Interview: Sunny, TechFlow TechFlow

Guest: Dan Reecer, Wormhole Foundation COO

"Our history is deeply rooted in crypto-native and hackathon culture, and we maintain that ethos by prioritizing decentralization, security, and open source principles."

——Dan Reecer, Chief Operating Officer, Wormhole Foundation

Uniswap released a major cross-chain bridge test report last year, in which Wormhole and Axeler Network stood out among the top six cross-chain bridges in the entire network and became the underlying governance facilities worthy of Uniswap's trust. Who are the other cross-chain facility providers - LayerZero, Celer, Debridge and Multichain, are all leading cross-chain providers in the industry.

Why have Wormhole and Axeler become decentralized cross-chain experts recognized by Uniswap?

How does Uniswap's governance information bridge to various blockchain networks?

Is LayerZero a Web2 company?

TechFlow TechFlow invited Dan Reecer, Chief Operating Officer of the Wormhole Foundation, to answer the above questions for us. What’s more interesting is that Wormhole is different from other Web3 projects in that it is a “headless organization” without a founder to lead the investment. So under such an organization:

What is the organizational distribution of wormholes? Is it similar to the Web3 three-piece package: DAO, foundation and engineer-based laboratories (Labs)?

Under such an organizational structure, how did Dan formulate an operational strategy and turn Wormhole into such a successful project today?

Dan has extensive experience in operations and marketing in the traditional pharmaceutical industry. In his eyes, what is the difference between a centralized and decentralized organization in terms of operation direction and tool use?

Why does Wormhole set up a gateway specifically for the Cosmos ecosystem? What is Dan’s opinion on Polkadot and the Cosmos ecosystem?

At the same time, I would like to thank the friends of the Wormhole Chinese community for asking some questions about some user experience issues currently encountered by Wormhole:

Wormhole's ZK engineering team progress?

Low liquidity issue using wormhole transfer to L2, and how to solve it?

Speed determinants of cross-chain transactions using wormholes

The following is the complete conversation with Dan, I hope it can clear up some confusion for you.

*Note: Wormhole and Wormhole will be used interchangeably in this article.

History: From Solana Hackathon to Jump Crypto to Wormhole

TechFlow: Today is my first interview with a deep infrastructure project like Wormhole. I took advice from others and made the problem concrete. In response to my original question, can you give a brief history of the Wormhole Foundation?

Dan Reecer:

The genesis of the Wormhole project is interesting, it came about during a hackathon about three years ago. We were originally conceived during the Solana Hackathon with the main goal of bridging the gap between Solana and Ethereum.

What started as a small team at a hackathon gained widespread recognition and attention, and grew into a major undertaking. Jump Crypto played a key role in incorporating Wormhole into its framework and incubating the project.

Over time, Wormhole's cross-chain scope has continued to expand, covering approximately 30 different blockchain networks. Currently, the people originally associated with Jump Crypto and Wormhole have transitioned, and the project is now entirely managed by a team of people outside of the Jump team. In recent years, multiple entities have emerged to contribute to the development of Wormhole.

The Wormhole Foundation, which is based in the Cayman Islands and has about 15 employees, provides grants to various organizations that support wormholes.

Operating out of Argentina, xLabs manages the relay infrastructure and is one of the network’s guardians and validators.

Wormhole Labs , the third core contributing organization, is responsible for driving many engineering, product and business development initiatives.

In addition, we recently funded two zero-knowledge (ZK) engineering teams, but details of the collaboration have not yet been officially announced. These teams are focused on developing Wormhole ZK, including light clients and bridges. In addition, multiple teams including the security team, community team, and teams within the Cosmos ecosystem contributed to the project.

Our history is deeply rooted in crypto-native and hackathon culture, and we maintain that ethos by prioritizing decentralization, security, and open source principles.

This commitment to decentralization and open source sets us apart from some competitors who choose a centralized and closed-source approach.

Despite the challenges, we firmly believe that proper decentralization and openness as an infrastructure layer are critical to ensuring security and scalability as we continue to grow.

Operation of a headless decentralized organization

TechFlow: Can you share the organizational structure of Wormhole (which is usually divided into DAO, foundation, and laboratory)?

Dan Reecer:

The DAO has not been started yet. We plan to implement both DAO and on-chain treasury. What makes this project unique is that we lack founders in the traditional sense . Although a man named Hendrick was involved early on, he is no longer part of the project. Now this is a founderless project . There are about 12 people spread across leadership groups on different teams, working together extensively to lead efforts in product development, engineering and business development. The physical settings are noticeably scattered.

