Original Author: TapiocaDao

Original translation: Synergis Capital

In the past week, Circle’s USDC de-pegged, a “decentralized”Stablecoin de-pegged due to the failure of a bank. If it only takes a few banks to destroy decentralized finance, is decentralized finance really decentralized?

There are three questions here:

Why are almost all major "decentralized"Stablecoin de-pegged (by 10% or more) from the USD due to a bank failure?

How did most decentralized Stablecoin end up backed by USDC?

How is it possible in decentralized finance not to be sheltered by a highly regulated and transparent banking institution that Jim Cramer endorses?

Just imagine, a truly decentralized and capital efficient Multichain world Stablecoin is about to be born.

According to tradition, we first take you back to the origin of everything - the initial stage of "decentralized"Stablecoin.

The Father of DeFi - Decentralized Stablecoin

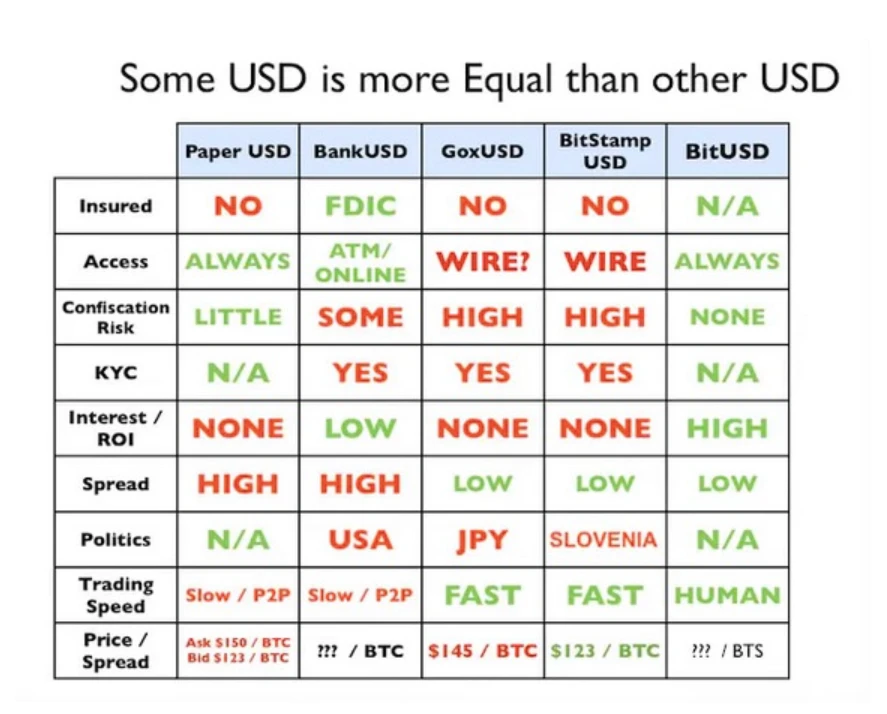

In early 2014, the most amazing, boldest, most innovative blockchain technology was released, and the man I personally attribute the creation of decentralized finance to is Dan Larimer (you may know him as "Ethereum Killer"EOS founder). But I'm not talking about that failed project, but about the BitShares project.

With the birth of BitShares comes BitUSD - the first decentralized Stablecoin!

But the story doesn't end here, BitShares is like a never-ending fleet of foreign exchange - BitEUR, BitCNY, BitJPY, etc., called "smart coins", they fully maintain the anchor value, not a meaningless network meme coin.

So, how does BitUSD work?

BitUSD is not backed by a cash reserve like Tether (I'm just assuming there is, am I right?), but is backed by BitShares' native token, BTS.

To create $1 of bitUSD, you need to provide $2 worth of BTS as collateral, so bitUSD is the first "over-collateralized"Stablecoin or Collateralized Debt Position (CDP) with the equivalent of 200% collateralization (or 50 % loan-to-value ratio, or LTV).

You can exchange the underlying BTS collateral by providing bitUSD, or if the collateral coefficient drops to 150%, a simple liquidation mechanism will occur, through the "margin call" mechanism to buy BTS related to the bitUSD CDP and carry out Liquidation (again, this is in 2014).

This all looks great, but how does bitUSD maintain its price peg to the USD?

A real quote from the BitShares Whitepaper: "So far, we have shown that the price of BitUSD is highly correlated with actual U.S. dollars, but we have not provided any reasonable means of actually establishing the price."

In fact, the price of BitUSD is determined based on its weight relative to BTS on the DEX built into BitShares. There is no direct mechanism to enforce bitUSD's $1 price anchor.

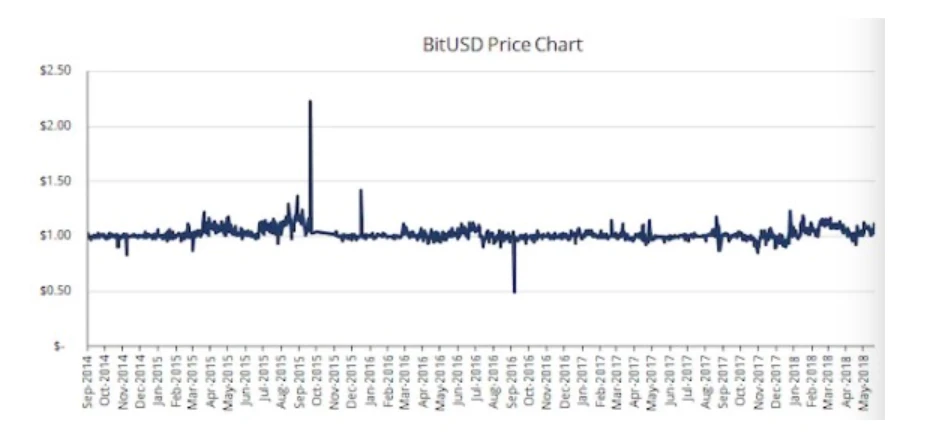

But who cares! While few smartcoins remain pegged, bitUSD has largely maintained its peg to the U.S. dollar.

But in 2014, with bitUSD on the BitShares blockchain, you could trade forex, buy bitGOLD and other real-world synthetic assets on early DEXs, borrow for yield, collateralize those smartcoins, do Going long or short these assets covers almost every function you can imagine in DeFi today, except that nothing actually works in the end.

