. Part of what makes Axie Infinity stand out, for example, is that the team has been building for two years leading up to 2020 - the team has been formed to build the community, maintain the token, and balance investor interest (token sale) before the next bull run The "power" required to benefit (earn tokens) from the user.

This explains why when the market is down, development tools and infrastructure are all the rage from a venture capital perspective . Because in order to solve the lack of interest of retail users, there is an option to focus on the business-to-business (B2B) side-you build tools for developers, and they are responsible for attracting retail users themselves.

Big players like Coinbase recognize this, which is why they release tools like wallet APIs in bear markets.

From Novelty to Convenience

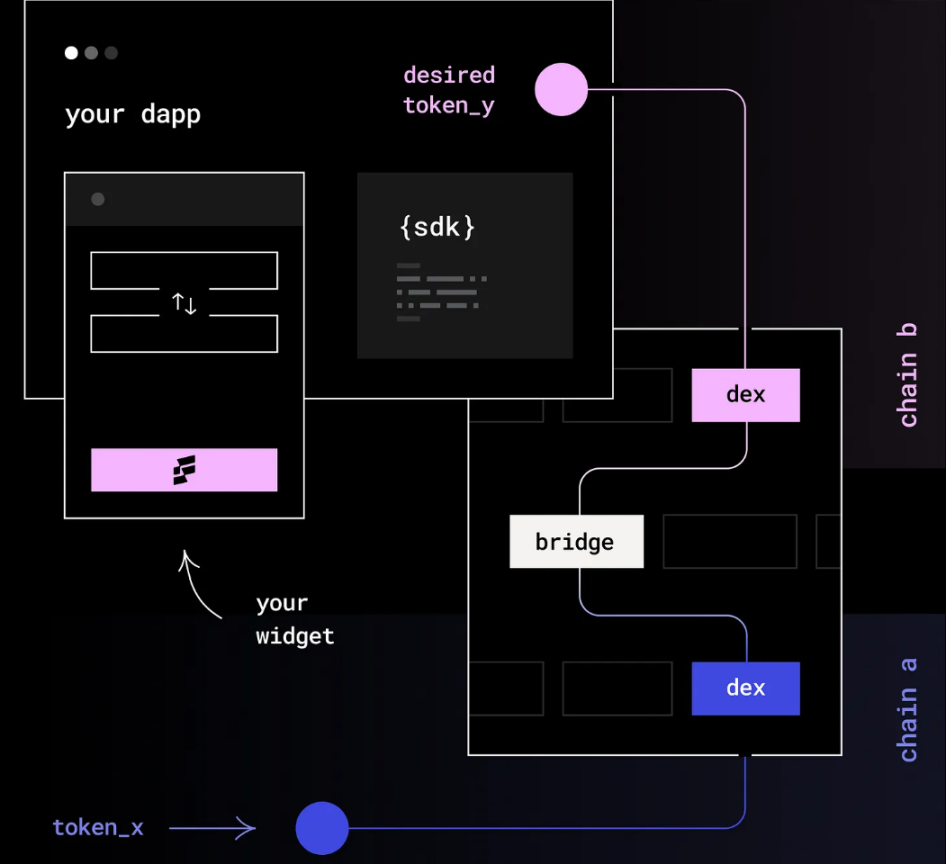

LI.FI is a Multichain Liquidity aggregator that provides an SDK for developers who want to extend their applications or users to multi-chains.

Assuming that Metamask or OpenSea want to enable developers to enable users to move assets between chains such as Polygon and Ethereum, then LI.FI provides a simple SDK for determining the best way to transfer funds across bridges and DEXs, so the development People can focus on what they do best.

Think of an aggregator like Li.Fi as a Lego brick that developers put into their applications to help users move assets between chains at minimal cost.

