Unibot aims to be the fastest Telegram trading robot, providing a seamless and extremely fast trading experience. It also has a web version of Unibot X. Unibot is the leader of bots in terms of popularity and market value.

Original author: Riyue Xiaochu

Original source: mirror

1 Basic information

Official website : https://unibot.app/

Twitter : https://twitter.com/TeamUnibot

Time : September 4, 2023

Author : Riyue Xiaochu (Twitter: https://twitter.com/riyuexiaochu )

Data: https://dune.com/whale_hunter/dex-trading-bot-wars

Bots headed by Unibot have sprung up in a wave of craze. The author believes that it has long-term significance. Its value support comes from two parts

Part One More Convenient Transactions

1) Be more friendly to newcomers

Trading bots are relatively user-friendly. The trading interface is also simple and easy to understand. New users don't even need to record private keys etc. It can be used directly on Telegram, which has 700 million users, and is simple and convenient.

2) More efficient for dex

For example, Unibot's transaction speed is optimized on uniswap, and officials say it can reach more than 6 times.

3) More practical interchange functions

For example, anti-MEV clips, checking the purchased tokens first, placing limit orders for buying and selling, etc.

Part 2 Everyone can be a scientist

In the 21-year bull market, scientists are synonymous with the envy of everyone. Because they hold the code, they can dominate the entire process and earn a lot of money. I can only drink some bone soup while waiting for leeks. After the popularity of Telegram Bot, the success of Unibot will also attract many code developers, because developing a function that is in demand can also be turned into a billion-level project and achieve a leap in life. Richer functions will also attract more users to look for useful Bots. Form a positive cycle.

The origin of Unibot's rise is also a trading strategy. Remember the mysterious man who made a million times in PEPE? It is actually a strategy robot that rushes into the pool at the beginning of the market. Now with unibot, everyone can become such a scientist.

Various functional bots are emerging, such as automated airdrop interactive robots, cross-chain bridge robots, smart money order-following robots, operation and distribution robots, etc.

It seems that the Bot track is still in its early stages, with an overall market value of only US$200 million. The daily users of trading bots such as Unibot and Maestro are only about 5,000 (excluding users of other functional bots), while the daily active addresses of Ethereum in the current bear market are 300,000, which is only about 1.5%. Most of the people who use trading bots now are aggressive users. If the bot sector wants to develop further, it needs to be recognized by more users. Although there are still some problems with the bot itself, such as worrying about private keys and additional handling fees. But the author considers these to be minor obstacles in moving forward. I look forward to the emergence of various bots that solve practical pain points, and I also hope that this track will grow.

Unibot is the leader in bot robots. Although its number of users ranks behind competitors Maestro and Banana. But it has no VC, is 100% liquid at launch, and has benefits such as dividends and fee discounts. And it charges a 5% transaction tax, making its revenue far higher than its competitors.

Unibot is a trading robot. Its functions include buying and selling tokens, limit buy and sell orders, follow-up functions, token sniping, etc. It aims to be the fastest Telegram trading bot, providing a seamless and extremely fast trading experience. It also has a web version of Unibot X

Unibot's chips are very dispersed and concentrated in the hands of users. The holdings of the top 200 users are only 60%. Large investors are mainly divided into two categories. One is early investors with very low costs, and this group accounts for nearly half of the positions of large investors. The other part started buying during the recent decline, and has accumulated more than 100,000 unibots, with losses generally exceeding 30%. Most of the unibots that bought during the previous rise have fled.

2 Project introduction

Unibot aims to be the fastest Telegram trading robot, providing a seamless and extremely fast trading experience. It also has a web version of Unibot X. Unibot is the leader of bots in terms of popularity and market value.

