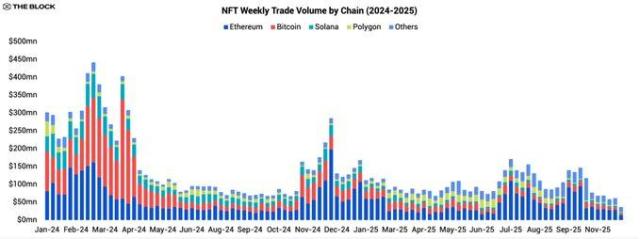

#Blur issued coins, detonating the biggest hot spot on the NFT track in February?#

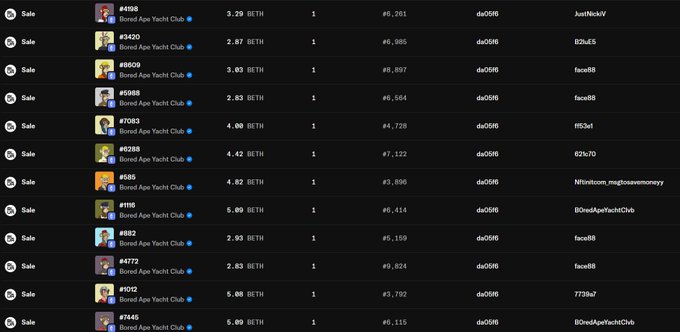

At 1 am on February 15th (UTC+8), the NFT market Blur officially issued the native token BLUR. According to data from Dune Analytics, since its internal test launch in July 2022, Blur has achieved a total transaction volume of 270 million US dollars, ranking third among NFT aggregation platforms.

Loading..