There have been several well-known "wars" in the DeFi battlefield, such as the battle of Curve and the battle of DEX Liquidity.

The upgrade of Ethereum Shanghai has launched the next war narrative-the pledge war.

What are the types of LSD (Liquidity Staking Derivatives), what are their characteristics, and who will dominate?

This article will introduce the above in detail to help you prepare for the upcoming "war".

Article will cover:

1) PoS and LSD

2) ETH pledge market

3) Comparison between LSD protocols

4) Personal opinion

1. PoS and LSD

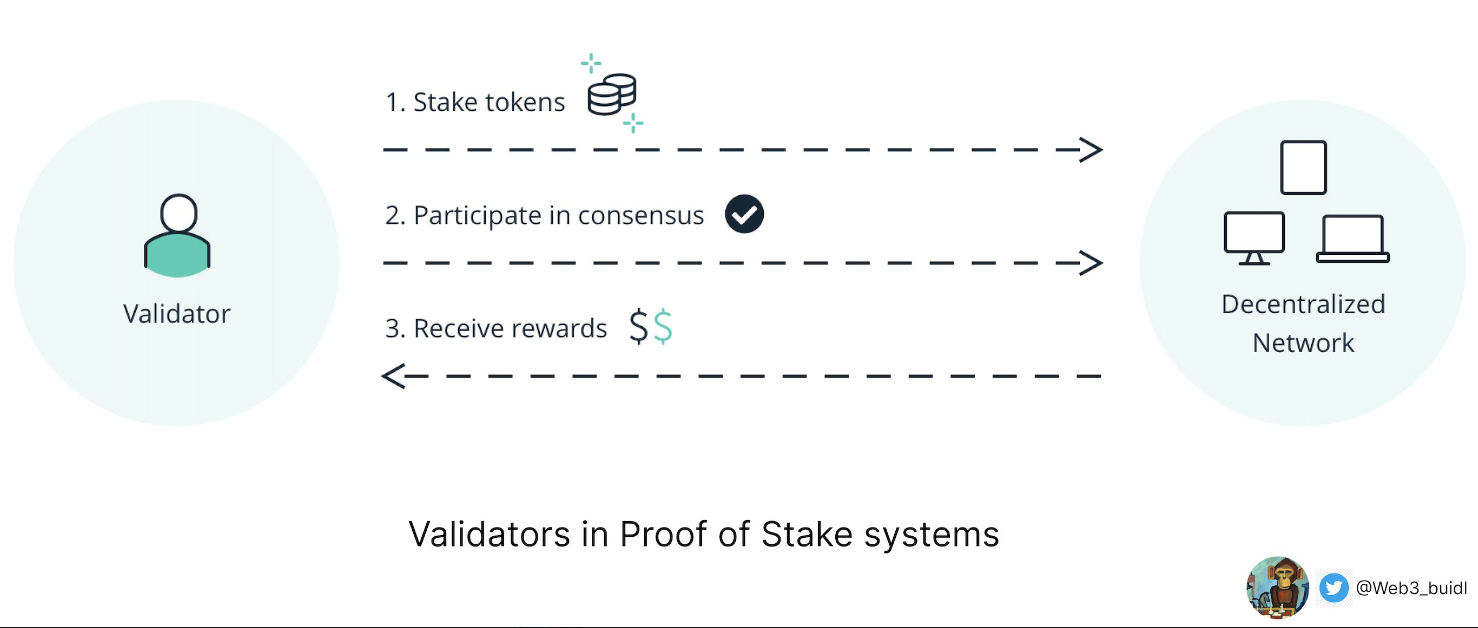

Proof-of-stake(PoS) is a consensus mechanism where validators stake tokens into a blockchain network to provide security for the network.

In return, validators receive block rewards from the network and transaction fees paid by users.

Given the technical issues involved, verification is usually undertaken by professional node operators.