Its functions include

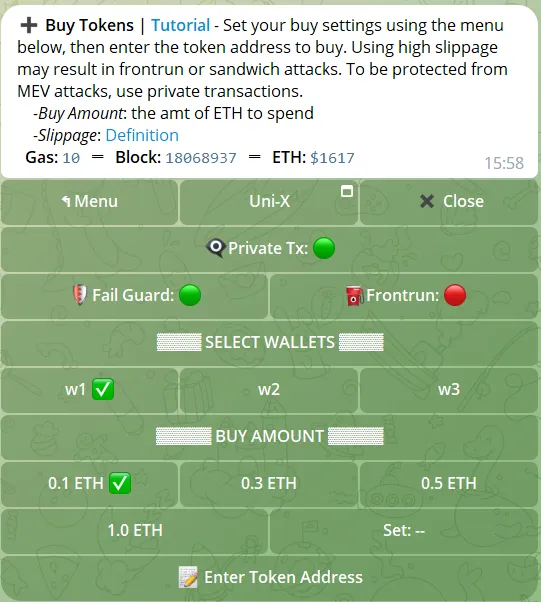

1) Buy and sell tokens

1) Buy and sell tokens

Private Tx function, enabled by default, can prevent being jumped and MEV clips. However, slippage cannot be set. Slippage can be set after closing.

Private Tx function, enabled by default, can prevent being jumped and MEV clips. However, slippage cannot be set. Slippage can be set after closing.

Fail Guard — Simulate trades to reduce the chance of failed trades.

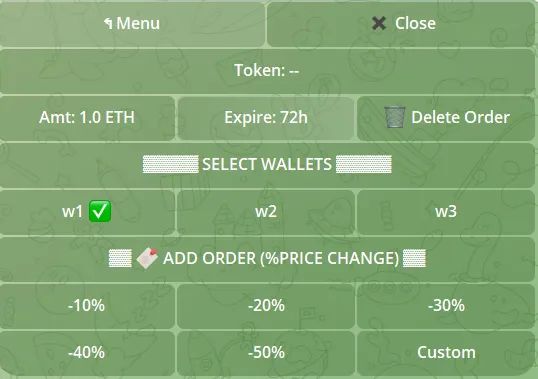

2) Limit buy and sell orders

Price limit trading is a function of centralized exchanges. Most dex doesn't have it. But using Unibot has this function.

For buying and selling limit orders, Unibot also provides the function of expiry cancellation.

For buying and selling limit orders, Unibot also provides the function of expiry cancellation.

3) Follow-up function

A wallet that tracks smart money you find and automatically copies its transactions.

4) Token sniping

Users add token contract addresses, and Unibot can snipe when these tokens are launched. That is to say, buy it immediately. Especially suitable for items that you want to buy immediately. In addition, Unibot has an ERC-20 token deployment scanner, which can find newly deployed tokens immediately and use them to snipe them.

Skip Blocks — Enter the number of blocks to wait before purchasing. Some coins have anti-bot measures at the start of a transaction, preventing user addresses from being automatically blacklisted.

5) Other basic functions include

5) Other basic functions include

Token scanning, token transfer, token following and other functions.

3 project status

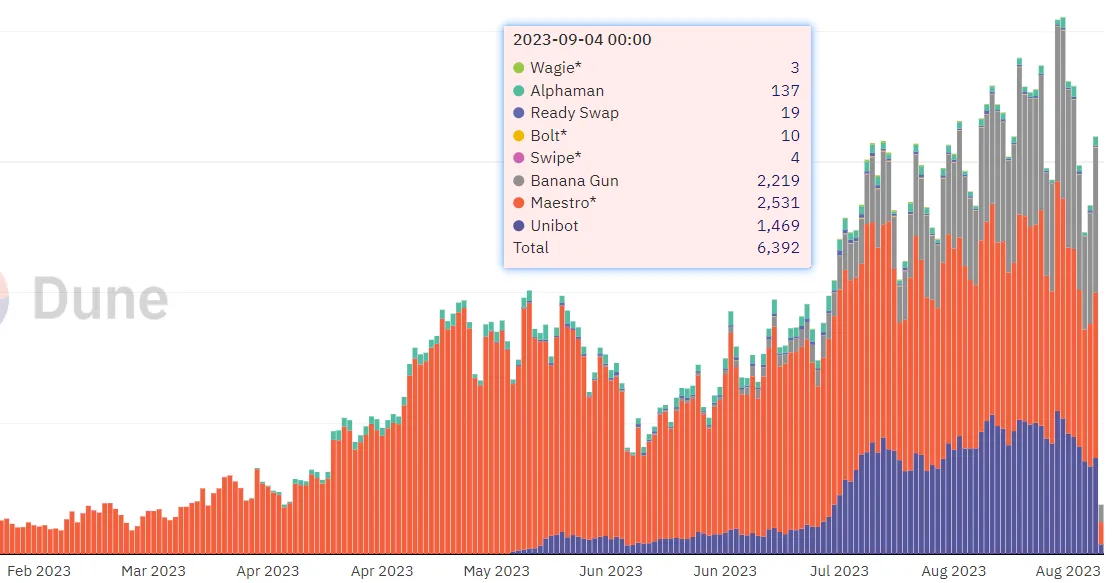

Judging from the number of users, Unibot has 1,469 users, compared with 2,219 Banana Gun users and 2,513 Maestro users. These three bots account for the majority of bot users, with Unibot in third place.

