Citibank recently released a 160-page report titled "Currency, Tokens, and Games: The Value of Billions of Users and Trillions of Dollars Under the Blockchain", Citibank said that the blockchain industry is close to a turning point , and the next mass adoption of crypto will be driven by the rise of central bank digital currencies (CBDCs) and the tokenization of real-world assets.

background

Disruptive technologies often change the way people do things, such as how people live, work, consume, invest, socialize, and so on. Blockchain and the related Web3 concept are both disruptive technologies, and for the past few years people have been talking about the potential of tokenization via blockchain as transformative, but we are not yet at scale The point of application. Unlike new energy vehicles or recent innovations such as ChatGPT or Metaverse, blockchain is a back-end infrastructure technology with no prominent consumer interface, so it is difficult to see how innovative it is at the surface.

However, blockchain as a disruptive technology is different from many others, firstly it involves the transfer of value, and it enters the currency field (which is a highly regulated field in most countries). Secondly, the blockchain will not have a ChatGPT moment, because the blockchain is an underlying infrastructure technology, more similar to cloud computing, rather than artificial intelligence (AI) or metaverse (Metaverse), these technologies have a more prominent consumer-oriented attributes of the recipient. So while the blockchain revolution started in the fringes, to drive its mass adoption it needs the backing of sovereign governments, regulated financial institutions and big corporations, as well as the backing of crypto-native rebels because they are the innovation, change and the heart of progress.

In this report, we will explore some of the key drivers that will enable the blockchain and Web3 industry to have the next billion users and potentially bring economic activity in a multi-trillion dollar market that will impact our lives , All aspects of work.

Billions of Users

The number of billions of users will increase due to the daily application of the blockchain industry, including currency, games, social media, etc. The successful application of blockchain technology will have more than 1 billion end users, and these users will not even realize that they are using this technology.

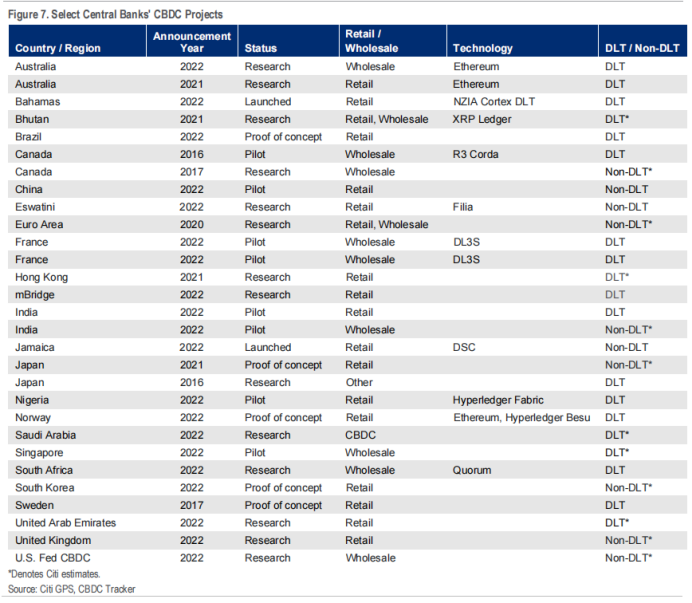

- Money: Some countries (with a total population of about 2 billion) may try central bank digital currency (CBDC) related to blockchain technology, especially the CBDC projects that some mainstream countries will adopt, such as the digital euro (EUR ), Digital Pound Sterling (GBP), Digital Rupee (INR), these projects will roughly cover 1/4 of the world's population and currency savings.

- Game: The next generation of games will include the tokenization of game assets and will initially be driven by Asian games, attracting high-end consumer users. The game industry will also drive most players into the blockchain, especially the Web3 game ecology in Southeast Asian countries.

- Social Media: Micropayments, including payments in Metaverse games, are likely to use blockchain technology. Additionally, large consumer brands are driving Web3 adoption. The field of art collection, film and television, and music entertainment will also enter the blockchain industry based on the characteristics of the blockchain (such as NFT), and many of them are supported by big brands such as Nike and Starbucks.

Market size of tens of trillions (Trillions of Dollars)