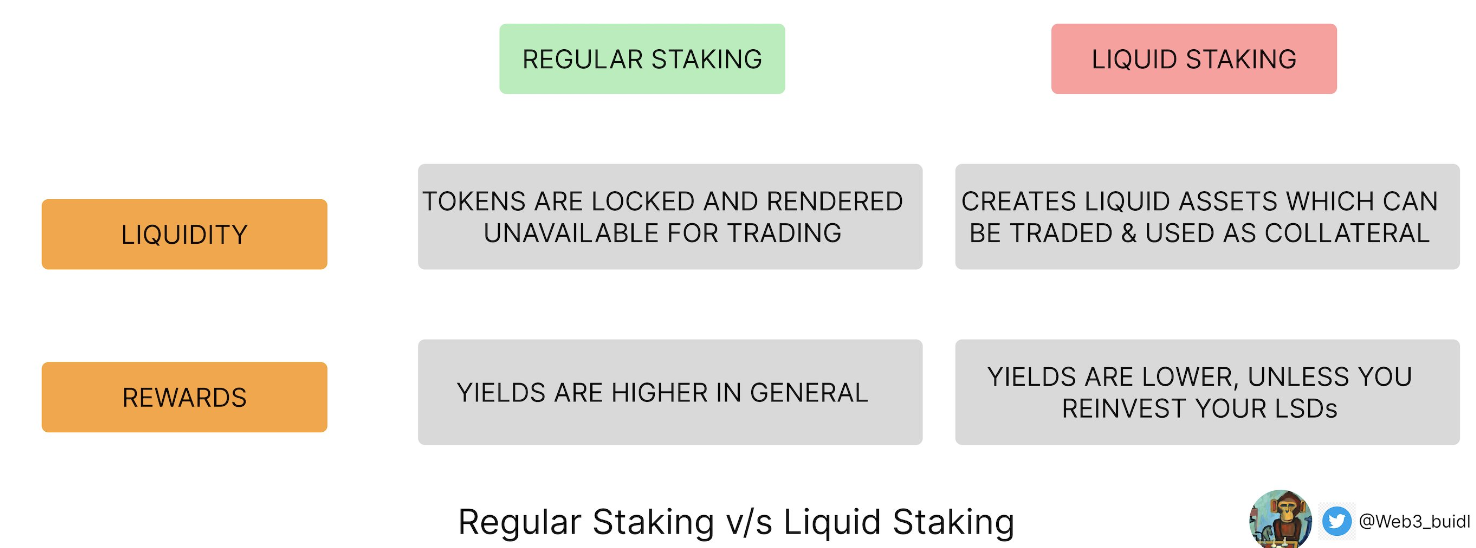

Therefore, in order to increase the accessibility of staking and Liquidity, Liquidity staking protocols like Lido have emerged in the market.

These protocols issue LSD - "Liquidity Derivatives".

These protocols allow users to stake their tokens to validators in exchange for a portion of interest earnings.

Additionally, these LSDs can be traded on DEXs, allowing users to convert them back into unstaked tokens.

Now, let’s get to know the warriors of the staking wars.