Dear reader, you must be asking yourself by now: "I have never heard of BitShares, so this project must have failed", and if you think so, you are actually wrong.

No prosperity?

No, there's a more critical one besides no real-time price feed from an oracle, low trading volume on the BitShares exchange that's prone to manipulation, and a stabilization mechanism that's akin to "well, it's supposed to be worth $1, why isn't it?" question:

Maybe the logic that "bitUSD is 200% collateralized by BTS, so at least there won't be a death spiral" sounds reasonable, but what is BTS? It is a highly Liquidity and volatile asset. The quality of the Collateral asset is almost as important as the collateral ratio (along with the debt ceiling, liquidation system, oracle quality, and many other factors).

Therefore, losing the $1 peg for bitUSD would only require a sharp and rapid 50% or more drop in BTS, and liquidators would no longer be liquidating the underlying BTS, as doing so would no longer be profitable.

Indeed, as mentioned above, BitUSD maintains a certain respect for the USD peg. However, BitShares is practically unusable as a blockchain network. With BitShares and BitUSD drifting into oblivion, Dan Larimer turns to EOS to "beat Ethereum" (also not quite successfully), so what's the next chapter in decentralized Stablecoin?

Enter the era of DAI

Tribute to Nikolai Mushegian, a true innovator

In a quick trip through history, we come to 2017's "single collateral" DAI, created by the legendary MakerDAO and its leader, Rune. The name DAI comes from WeiDai, the creator of the cryptocurrency (among other meanings). Ironically, Rune was a well-known member of the BitShares community, and indeed, the original Maker deployment was targeted on BitShares.

Compared with bitUSD, DAI has made great technological progress. But let's start with the similarities:

DAI is 150% collateralized, slightly lower than BitUSD, offering greater capital efficiency (less idle Liquidity) in the first place. DAI is only supported by Ethereum, similarly BitUSD is only supported by BTS.

DAI is also a CDP-based Stablecoin, but more complex. If a borrower accumulates too much debt due to Maker's interest rate, an off-chain liquidation bot can buy some of the user's collateral at a profit, a much smoother and more efficient system than BitShare's "forced liquidation" mechanism.

This is the similarity between DAI and bitUSD. DAI is deployed on the more complex Ethereum blockchain. Maker uses oracle price feeds to ensure the exact value of Ethereum as collateral, interest rates to control the supply of DAI, like a real central bank, users can exchange DAI for Ethereum at any time, and most importantly, through arbitrage implementation The mechanism of DAI equivalent to USD:

If the price of DAI exceeds $1, users can create new DAI at a discounted price, and if DAI falls below $1, users will buy DAI to pay off debts at a discounted price.

Despite an 80% drop in the price of Ethereum during DAI’s first year, DAI has held on to its $1 peg. Overcollateralization and a good liquidation system worked!

power struggle

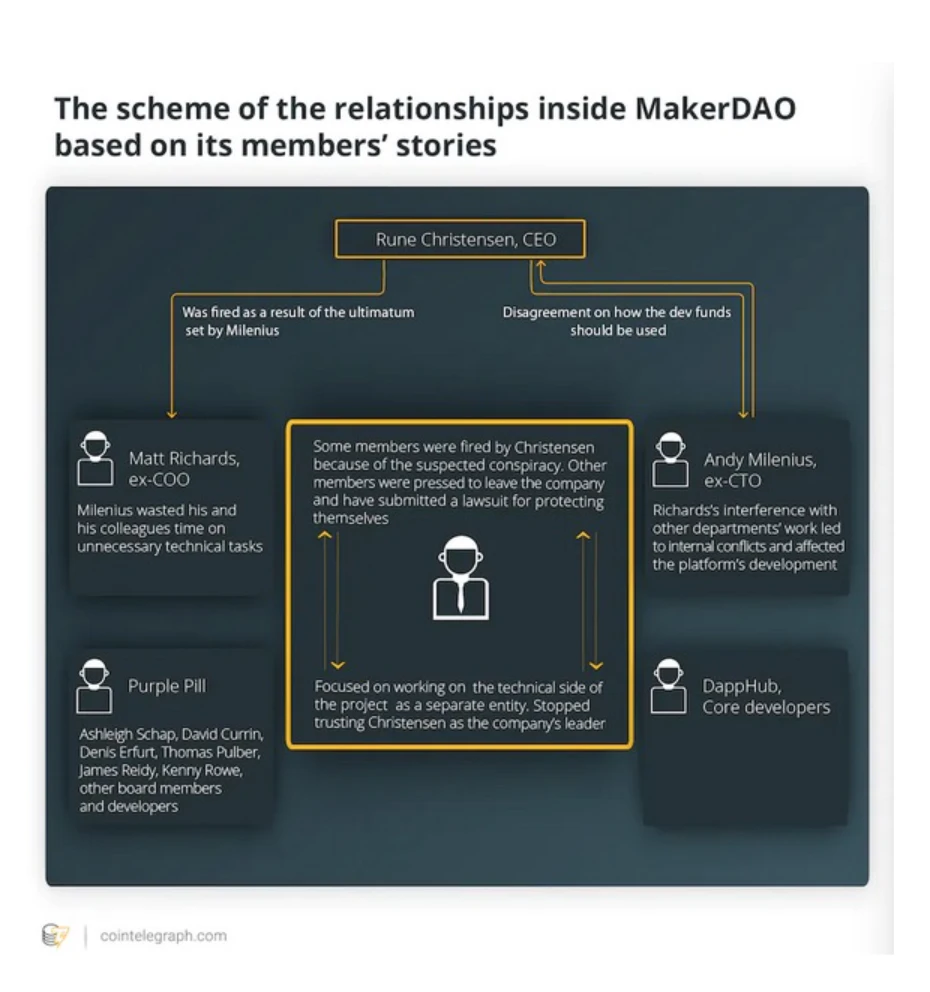

With the fact that the DAI Stablecoin has achieved nearly $100 million in Liquidity, of course a power struggle must have started, and this struggle began in 2019.

Rune’s perspective has shifted — he believes that the path of pure decentralism limits DAI’s potential, and that Maker needs to integrate itself into the traditional financial system in order to really spread its wings. Maker lost its chief technology officer, Zandy, in the transition. Zandy left a public memoir titled "Zandy's Story" on April 3, 2019.

