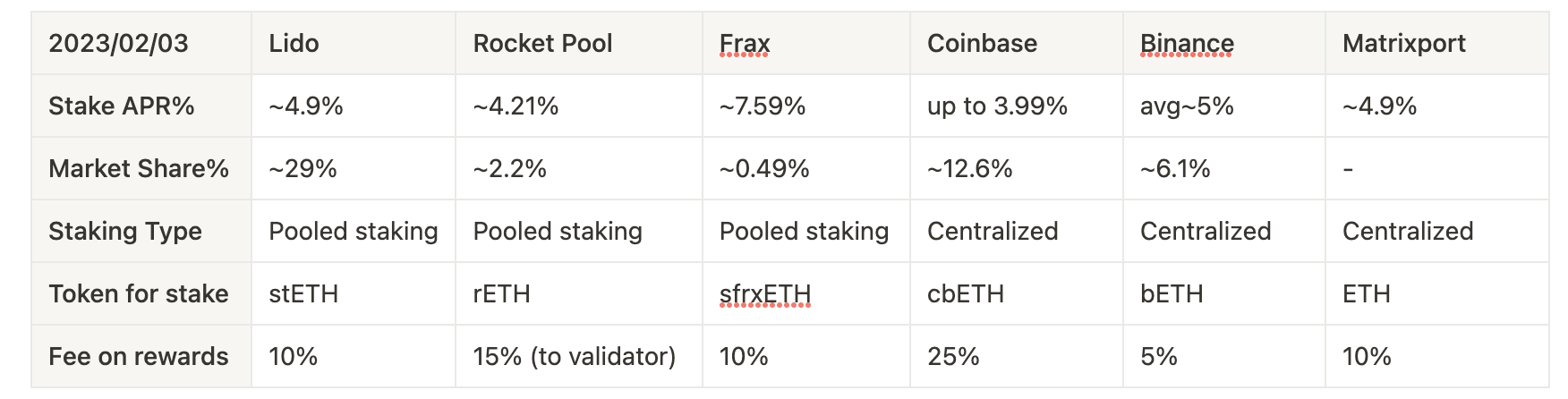

Author: CompoundWater 复水; Contents May Also Contribute to MatrixDAO This article was written before the ETH Shanghai upgrade (23/02/03), and the comparison of the interest rate of each ETH pledge ETH 1d700d145a97443c8543ebebcbcbcad9

Contents

IntroComparing the Staking RatioStaking Deposits BreakdownLidoRocketPoolFraxCoinbaseBinanceMatrixportConclusionReference

Intro

ETH Staking APR% is an important metric to consider when deciding where to stake your Ethereum. This document will compare Ethereum’s staking ratios before the Shanghai upgrade, breaking down the total amount of staking deposits, the largest staking providers, and the fees associated with staking rewards. It will also outline the largest staking providers such as Lido, RocketPool, Frax, Coinbase, Binance, and Matrixport.

