1. Key Points

- In 2024, a large amount of capital has poured into DeFi, increasing the total value locked ("TVL") from $54.2 billion at the beginning of the year to $94.9 billion year-to-date ("YTD"), an increase of 75.1%. This growth has benefited almost all DeFi industries, including major and niche markets, leading to the emergence of differentiated markets that enable previously unavailable financial elements to be realized on-chain.

- This year, Yield has grown by 148.6% to $9.1 billion, and Yield is now the eighth largest DeFi market by TVL. Pendle was the first to introduce interest rate derivatives on-chain, and benefited from the increase in yield assets, as well as the increased volatility of interest rates stimulated by liquidity re-pledge and speculative point systems. Pendle achieved a significant growth of 1962% to $4.8 billion at the beginning of this year.

- The circulating market value of stablecoins has reached $161.1 billion this year, the highest in nearly two years. Ethena has taken advantage of the market demand for more capital-efficient and yield-generating stablecoins, and its market value has soared 2730.4% to $2.4 billion, becoming the fifth largest stablecoin. Its unique delta-neutral strategy combines ETH and perpetual futures funding rates, which has obvious advantages.

- Money markets have grown this year, with on-chain TVL up 47.2% to $32.7 billion. The need for more flexible lending products, such as those that can use long-tail assets as collateral, has fueled interest in modular lending. Morpho launched Morpho Blue and MetaMorpho, combining the simplicity and centralized liquidity of traditional lending with the efficiency and flexibility of segregated markets, attracting billions of deposits in just a few months.