2. ETH pledge market

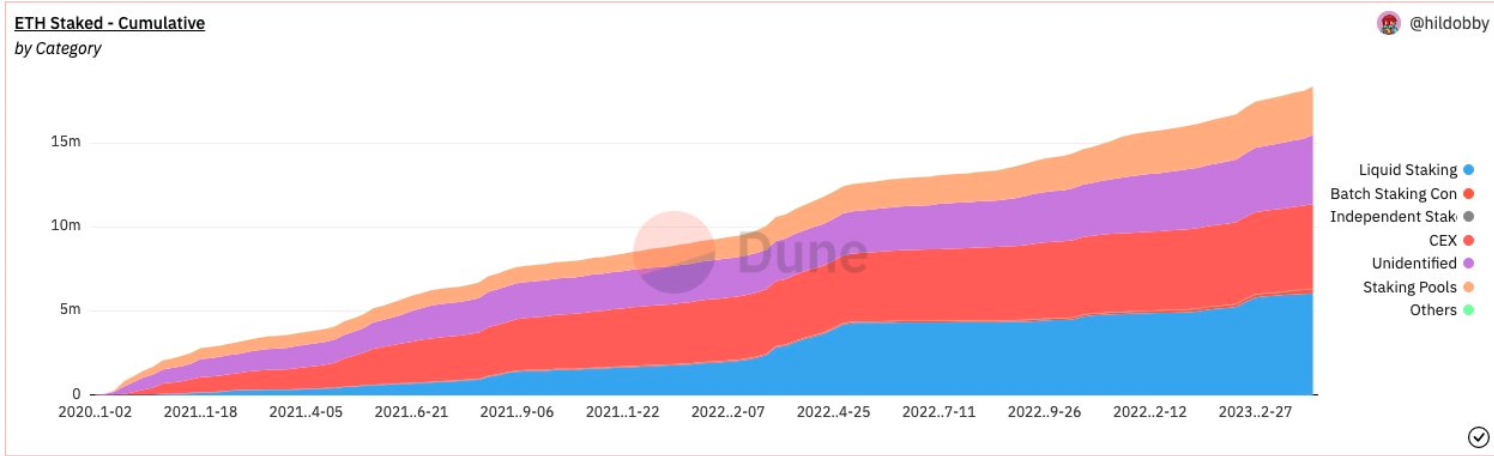

The ETH Liquidity staking market is growing rapidly, accounting for almost 45% of the ETH staking market.

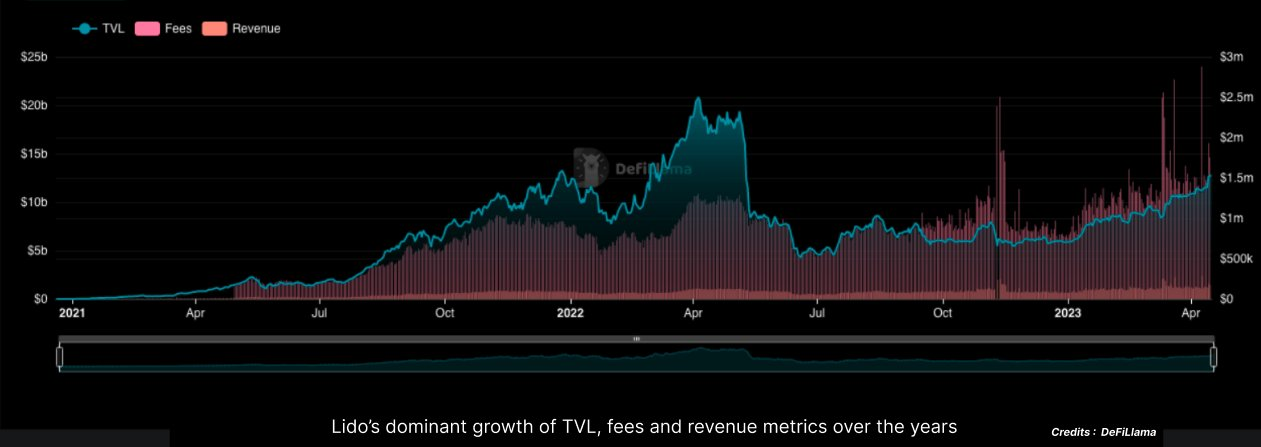

What's more, after the Shanghai upgrade, the TVL of all LSD protocols increased!