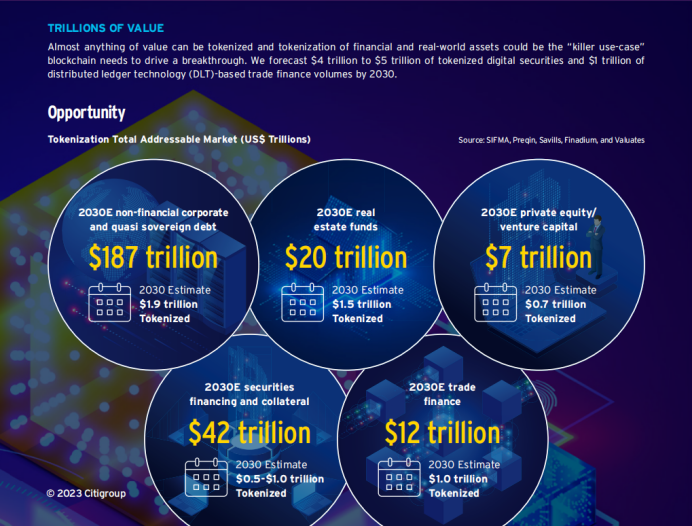

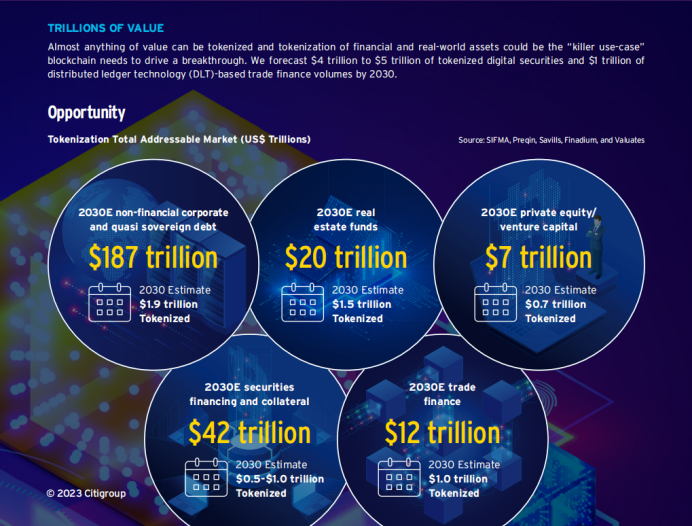

We predict that by 2030, as much as $5 trillion may be transferred to new forms of digital currency, such as CBDCs and stablecoins, about half of which may be based on blockchain distributed ledger technology. Benefiting from legal and technological innovations, the tokenization of real-world assets (RWA) will be the trump card that drives the blockchain industry into tens of trillions of dollars. Almost any asset that can be represented by value can be tokenized. Be it wine or financial assets. We expect the tokenization of private sector/private company assets to grow more than 80-fold to reach ~$4 trillion by 2030.

By 2030, it could drive the tokenization of up to $1 trillion in assets in global trade finance. We expect private sector/unlisted companies such as securities and funds to drive up to $5 trillion in tokenization markets: non-financial corporate and quasi-sovereign debt markets; repo, securities financing and collateral markets; real estate, private equity (PE) and alternative asset markets such as venture capital (VC). Estimates from the financial industry for the total volume of tokenization are even higher.

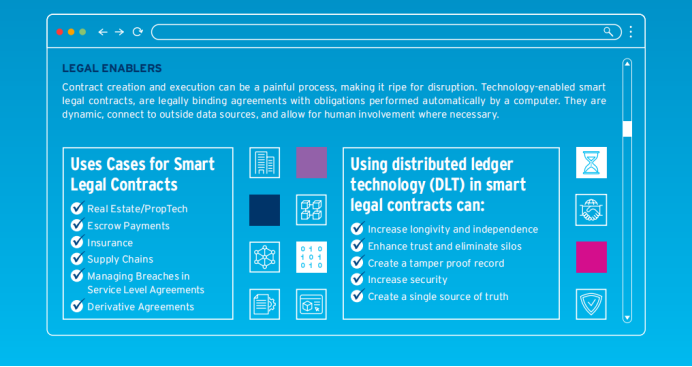

Technology and Legal Enablers

Of course, there is also a strong regulatory and legal framework that allows individuals and institutions to embrace this new technology. The next generation of legal smart contract (Smart Legal Contract, SLC) is on the way, and SLC will provide a new execution model for global business and finance.

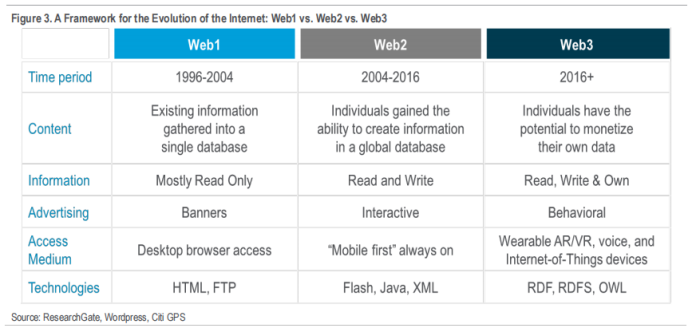

Web3, tokenization, and opportunity

Web3 often refers to the third iteration of the internet, which is based on blockchain technology for personal ownership and decentralization. The decentralized nature of Web3 can create a more transparent environment and help resolve ownership and data control issues from Web2 subjects.

As we explain in this report, the key drivers of blockchain and Web3 adoption will be Web2 consumer companies and established traditional financial institutions. We believe that Web3 will execute in parallel with Web2, and in some cases nest within it, like a Russian Matryoshka.

Definition of Tokenization

Tokens are pieces of code on the blockchain that record information about the liabilities of the underlying asset, including its attributes or characteristics, status, transaction history, and ownership. After assets are tokenized, their ownership and value can be directly traded/transferred on the blockchain network. Asset tokenization can be divided into two categories:

A. Real World Assets: Represents highly illiquid, customized assets such as real estate, art and collectibles, agriculture, climate assets, and intangible assets (such as carbon credits and intellectual property rights). Real-world assets may also include those financial assets that are infrequently or easily traded, such as trade invoices, personal loans or mortgages, which are not generally defined as "securities".

B. Financial Assets: Assets that represent existing financial value, such as currencies, stocks, bonds, commodities, and funds.

In theory, almost any asset with monetary value can be tokenized. We believe that the best use cases for tokenization will be central bank digital currency (CBDC) and private sector/non-listed company assets (Private Financial Assets), especially illiquid assets, and assets in games.

Opportunities for Tokenization

According to research by BCG and ADDX, the tokenization of global illiquid assets will generate a market size of 16 trillion US dollars (this will be close to 10% of global GDP in 2030), including a 3 trillion housing asset market, a 4 trillion listed/non- The listed asset market, the 1 trillion debt and investment fund market, the 3 trillion alternative financial asset market, and the 5 trillion other asset tokenized market.

We believe that the private sector/private company market is more suitable for blockchain applications because of the liquidity, transparency, and fragmentation that come after tokenization. For public company securities across industries, tokenization will also provide benefits in the areas of efficiency, collateral usage, data usage and ESG tracking.

Although the industry is still in its early stages, based on our conversations with industry experts and insiders, we estimate that, assuming 1% corporate and quasi-sovereign bonds, 7.5% real estate funds, 10% private equity and venture capital funds, and 1% If $1 trillion in securities financing and collateral activities are tokenized, then the market size of digital securities will reach $4 trillion to $5 trillion. At the same time, it is accompanied by the tokenization of the trade finance market. By 2030, the scale of the blockchain-based trade finance market may be as high as $1 trillion, accounting for about 8%-10% of the global trade finance scale.