Judging from the number of users, Unibot has 1,469 users, compared with 2,219 Banana Gun users and 2,513 Maestro users. These three bots account for the majority of bot users, with Unibot in third place.

Judging from itself, Unibot had about 100 to 200 users in June, and by mid-July, the number of users increased to about 2,000. Increased 10 times. The maximum number can reach 2189, but the number of users has declined to a certain extent in the past week. The decline in daily users also occurred in Banana Gun and Maestro, indicating that the overall bot usage is declining.

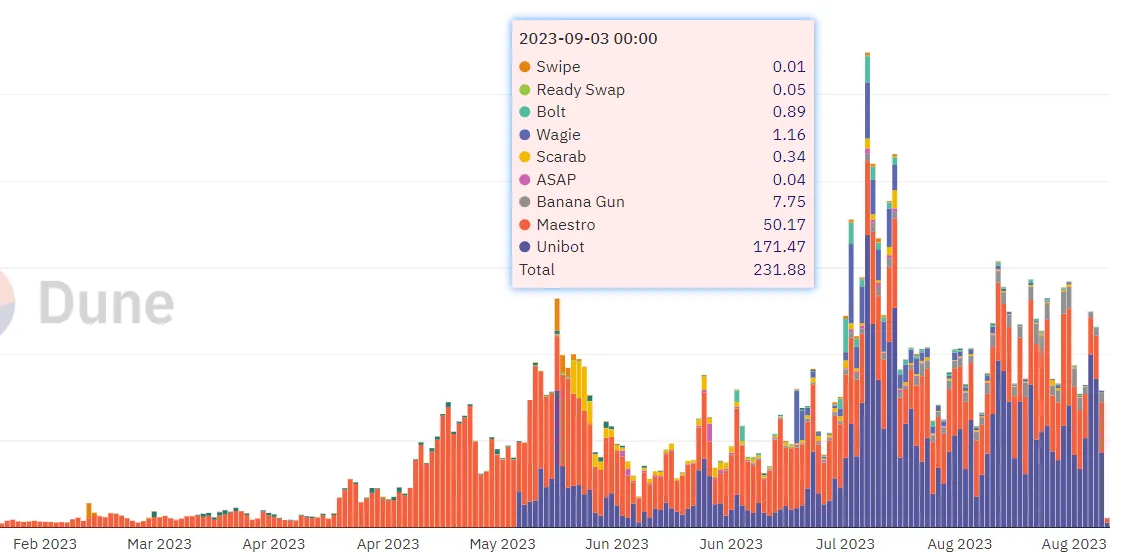

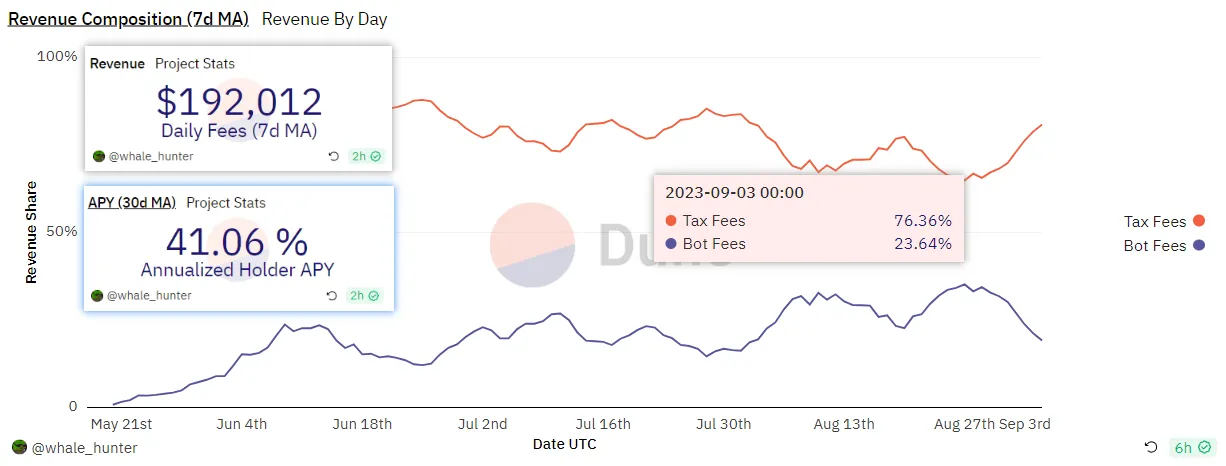

In terms of revenue, Unibot’s revenue on September 3 was 171 ETH, Maestro’s was 50 ETH, and Banana Gun’s was 7.75 ETH. Since daily income varies greatly from day to day, the comparison of values between projects has no absolute meaning. But Unibot can basically maintain the first place.

In terms of revenue, Unibot’s revenue on September 3 was 171 ETH, Maestro’s was 50 ETH, and Banana Gun’s was 7.75 ETH. Since daily income varies greatly from day to day, the comparison of values between projects has no absolute meaning. But Unibot can basically maintain the first place.

However, Unibot’s income comes from two parts, one is the robot’s handling fee. Part of it is the 5% tax paid on specialized tokens. On September 3, transaction fees accounted for only 23.64% of revenue, which is about 40 ETH. Less than Maestro’s 50ETH. In addition, Unibot’s average transaction revenue in the past seven days was US$200,000.

However, Unibot’s income comes from two parts, one is the robot’s handling fee. Part of it is the 5% tax paid on specialized tokens. On September 3, transaction fees accounted for only 23.64% of revenue, which is about 40 ETH. Less than Maestro’s 50ETH. In addition, Unibot’s average transaction revenue in the past seven days was US$200,000.

4 Token Economics

- The total amount of UNIBOT is 1 million, which is fully publicly issued. All tokens will be put into liquidity at the beginning.

- UNIBOT token transaction tax: 5%

The distribution is: 1% to LP, 2% to holders, 2% for team and operating expenses

- UNIBOT dividends

40% of the robot’s transaction fees will be distributed to UNIBOT holders as dividends

- You need to hold more than 10 UNIBOT to participate in dividends.

There is no staking or locking. Just hold the tokens.

- There is a default fee of 1% for transactions made through the bot

If you have 10 UNIBOT and your wallet is linked to the bot, you can get a 20% fee discount.