**The main reference for this article comes from: Liquid Staking Derivatives by MatrixDAO RF- GM. **

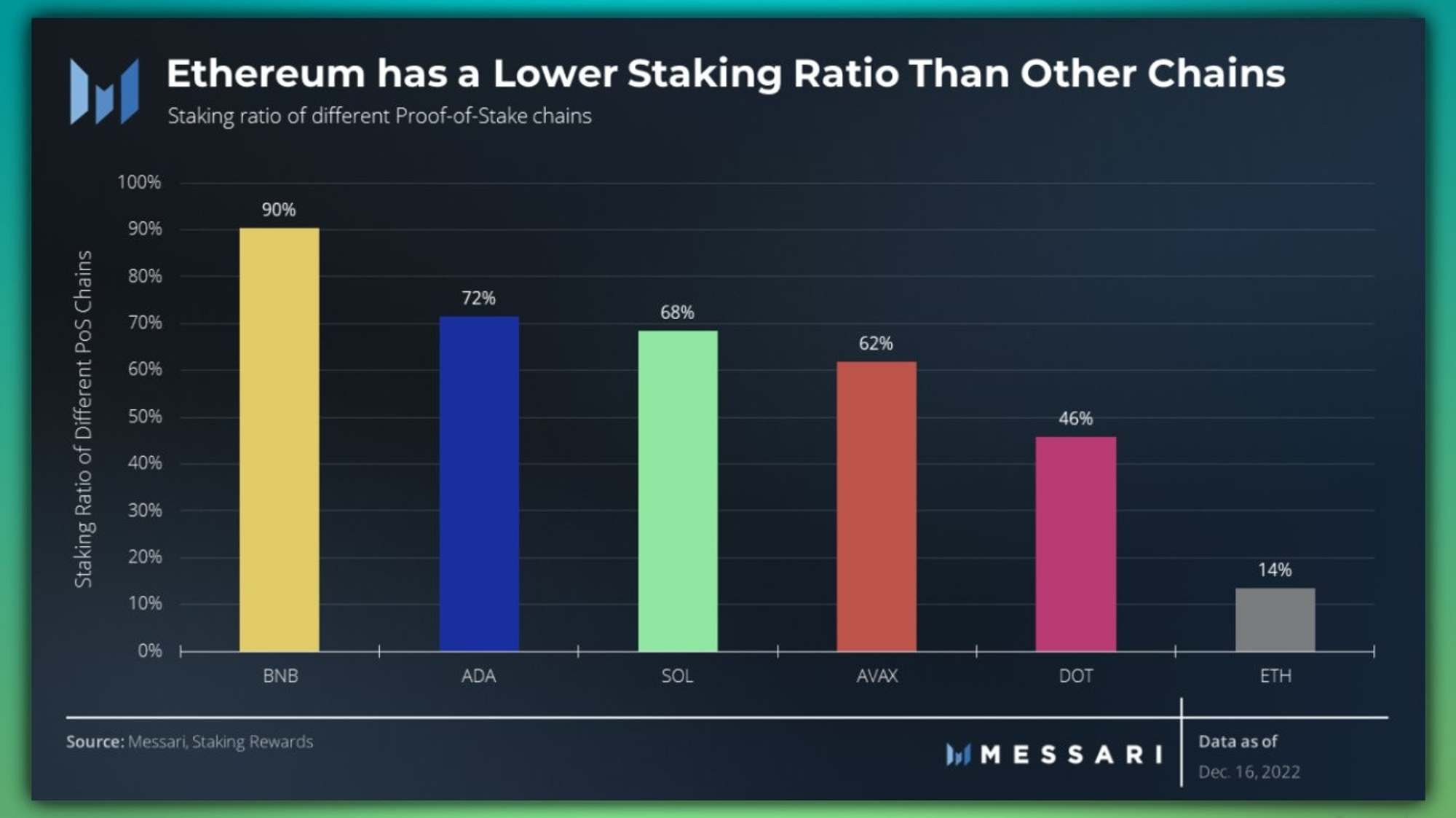

Comparing the Staking Ratio

The ETH before the upgrade in Shanghai. From the perspective of the public chain, the pledge rate of the ether chain itself is relatively low