To achieve the above goals, the support of traditional financial institutions will be needed, whether it is in the tokenization of assets or in the promotion of relevant legislation.

Why is Tokenization of Real World Assets (RWA) needed?

RWA opens up a new formalization of monetizing illiquid assets, which helps unlock liquidity while retaining fractional ownership of assets. For example, art collectors can tokenize their treasured collections. On the one hand, they can share ownership with lovers all over the world. On the other hand, they can also hand over their collections to museums for safekeeping and public display. In addition, tokenization can enable new financing methods for infrastructure assets such as roads, heavy machinery and public goods, and open up new direct decentralized financing channels for small companies and small and medium-sized enterprises (SMEs). Tokenization using blockchain technology can solve the traditional financing problems of the sector, such as lack of transparency, lack of liquidity and lack of democracy. Tokenization also helps to increase the efficiency of investors holding real assets on their balance sheets, as it provides liquidity to illiquid assets and simplifies the collateralization process.

A. Real estate (Real Estate): The traditional real estate market has been criticized for lack of transparency, difficulty in circulation and numerous intermediaries. Blockchain can be a good option to provide and coordinate data for all participants as a single, public source of information. Tokenization can also help lower minimum investment amounts and potentially reprice assets.

B. Art and Collectibles: The tokenization of artworks and collectibles can help improve asset transparency, serve as proof of asset origin, provide liquidity, and provide fragmentation of ownership (dividing some assets to capacity of other investors).

C. Unconventional Commodities: From gold to agricultural products, more and more commodities are brought to the blockchain. Agriculture: Platforms like Agrotoken use oracles and real-world proofs of grain reserves to build stablecoins backed by commodities like soybeans, corn, and wheat, offering new financing solutions. Climate financing project: Blockchain can help reliable records and transfer of carbon credits between suppliers and demanders, while also lowering the barriers to entry for carbon trading.

Challenges of Real World Asset Onchain (RWA)

The main obstacle to the scale of digital assets lies in the fragmented legal and regulatory environment for digital assets in different jurisdictions, as well as inconsistent classification or classification standards around the world. Additionally, the tokenization of real-world assets may encounter other additional challenges:

- Interoperability Issues: When tokens are based on multiple blockchains, or tokens need to interact with back-end systems outside the blockchain ecosystem, and between new architectures built on different chains, May cause interoperability issues.

- Lack of Experienced Custodians: There are a limited number of professional third parties capable of safely custodying tokens and real-world assets.

- Duplication and Unauthorized Tokenization: While information on the blockchain is publicly visible, there is a lack of oversight and practice standards to curb duplication or unauthorized tokenization associated with real-world assets change.

- Real-World Liquidity Risks: On-chain liquidity tends to be greater than real-world liquidity, likely due to market access with fragmented ownership.

- Elevated Cyber Risk: More technology needs to be developed to achieve blockchain transparency without revealing actual information about borrowers and asset owners. The most widely used privacy solution today is Zero-Knowledge Proofs (ZKP). Cyber-hacking attacks on the blockchain will introduce additional risks associated with theft or loss of tokens.

- Difficulty of Full Disintermediation: Internet of Things (IOT) technologies and oracle networks for valuation and status reporting of underlying real-world assets are still in their infancy and may take a while to reach commercialization at scale . Until then, many key steps, such as valuation, accounting, and reporting, may still rely on human expertise and manual labor, just like traditional finance.

Billions of Users

Blockchain-based currencies, games, and social products will have a major impact on consumers. In this chapter, we discuss how blockchain is revolutionizing these fields, why it is happening now, and how it has gained billions of users.

Central Bank Digital Currencies (CBDC)

CBDC is a digital currency denominated in national currency units issued by the central bank and represents a form of liability of the central bank. This differs from other forms of digital payment instruments (e.g., card payments, electronic money, credit transfers), which are liabilities of private institutions.

At present, more than 100 countries have conducted research, discussion, and experiments on CBDC, but only some small countries have adopted CBDC projects based on distributed ledger technology, and some large countries (with a total population of about 2 billion) may soon try to integrate with decentralized Central bank digital currency (CBDC) related to digital ledger technology, such as digital euro (EUR), digital pound sterling (GBP), digital rupee (INR), these projects will roughly cover 1/4 of the world's population and currency savings. However, due to policy and other reasons, a big country like China has adopted a CBDC project based on centralized ledger technology.

Beyond the individual use cases of CBDC, millions of businesses and importers/exporters will use bilateral or multilateral CBDC settlement arrangements developed between different countries. For example, a decentralized Multi-CBDC project between China, Hong Kong, Thailand and the UAE, and is piloting different use cases, starting with cross-border foreign exchange (FX) trade settlement.

The Bank of England expects that 20% of savings will be converted into digital currency, which means a digital currency circulation market of more than $5 trillion and 2 billion users, half of which are based on distributed ledger technology. The bank's currency reserves cannot be transferred, but they can generate high liquidity in the form of CBDC, which is convenient for the bank's balance sheet and liquidity management.

In addition, the increase in CBDC projects may bring many stablecoin projects to the table, because stablecoin projects can hold CBDC as their reserves, which is more stable and liquid than general money market instruments.

Gaming

Games may be one of the biggest entrances for consumers to enter the blockchain and Web3 industries from the bottom up. In 2022, more than 1 million unique active wallets are connected to gaming Dapps every day. With the emergence of Web3 games, especially blockchain games from Asian studios in the next 1-2 years, it will lead the most active players (nearly 100 million "whales") to blockchain games. This could prompt mainstream game studios to incorporate blockchain and tokenization elements into their games.

Games account for the largest share of the entertainment industry, earning more than the movie and music industries combined. According to Newzoo, the gaming market is huge, with nearly 3.2 billion players by 2022. In 2022, 184 billion game revenue will be generated, of which Asian players account for half, North American players account for 26%, and European players account for 18%. Even if only a small percentage of gamers use blockchain-based games, this increase is enough to leverage the entire blockchain and Web3 ecosystem.