5 On-chain data analysis

Position address 3: follow-up token contract

Position address 3: follow-up token contract

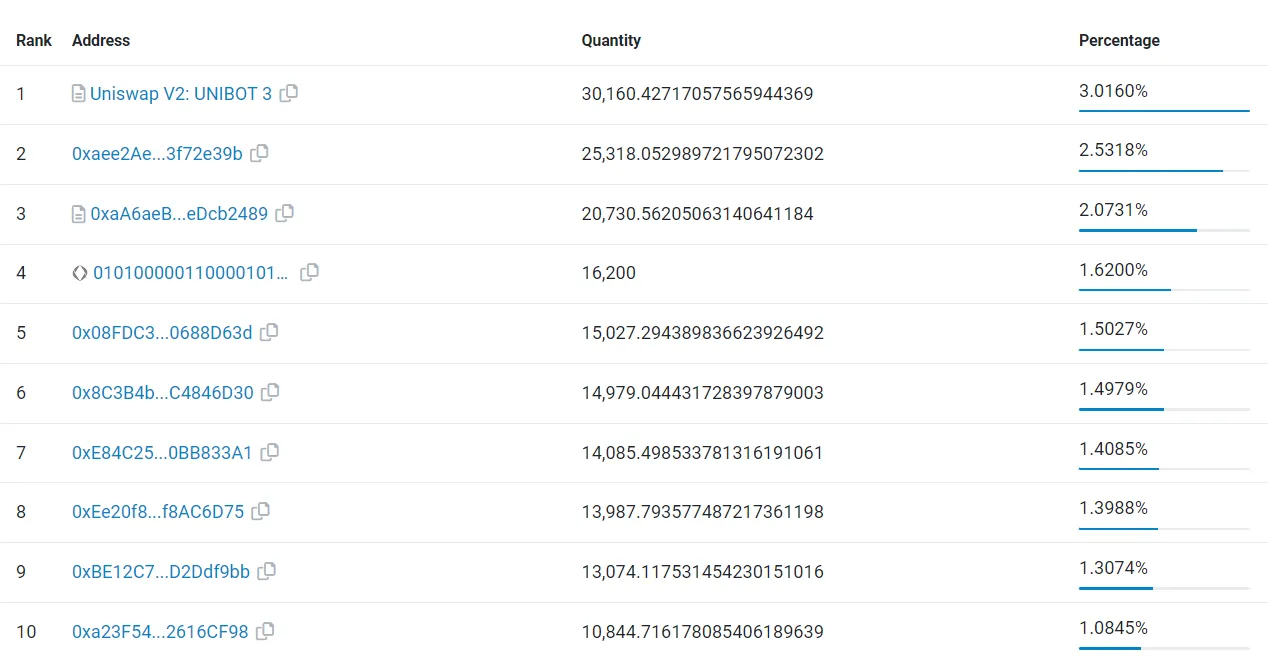

From the perspective of address allocation, Unibot's holdings are very different from most tokens, that is, the holding addresses are very scattered. The address with the largest holding accounted for only 3.01%, and it was the Uniswap pool. The holdings of the top 10 addresses are only 17%. And among the top 10 positions, only position address 3 is controlled