You can never be sure if this was written in 2019 or 2023, Zandy apparently knew what was coming before it happened:

After Zandy left, Rune emerged victorious, determined to achieve world domination by combining the highly complex and heavily regulated financial system of the traditional financial world with DeFi's trustless medium of exchange - DAI.

Rune gives MakerDAO contributors two choices — the red pill or the blue pill:

Those who choose the red pill should work on initiatives that advance government compliance and integrate Maker into the existing financial system.

Someone who chooses the blue pill will build the core contract of multi-collateral DAI and then be fired from Maker.

The core contributors are unfortunately not in the "Matrix", and Rune is not as convincing as Morpheus, so some contributors chose to create the "Purple Pill" faction, to overthrow Rune's rule, and take control of the 200 million now controlled by Maker USD, and continue on the path to making DAI a truly decentralized currency.

The Birth of the Poison Apple

In 2020, multi-collateral DAI was born, supporting more collateral besides ETH to mint DAI. Basic Attention Token (BAT) is the second asset that can be collateralized as DAI. The legendary Maker PSM ("Price Stabilization Module") was born via MIP 29, which allows DAI to be easily swapped with other assets with low slippage and low fees.

On the fateful day of March 16, 2020, Maker introduced a third type of collateral to back multi-collateral DAI, Circle’s USDC.

This is an extremely important event for DeFi. However, at first it did do so in a more "isolated" way - USDC was capped at the amount of DAI it could support, which at the time was around 10%, equivalent to $20 million.

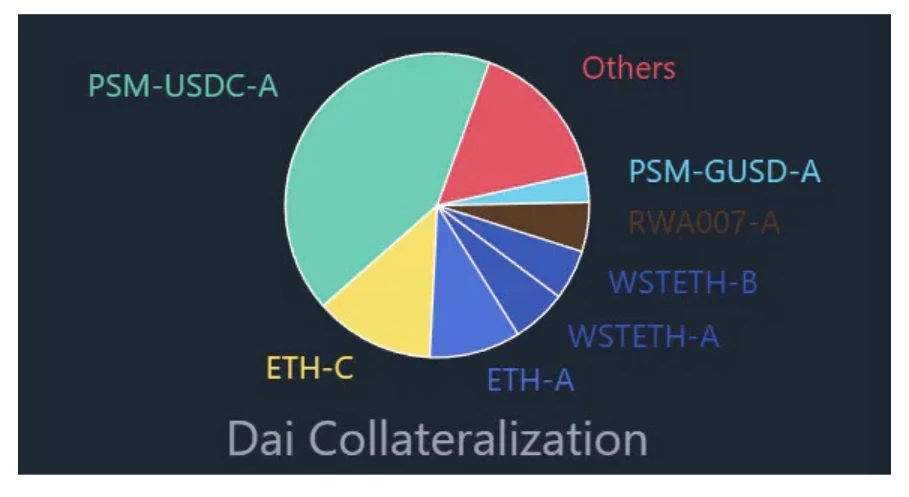

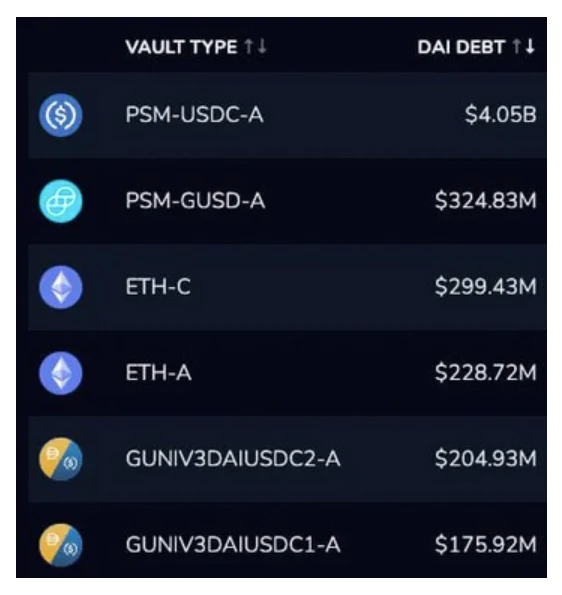

However, with the bite of this poisonous apple, DAI’s USDC collateral grew rapidly, eventually becoming DAI’s main backing asset. USDC currently holds 57% of DAI’s circulating supply and 40% of its backing assets.

This event has seen an influx of more and more "decentralized"Stablecoin taking a bite out of the centralized poison apple (USDC) to gain substantial adoption during the 2021 bull market frenzy.

The lure of massive capital provided by centralized entities like Circle is so strong that it's easy to forget the real reason cryptocurrencies were created — namely, the 2008 financial crisis and the relentless collapse of banking institutions fueled by unrelenting greed. Unrestrained indulgence.

15 years later and we're still stuck in the same damn place, to get a better understanding of the past few months in the crypto space:

Silicon Valley Bank: $1.8 billion in losses

Silvergate Bank: $1 billion in losses

FTX: $8 billion in losses

Celcius: $5 billion in losses

Three Arrows Capital: $3.5 billion in losses

Genesis (Digital Currency Group): $3.4 billion in losses

TOTAL: $22.7 BILLION

Despite the $600 billion in 2008 Lehman Brothers bankruptcy losses, we can choose to continue deluding ourselves into believing that centralized entities are "too big to fail" and that USDC envelopes are considered decentralized because they are based on decentralized Governance in such a way that Circles (or governments) can wipe them out with the push of a button.

Or, we can accept the fact that "no centralized entity is too big to fail" and need a trustless and censorship-resistant dollar-pegged currency - which is what DAI once stood for, and in the real world In centralized finance, this is one of the most basic needs.