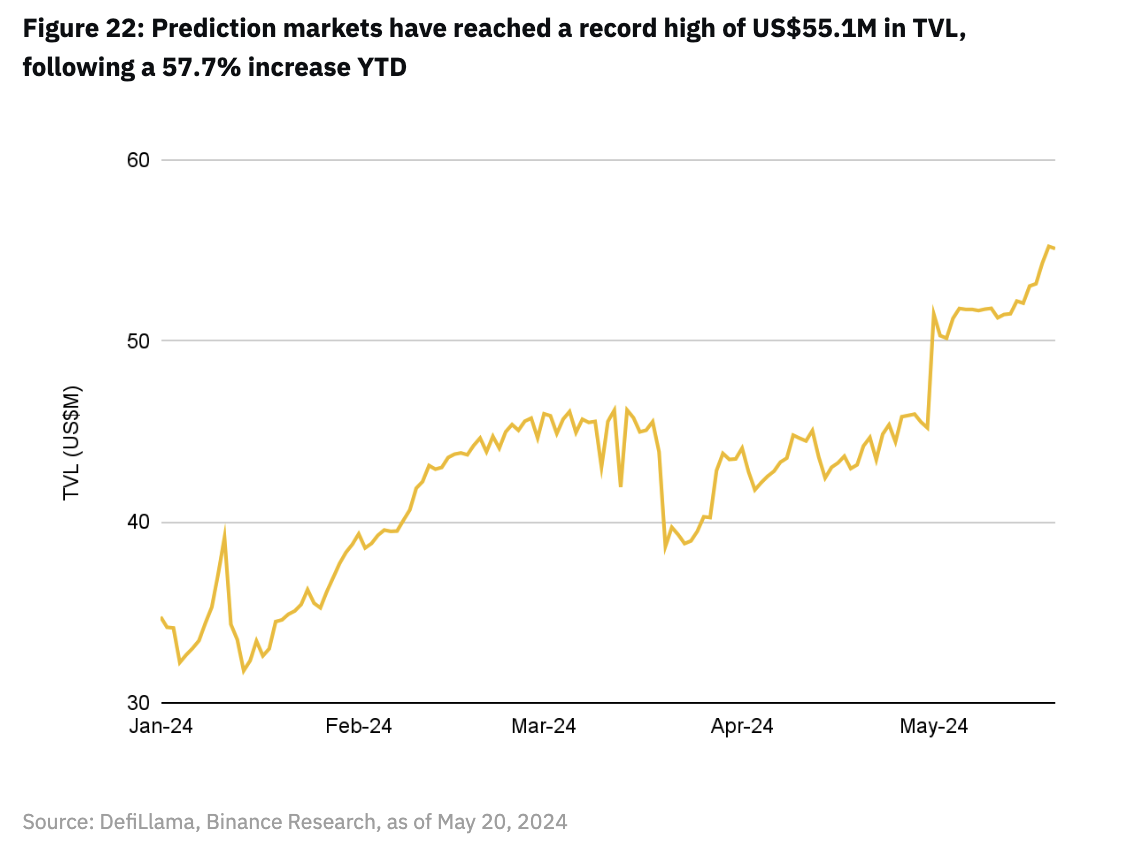

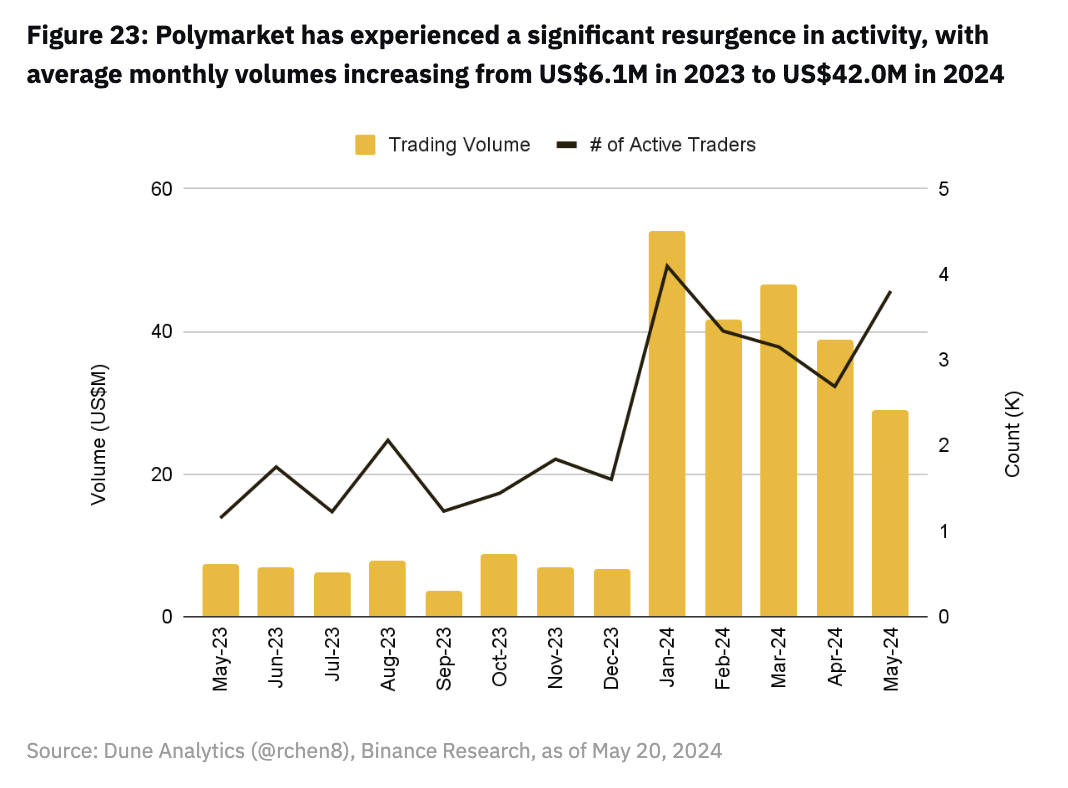

- The prediction market reached a new peak in this cycle, with a record TVL of $55.1 million, up 57.7% from the same period last year. The prediction market has historically prospered due to political events, and as the US election approaches, the prediction market has seen a significant recovery, with average monthly trading volume soaring from $6.1 million in 2023 to $42 million in 2024.

- The market upturn has revitalized on-chain derivatives activity, increasing average daily volume from $1.8 billion last year to $5.4 billion this year. Hyperliquid has taken advantage of this trend to increase its market share to 18.9%, becoming the second largest company in terms of trading volume, second only to dYdX. Hyperliquid's advantage is that it is a high-performance, fully on-chain DEX with its own L1, providing a CEX-like experience and unique products such as pre-market products and exotic currency pairs.

2. The Big Picture

The market recovery has arrived, and with it, interesting developments in the decentralized finance (DeFi) space. Notably, capital has poured into DeFi in tandem with the broader market rebound, driving total value locked (“TVL”) from $54.2 billion at the start of the year to $94.9 billion this year, reflecting a strong year-to-date (“YTD”) rebound of 75.1%. Interestingly, the same trend cannot be identified when taking into account DeFi dominance (DeFi market capitalization as a percentage of global cryptocurrency market capitalization)(1). This suggests that while DeFi has gained more on-chain liquidity, the sector’s public market valuation has yet to catch up to the broader cryptocurrency market.