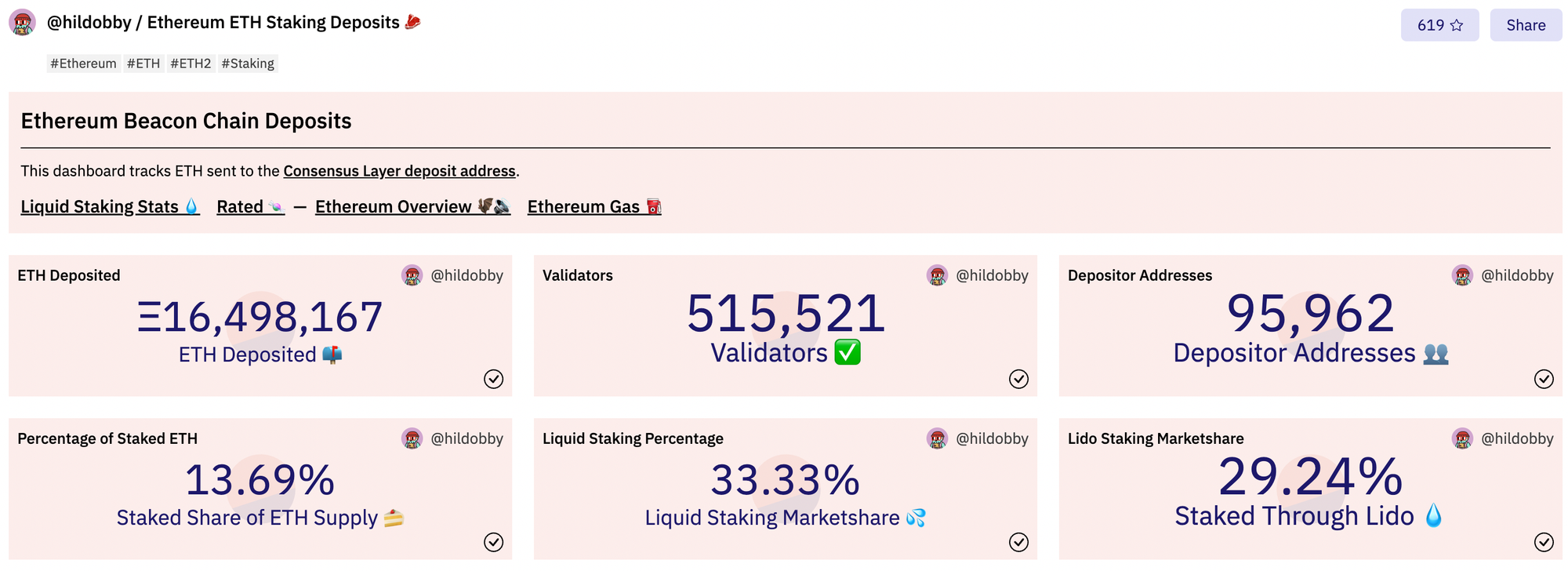

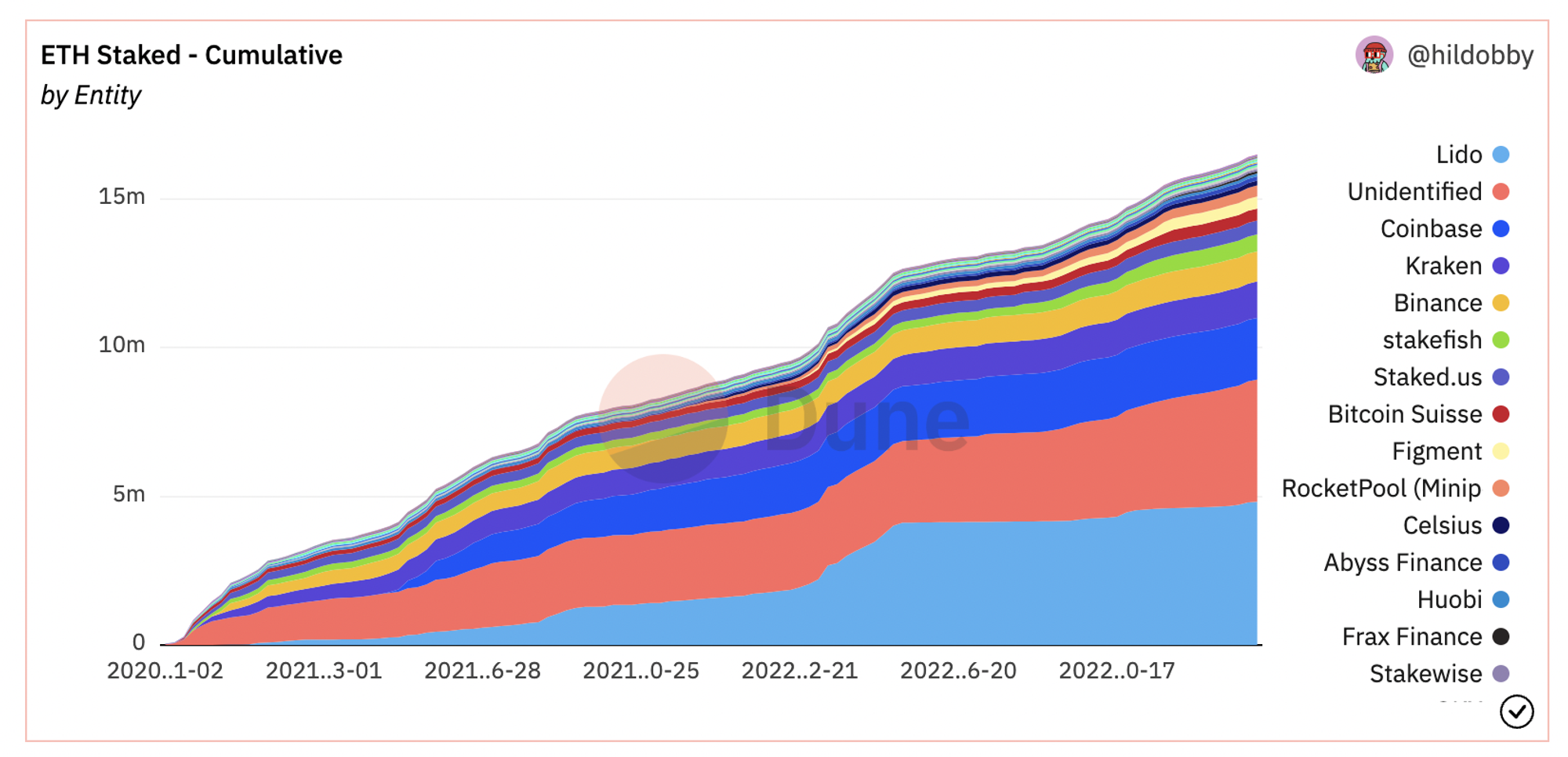

Staking Deposits Breakdown

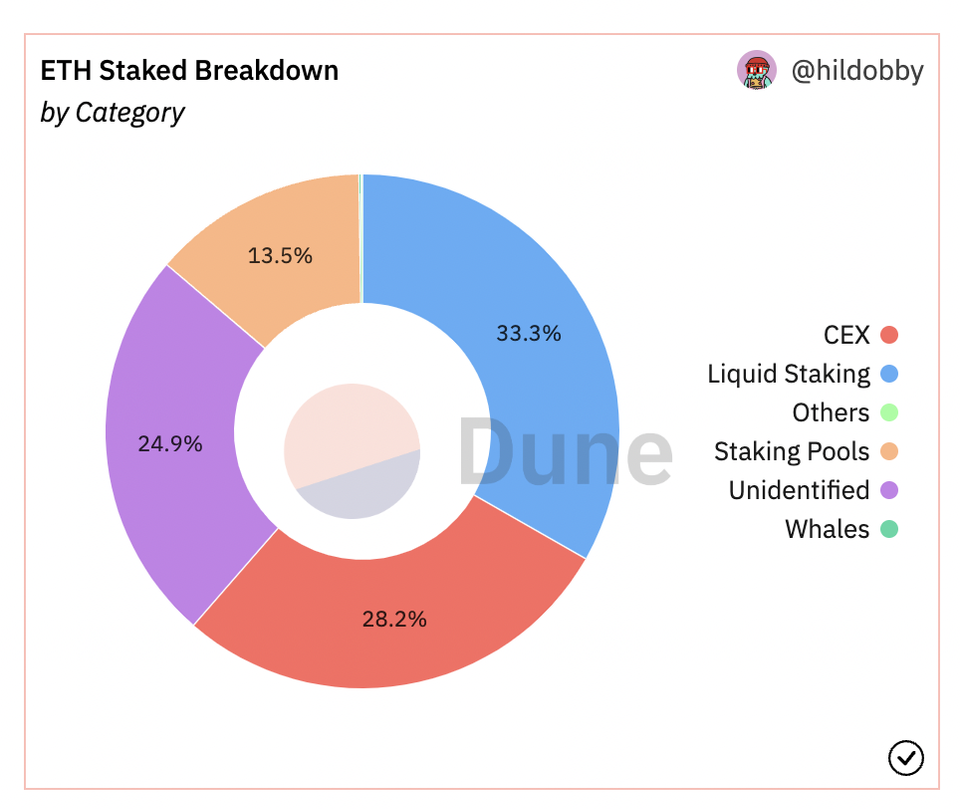

The total number of pledged coins/node validators/number of addresses/the ratio of pledged to the total supply of Ethereum, etc., as shown in the following Dune information

https://dune.com/hildobby/eth2-staking

The largest staking is concentrated in Lido (~29%) / Coinbase (~12.6%) / Binance (~6.1%) etc.