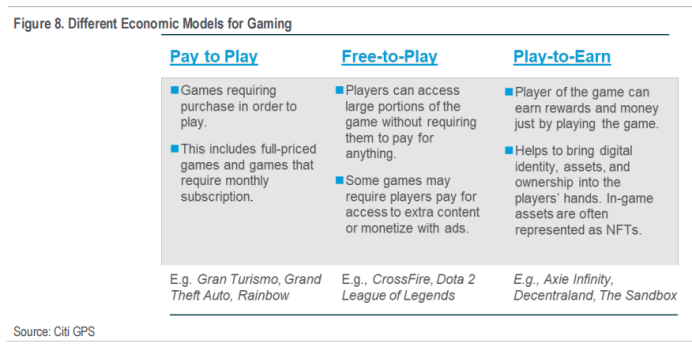

In our opinion, the gaming industry is inherently suitable for blockchain. Gamers are tech-savvy, and most already have a good understanding of digital ownership and digital assets. The emergence of Web3 and the rise of a new economic model (Play to Earn) aims to allow players to own their own in-game assets. These digital assets can range from digital currencies to in-game assets that have been tokenized.

Until now, blockchain-based games have typically been developed by crypto-natives who are more concerned with in-game token economics than making games fun and exciting. Hardcore gamers often criticize the superficial and simplistic gameplay in blockchain-based games. Some players also worry that NFTs and in-game tokens could become another tool to extract more money from players.

The next generation of game developers is already working hard to integrate digital assets into fun games. This will help address current concerns in the gaming community and increase adoption. For example, the recent Dookey Dash competition held by Yuga Labs provided the Bored Ape Yacht Club community with a fun gaming experience, attracted participants from all over the world, and proved the importance of NFTs in gaming.

We believe that the next iteration of blockchain-based games will include digital asset elements and a more complete model (not just Play to Earn). Regular pay-to-play or free-to-play games will include blockchain elements, perhaps even without the player's explicit perception (gamers won't understand what cloud computing brings to the game) Is it beneficial, nor will you know whether the game is based on Amazon Cloud Server or Google Cloud Server).

Today, there are over 3 billion gamers worldwide, and by 2025 we may see close to 50-100 million people using games with Web3 or blockchain elements. Gamers in Asia may be the earliest adopters. However, the reality is that a small percentage of gamers account for the lion's share of game spending. In the next few years, we may see a major shift in transaction spending from off-chain to on-chain. The shift of heavy consumers to blockchain games may be an inflection point for the entire Web3 game ecosystem.

social media

Proponents of Web3 believe that a new system needs to be built that is completely decentralized. Blockchain-based social media can help with identity verification, account verification, and the process is completely open and transparent. The openly shared and non-tamperable digital transaction ledger established by the blockchain can also help users improve transaction credibility and help build trust.

Companies like Aave are building decentralized social media platforms like Lens Protocol, where users can create profiles on-chain, follow others, create and collect content, ownership and control of which remains in the In the hands of users (Social Capital), and users can also tokenize it. This is different from the Web2 era where user data is locked in a platform, monopolized by the platform and used for free.

The emergence of the Web3 creator economy enables users to take ownership of their own content. Web2 companies are also taking action, with the Raddit social media forum allowing millions of users to access Web3 through their NFT. Consumer and fashion brands like Adidas, Nike, Burberry, and Gucci are embracing NFTs and in-game assets in an attempt to catch the next cultural and marketing megatrend. Amazon plans to launch an NFT marketplace for its 167 million Prime users in the U.S. in April 2023, after which the move could be global.

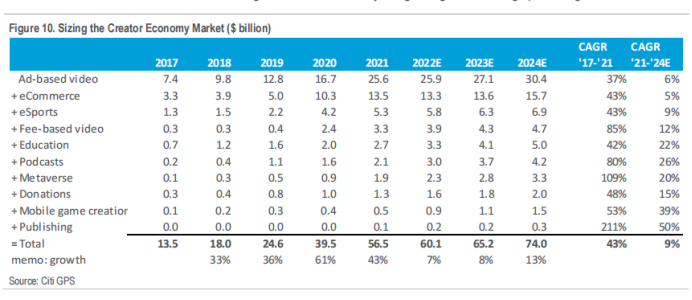

We believe that the current market size of the creator economy is 60 billion per year, and it is increasing at an annual growth rate of 9%. By 2024, the market size will reach 75 billion, and many subdivision tracks are growing at a double-digit rate. Blockchain-based social media platforms aim to put social media on-chain, offering the benefits of privacy protection, profile ownership, and control over generated content. Most platforms also offer native tokens for the tokenization of content from creators. However, decentralized social media networks are still in their infancy, and the user experience is not as rich as traditional media.

Art, NFTs, and The Metaverse

Trust is the most important factor in the art world. Blockchain technology can help solve the trust conundrum without forcing anyone to trust an individual or institution. Tokenization of artwork helps to make this information accessible to all by cryptographically verifying that due diligence certificates are embedded in smart contracts and stored on-chain.

The art market is plagued by fraud, forgery and theft. In the absence of any central authority, establishing a trustworthy registry of digital records can be difficult. Using blockchain technology does not mean that traditional market participants cannot be trusted. Instead, it shows that they are more trustworthy because all information will be recorded on an immutable ledger.

Blockchain technology can help artworks establish immutable records such as ownership history, independent evaluation records, and ownership certification throughout the life cycle. These proof records, also known as asset tokens, can be legally bound and are digital representations of proof of ownership. We could see art owners and traditional galleries such as Sotheby’s, Christie’s, and Phillips working with blockchain companies to create digital proofs that capture all information related to an artwork.

In addition, digital proof of artwork can also be packaged in token assets, creating institutional-level investment opportunities for high-value artwork and collectibles. Blockchain-based art funds can create an open and transparent environment for potential investors by providing artwork information, attribute performance and update records. For example, Sygnum, a Swiss digital asset bank, tokenized Picasso's Fillette au béret work itself according to the Swiss legal framework for digital assets, enabling individual/institutional investors to participate in the investment of Art Security Tokens of this work .