TechFlow: I'm interested in Wormhole's operational strategy given the competition it faces and its leadership in a space with numerous messaging protocols and ongoing hackathons.

Given your background in business management and apparent expertise in Web2 marketing strategy and operations, how do you manage to run operations in a decentralized, leaderless organization like Wormhole?

Can you share your personal approach and highlight the differences between Web2 and Web3 operations?

Dan Reecer:

That’s a great question, the dynamics of work are very different right now. As mentioned earlier, we work with about five or six teams on a regular basis, creating a dynamic environment that differs from a traditional structure where tasks are assigned by a fixed hierarchy of managers . Coordination is similar to a workgroup, where individuals from different teams usually come together to work on a specific project or initiative. This involves active participation via phone calls, Slack channels, and similar platforms.

Another aspect worth noting is the importance of goal setting, which is less common in the cryptocurrency space compared to traditional companies. In my experience working at Eli Lilly, the company places a strong emphasis on setting annual and quarterly goals as well as personal goals. My corporate background gives me a deep understanding of established companies that have been operating for over 200 years, so integrating these practices into a fragmented ecosystem presents challenges.

However, leveraging a system like OKRs (Objectives and Key Results) so that everyone has the same quarterly goals can be both challenging and rewarding .

Corporate experience has proven to be invaluable in implementing a coordinated strategy. This includes working with leaders from across teams to define strategy, set goals, inspire team members and celebrate achievements.

This contrasts with the specific hierarchies found in businesses, where an emphasis on personal coordination and a decentralized structure are the main differences.

TechFlow: I understand the challenges of simultaneously handling user event operations, tracking an evolving technology stack, and keeping up with market trends, especially in the rapidly evolving cryptocurrency space. Considering recent developments such as BTC ETFs and cryptocurrency regulations, how do you balance these operational aspects within Wormhole Foundation?

Dan Reecer:

Yes, you are talking about the various project management tools used in our company's internal technology stack, such as Notion and Slack.

Over time, I've discovered the most effective communication tools, and Slack is the obvious choice. Although not decentralized, its efficiency exceeds other decentralized tools. While some teams, like Polkadot, prioritize decentralization and opt for decentralized tools, this approach can be less efficient, especially when it comes to mobile functionality. Given Slack's superior performance, we rely on it for our communication needs.

Making sure everyone is on the same page is critical. When it comes to tracking product documentation and strategy documents, we use Notion to organize the information in a way that is easy to access and track.

Project management is another key aspect and we use ClickUp for this.

Getting everyone into the same project management tool and using it consistently is critical to keeping projects on track. To this end, we have a dedicated project manager who oversees all projects, conducts weekly status checks, and ensures project launches and other milestones are completed as scheduled.

This approach forms the basis of our operating strategy.

Wormhole’s Four Products

TechFlow: Wormhole contains multiple product lines. Can you briefly introduce each product and explain its capabilities?

Dan Reecer:

Wormhole Messaging is an indispensable main product in our ecosystem. It is usually classified as a bridge in the industry, but it is actually a message transmission protocol, on which bridges such as AllBridge, Mayan and Portal can be built.

message protocol

However, it must be noted that Wormhole functions as a messaging protocol . Currently, there are about 10 bridges built based on the Wormhole protocol. Beneath it is a messaging layer that can transmit various forms of data between blockchains. This data can be token-related information or non-token data.

Uniswap’s governance is an example of tokenless bridging . Uniswap uses Wormhole in five instances, leveraging the protocol to broadcast governance decisions across chains. They use Ethereum as the parent chain and deploy about 15 to 20 units on other chains. When a governance decision is made on Ethereum, Wormhole messaging propagates the decision to all connected chains.

Another case involves Pyth, which is the second largest oracle after Chainlink. Pyth's entire oracle network relies on Wormhole messaging , propagating price feeds from its Solana Fork base to approximately 40 different chains.

At a higher level, wormhole information transmission is the basic platform for various applications.

Delving deeper into the technology, information is verified through the Guardian Network - a network of 19 validators responsible for verifying the authenticity and quality of each piece of information.

After verification, 13 of the 19 verifiers must agree on the validity of the information before the information can be forwarded to the destination chain. This provides us with more technical information about wormhole information transmission, making it an infrastructure for building various applications.

WormholeGateway

The Wormhole Gateway you mentioned is a blockchain we developed for dual purposes.

First, it enhances the security features of the entire wormhole network.