Please note:

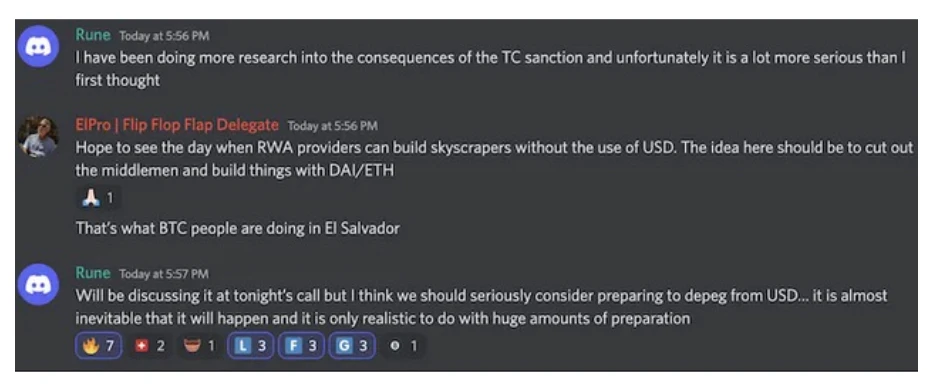

After the arrest of Alexey Pertsev (creator of Tornado Cash) in August 2022, Rune (seemingly) realized the dire situation facing DeFi, and even suggested that we should seriously consider converting a currency worth tens of The billion-dollar Stablecoin(DAI) is depegged from the U.S. dollar.

Centralized entities now have a kill switch for so-called "decentralized"Stablecoin, which they can turn on at any time - and most of the "decentralized" financial system, like a bug.

Not long after, Rune published the now (infamous) Maker endgame proposal.

This radical shift would take steps to launch Maker's chemotherapy program to cure its centralized cancer - accumulating ETH into the Maker PSM, eventually converting all remaining USDC into ETH, becoming a censorship-free, free-floating non- Stablecoin.

In the wake of the Silvergate Bank, Silicon Valley Bank, and Circle USDC decoupling debacle, Maker has also issued an emergency proposal to begin purging centralized assets in the Maker PSM as DAI is losing its peg.

But unfortunately, I think this cancer is terminal.

Maker and DAI face deeper problems:

Revolving Funding: Backing DAI with DAI (DAI/USDC LP - $375M). Backing DAI with DAI, yes, you read that right!

More centralization: $300 million in Gemini USD (GUSD) backs DAI.

Custody risk: Maker PSM's $1.6 billion USDC loaned to Coinbase Prime.

More Centralized: Abuse of Maker's upgradable automated contracts to seize user funds from DAI repository ($202M by Wormhole Hacker) for use in UK courts.

Note the note about the Wormhole hack reverse-engineering:

While funds from the Wormhole hack were stolen and should be returned to their rightful owners, a truly decentralized and trustless protocol cannot dictate this. Think about the impact? Can Courts Now Order Protocols to Seize Users' Funds? Is this DeFi?

In my opinion, DAI is now tainted by centralized assets (and governance drama) and is no longer the censorship-resistant decentralized Stablecoin it once was, especially compared to when it was single-collateral DAI.

A second note: I will publicly state that in many ways I am basing Tapioca and my own model on Maker and Rune. His pessimistic approach to traditional finance, his openness to broadly discussing radical ideas with the community, his views on decentralization, etc. all influenced my views. I definitely don't hate Maker or Rune, and I wouldn't be here without them.

But we have to dig deep into the annals of decentralized Stablecoin history for a ruined scroll written by Stablecoin“guru” Rick.

Rick & Morty and Decentralized Stablecoin

The first thing you'll probably say is, "Wait, Rick?" Please bear with me, dear reader.

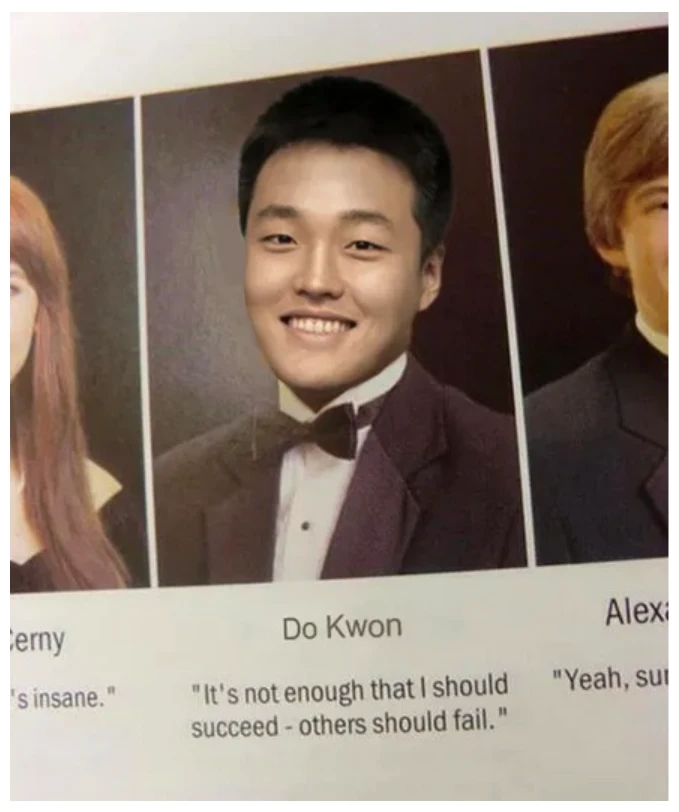

Before the Stablecoin“guru” used his real name, his first name was Rick — a clear display of his sharp intellect — and he borrowed one of the main characters from the popular “Rick and Morty” cartoon alias, and one of his company's engineers, "Morty."

So, what did "Rick" and "Morty" build? Basis Cash, but they don't really "build" anything. Base Cash actually existed before Rick's self-proclaimed "guru" of Stablecoin, and has its roots going back to Basecoin/Basis. Basecoin is a non-collateralized Algorithmic Stablecoin that leverages the now-common currency issuance model. Basically, when Basecoin is below its peg price, Base bonds are auctioned to re-peg it, and when Basecoin is above its peg price, shares are issued.

Let's pause for a moment - what are Algorithmic Stablecoin? Algorithmic Stablecoin are not directly backed by backing, but rely on mathematical formulas and incentives to hold prices equivalent to U.S. dollars.

The three main Algorithmic Stablecoin models currently in use are Rebases, Seigniorage, and Fractionally Backed, or Fractionally Backed — which is a mix of collateralization and currency issuance.

Rebases — Stablecoin that mint and burn their supply to keep their peg to the dollar, Ampleforth is an example. In general, Rebases Stablecoin are out of fashion.

Seigniorage - These Stablecoin often have a multi-token economy. One is the Stablecoin itself, and the other is a secondary token with a non-fixed price that is used to keep the Stablecoin stable. Incentives are often used to induce market participants to buy or sell second-generation assets in order to keep the Stablecoin in line with the anchor price.