The community seems to be Bullish! 🐂

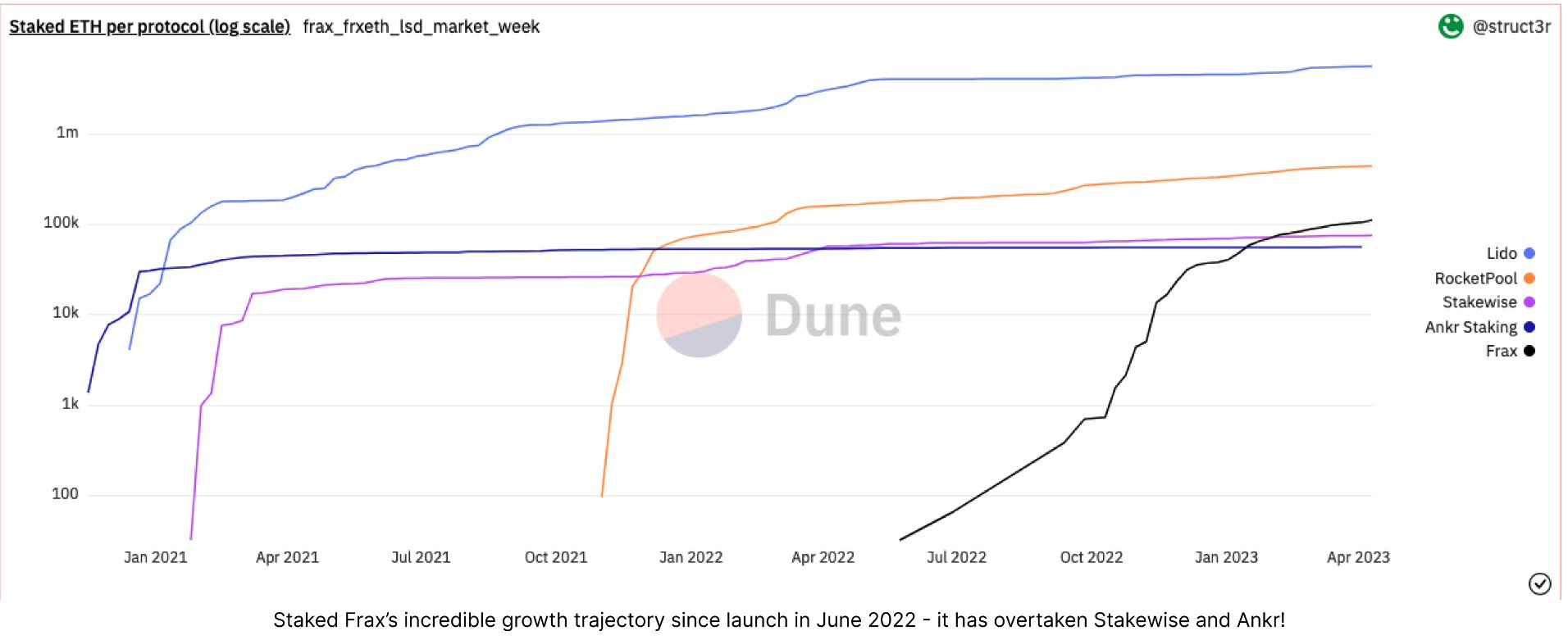

Lido is the absolute leader, accounting for more than 70% of the ETH LSD market share.

Rocketpool, Stakewise, and Frax are all steadily gaining remaining market share.

Coinbase also entered the LSD space as a leading CEX.

Let's take a look at these different LSD protocols and compare them.

3. LSD protocol comparison

Comparison parameters:

• Token types and mechanics

•commission

• Advantages of the LSD type

• Disadvantages of the LSD type

• #node operator

The protocols we will discuss are:

3.1Lido

3.2 Rocketpool

3.3 Coinbase

3.4 Frax

3.5 Stakewise

let us start!

3.1 Lido (stETH)

• Token Types and Mechanisms:

stETH is a rebase token with an elastic supply.

The benefits obtained by holders will be automatically reflected in the increase in the amount of stETH held (rebase).

• Commission: 10%

• Advantages of LSD type: stETH is by far the most popular LSD token.

stETH is also generally accepted as collateral.

• Disadvantages of LSD type: It is complicated to use in DEX, because the stETH in the Liquidity pool must also be rebased, which is why its encapsulated version is used.

