Note: This article comes from @NintendoDoomed Twitter, and MarsBit organizes it as follows:

Detailed explanation and quick valuation of $ARB token economics

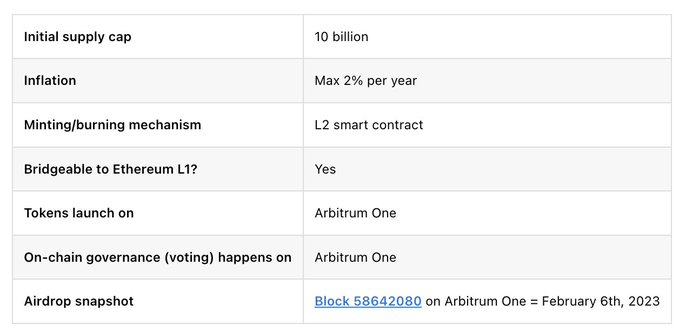

Initial total amount: 10B (the total amount is not the circulation)

Inflation: up to 2% per annum

Forging and destruction mechanism: L2 can only contract

Can be bridged to L1 : Yes

Tokens issued on: Arbitrum One

On-chain governance at: Arbitrum One

Airdrop snapshot time: February 6, 2023

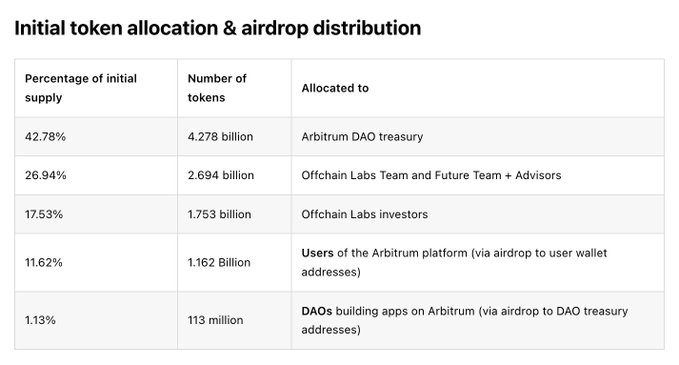

The initial token distribution is as shown in the figure below, and the estimated initial circulation

1. User

2. Ecological developers (ie DAOs)

3. A small part of treasury, team and investors

Estimated to be between 1-2B

Valuation:

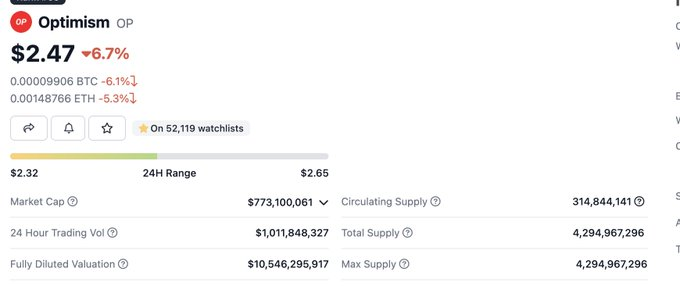

Benchmarking$OP

Circulating market value = 0.8B

Full circulation market value = 10.5B

$Matic $Sol The full circulation market value is also around $10B

Arbitrum's TVL has been 1.7 times that of OP without incentives, achieving vigorous organic growth.

If the OP is given 2 times the FDV, it is 21B, and the corresponding token price is $2.1.

Reasons for higher valuation: L2 leader, rare organic growth and healthy ecology, relatively high certainty

The reason for the lower valuation: The airdrop boutique account is not much different from the Lumao account, and the initial circulation is relatively high, which may lead to greater initial selling pressure.

Addendum: $ARB Token Economics Documentation

https://docs.arbitrum.foundation/airdrop-eligibility-distribution