As an emerging art form, NFT will be highly sought after in 2021. Between March 2022 and February 2023, sales of art and collectibles totaled 3.8 million transactions worth $9.5 billion, according to Nonfungible.com. In the real world, artists cannot get a share of revenue from secondary sales, and NFT can be carefully designed to ensure that artists can obtain subsequent secondary sales royalties after the initial casting sale.

In addition to artworks, collectibles can also be chained in the form of NFT. In addition, based on the fact that NFT can be used as a proof of the authenticity of its corresponding physical assets, it creates trust, especially in the high-end collectibles market. For example, the BlockBar platform enables luxury brands to issue NFTs for their collections of wine and rare spirits. The main goal is to have exclusive wine and spirits bottles on the one hand, and to trade in the secondary market on the other hand, while physical wine bottles are stored in a secure, temperature-controlled warehouse.

The enthusiasm of consumer goods, luxury goods, and fashion brand companies for NFT may attract 1 billion users. Various brands, especially Starbucks, Nike, Disney, etc., are trying to use NFT to improve customer loyalty, engagement and marketing. E-commerce platform Shopify has launched a Web3 toolkit that enables merchants to easily build a Web3 commerce experience.

Market size of tens of trillions (Trillions of Dollars)

Tokenization of the securities market

Why is the stock market important? Because the global tradable equity and fixed income markets exceed the size of 250 trillion US dollars. As such, the traditional securities market has the potential to be one of the largest use cases for tokenization. We believe that the private company/private company market may be tokenized faster due to the benefits of high liquidity, transparency, and fragmented ownership.

Although the industry is still in its early stages, based on our conversations with industry experts and insiders, we estimate that, assuming 1% corporate and quasi-sovereign bonds, 7.5% real estate funds, 10% private equity and venture capital funds, and 1% If $1 trillion in securities financing and collateral activities are tokenized, the digital securities market size will reach $4 trillion to $5 trillion. At the same time, it is accompanied by the tokenization of the trade finance market. By 2030, the scale of trade finance based on blockchain technology may reach 1 trillion US dollars, accounting for about 8%-10% of the global trade finance scale.

Why does the securities market need tokenization?

So why do securities market products such as stocks, bonds, and funds need to be tokenized? The traditional securities market has solved the problems of accessibility, high liquidity, openness and transparency for most products. What drives private equity giants (such as KKR, Apollo, Hamilton Lane) to set up their encryption funds on digital asset exchanges such as Securitize, Provenance Blockchain, and ADDX? Why are some of the biggest asset managers like Franklin Templeton and Wisdom Tree trying to set up crypto mutual funds on public chains like Ethereum or Stellar?

The reasons may be: some financial assets may be restricted by traditional financial markets and rules, such as fixed income, private equity and other assets, and have liquidity like publicly traded securities, and it is relatively difficult to invest in these assets; , a phenomenon in the financial market is that financial institutions will pay a high premium for partial control of assets, which may be contrary to the wishes of investors, because these assets are more expensive, more complex, and more difficult to control; and the current financial market The infrastructure is fragmented, and the payment system, value discovery, market matching, and clearing and settlement systems are all different; many intermediaries in the financial system also create obstacles to the circulation of data.

What blockchain-based distributed ledger technology and tokenization schemes can provide is a brand-new technology stack that allows all stakeholders to develop a golden data source on the same and shared infrastructure. All related activities - no more costly reconciliations, risking settlement failures, waiting for faxed files or "original files" in the mail, or investment decisions limited by operational difficulty. The above is only the improvement of operational efficiency brought about by blockchain technology, not the final form of blockchain technology to transform the financial market.

The end state of the financial blockchain is a digitally native financial asset infrastructure that is globally accessible, executed 24 x7 x365, and optimized through the automation of smart contracts and decentralized ledgers. From this, new product features range from debt instruments that pay out cash flow on a daily, hourly or even minute-by-minute basis, to instant ESG tracking embedded in any security, to fund. Financial blockchain could also expand market access for these instruments to targeted accredited and high-net-worth investors, enabling better matching of products to risk profiles and enabling smarter, simpler distribution.

In addition to the aforementioned financial blockchain-based advantages, different classes of assets can also be represented on the same blockchain, unlike today's traditional financial markets. Although cash tokens are conceptually and functionally different from bond tokens, they can be treated in a similar way on financial blockchains, and the nuances of each asset can be handled in smart contracts (such as fund tokens). limited holding period and limited screening of cash tokens). Smart contracts can then be programmed to automatically trigger cash token payments for company-specific actions or dividend deadlines. The use cases for tokenization are endless. But this requires a whole new blockchain infrastructure that supports programmability, verifiability, and a trustless network.

Benefits of Tokenizing the Securities Market

After tokenization, the direct benefits of liquid financial assets are concentrated in the efficiency of clearing, settlement, custody and asset services, while illiquid assets have a wider upside and expandability.

Liquidity: High-value illiquid assets benefit from tokenization because tokenization allows asset ownership to be fragmented, which makes transactions, ownership transfers, and record updates easier, and can significantly improve high Liquidity of value illiquid assets. After high-value assets are fragmented through asset ownership, the minimum threshold for investment is lowered, and it can meet the customized needs of owners (only sell or mortgage a small part of high-value assets, and enjoy the appreciation/income of the rest).

- Operational efficiency improvement (Distribution): The entire token distribution process (from creating tokens to transferring ownership) can be done openly and transparently on the chain (without any rent-seeking intermediary). In theory, any token connected to the Internet Anyone can open a wallet to own tokens. In addition, transactions built on the blockchain can achieve transactions and settlements at the same time (significant for cross-border foreign exchange transactions and real estate transactions), no matter who the counterparty is, and no transaction intermediary is required.