CEX accounts for ~33%, and Liquid Staking accounts for ~28%

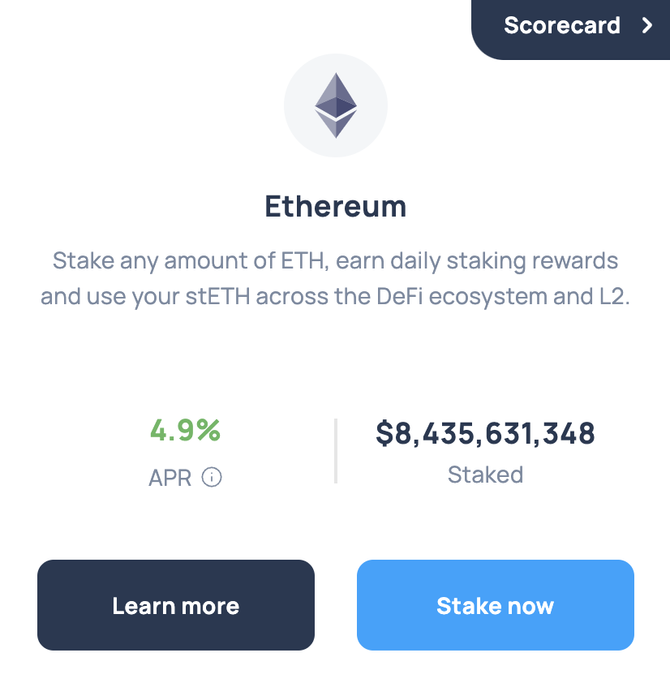

Lido

It is the largest integrated staking provider on DeFi, accounting for about 29% of the market and APR~4.9%

There are currently 29 professional node suppliers

Private Key form: 1. Verify that the private key belongs to the node supplier / 2. Withdrawal private key belongs to DAO management

Compared with the pledge method of Solo staking (Keys belong to the owner)

A total of 4 types of Staking forms, detailed explanation and discussion about the management and ownership of these 2 keys

Also extend service on L2 and partners with MetaMask

ETH <> stETH conversion pledge

10% commission on staking rewards

5% node operations

5% DAO treasury, insurance ETC

https://capitalismlab.substack.com/p/lido-43a?r=1ly7b3&utm_campaign=post&utm_medium=web

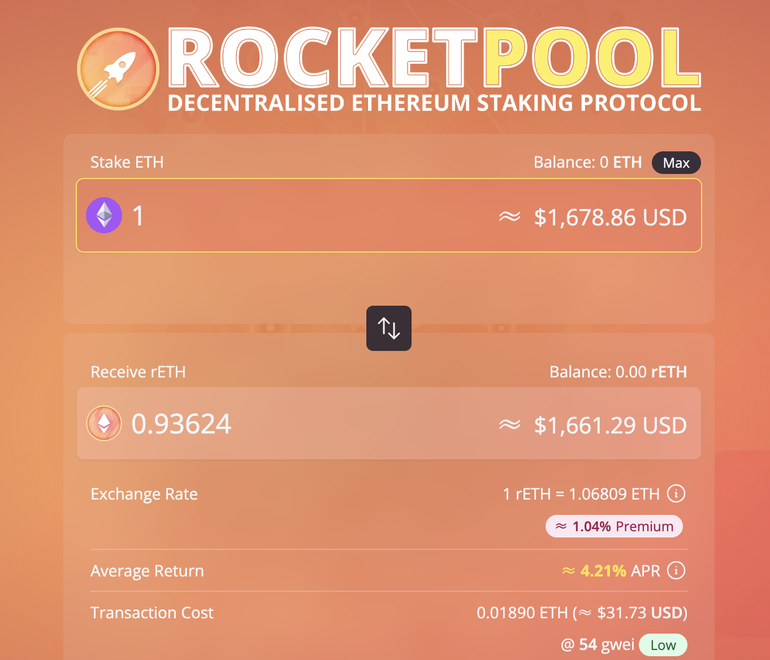

RocketPool

The second largest staking provider on DeFi, accounting for about 2.2% of the market, APR~4.21%