by the project party and is used for old currency exchange. The others are owned by individuals.

Since currency holding addresses are very scattered, when researching large households, the author used the Top 200 personal addresses.

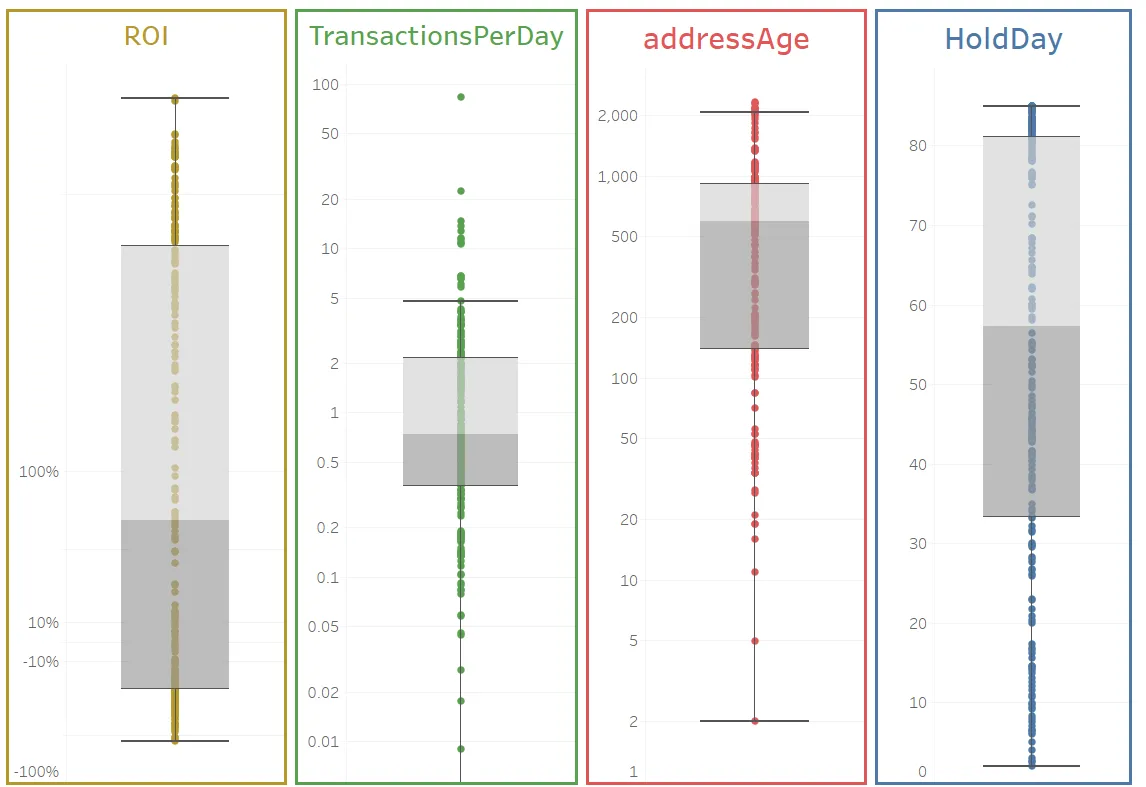

From the perspective of ROI , the differences between the profits and losses of large investors are particularly large, with the median profit being 67% and the highest profit being 830%. But 1/4 of the large investors lost more than 24%.

