Based on the recorded data, the US Government is currently ranked as the largest Bitcoin holder by far.

The top 3 BTC holders now account for 0.77% of the total supply

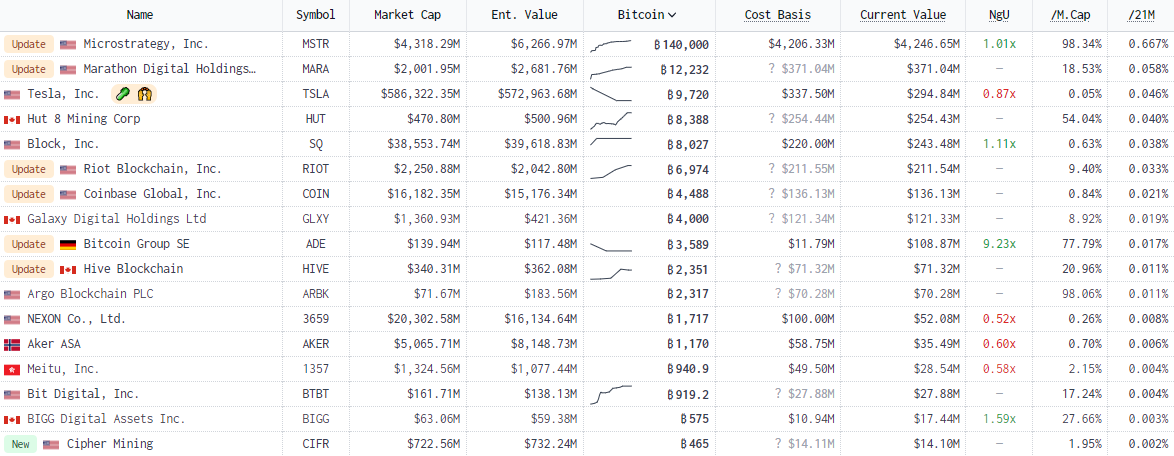

As most of us know, MicroStrategy is one of the largest Bitcoin (BTC) holders today. Michael Saylor has been accumulating Bitcoin for a long time, and as of the time of this writing by BeInCrypto, the company MicroStrategy is noted to currently hold around 140,000 Bitcoins. It is worth noting here that after a long string of negative days due to the sharp drop in Bitcoin price, MicroStrategy has started to profit as the price has returned above $30,000 in the past few days.

Billionaire Elon Musk's Tesla is currently in 3rd place with a holding of about 9,720 BTC after selling off half of the previous accumulated BTC . 2nd place belongs to a cryptocurrency mining company with around 12,232 BTC. Together these three institutions currently hold about 0.77% of the total supply of 21 million BTC.

The US government is the big shark

Despite the recent crackdown on the crypto market, based on on-chain data, it appears that the US Government is currently holding a large amount of BTC. According to the report, the institution is currently holding more than 205,000 BTC, more than all three institutions combined. At current market prices it is worth about $6.2 billion. Despite sending 9,860 BTC to Coinbase in March 2023, the US Government Bitcoin holdings are still among the top today.

What is more special, unlike MicroStrategy or Tesla, the US Government owns BTC with almost no fee. Because the authorities have accumulated this money through many property seizures over the years. Specifically:

- The first action was when the US Government confiscated 69,396 BTC in 2020. According to the announcement, this seizure is related to the previous Silk Road case.

- The second seizure case totaling 94,636 BTC, related to the 2016 Bitfinex hack. During the investigation, Ilya Lichtenstein and his wife were arrested and charged with laundering 119,754 BTC in more than 2,000 transactions over a period of time. 5 years.

- Another case that resulted in the seizure of more than 51,326 Bitcoins also involved the Silk Road and involved James Zhong, who pleaded guilty to taking the money illegally.

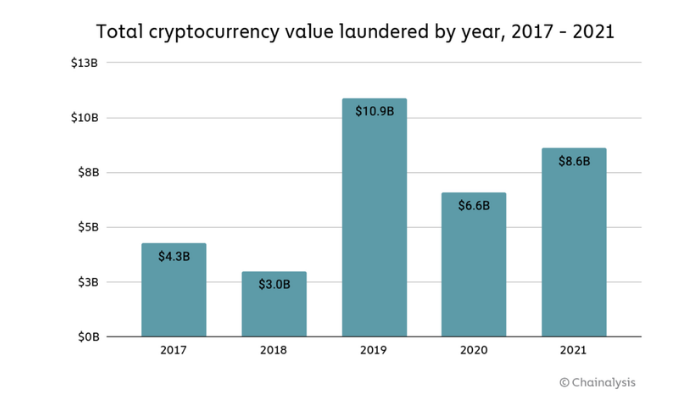

Bitcoin has long been condemned by the whole world when it becomes a tool for illegal activities such as money laundering or terrorist financing. However, people forget that Bitcoin has only been around for a short time compared to the long history of the global economy. And it is a fact that fiat money and traditional networks are still much more commonly used than cryptocurrencies for illicit financing. This has been confirmed by the US Treasury Department when it released its triennial reports on money laundering and terrorist financing in March 2022.

Like any other form of money, Bitcoin can be used by bad actors as a tool to launder money and finance terrorism. However, the fact that the US Government has a huge amount of Bitcoin above, in some respects, it also shows us two interesting points.

- First , it shows that the US Government is fighting against what it considers illegal activities within its jurisdiction and considers Bitcoin a form of currency. Activities will not be challenged and Bitcoin will not be confiscated if the Department of Justice does not believe that Bitcoin has value.

- The second interesting point is that the US Government is still holding Bitcoin and they have not or are planning to gradually liquidate that amount of BTC . In this respect, the US Government can also be seen as a speculator. Looks like they are also waiting for the right time to sell instead of selling them all when they can.