A Bitcoin address – created on June 21, 2010 – has moved its entire balance of 50 BTC worth $1.25 million for the first time in more than 12 years amid the Bitcoin price drop of around 5 .6% for the month.

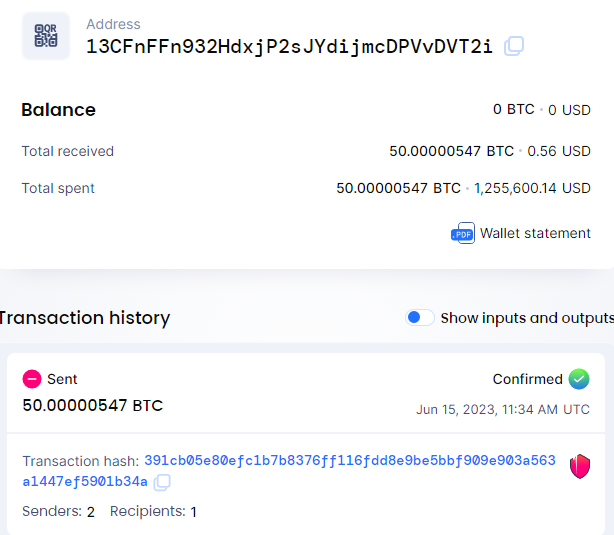

At the moment, the 2010 Block reward migration is relatively rare and more common when the value of the cryptocurrency is at double the price. Blockchain analyzer Btcparser.com captured the movement of the entire balance from the address “ 13CFn ”.

Source: Blockchair

Interestingly, the data revealed that the owner did not spend bitcoin cash (BCH) . The transfer 'Bitcoin sleeping since 2010' happened 24 days ago on May 22, 2023, with a total of 100 BTC in two Block rewards. In April, a single Block reward from 2010 was moved undetected by analysts due to a small previous "tease" transaction.

Prior to the April migration, a separate transaction involving the Block BTC block reward was made on March 20, 2023. In February 2023, a single Block reward from 2010. has been transferred . January didn't see any money-related moves from that year.

This entire BTC balance was transferred to one address before going to another wallet and it was eventually split into two addresses holding 23.11 BTC and 26.88 BTC respectively . In total, 2023 has seen six Block reward transfers since the 2010 era.

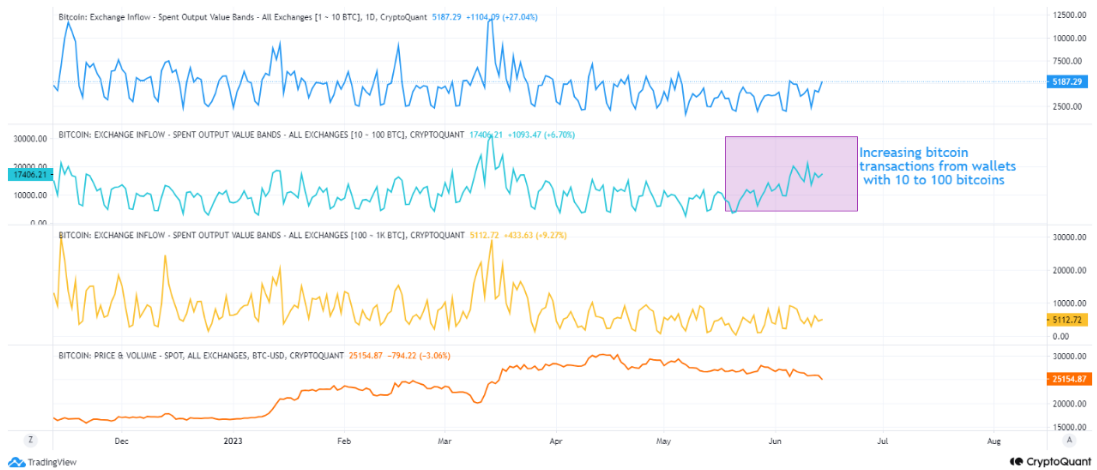

A recent report by i CryptoQuant revealed that Bitcoin transactions originating from wallets containing 10 to 100 bitcoins rose to their highest levels since March. This development represents a notable increase in the sales activity of this group, hinting at potential changes in the dynamics of the Bitcoin market.

Source: CryptoQuant

Since the rapid rise of Bitcoin and the subsequent bull market in cryptocurrency in recent years, institutional investors, high net worth individuals and whales have become important players. on the market. The actions and sentiments of these actors often influence Bitcoin's price trajectory and shape market trends. Tracking the transactions of these larger wallets can provide valuable clues about the overall sentiment and potential changes of the market.

Although the reason for the increase in Bitcoin transactions from wallets holding 10 to 100 BTC is still speculative, experts suggest a number of factors could be driving this trend.

One possible explanation is that this group of investors is taking advantage of Bitcoin's recent bull run. Bitcoin has experienced periods of significant growth and volatility, making it an attractive asset for short-term profit-taking strategies. As the value of Bitcoin reaches new heights, some investors may have chosen to sell part of their holdings to secure profits or rebalance their portfolios.

Another factor could be the maturity of the market and the growing number of alternative investment options in the crypto ecosystem. As the industry expands and new projects emerge, investors can diversify their holdings or reallocate their resources across more cryptocurrencies. This diversification may cause some people to offload portions of their Bitcoin holdings to explore other investment opportunities.

Join Telegram of Bitcoin Magazine: https://t.me/tapchibitcoinvn

Follow Twitter: https://twitter.com/tapchibtc_io

Follow Tiktok: https://www.tiktok.com/@tapchibitcoin

Itadori

Bitcoin Magazine