Fractionally Backed - Partial currency issuance, part mortgage. Frax is an example. Although fully backed by USDC, Frax has recently officially announced that it will be an over-collateralized Stablecoin, making this clear through FIP-188.

However, Basecoin was never deployed because its founder Nader Al-Naji stated that there were regulatory restrictions that forced Basecoin to shut down. Nader, however, argues that cloning the Bitcoin blockchain and labeling it "BitClout" is embarrassingly embarrassing, selling CLOUT tokens to venture capitalists for $0.80, and selling them to VCs for $180. It sells to retail investors for an effortless 5,000% gain that doesn't raise concerns from regulators. In Nader's mind, why Basecoin's mechanics were more illegal than his and a group of "top-notch" VCs defrauding retail investors of huge profits, the executive would never understand.

However, going back to our Stablecoin guru “Rick,” he doesn’t care about Nader’s legal concerns, or more importantly, the sustainability of the technology. In his Telegram group in the summer of 2020, he made an announcement comparable to a sermon on the Mount:

"Hey guys, remember what Basis is? It was an early 'DeFi' Algorithmic Stablecoin with high ambitions, but was shut down due to the risks involved with the SEC. Today we take Basis from the grave resurrection."

With this announcement, "Rick" set out on his mission to build a number of Algorithmic Stablecoin with no backing, hassle-free money issuance models, including one we're all familiar with (don't worry, we'll get to that ).

Basis Cash launched in Summer 2020 with Rick and Morty deploying Basis Cash (Stablecoin), Basis Bond (Treasury Bond) and Basis Share (Treasury Bond).

The U.S. Treasury Department is the agency of the U.S. government responsible for printing dollars and issuing treasury bonds and bills. Therefore, Algorithmic Stablecoin like Basis Cash are not actually innovative, but simply mimic the actual fiat currency system, which works flawlessly.

Basis Cash = USD, Basis Bond = Treasury Bonds, Basis Share = Treasury Bills.

One thing to add is that the full credibility and credit of the US government is of course equal to "Rick and Morty", right?

Basis Cash was a poorly conceived and practiced Ponzi scheme that eventually attracted $30 million in funding before dropping to $0.30 in January 2021. But Rick and Morty kept busy, launching the Empty Set Dollar (ESD), which had a market capitalization of $22 million but fell to a penny within a few months; Dynamic Set Dollar (DSD), an instant s failure.

So why did Basis Cash fail? Basis Cash, the best performer of the three projects with a market cap of $170 million, surprisingly didn’t actually fail catastrophically, it just never maintained its peg to the dollar.

The best summary of this statement comes from the following quote:

"While the DeFi folks are busy trapping zero sum games like @emptysetsquad, @dsdproject and @BasisCash, remember the only real stabilizing force in Algorithmic Stablecoin is growing adoption and usage."

Who said this sentence? It's Rick himself, the guy who created ESD, DSD, and BAC.

How does this make sense? Why would Rick call his project a "zero-sum game"?

Because Rick is no longer known by the name Rick, he is now known as Do Kwon. Do Kwon will provide context for the phrase "fail upward". His three failed Stablecoin projects round out his experience, making his fourth disaster all the more massive.

However, the most ironic and interesting part of this sentence is not here. "The only stabilizing force in an Algorithmic Stablecoin is growing adoption and usage." What does that mean? Do realizes that in order for an Algorithmic Stablecoin to remain stable, people need to keep buying into that Algorithmic Stablecoin ecosystem to keep it stable. Well, what's this called? Ponzi scheme?

Rick realized that the most important missing ingredient in his ESD, DSD, and Basis "collateralized, hassle-free"Stablecoin was that there was no incentive for users to buy and keep buying in order to maintain stability. So fail!

Am I ruining DeFi?

Yes, you ruined DeFi - enter the era of Terra.

In 2019, Do Kwon and Terraform Labs incorporated in Singapore, completed a seed round at 18 cents per LUNA token, created a Cosmos blockchain, and got almost all the "top VCs" (a paradoxical words) participation.

Shortly thereafter, in 2020, UST was publicly announced as a “decentralized” “Stablecoin” on the Terra blockchain. However, the second key part of the story is that an engineer at Terraform Labs created the Anchor Protocol, a money market on Terra that enables high-consistency yields paid in UST. The developers at Terraform Labs told Do they will set an Anchor yield of 3.6% for UST. A week before Anchor went live, Do told them: "3.6%? No, let's set it to 20%".

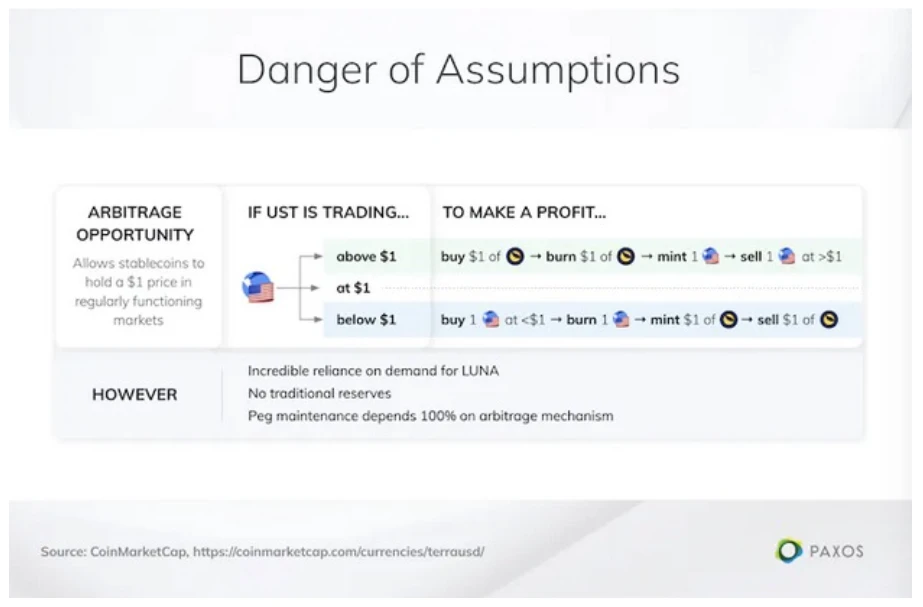

UST, also known as TerraUST, is a "decentralized" "Stablecoin". Many anonymous users mistakenly believe that UST is powered by LUNA, but this is not the case.