Secondly, its main function is to serve as a gateway into and out of the Cosmos ecosystem .

Integrating new blockchains into Wormhole is challenging as one of the 19 guardians is required to run a full blockchain node every night.

Wormhole Gateway solves this problem by allowing any new Universe chain to seamlessly connect to the Wormhole network via an IBC connection, especially enabling good expansion within the Universe ecosystem.

A wormhole gateway is a component in a broader wormhole network, distinct from the dynamics of the entire wormhole.

Another significant difference is that compared to Axelar Network, their entire bridge network is built on a Cosmos-based chain.

Wormhole connection

Regarding Wormhole Connect, it is described as an in-app gadget that solves a historic challenge faced by apps like AAVE. Traditionally, users' bridging funds are transferred to external bridging, resulting in loss of users and reduced revenue. To overcome this problem, Wormhole enables developers to embed bridges in their applications with just three lines of code. Users can seamlessly bridge funds within the app without leaving the app.

Wormhole query

Finally, Wormhole Queries recently launched three weeks ago. This innovative product functions like an oracle , but for on-chain data. Chainlink and Pyth are oracles that bring off-chain data into the blockchain, while Wormhole Queries introduces a new primitive to DeFi. It allows other blockchains to query data on different blockchains efficiently and cost-effectively. The product has already seen huge demand, with more than a hundred applications expressing interest in the first few weeks.

Multiple ecology: Cosmos, Ethereum, Solana

TechFlow: I guess you have to deal with various networks such as Ethereum, Cosmos, Solana, and Polkadot. You have worked in the Polkadot ecosystem before and now see the connection between Wormhole and Cosmos, can you share the differences between Cosmos and Polkadot? As far as I know, there is a bullish sentiment on Cosmos in the 2024 predictions. Can you explain why? Or more pertinently, can you explain why Wormhole built a Gateway specifically for Cosmos ?

Dan Reecer:

Yes, we developed WormholeGateway for Cosmos because the Cosmos ecosystem is very active. Noteworthy teams such as Osmosis have recently launched and demonstrated significant developments, such as the team at WBTC Chain. Launching Wormhole Gateway allows us to scale seamlessly within this ecosystem without incurring additional infrastructure costs when adding new chains - a concept similar to router chains.

A similar concept has been implemented in the Polkadot ecosystem, with the Moonbeam and Acala teams independently setting up routers to facilitate information in and out of their chains and connect with any other chain in the Polkadot ecosystem. This approach benefits both parties, increasing network traffic for both parties and improving our scalability within the Polkadot ecosystem.

Looking back on my four or so years in the Polkadot ecosystem, there are some shortcomings in business development and marketing. The emphasis on engineering obscures the need for effective marketing and sales efforts.

Cosmos, on the other hand, has made strides in these areas, with a longer launch and leadership changes that have led to its recent growth.

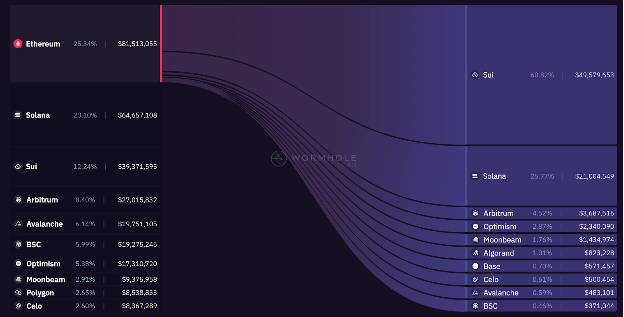

As a member of the Wormhole team, I find the advantage of being central and neutral, allowing us to observe and participate in various ecosystems. Currently, Solana and Ethereum are the most active, with Ethereum being the second-tier solution and Cosmos following closely in third place . Recent developments in the ecosystem are evident in Wormhole Scan, which provides in-depth visualization of token flows across networks.

Wormhole Scan's Snapshot of Cross Chain Volume

The unique location of the wormhole allows us to witness the trend firsthand. It is worth noting that Ethereum transfers mainly flow to Solana and Sui. Starting with Solana, our initial goal was to connect Solana and Ethereum, a foundation that has contributed significantly to our growth in the most active ecosystem in the industry.

Competitors: LayerZero is the Web2 company of Web3

TechFlow: Regarding bridge competitors in the industry, I remember in your podcast with the Crypto Coin Show , you briefly mentioned LayerZero, emphasizing that their centralization is similar to a Web2 company rather than a Web3 company. Can you elaborate on the reasoning behind this opinion?