There are several players in the same business, but I'm using LI.FI as an example because they have actually fulfilled the conditions I mentioned above, and some of the things they've been doing validate the moat I mentioned earlier:

- LI.FI is starting to focus on businesses, not retail users. If long-tail developers building applications that may require Cross-chain transfers are captured, then there is no need to worry about directly attracting users;

- Companies using this product save research and maintenance time. In a bear market, everyone wants to conserve resources as much as possible. So selling a product like LI.FI becomes relatively simple by default;

- From an end-user perspective, an aggregator provides the best cost basis for transfers. So people want to use products that already have their SDK integrated;

- LI.FI is often the first project on the same track to integrate a new blockchain network - this puts it at the cutting edge of the competition;

- Finally, their target group is mainly the players who are the last to leave cryptocurrencies. Generally speaking, one year after entering the bear market, it is advanced users who are speculating and trading in the industry, and you don't have to spend too much money to educate them;

Now, don't get me wrong, LI.FI is not the only Cross-chain bridge aggregator on the market, and while meeting the criteria I mentioned above for cost, headcount, and use cases, it's hard to see how any of them will build moat. But I'm particularly interested in how they evolve from novelty tools to convenience tools.

In the early days, users relied on Cross-chain bridges because the transfer process required a painful wait for an exchange to go through - you had to move funds through a centralized platform, undergo security checks, and hope that the funds arrived instead of just a few clicks .

Sure, DeFi degens are sending billions of dollars Cross-chain today, but normal people (like your high school friends) don't care about that.

So how do you survive when the novelty wears off? If you pay attention to how Nansen and LI.FI work, you can get the answer by looking at who they sell their products and services to:

LI.FI is primarily marketed to developers, and yesterday Nansen launched Query, a tool that gives corporates and large funds direct access to Nansen data, which they claim is sixty times faster than its closest peers at querying the data. So why are both companies focused on developers?

It has to do with the fact that it can be a tool for novelty and convenience at the same time if the company sells to power users . For example, when developers decide whether to integrate with LI.FI, they usually have a simple calculation in their mind, such as does the aggregator effectively spend less time and money than integrating a single Cross-chain bridge?

Again, the question for anyone using Nansen queries is whether the tool saves enough time and effort to keep its cost low enough if implementing it yourself in-house is less than paying a third party like LI.FI , then decision makers are likely to prefer not to build from scratch.

The fastest way for a company to escape through the "valley of death" in the convenience-to-novelty spectrum I mentioned in the diagram above is to focus on the few users who are willing to pay a premium because your product Now a convenience tool, this gives the product enough room to run to build enough user interest and become the convenience tool of choice.

I discussed this framework with Alex, the founder of Nansen, and he put it differently, that users seek value regardless of market conditions . In a bear market, enterprises and networks are the largest customers, requiring very specific data sets that are often not available from third-party vendors.

So tailoring the product to their needs, and letting them see value, means more revenue for you and less competition.

Back to Basics

When I wrote about aggregation a year ago, I mistook product features (using blockchain) for moats. Since then, DeFi yield aggregators have sprung up, but most have failed. Simply integrating blockchain may not make much sense if competitors can launch products with the same features and a better user experience, or if they launch tokens like Blur has done. In this environment, it is necessary to think about what really differentiates the product.

As I write these words, some patterns become very apparent:

- First, the cost of user acquisition will skyrocket in a bear market , as retail user interest is low, and unless the product has special novelty or convenience, it's in an odd position;

- Second, businesses built for other companies (B2B) may be able to compound enough to survive and then dominate in a bull market, like FalconX;

- Third, if poorly designed, tokens are temporary moats and long-term liabilities , with few communities actually building value meaningfully for tokens long enough;

When you think about the retail market or niche markets like DeFi, it's clear that the average person doesn't care which chain or how decentralized they are, they care about the value they can get out of it , and blockchain can help increase the value that end users can The value obtained. But founders can often fall into the trap of building a product and selling a service for VCs (or token traders) without actually building a moat based on cost, convenience, and community.

This might be a bit cynical, but it's worth considering.