3.2 Rocketpool (rETH)

• Token Types and Mechanisms:

rETH is a token with rewards, that is, its base value will gradually increase as the rewards increase.

Unlike rebase tokens, these tokens do not have an elastic supply that changes frequently.

• Commission: 15%

• Advantages of the LSD type: RPL has permissionless node operations, that is, anyone can become a node operator by staking 16 ETH and 1.6 ETH of RPL.

This differs from Lido, which has a set of licensed validators.

Additionally, rETH arguably maintains its peg to ETH better than stETH.

•Disadvantages of LSD type: the Liquidity is lower than stETH, and the scope of use is smaller than stETH.

3.3 Coinbase (cbETH)

• Token Types and Mechanisms:

cbETH is a token with rewards, similar to rETH.

• Commission: 25%

• Advantages and disadvantages of LSD type: The fact that CB is a listed public entity is both an advantage and a disadvantage of cbETH.

While it may instill confidence in institutions willing to participate in staking, it can also create concerns about regulation.

High commissions and only one node operator is another downside.

3.4 Frax (sfrxETH & frxETH)

• Token Types and Mechanisms:

Frax uses a unique model that allows users to choose between 2 tokens - frxETH and sfrxETH.

frxETH does not receive beacon chain benefits from staked ETH, while sfrxETH gets all benefits from staking.

This means, sfrxETH gains from all unstaked frxETH, increasing its yield.

Advantages of the LSD type:

a. frxETH is designed to be pegged to ETH , which makes it attractive to Liquidity Provider who can provide frxETH- ETH Liquidity pools.

Since Frax is the protocol that holds the most CVX, it can directly release & attract more Liquidity.

b. The yield of sfrxETH is higher than that of other LSDs, because the pledged yield from frxETH flows directly to sfrxETH.

The disadvantage is that there is only one node operator and the design is complicated.

- Commission: 10%

3.5 Stakewise (sETH2 & rETH2)

- Token types and mechanisms:

StakeWise uses a unique base model (sETH2) + reward tokens (rETH2) to refine user earnings and rewards, and the value of these two tokens is 1:1 with the ETH staked and earned on the beacon chain.

Advantages of LSD type: 2 different tokens help mitigate Impermanent Loss when providing DEX Liquidity .

Disadvantages of the LSD type: it causes Liquidity splits and higher slippage due to the need for 2 Liquidity pools.

