Author: Jinse Finance, Climber

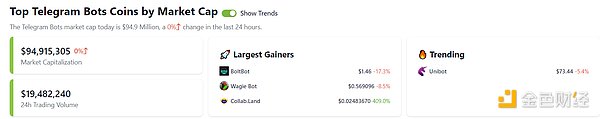

Recently, the sudden surge in the concept currency of Telegram Bots has attracted market attention. Data shows that the market value of Telegram Bots tokens is close to 95 million US dollars, and the transaction volume in the past 24 hours exceeds 19 million US dollars.

Among them, the tokens led by Unibot (UNIBOT) rose to 86.99 US dollars, an increase of about 3029.96% in just two months after the token was issued. There are not a few other similar currencies with similar gains.

So what exactly is the Telegram Bots section? What caused its sudden surge?

Introduction to Telegram Bots and their tokens

Due to the large number of Telegram users, in order to contact customers and keep in touch with them, while automating customer service and optimizing processes to reduce manual work, Telegram Bots were born on demand.

By providing APIs, Telegram enables developers to create various programmatic robots for social, gaming and e-commerce services on the platform, so as to achieve promotion and attract users for business interaction. At the same time, Telegram Bots can simplify the dialogue between users and machines, allowing users and machines to seamlessly perform task requirements, and greatly improve the successful conversion rate of transaction orders.

Telegram Bots is an application that specializes in providing financial services. The platform associates customers' personal accounts with chat tools, allowing users to conduct financial transactions with other users or businesses on the platform. In summary, Telegram Bots allow customers to transfer money or pay for services without leaving the platform.

At present, the existing Telegram Bots related to financial services in the field of encryption include DeFi transactions, automatic AirDrop transactions, game community management, bridging assets, new tokens online, etc. Telegram Bots are becoming more and more diverse in imitation of encrypted ecological project categories.

Recently, Telegram Bots projects led by Unibot and LootBot have followed the example of encrypted projects to issue coins. Due to their meme currency attributes, they have attracted market capital. However, investors need to be aware that there are many uncertainties and risks in this type of investment target, and they should properly handle their personal assets.

Main categories and data representation

Currently, the main categories of the Telegram Bots section are as follows:

DeFi category: Unibot, BoltBot, 0xSniper, Wagiebo, TokenBot, Swipe Token

Cross-chain bridge: Bridge Bot

AirDrop Trading: Lootbot

Community Management: Collab.Land, alfa.societv

On-chain data tracking: GenieBot

Artificial Intelligence: AIlin, Blacksmith

While Telegram Bots exploded, a number of data organizations on the encryption chain set up relevant sections to track the market changes of various currencies in the latest Telegram Bots.

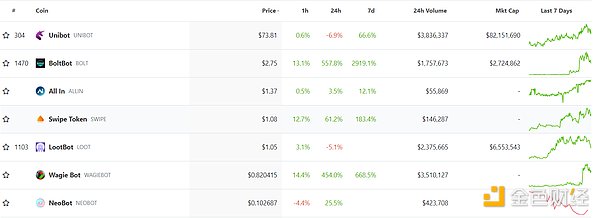

According to CoinGecko market data, as of writing, the total market value of the Telegram Bots sector has reached US$94.91 million, and the trading volume in the past 24 hours has reached US$19.48 million. The three currencies with the largest increase are BoltBot (BOLT), Wagie Bot (WAGIEBOT), and Collab.Land (COLLAB).

Currently, there are 5 Telegram Bots whose token prices are above $1, among which Unibot (UNIBOT) has the highest price of $73.81, and BoltBot (BOLT) has the highest increase of 2919.1% in the past 7 days.

Unibot (UNIBOT) analysis

Among the many types of Telegram Bots tokens, Unibot (UNIBOT) is undoubtedly the most successful representative at present. The functions and attributes of Unibot (UNIBOT) are more like MetaMask installed on Telegram. While having similar functions, it also has the feature of detecting and tracking transaction information on the chain.

UNI bot will be launched on the Ethereum mainnet on May 17, 2023, and 1 million UNIBOT tokens will be created at Genesis. 100% liquidity is added during the launch, and the token burn rate is set at 0.1% per day.

The founder of UNIBOT is Ayden, who previously worked at Apple, and his partner is from an end-to-end machine startup company located in the Bay Area of California.

Unibot claims to be the fastest Telegram Uniswap data monitoring tool, which can achieve lightning-fast data exchange and tracking, and all users only need to pay a 1% transaction fee to use it.

Unibot stands out from its competitors primarily because of its class-leading speed driven by advanced algorithms and robust infrastructure. This includes private nodes for data detection tools, private exchange options for buying and selling tokens, wallet monitoring, and token trackers.

UNIBOT token holders enjoy numerous benefits, mainly including: reduced fees for using platform utilities; access to perks such as reserved premium nodes for faster transactions; advanced algorithms such as MEV protection and private transactions.

Currently available UNIBOT tools include: Quick Buy and Sell Platform, Mirror Sniper, which enables users to copy transactions from other wallets, Token Release Channel, which provides real-time information on newly deployed tokens, Method Sniper, which allows users to enter up to 3 token addresses for monitoring at launch, wallet management and profit and loss analysis of the value of tokens held by users.

In terms of data, Unibot (UNIBOT) has been issued at $2.46 on May 22, and the increase has reached 3029.96% so far. The current currency price is $78.93. From the perspective of return on investment, it can be described as considerable.

epilogue

Telegram bots like Unibot (UNIBOT) are on the rise, partly due to the ease with which users can execute transactions with Unibot X-like bots, whether they are on a mobile device or a PC. Say goodbye to multi-screen operations and view real-time data supported by Telegram Bots, which is more convenient than existing similar encryption projects to a certain extent.

In addition, since Telegram has recently obtained US$270 million in bond financing and has sufficient funds to develop encryption projects, the market and investors have expectations for its prospects for building an encryption ecosystem, which has led to related encryption projects and tokens being sought after.