Figure 1: DeFi TVL has grown 75.1% this year to $94.9 billion

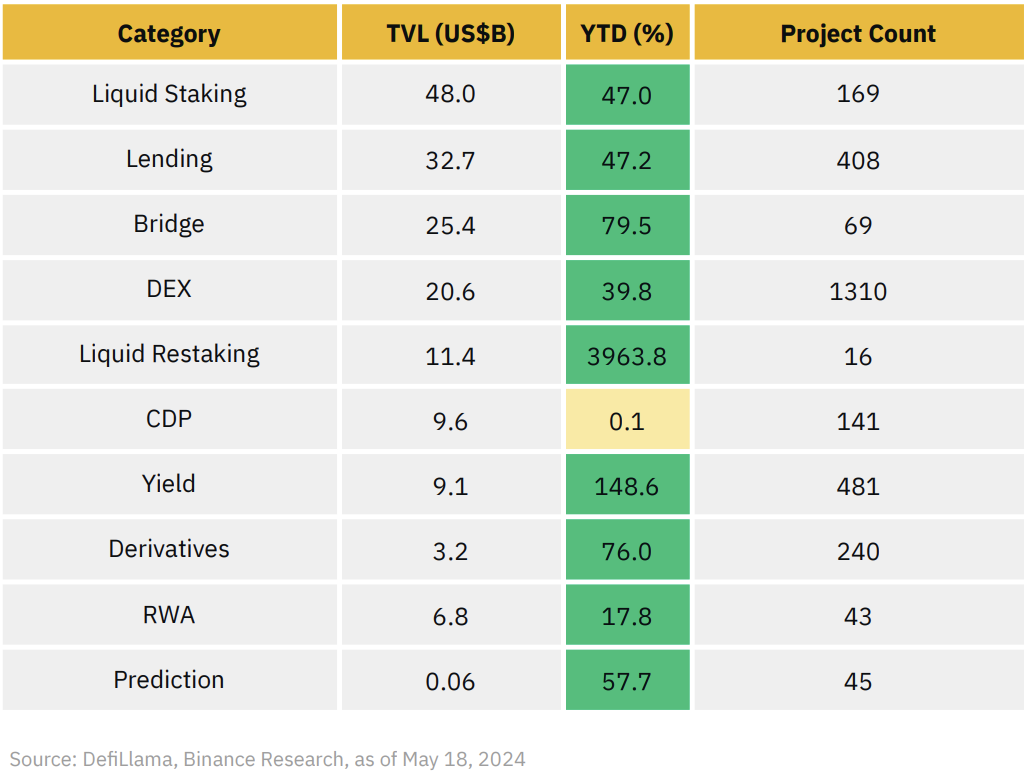

Of particular note is the continued investment of billions of dollars, highlighting the strength of DeFi. When examining the distribution of this capital, we can see that nearly all DeFi sub-sectors, including smaller ones, have experienced significant growth this year. Gone are the days when only sub-sectors such as decentralized exchanges (“DEXes”) were the primary drivers of the DeFi market. This diversification is critical if DeFi is to achieve its ambitious revenue projections, such as $231.2 billion by 2030(2). Achieving this goal will require the development of a diverse range of markets that unlock new financial elements, allowing users to maximize the value they extract from DeFi.

Figure 2: In 2024, almost every DeFi sub-industry will see a large influx of capital

This raises a simple question: what is the next frontier in DeFi to achieve this goal? Fortunately, we are seeing not only an influx of capital, but also positive trends across markets. These trends include the emergence of narratives such as on-chain interest rate derivatives, modular lending innovations, new yield stablecoins and perpetual DEX models, and the resurgence of previously underperforming areas such as prediction markets. The most interesting result of this trend is the emergence of protocols that are changing the way we think about these markets. Therefore, these breakthrough markets and protocols are worth exploring as they will play a vital role in the next stage of DeFi's development.

Although “re-staking” and “liquidity re-staking” have become mainstream in the market this year, this report will not cover them as they are extensively discussed in our recently published “A Free Rider’s Guide to Re-staking” . This report will explore five DeFi markets that have grown significantly this year and examine the main protocols that are driving progress in these markets.

Please note that the specific projects mentioned in this report do not constitute an endorsement or recommendation by Binance. Instead, the projects cited are only used to illustrate the above concepts. Additional due diligence should be performed to better understand the projects and associated risks.

3. Income Market

This year, the yield market has emerged as a major sub-segment of DeFi, with its TVL growing 148.6% to $9.1 billion. This marks a significant breakthrough for a market that has remained largely unnoticed over the past few years. Given that yield trading has been one of the most underdeveloped and underexplored areas of DeFi, its recent growth is not surprising, especially given its critical role in traditional finance (“TradFi”). In TradFi, the comparable market for interest rate derivatives has a notional value of over $400 million (3).

The interest rate market in TradFi is large and presents a huge business opportunity for DeFi, especially with the growing demand for on-chain trading and speculative yield products. Yield trading is particularly attractive because it provides greater market depth and a wider range of strategy options , allowing traders to express their views on the market.

Figure 3: Yield has grown 148.6% this year to $9.1 billion, making it the eighth-largest DeFi market by TVL.