• Commission: 10%

• # node operators: 4

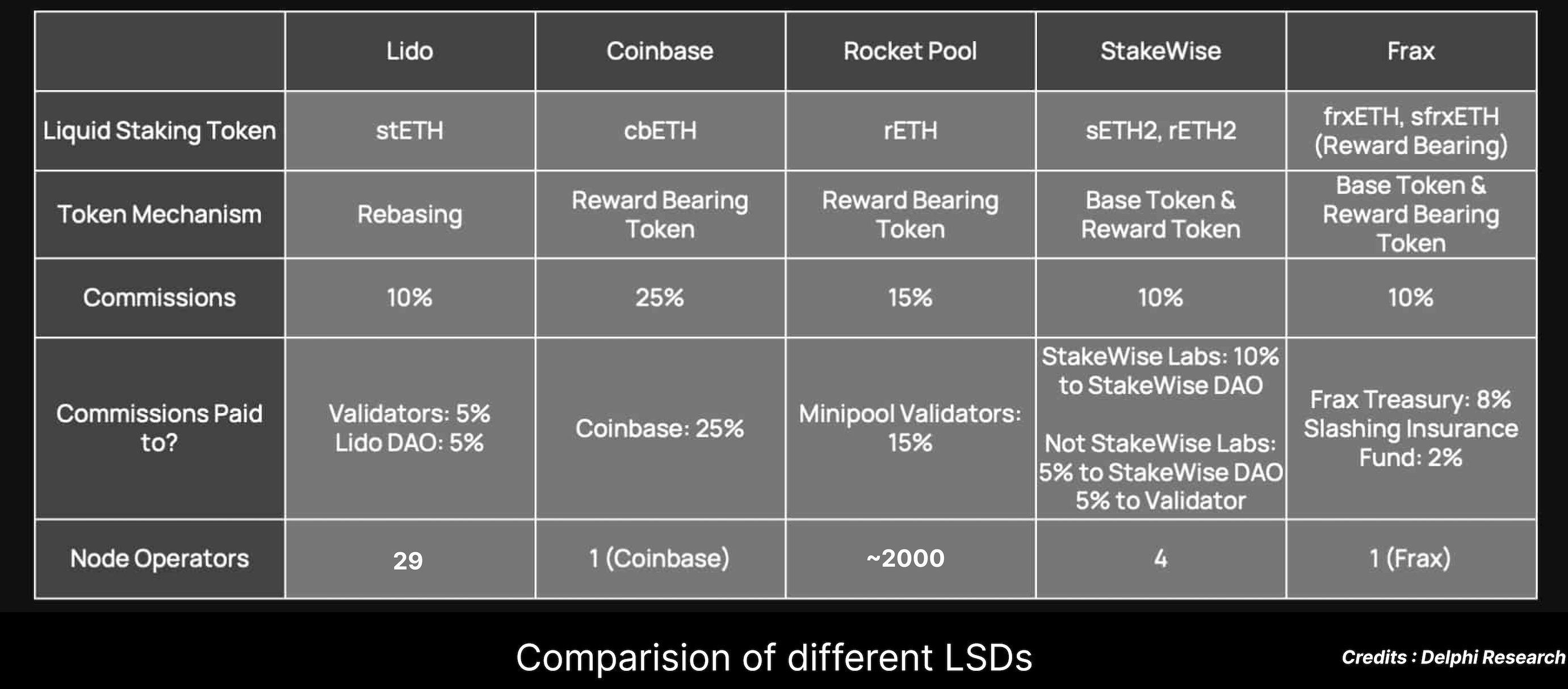

The following is a comparison of the five LSD protocols, summarized in tabular format. 👇

4. Personal thoughts

1. LSD is a leveraged bet on the price of ETH

Currently, 15.3% of ETH is staked. Around 30% of the ETH supply is expected to be staked by 2025.

The reason can be seen in my previous article: https://twitter.com/Web3_buidl/status/1642543232084230145

Considering that the total pledged amount of ETH will double in the next few years, there is still room for growth in the market value.

Since the protocol revenue of the LSD protocol is directly related to the ETH price, Liquidity staking protocols can be considered leveraged pledges of ETH, as they gain a larger market share than staking ETH.

2. Lido will occupy more than 50% of the LSD market in 2025

While protocols such as cbETH and frax are eating away at Lido’s market share, Lido is still highly likely to maintain a market share above 50% by 2025.

Recently, the deposit volume of "giant whales" such as Justin Sun shows people's confidence in Lido.

3. Yield will be reduced to about 3.5% in equilibrium

Investment income comes from the consensus and execution layers.

• Consensus layer rewards will decrease as rewards are distributed to more stakers.

• Execution layer yield will rise as on-chain activity/MEV increases

On average, yields are expected to be around 3.5% in 2025.

By 2025, the consensus layer yield will drop from 3.57% to 2.76%.

The rewards of the executive layer will vary based on on-chain activity and dilution of ETH.

4. Generally high fully diluted price-to-sales ratio (P/S)

Lido trades at 610 times earnings, which has fallen sharply to 76 times over the past year.

Even with lower FDV, Frax and vastwise have higher P/S ratios because of their smaller market share and lower revenue.

To sum up, the Shanghai upgrade is a huge de-risking event, and the rise in the price of ETH is a vote of confidence cast by the community.

It will be interesting to see how the staking wars story unfolds and who emerges victorious. 🏆

Wait for the war to start.