UST is not backed by anything, it is an unsecured "Stablecoin" with a pure minting power algorithm.

We’ve already discussed the minting power model, but to explain again: you can create 1 UST by burning 1 USD of LUNA, and vice versa.

If UST exceeds the peg price, you can exchange 1 USD of LUNA for 1 UST worth more than USD 1 and sell it at a profit.

If UST is below the anchor price, you can always exchange 1 UST for 1 USD of LUNA. (this is the important part)

In theory, this model might seem logical to some extent. But remember, “the only stabilizing force in an Algorithmic Stablecoin is growing adoption and usage”.

So why would anyone risk holding or using UST instead of USDC or DAI?

Well, that's the $60 billion answer, remember Anchor Protocol? That is Terra's central bank. Remember that 20% guaranteed return part?

In fact, you can deposit UST into Anchor and get a 20% annualized rate of return. This means that for every 1 UST you deposit, you will be guaranteed $1.20 after one year. How is this possible when real banks are barely offering 1% yield? We will discuss this later. But through this Ponzi-like high yield, Do has created his "stabilizing force" to attract people to adopt and use UST!

Also, as a foreshadowing, Do Kwon tweeted in 2021 that it would be “stupid” to destroy UST similar to George Soros’s “Black Wednesday” attack.

For context, what was the "Black Wednesday Soros Attack"?

black wednesday

The UK joined the European Exchange Rate Mechanism (ERM) in 1990. The ERM basically pegs member countries' currencies to the European Currency Unit. The European Currency Unit will ensure that the currencies of all member states trade in "bands" among each other, minimizing fluctuations in the ECU's exchange rates and allowing for a smooth transition to a shared European currency. However, when member countries peg their currencies to each other, they are artificially altering the value of the currency to make it easier to convert, thus potentially leaving the currency in a vulnerable state.

The Deutsche Mark (DM) grows strongly in united Germany, so most of the ERM's member states link their monetary decisions to the Bundesbank. However, there is a problem with this, which is that the German economy is booming, while the UK is feeling the pain of inflation in a stagnant economy.

When the UK joined the ERM, it set its exchange rate at 1 pound equal to 2.95 Deutschmarks, vastly overvaluing the pound. Inflation in the UK continued to run out of control, forcing them to raise interest rates to 10%, further exacerbating the economy's woes.

A billionaire named George Soros saw the UK joining the ERM at an exorbitant exchange rate and decided to take a $10 billion short trade against the British pound via a 20:1 margin position. Central bankers think Soros is over-leveraged, like a Web3 VC addict, but Soros knows it's an easy house of cards that he can easily topple for endless cash.

This puts the UK and Soros in a game where they can continue to devalue the pound and let Soros profit on short trades, or find a way to squeeze Soros out of short trades. So the UK started buying back pounds. Beginning Tuesday, September 15, 1992, the Bank of England faced a panic-buying frenzy. This may seem bad, but in retrospect, Tuesday is nothing compared to Wednesday.

On Wednesday, September 16, 1992, the Bank of England bought back $2 billion an hour in British pounds, and finally had to announce that it was abandoning other options, formally exiting the ERM, and completely unpegging the British pound to the Deutsche mark. This further slashed the value of the pound, allowing Soros to repay the loan on his margin position, leaving him with a $1 billion profit, and single-handedly nearly causing the collapse of the British economy.

So the artificial peg of the pound to the Deutschmark, the repo operation and the bank panic that led to Black Wednesday, let's keep that in mind before looking back at Do Kwon.

black saturday

On Twitter, after @FreddieReynolds described a Black Wednesday-like attack to take down Terra and UST not long ago, Do Kwon raised $1B from Three Arrows Capital and others to create a Bitcoin-based "Luna Foundation Guard", used to buy back LUNA/UST to protect UST's anchor.

Unfortunately for Do Kwon, if you remember Black Wednesday, just like the UK, Do Kwon is implementing buybacks and his central bank Anchor is in trouble.

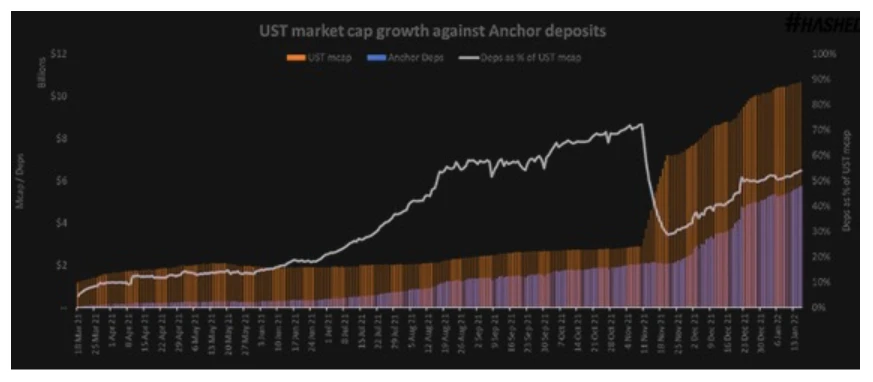

With $14 billion in UST now deposited into Anchor, maintaining this scale will require an annual cost of over $1 billion. More on why this hasn't been found to be ridiculously unsustainable later.

Do Kwon claims there will be no problems with Terra. He then infamously declared that DAI was going to kill him and pitted Curve's FRAX/UST/USDT/USDC 4 pool against Curve's 3 pool (DAI/USDC/USDT).

As increasing yields lent to Anchor Protocol depositors push to tipping point, 10x leverage on UST via Abracadabra's Degenbox (Bentobox) strategy, providing Anchor with nearly 100% yield, nearly $3 billion more deposits earn unsustainable, ridiculously highly leveraged returns from Anchor. This Degenbox strategy is the most profitable yield strategy ever built on top of Terra's ridiculous Ponzi scheme.

Things reached a tipping point, with Anchor’s gross yield reserve of $65.5 million in UST for the 20% APY paid to depositors who lent billions of dollars in UST on Anchor.