Only charge 15% fee on staking rewards for "validators" , ETH <> rETH

The feature is "no permission required", and everyone can be a node operator.

Private Key form: 1. Verify that the private key belongs to the address owner/ 2. Withdrawal private key belongs to DAO management

Only need 16ETH to build a node

The other half of 16ETH is provided by non-node operation users.

- but need 1.6 ETH worth of RPL token for validator punished or slashing

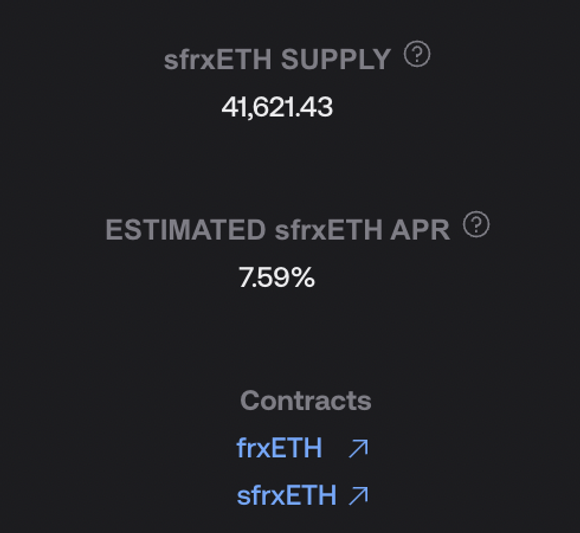

Frax

This staking service was released at the end of 22, with an APR~7.59%

Due to the high dividend income in the early stage, but its tokens ( sfrxETH / frxETH ) have no discount advantage

frxETH always represents 1 ETH

sfrxETH is an ERC-4626 vault designed to increase staking returns for Frax ETH validators.

https://docs.frax.finance/frax-ether/frxeth-and-sfrxeth

10% commission on staking rewards

No fees paid to node operators

Suitable for users familiar with the Frax/Curve ecosystem and more professional DeFi users.