- Enable Access: While potentially restricted by jurisdictional regulation, tokenization can help individuals gain access to certain assets that have traditionally been accessible only to institutional clients or top-tier investors. In addition, people in less developed parts of the world have limited access to banks and brokerage firms, which may also give them access to investment opportunities in securities and other real-world assets, benefiting from asset appreciation.

- New user groups (Wider Appeal): Those who accept or advocate tokenization tend to be younger, more enthusiastic about technology, and have diverse backgrounds. These user groups can become new target customers of traditional financial institutions.

- Opportunities in Smaller Companies: In traditional financial markets, it is difficult for many assets to obtain financing. The tokenization of such assets, such as the equity of private companies of small and medium-sized enterprises, accounts receivable, etc., can open up new financing channels and investment channels.

- Operational Efficiency: Smart contracts make issuance, trading and post-trade processes smoother, faster and potentially cheaper, effectively reducing communication costs between issuers, investors, traders and market infrastructure. In theory, this could also reduce transaction errors and transaction costs. The combination of smart contracts and other interoperable protocols can perform key functions together, and can be applied to application scenarios such as KYC/AML, margin calculation, and corporate behavior. Smart contracts can also improve the flexibility of corporate governance voting through automatic calculations and conditional payments. and improve the efficiency of communication between investors. Finally, blockchain-based infrastructure has the potential to provide shorter and more flexible netting, clearing and settlement cycles.

- Composability: The tokenization of real-world assets and financial assets can realize product innovation in the financial industry by exchanging, mixing and combining with digital assets. Asset and wealth managers can build more diverse and flexible portfolios, including real-world assets, financial assets and digital assets accessed through a single digital wallet. The composability of tokenization models could also enable direct cash flow generation, replace new data-driven contracts, and improve investor treatment in traditional financial markets.

Trust Minimization and Transparency: Transactions of real-world assets, financial assets, and intangible assets (such as securities, artwork, real estate, and intellectual property rights) often rely on trust between buyers and sellers , and sometimes rely on trust between brokers and other third parties with legal, valuation and transactional expertise. Tokenized assets supported by smart contracts can automatically execute and record transactions and transfer ownership when preset conditions are met, thereby eliminating counterparty risk. The use of the Internet of Things (IoT) and Oracle Net can also further reduce the need for manual reporting and managed asset valuations.

The immutable, open and transparent nature of the blockchain also makes it more difficult for fraud to occur. Even if fraud occurs, the blockchain will also carry out a comprehensive audit trail, helping auditors to more easily prove and identify fraud, rather than through manual analysis. document.

The tokenization of real-world assets, especially real estate, art, and collectibles, brings much-needed transparency and traceability to the provenance and valuation of assets. The blockchain can automatically update the ownership history of each transaction and record a time-stamped appraisal signature, providing clear evidence of the quality and authenticity of real-world assets. Appraisers’ historical verifications can be made visible on-chain, thus, price discovery for such assets becomes easier.

Barriers to Tokenization in the Securities Market

If you want to achieve the final form of the financial blockchain mentioned above, an analogy based on the current situation is like changing the engine of an airplane when it is flying at an altitude of 30,000 feet. Additionally, the new engine required a complete rewiring while still being compatible with the old system.

Before tokenization can have a meaningful impact on financial markets, the entire financial market and its workflow must first be digitized. This requires legal documents to appear digitally native (rather than via scans and PDFs), such as smart contracts, to enable composability with smart features. Different jurisdictions are prioritizing making digital records legally binding, which will pave the way for more tokenization projects. Countries such as Switzerland, France, the United Kingdom, Singapore, and the Philippines have embarked on the implementation of pilot transactions related to tokenization.

However, a brand new technological innovation needs the test of time and the cost of replacing existing technologies, not to mention replacing the complex and huge traditional financial market. The blockchain industry also lacks an operational consensus standard, and it is not appropriate to use the existing blockchain infrastructure directly in the traditional financial system.

See a failure of the Australian Securities Exchange (ASX). In 2015, ASX tried to use distributed ledger technology to solve the exchange's clearing, settlement, asset registration, post-trade services and other issues. Because the development team believed that it did not need to be compatible with the previous business processes and technology stacks, the system development was completed. Afterwards, many delays were caused, and finally the project was terminated, resulting in a loss of 16.5 million yuan. In addition, the banking system has formed a trustless state, which does not require blockchain to solve the biggest trust problem. What the banking system needs more is barrier-free coordination and communication, eliminating the risk of settlement failure, and traceability . Transaction speed and throughput, liveness and data availability, and transaction privacy are very important to financial institutions once financial blockchains are to be implemented.

In any case, traditional financial institutions are still very keen on tokenization. There are a large number of market participants in the traditional financial market, as well as huge assets: the real estate market exceeds US$300 trillion, the securities market exceeds US$250 trillion, regulated public funds exceed US$60 trillion, and fast-growing private equity market. Even if the above 1% of the volume can be tokenized, the scale will reach trillions of dollars. Early adopters will benefit greatly.

The practice of tokenization in the securities market

The securities we mentioned are tokenized in two ways:

A. Tokenization of securities: refers to placing the underlying assets - traditional securities - in the tokenized infrastructure of the blockchain, and reissuing them in a tokenized manner. This is by far the most common and widespread method. Using distributed ledger technology to record the movement of securities can improve the efficiency of existing records, while also allowing asset ownership to be fragmented and collateralized.

B. Native Security Tokens: Refers to the issuance of new securities directly on the infrastructure of the blockchain and storing them in wallets associated with the decentralized ledger. While currently representative cases are limited due to regulatory constraints, this is likely to be the area of greatest impact in the long run. The issuance of native security tokens can not only enjoy the many benefits brought by blockchain finance, and is no longer limited by the traditional financial system, but also opens the door for new innovative product functions, such as ESG tracking and dynamic portfolio reallocation .