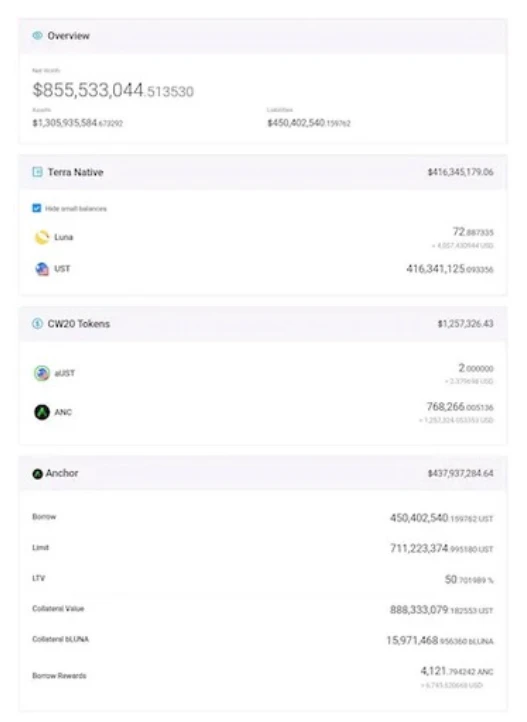

So why doesn't anyone see that Anchor is losing money massively? @FatManTerra found out that notorious clown-level VCs TFL and Hashed were manipulating Anchor's borrowed capital to make it look like nothing would go wrong, as if there was real borrowing to make UST's 20% APY sustainable.

This account borrowed $450 million in UST, did not earn any proceeds, so forgone $29 million of proceeds, and paid $44 million in interest on the loan. There are many similar "whale" accounts just so that Anchor can maintain its 20% APY on UST with fake loan interest.

In an attempt to fill a bottomless pit that ultimately proved to be an impossible task, Terra community member 0x Hamz calculated that, based on the rate at which Anchor’s yield reserves are declining, there would only be 80 days left until January 2022 before Anchor’s yield reserves would be completely depleted. This yield reserve is supposed to build up when Anchor is operating in surplus (more money received than paid out), but since basically all of Terra's Liquidity and performance is fake, it's all illusory.

As the flames began to touch Do's face, Terraform Labs and Anchor realized they needed to spend $1.8 million per day to continue paying depositors the 20% yield.

Of course, Do Kwon realizes that Anchor cannot sustain such a yield and decides to lower the yield to a more reasonable 4%.

Do you like going to jail?

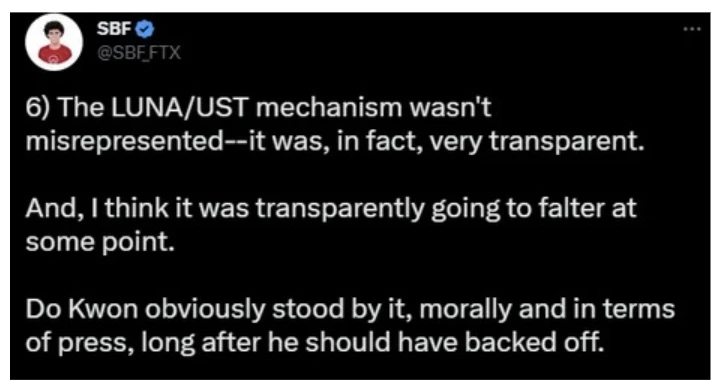

An attacker (definitely not SBF OTC) amassed $1B in UST and borrowed $3B in Bitcoin to build a huge short Bitcoin position.

Remember - the Luna Foundation Guard (LFG) is accumulating bitcoins to protect the UST peg.

First, the attacker just happened to be waiting for UST to migrate from Curve's Pool 3 to DAI-killing Pool 4 to make UST Liquidity enough to drain it easily, leaving $350M in UST. Remember, Do declares that DAI will be terminated by his hand, and by 4 Pool is actually ready (and UST) to commit suicide with 4 Pool. I swear this isn't made up.

Second, he started selling UST on the Binance exchange after UST started to drop sharply ($0.97 ) and entered the unanchored state. LFG then began selling BTC to buy back UST and repair the unanchored state. Remember, our attacker is shorting BTC, so by selling BTC to protect their peg, they are effectively allowing the attacker to profit in both directions (LUNA/UST down = profit, BTC down = profit) , which makes the deal pretty smart.

When the Curve 3 Pool was emptied, the attackers began to use the remaining UST holdings to sell wildly on the Binance Exchange, further deteriorating the unanchoring situation and triggering a bank run.

Binance then suspended trading on UST, the UST peg was destroyed, LFG had to sell all their BTC in an attempt to restore the peg, and the attacker profited enormously from the BTC dump, making an estimated $850 million dollars of profit.

The situation is getting worse for LUNA due to the lack of buying pressure of LUNA, the profitability of UST unpegging arbitrage, and the hyperinflation of LUNA due to the minting mechanism with UST - remember, you can always redeem it with 1 UST LUNA for $1. Even if UST = $0.01, you still get $1 of LUNA.

In the end, this horrific Ponzi scheme resulted in $60 billion in losses that any decent business person would have sneered at. And it didn't just happen once, it happened several times later (Celcius, 3AC, FTX, etc.).

TerraUST conclusion

While the UST dealt a major blow to consumer confidence in "decentralized"Stablecoin, it conveyed an important lesson. Algorithmic Stablecoin simply won’t work in the long-term.

It cannot maintain its peg to the U.S. dollar unless more flows into the trustless decentralized currency than spending. This means that for every dollar of Decentralized USD, there needs to be more than one dollar of funding backing it. While fiat currencies today are not backed, even in the last century fiat currencies started with being fully backed with precious metals.

Whether you love or hate governments, they can be trusted far more than the BBQUSD Algorithmic Stablecoin built by 0x Genius. Ultra-collateralized Stablecoin, while less capital efficient, are trustless because all participants know that there are more on-chain funds behind each decentralized dollar issuance than are issued.

But that doesn't mean we have to settle for USDC wrappers or "decentralized"Stablecoin that use USDC (or USDT, USDP, BUSD, etc.) as the primary (and sometimes only) backing. We also don’t need to be satisfied with a DAI-type decentralized Stablecoin like LUSD that strictly only supports one collateral such as ETH . Nor should we sacrifice all capital efficiency ( Liquidity yield) for a lower maximum collateralization ratio. Finally, we should not rely on capital providers providing Liquidity through incentive mechanisms such as veCRV and CVX to ensure that Liquidity in ultra-collateralized decentralized Stablecoin is deep enough.