From the perspective of ROI , the differences between the profits and losses of large investors are particularly large, with the median profit being 67% and the highest profit being 830%. But 1/4 of the large investors lost more than 24%.

Judging from the number of transactions , the average number of daily transfers is 0.74, and the average number of transfers per month is 22, which can be regarded as a medium-frequency exchange. Considering that the market has been relatively cold recently, this transfer frequency can be said to be for moderate or above users on the chain. In addition, more than 25% of people make an average of 2.5 transfers per day, which is presumed to be people who often go against the trend.

Judging from the address age , the median is 597 days, which can be said to be an old man in the crypto.

From the perspective of currency holding time , the median is 57 days. Considering that Unibot has changed the contract once, the maximum time for new coins does not exceed 90 days.

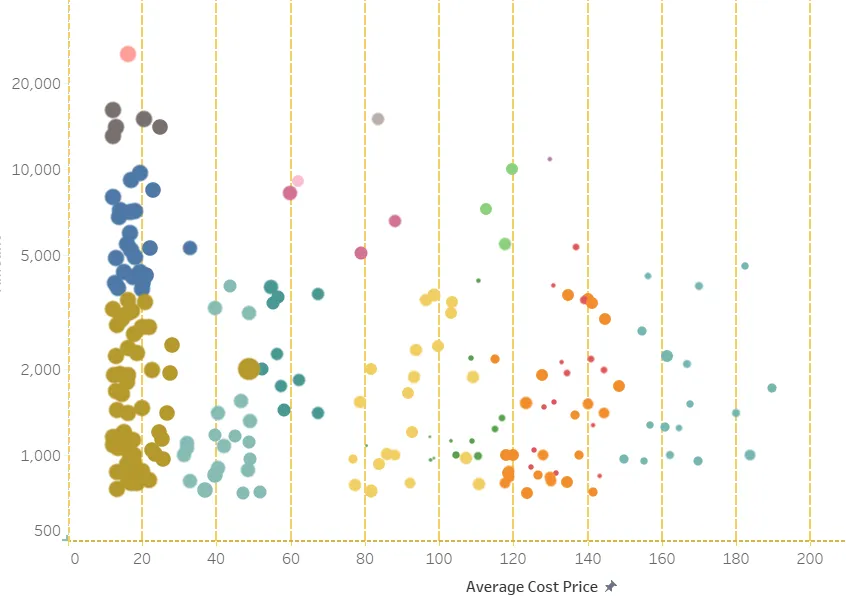

The picture above shows the relationship between the cost of large currency holders and their holdings. The size of the ball represents the holding time. From the above figure we can intuitively see

The picture above shows the relationship between the cost of large currency holders and their holdings. The size of the ball represents the holding time. From the above figure we can intuitively see

1) The maximum proportion of holding costs is less than 20 dollars. And the spheres of these people are the largest, which means they have held positions for the longest time. That is to say, this group of people exchanged old coins for coins and have remained unchanged. Specifically, this part holds 270,000 Unibots.

2) The spheres above 80 dollars are relatively small and scattered, indicating that the holding period is the result of continuous buying during the recent decline. And there are buys at every price.

3) Comparing the price trend, unibot had a period of sideways trading around 30 to 40 dollars for about 2 weeks before it rose sharply. But as you can see from the picture above, there are not many chips at the price of 30 to 40 dollars. It shows that the chips of this group of people have been washed away in the subsequent market.

Generally speaking, those with the most concentrated chips under $20 are the most loyal holders of unibot. The second largest group of position holders is buy the dips hunting during the decline. Most of the users who bought in the sideways range before the sharp rise have already sold.