Tokenization can be used as an entrance for real-world assets to enter the Web3 blockchain ecosystem, which can enable an orderly transition of capital to the new Web3 ecosystem, thereby avoiding damage to the existing infrastructure. At present, various jurisdictions are actively exploring the tokenization of securities, while the issuance of native securities tokens is mainly concentrated in bonds.

Case 1: Digital collateral market

The collateral/securities lending market, or Repo Market, is a key segment of the securities market that can benefit immediately from tokenization. Despite the repo market's monthly trading volume exceeding $2 trillion, existing trade and post-trade processes in the market are still largely manual and inefficient, with significant risk.

A number of new tokenization projects based on decentralized ledger technology have emerged, targeting this large and inefficient market by establishing a digital mortgage record on the blockchain. Once digitized, these assets will enter a single, seamless pool of collateral assets and be able to take advantage of smart contract features such as automation and conditional settlement, greatly improving operational efficiency.

Platforms such as the HQLAX platform, JP Morgan's Onyx repo platform, and Broadridge's DLT Repo are already processing billions in securities lending volume and have the potential to scale further. These platforms will bring considerable operational and capital savings to the industry. Given the current momentum in the industry, it seems likely that the digital collateral market will be the first large-scale use case for digital securities.

Case 2: Tokenization of Private Equity Funds

Historically, there has been a barrier to entry for retail investors investing in private market funds, a market limited to large institutional investors and ultra-high-net-worth individuals. Furthermore, a clear goal of the alternative asset market is to increase allocations to retail investors. This persistent underallocation is driven by high investment minimums, long holding periods, limited liquidity (including a lack of developed secondary markets), lack of means for value discovery, complex manual investment processes, and lack of investor education wait.

The challenges supporting this ongoing underallocation are high investment minimums; long holding periods; limited liquidity, including a lack of developed secondary markets; fragmented asset discovery options; complex manual investment processes; and lack of investor awareness and education etc.

While tokenization is still in its early stages, asset managers are testing the waters by launching tokenized versions of their popular funds.

Private markets investment firm Hamilton Lane has partnered with digital stock exchange ADDX to tokenize a share class of its most popular global private equity fund, lowering the minimum investment threshold from $125,000 or more to $10,000. It also allows investors to choose to trade these token assets on digital stock exchanges.

Alternative asset manager KKR has also tokenized its healthcare fund on the Avalanche blockchain through digital asset firm Securitize in late 2022. Meanwhile, private equity firm Apollo partnered with fintech firm Figure on investment management on the Provenance blockchain and launched a new tokenized fund.

Trade Finance

Trade finance is a set of technical or financial tools used to mitigate the risks inherent in international trade, ensuring payment to exporters and delivery of goods and services to importers. Trade finance is a huge market, worth about $8 trillion by 2022 and likely to grow to $12 trillion by 2030. The World Trade Organization (WTO) estimates that trade finance plays a key role in facilitating and supporting as much as 80%-90% of international trade. Changes in the law and advances in technology could drive the tokenization of up to $1 trillion in assets in global trade finance by 2030.

One of the drivers of change in trade finance is upcoming legal reforms. Almost 80% of global trade is governed by UK law, which may soon begin to accept Electronic Transferable Records. The Model Law on Electronic Transferable Records (MLETR) was first introduced by the United Nations Commission on International Trade Law (UNCITRAL) in 2017 and applied by Bahrain, Singapore, Abu Dhabi and others in 2021. MLETR applies to electronic transferable records such as bills of exchange, bills of lading, bills of exchange, international guarantees, letters of credit, other receipts, etc. This is a potentially major change with far-reaching implications for the digitization of trade finance.

So far, only paper records are legally binding under common law in most countries. Once files are legally binding in electronic form, they will greatly increase transmission speed and security, allow data to be reused, and enable transactions to be automated through smart contracts. Digitizing trade files is the first step in using digital assets in trade finance. Digital transformation is expected to reduce the cost of global international trade by 80 percent and boost trade to $9 trillion, or about 10 percent of global GDP. Countries in Asia are also expected to benefit from legal reforms that could bring the combined benefits of paperless trade in Commonwealth countries to $1 trillion by 2026.

Another driver of change in trade finance is increased interoperability. Previously, banks and corporations deployed private closed networks, which amounted to some people using SMS, others WhatsApp, and another Telegram. But now, there's a growing awareness that networks need to communicate -- to have a network of networks.

The People's Bank of China, the Central Bank of the UAE, the Bank for International Settlements, the Bank of Thailand and the Hong Kong Monetary Authority (HKMA) have joined the mCBDC bridge to facilitate instant, distributed ledger technology-based cross-border foreign exchange payments. International trade settlement was chosen as the first business use case to be piloted on mBridge. The mCBDC pilot, which consists of four participating jurisdictions directly on mBridge, differs in two ways: (1) the settlement of international payments occurs directly on the blockchain common platform, rather than in each country’s On the domestic payment system, and (2) the paying bank and the beneficiary bank transact directly with each other. The mCBDC pilot aims to demonstrate the capabilities of blockchain networks and central bank digital currencies to increase the speed and efficiency of cross-border payments while reducing costs and settlement risks.

After 2030, we will likely see wider adoption of blockchain in trade finance, where interoperability will enable tokenization to reach a higher percentage. Wider adoption will require simpler apps, basic functionality at low or no cost to use, and new liquidity providers to support trade finance.

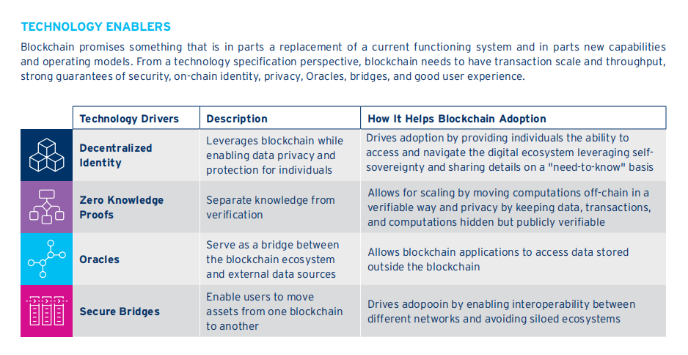

Technology Enablers

So what needs to be improved at the technical level for the Web3 and blockchain ecology to achieve billions of users and a market size of tens of trillions of dollars?