Coinbase

ETH <> cbETH, about 12.6% of the market, APR up to ~3.99%

25% commission on staking rewards

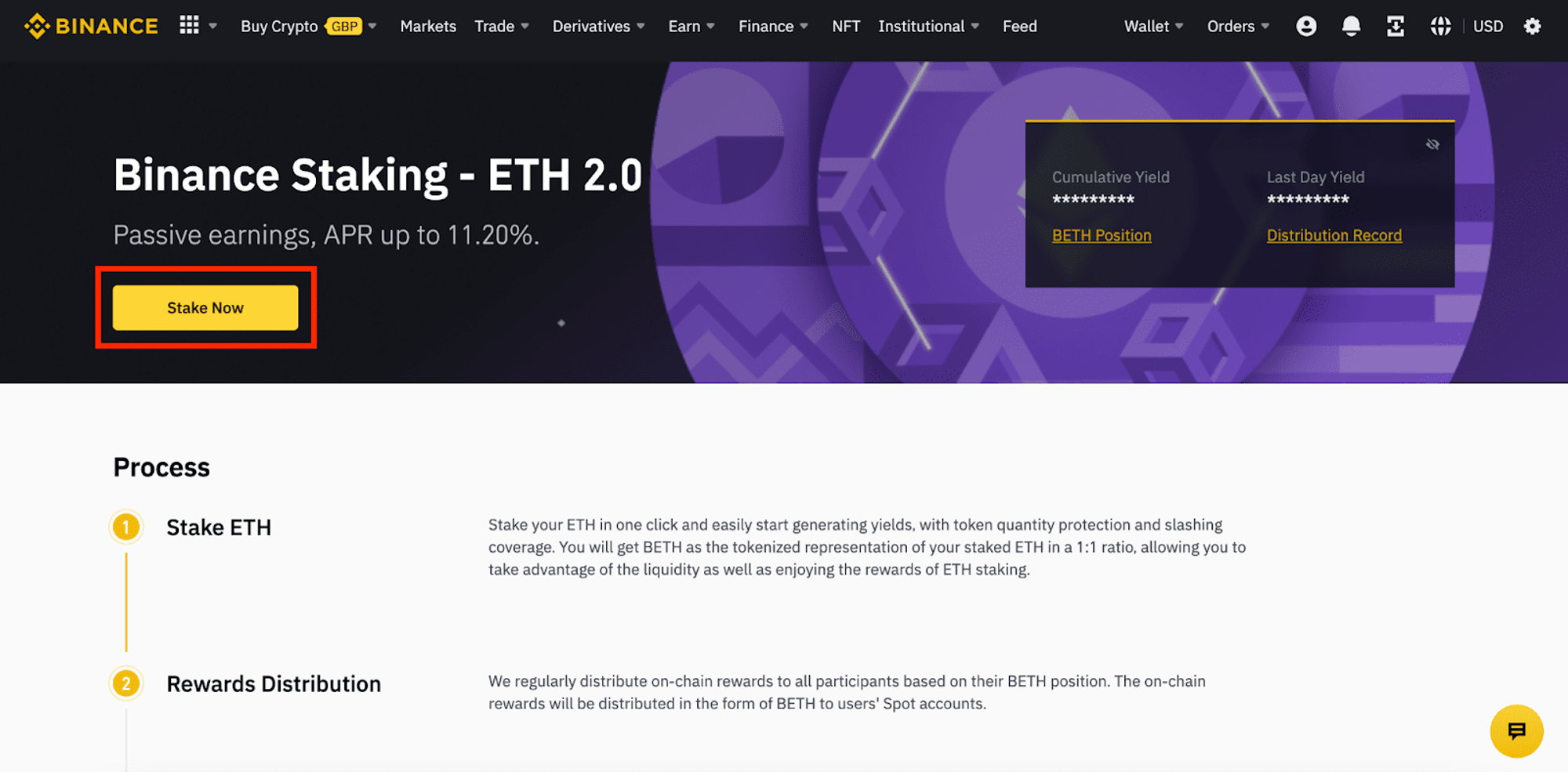

Binance

ETH <> bETH, the market accounts for about 6.1%, the official writes APR up to ~11.2% (actually about ~5%)

5% commission on staking rewards

Matrixport

Directly staking ETH , APR 4.9%~8.77% (leverage)

- Staking on Lido and other on-chain Staking Pools, which can be operated with AAVE leverage

10% commission on staking rewards

https://www.matrixport.com/eth2-staking-yield

conclusion

This document compares the staking ratios of Ethereum before the Shanghai upgrade, breaking down the total staking deposits, the largest staking providers, and the fees associated with staking rewards. It also provides an overview of the largest staking providers, such as Lido, RocketPool Frax, Coinbase, Binance, and Matrixport.

Reference

The main collation reference comes from: Liquid Staking Derivatives by MatrixDAO RF- GM. URL: https://youtu.be/krHShA6xjzs

How to obtain ETH Staking income in the most scientific way. URL: ETH

Awesome Ethereum Staking Resources URL: https://hackmd.io/@jyeAs_6oRjeDk2Mx5CZyBw/awesome-ethereum-staking#MEV

ETH Staking official. URL: https://ethereum.org/en/staking/

Reprint please indicate the source and author

Contact email: nctu.frank@gmail.com

More About Me: CompoundWater Rehydration

IG / TG / YT / FB / Linkedin / Twitter : Channel Search @compoundwater

Welcome to Freedom Support (ERC20): 0xc2Ac7F93D54dfbf9Bf7E4AeD21F817F2ce598D28