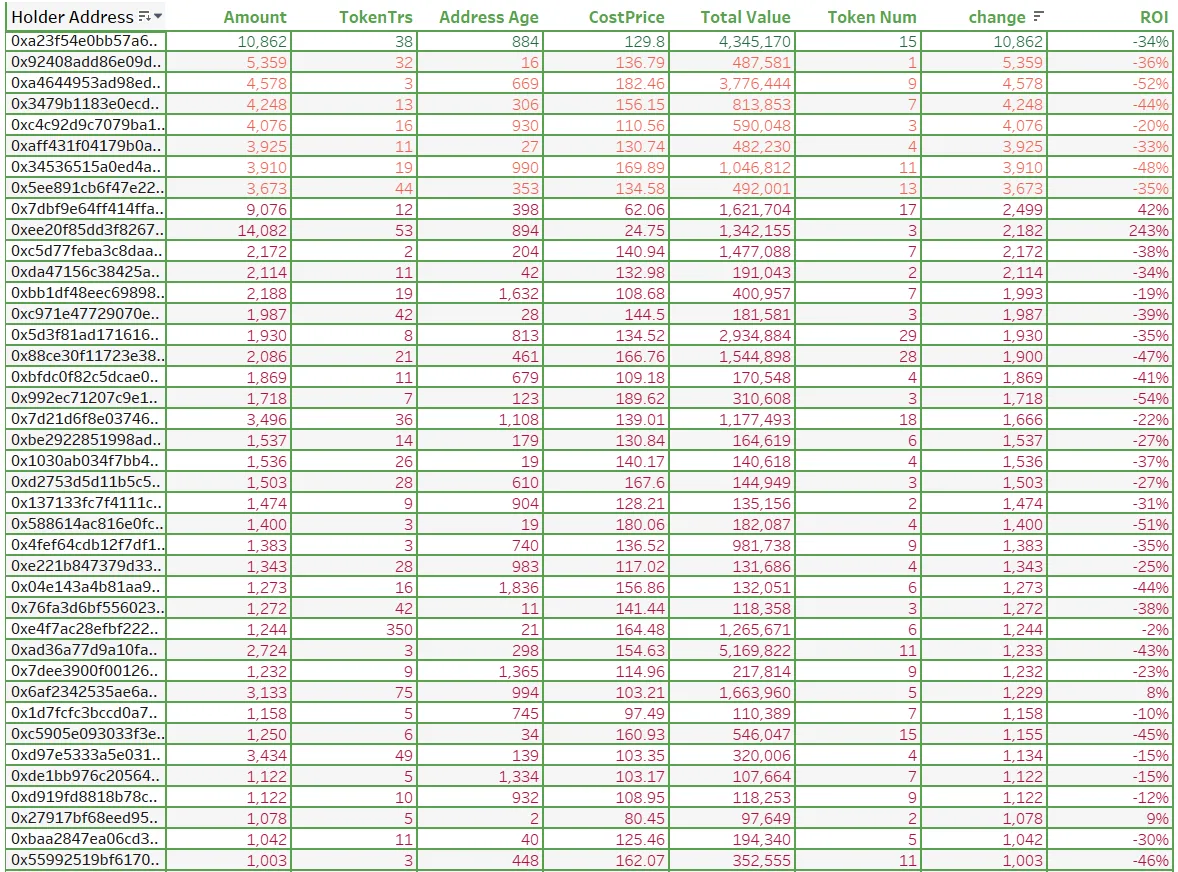

According to statistics, the top 200 individual investors hold a total of 606,000 unibots, accounting for 60.6% of the total. 52% of them have increased their holdings in the past month. There are 40 people, accounting for 20%, who have accumulated more than 1,000 coins. However, we can also find from the above table that most of the increased large investors are in a state of loss. The largest increaser increased his holdings by 10,862 unibots, and his loss has reached 34%. Among the top 10 people who increased their holdings, they were generally at a loss, and the losses were more than 30%.

According to statistics, the top 200 individual investors hold a total of 606,000 unibots, accounting for 60.6% of the total. 52% of them have increased their holdings in the past month. There are 40 people, accounting for 20%, who have accumulated more than 1,000 coins. However, we can also find from the above table that most of the increased large investors are in a state of loss. The largest increaser increased his holdings by 10,862 unibots, and his loss has reached 34%. Among the top 10 people who increased their holdings, they were generally at a loss, and the losses were more than 30%.