whale long position lost more than one million US dollars

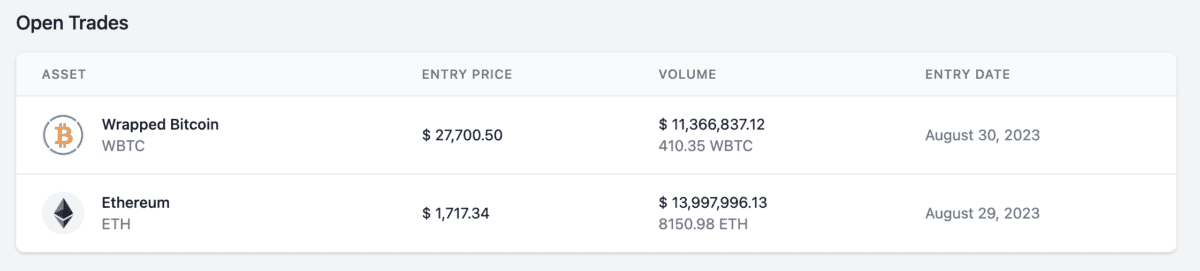

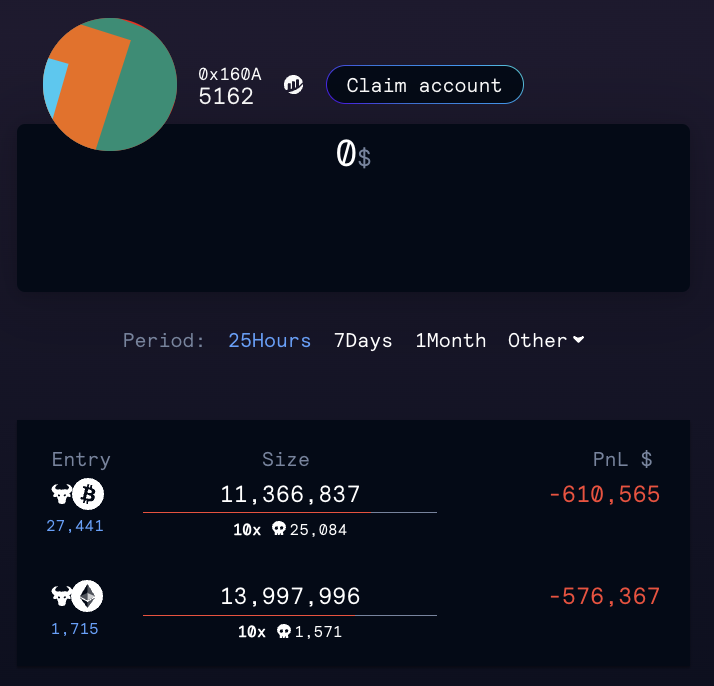

According to on-chain data monitored by Lookonchain, a certain whale chased the price after Grayscale won the lawsuit and opened long positions in Bitcoin and Ethereum on the decentralized derivatives trading platform GMX. The average opening prices were US$27,700 and US$27,700 respectively. $1,717.

But so far, the market has not risen as he expected. Instead, the gains have been flattened by the SEC's extension of ETF review, causing the whale to have to add margin to avoid being liquidated. Currently, the forced liquidation prices of its bitcoin and ethereum positions are $25,084 and $1,571 respectively, with a floating loss of $1.18 million. In March of this year, the address also lost more than 4.5 million US dollars on a long order of Ethereum.

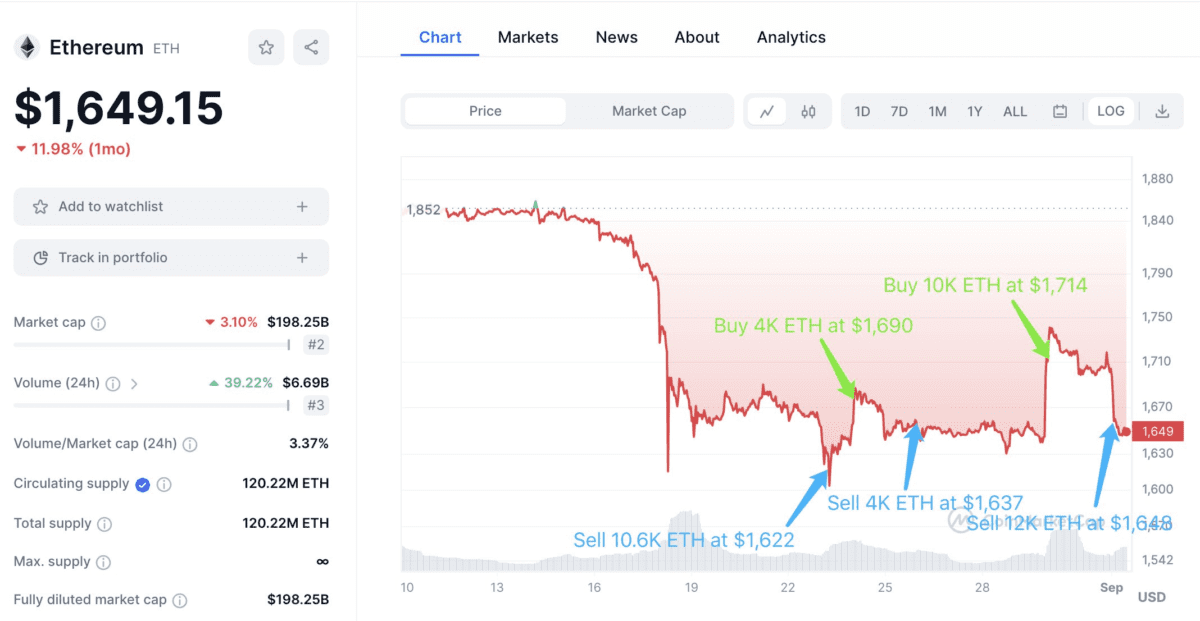

Failure to chase the rise, decisively admit loss

On the other hand, according to data monitored by on-chain data analyst Ember, the whale that chased up the purchase of 10,000 ETH at an average price of 1,714 on August 29 also surrendered today. On-chain data shows that it sold 12,000 ETH at an average price of $1,648, and lost about $790,000 in this round of transactions. It is worth mentioning that Lookonchain pointed out that the recent rounds of transactions at this address have been "buying high and selling low", and the performance is not satisfactory.

Take advantage of the fall

Some whale suffered in the falling market, but some whale continued to receive goods when the market was in a downturn. Data on the chain shows that an address of 9 million ARB tokens was previously withdrawn from Binance Exchange in July. Taking advantage of today's record low of ARB, 2.11 million ARB tokens were withdrawn from Binance again. The average cost was initially estimated at US$1.18. , the current floating loss is approximately US$3.3 million.