Decentralized Identity

The digital identity of Web3 refers to the unique, verifiable and decentralized identity representation of individuals or entities on the blockchain, which digitally proves "who I am". Web3 digital identity solutions are designed to provide individuals and entities with control over their data and the ability to use that data (e.g. transact, interact) in a secure and trusted manner.

We have developed from the simple email normalization of Web1 digital identity to the only safer and more isolated form of digital identity in the Web2 era (such as Google, Apple, and Facebook all have their own independent account verification systems, and users can only rent on a separate platform Space for Read & Write, and pay data rent). Now, we are on the cusp of the Web3 era - decentralized on-chain self-sovereign identity. This allows users to have their own identities, thereby owning their own digital content and digital assets (Read & Write & Own).

Why do we need decentralized identity? Web3's decentralized identity can transform the data-holding model of large platforms into self-control, and use this decentralized identity system for the entire platform and network. At the same time, this is an effective way for the centralized platform to use its monopoly position to do evil (whether it uses user data for its own benefit, or the possible leakage of data privacy).

Decentralized identity also introduces a new paradigm of sharing some identity information (but not all) based on the "need to know" information of different scenarios. It minimizes the personally identifiable information (digital footprint) that users leave on the Internet. Decentralized identity is a core technical element of blockchain that will allow the use of blockchain to comply with regulatory requirements while still retaining anonymous access.

We believe that decentralized digital identities may be the key to interacting with Web3 worlds such as decentralized finance, decentralized social and open metaverses. A 2022 report by Cheqd estimates the potential market for decentralized digital identities to be around $550 billion. McKinsey estimates that in just the seven focus countries they analyzed, full coverage of decentralized digital identity systems could add 3% to 13% to GDP by 2030.

Zero-Knowledge Proofs

Zero-knowledge proof (ZKP), in simple terms, is a proof that separates knowledge (information required for verification) from verification, which can fully prove that one is the legal owner of certain rights and interests without leaking relevant information. ——That is, the "knowledge" to the outside world is "zero".

In cryptography, this "proof" process is usually done interactively, with the verifier asking the prover a series of questions, and the prover answering the questions. For example, these problems may involve "opening" the solution at a specific location to prove that the solution is correct, but this "proof" does not reveal all information about the entire secret solution, that is, the prover proves to the verifier that Make it believe that it knows or has a certain message, but the proof process cannot reveal any information about the proven message to the verifier. After repeating enough times, there is a high probability that the prover knows the solution.

Privacy is a fundamental right and necessity of individuals and institutions. Banks and financial institutions may want to use blockchain for transactions, payments, and various processes, using the technology to increase efficiency in the middle and back office. However, on-chain data is public to anyone and everyone, and anyone can see a private transaction between two customers of the bank. ZKP solves the above privacy issues, and the payment amount, goods or services delivered, payment terms and other information will not be publicly disclosed.

ZKP's privacy-preserving solutions on public blockchains are critical to driving institutional blockchain adoption. ZKPs provide us with an elegant solution that “has the best of both worlds,” leveraging the transparency and public verifiability of blockchains without compromising the confidentiality and privacy of institutional proprietary data.

ZK-SNARKS technology addresses two main properties in blockchains: privacy and scalability. Privacy comes from ZKP, the prover is able to prove a statement to the verifier without revealing the secret. Scalability comes from SNARKS technology, where verification statements are orders of magnitude faster than the computations required to execute proof statements.

Oracles

Blockchains, by design, can only access and process data "on-chain". Oracle can be thought of as an application programming interface (API), which helps to connect the blockchain with the real world, connecting on-chain and off-chain data. Oracles are at the heart of connecting blockchains to real-world data and information.

Oracles are a prerequisite for scaling the blockchain, because without access to real-world assets, Web3 use cases will be limited to on-chain ecosystems. Oracle will build a hybrid smart contract (Hybrid Smart Contract), which consists of contract code on the chain and real-world data nodes off the chain.

In a typical transaction, the oracle's on-chain contract code receives data requests from other smart contracts and passes them on to off-chain oracle nodes. Oracle nodes are then able to obtain and validate external information by querying external databases using the API in order to collect the requested data. The collected data is then transmitted back to the smart contract using the on-chain contract code.

Currently, we find that most of Oracle's work is done in the DeFi space. However, we are starting to see regulated financial institutions building many oracles for market and data pricing. As more and more assets are on-chain (e.g., bonds, stocks, real-world assets), Proof of Reserves will be a necessity, and Oracles are expected to play a greater role in external financial market feeds.

6.4 Cross-chain bridge (Secure Bridges)

The nature of the future blockchain is multi-chain, because different blockchains are being built and optimized for different use cases with different design ideas. This leads to the need for interoperability between chains and the emergence of potential solutions for cross-chain bridges.

A cross-chain bridge refers to a protocol or intermediary that enables users to transfer assets on the chain from one blockchain to another. The cross-chain bridge is suitable for a wide range of information communication, smart contract calls and other types of cross-chain communication. This is especially important in the context of promoting blockchain adoption in traditional financial markets, as information and data need to be transferred between different institutions or blockchain ecosystems.

One of the common use cases of cross-chain bridges is the Lock and Mint mode. In this mode, users can use the tokens of the A blockchain on the B blockchain. First, the user transfers tokens from the A blockchain to the smart contract of the cross-chain bridge and locks them; then, the cross-chain bridge deploys a smart contract on the B blockchain, aiming to mint the same amount on the B blockchain token, which is usually a "wrapped" version of the A blockchain token; finally, the B blockchain token is sent to the user's address, and the user can now use the token on the B blockchain for consumption, Borrowing etc.