There's a better way to balance the "decentralized Stablecoin trilemma" of price stability, censorship resistance, and capital efficiency.

Enter Omnichain Dollar

The word “decentralized” has become a self-deprecating symbol, merely an ideological gimmick used to appeal to people who don’t understand cryptocurrencies. We reject this prospect and believe it is time to return to truly trustless and decentralized money, as established by the anarchist roots of cryptocurrencies and decentralized finance (DeFi) in the 2008 financial crisis. The events of November 8, 2022 and March 11, 2023 have proven that this is the only path DeFi must move forward in order to survive. A bottom line must be drawn, in order to ensure that real DeFi applications not only survive, but also thrive, we need to once again build a decentralized dollar currency on the chain.

On this basis, TapiocaDAO introduces Omnichain Dollar (USDO) to anonymous users around the world, built on Tapioca, a DAO-governed decentralized central bank.

Five principles that shape USDO:

Composability: We now live in a Multichain world. With 179 chains listed on DeFiLlama, Ethereum currently only holds 60% of the total value locked. According to the Tapioca community, most members use at least 3 chains on a regular basis. We cannot issue Stablecoin on one chain and store (often hacked) credits on another chain (e.g. USDC on Ethereum vs. USDC.e on Avalanche). Therefore, USDO is built for a Multichain world, and can be minted and burned (transmitted) on each chain without the use of bridges or middlemen. Competitors such as Axelar use a man-in-the-middle consensus chain Wormhole, Multichain and Nomad have been hacked and use a man-in-the-middle, and lesser-known Cross-chain solutions like Synapse and Abacus/Hyperlane use a man-in-the-middle and an unknown set of external validators respectively.

Trustless: Some Stablecoin(e.g. MIM) need to be minted based on 5/10 multi-signature contracts while requiring manual intervention to populate their markets. USDC and USDT obviously need trust, because Stablecoin issued on the chain need to be supported by real off-chain Liquidity. Algorithmic Stablecoin require some mechanism to maintain stability through buying pressure on the Stablecoin and its token economy, which is intrinsically linked to trust in the system. Some decentralized Stablecoin contain upgradable contracts that may modify key systems. USDO is minted trustlessly against user-supplied collateral, while Tapioca’s contracts are completely immutable. In terms of USDO's anchoring ability, there is no assumption of trust, because there is high-quality collateral on the chain to support USDO's issuance. On the part of Tapioca, the central bank issuer of USDO, it is also through immutable code and does not require trust.

Stability: USDO not only adopts a super-guaranteed mechanism with a minimum mortgage rate of 110%, but also its Liquidity is composed of Tapioca's POL (POL - Protocol Owned Liquidity, protocol capture Liquidity). When users redeem oTAP options, POL will be generated, and then supplied to USDO's LP trading pair through Arrakis Vaults Cross-chain. This ensures that USDO's Liquidity depth continues to grow without fear of bank runs, and without the need to rely on external systems (such as Curve's veCRV bribe) to ensure sufficient Liquidity exists and maintains the peg. High loan-to-value (LTV) ratios may seem dangerous, but liquidation is fast and efficient, and is done off-chain. USDO's collateral backing is also not lent out (re-hypothecated) like DAI and some other smaller Stablecoin, which introduces significant risk, especially when leveraged with re-hypothecated collateral, in fact Make Stablecoin no longer ultra-secured. Finally, Tapioca uses the "collateral debt ratio" (CDR) in the "Big Bang" loan to mint USDO, which allows Tapioca's Big Bang market to accurately control the backing weight and risk pricing of collateral assets, as well as control the expansion and shrink. (Learn about Tapioca Big Bang, visit: https://docs.tapioca.xyz/tapioca/core-technologies/singularity/big-bang )

Capital Efficiency: With the possibility to use ETH, wstETH for 90% LTV, and other assets for 80%+ LTV in a standalone CDP (loan), this ensures that dormant Liquidity needs are as small as possible. Other Stablecoin such as LUSD require large stability pools to cover liquidations - at peak times over 80% of issued LUSD was deposited into stability pools. This caused Liquidity issues in the secondary market, and secondary to LUSD always trading above the peg (paying a premium was just as bad as going off the floor).

Censorship resistance: USDO can only be minted through network fuel tokens (such as ETH, AVAX, FTM, Matic) and Liquid Staking Derivatives(such as RETH, stMATIC, sAVAX, etc.). USDO is not backed by any USDC or other centralized Stablecoin. USDO will also form a trading pair with ETH to ensure that even if USDC is destroyed, users can still continue to trade USDO as if nothing happened.

Of course, these are all great selling points for USDO, but why would anyone want to use USDO? This introduces the "singularity".

Singularity is Tapioca’s full-chain isolated lending engine, based on Kashi, which allows users to obtain high real returns on attractive yielding assets such as GMX ’s GLP, Stargate’s ETH and USDC, and Curve’s TriCrypto. Since AAVE and Compound (and their countless forks) have shared collateral pools, they cannot offer these riskier assets, nor allow users to gain efficient leverage.

This allows users to gain leverage on the asset they want, while USDO holders earn the benefits of lending Liquidity, which is the second benefit of Singularity. In AAVE or Compound, the minimum and maximum interest rates are set manually, whereas Singularity’s interest rate is determined by utilization with no minimum or maximum limits.

Greater demand = higher real income

This is a sustainable approach to drive USDO adoption by offering attractive yields like Anchor, but without relying on incentives or cash reserves, nor generating excess to support high-yielding risky assets like Abracadabra to make up for the lack of USDO's actual collateral support.

USDO can fill the huge void left by DAI and become a decentralized, immutable, and trustless USD Stablecoin for DeFi’s base layer asset. But more importantly, it is able to provide a CDP-based over-collateralized Stablecoin with the highest possible capital efficiency without sacrificing sustainability and stability, and finally empowers DeFi users to have free liquidity on each chain again , no longer get parked at unsafe bridge tollbooths.

Believe we have designed the perfect decentralized Stablecoin capable of scaling to new heights without resorting to the harmful ways of centralization - immutable code is the law after all.

To join the full chain revolution, visit tapioca.xyz.