Dan Reecer:

One noteworthy data is the Uniswap Bridge evaluation report . Recognizing the complexity of community voting on bridge selections, the Uniswap Foundation commissioned a group of impartial third-party researchers with deep technical expertise.

Over the course of several months, they conducted research on six different cross-chain protocols including Wormhole, Axeler Network, and LayerZero. The report mainly focuses on decentralization and security, with Wormhole emerging as the top-rated protocol due to its decentralization achieved through the operation of 19 guardians and open source code.

Another protocol, Axeler Network, has also been approved for use by Uniswap, which demonstrates its open source and decentralization.

However, the other four bridges have been denied the opportunity to cooperate with Uniswap governance unless substantial changes are made.

An important reason for LayerZero’s rejection was its operational structure: it was controlled by a centralized two-to-two multisig, which posed risks such as potential transaction censorship and fund theft.

In contrast, both Wormhole and Axeler Network prioritize decentralization and open source principles. The report also highlights a major flaw with LayerZero - its closed source code, similar to that of major companies such as Twitter, Google and Apple.

In an industry where decentralization and open source are crucial, relying on closed-source methods raises concerns about transparency and security.

Therefore, the Uniswap Bridge Evaluation Committee has reservations about LayerZero, arguing that it is a dangerous choice for users due to its lack of transparency and decentralized operations.

Three questions from the Wormhole Chinese community

TechFlow: According to current information, Wormhole will integrate ZK technology in 2024 to achieve completely trustless transmission between major networks. What is the current progress in this regard?

Dan Reecer: We're going to be making these announcements very soon and I'm working on that today. Several engineering teams have received funding to focus on zero knowledge (ZK). We will announce a key hardware partner who will work with us to enhance hardware supporting ZK technology. Additionally, we are moving forward with a plan where the ZK Bridge will leverage light clients. Our Ethereum light client is nearing completion, with light clients for various other chains to be announced later.

This development will allow us to launch several completely trustless corridors between chains.

We are actively developing light clients for Wantong, Sui and several other chains, with the goal of achieving challenging but significant industry impact. These are all ongoing plans, and a lot of new information about ZK will be released over the next two weeks.

TechFlow: Wormhole assets lack liquidity on different second-layer solutions, resulting in poor user experience. How does Wormhole plan to solve this problem, and will the liquidity layer improve the situation?

Dan Reecer:

That's a great question, and my answer is really to emphasize the liquidity layer. We are currently building this product and working towards releasing it as soon as possible.

Historically, Wormhole bridges used wrapper assets to facilitate bridging. The new liquidity layer is designed to provide users with a local-to-local transfer experience. We recently launched this technology and will officially announce it this Wednesday. It enables native Ether transfers and native encapsulated Ethereum transfers between six top Ethereum mainnets and second-tier chains (including Optimism and Arbitrum).

This development marks a significant improvement in user experience for those transferring assets between these chains. Going forward, our goal is to expand the liquidity layer to include essentially any asset that has native liquidity on both sides. Our goal is to reduce reliance on token wrappers as much as possible.

While some assets, like Ethereum and Solana, have immutable contracts that prevent burn, we plan to launch products that involve burn and minting. For assets such as WBTC or USDC, burning and minting can be used. However, with Ethereum, encapsulation is always required to move it to another chain. Nonetheless, our overall strategy is to prioritize native transfers and incorporate burn and mint transfers where feasible.

TechFlow: In your discussion about transactions and cross-chain areas, what factors would affect the timing or duration of such transactions?

Dan Reecer:

Transaction speed depends on the finality of the original chain. For example, Polygon, a second-tier solution, may experience extended transaction times. Even on the Ethereum mainnet, block times can be as long as 20 minutes. To solve this problem, our liquidity layer solution includes the development of a "fast transfer" product. The feature is designed to speed up the transfer of funds by providing users with near-instant transfers by placing the ultimate risk on the counterparty. Users who opt for fast transfers will pay a small fee for the speedy service.

Finally, I'd like to share with you an update on the Wormhole messaging campaign. If you go to wormhole.com/stats and scroll down to the second chart, you'll see that today we passed the 900 million message milestone, which is a significant industry record. We expect to reach 1 billion messages in the next month or two. This statistic is an insightful assessment of the widespread usage of our platform. For community members and readers interested in more statistics, the Wormhole Scanning page provides more telling data.

Over 900M messages were transmitted by Wormhole messaging protocol