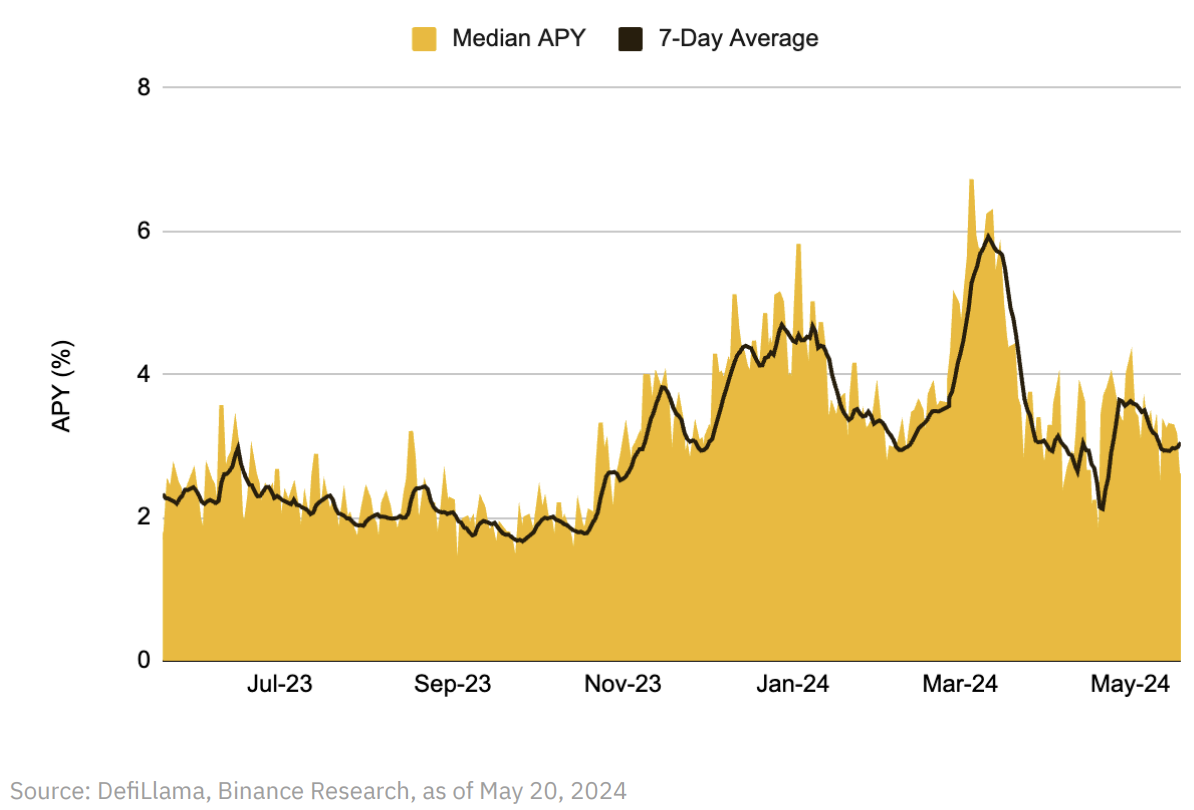

The growth of on-chain yield assets and their potential volatility has greatly influenced the development of yield markets. These markets thrive on the synergies created by the continued influx of yield products. As more sophisticated interest-bearing products and strategies enter the crypto market, interest rate derivatives protocols can build on these use cases. This trend is particularly evident with the rise of new sources of on-chain yield, such as tokenization and liquidity recovery of real-world assets.

At the same time, the shift toward higher yields observed in lending protocols and yield-bearing stablecoin providers is likely to generate greater interest in on-chain money market yield trading. The current market upturn has brought more tailwinds, including yield volatility, more diverse sources of yield, and greater participation, creating a larger market space for the yield market to flourish.

Figure 4: Over the past year, the median on-chain interest rate has risen and interest rate volatility has increased

Pendle

Pendle is an on-chain yield trading protocol that has been at the forefront of bringing interest rate derivatives markets to DeFi. It democratizes access to the yield market , allowing users to speculate, arbitrage, hedge, or execute advanced strategies to earn a fixed yield, leverage the yield of related assets, or a mixture of these strategies. Essentially, Pendle can be thought of as the " Uniswap of interest rate markets ."

In the current cycle, two trends have emerged with high product-market fit: the need for leverage and yield. In DeFi, each liquidity pool provides a source of yield, whether through staking , swap fees, or yield strategies. As long as there is liquidity and yield, a Pendle pool can be established. By building on a variety of projects rather than relying on a single ecosystem or source of yield, Pendle captures network effects and brings value to both users and projects. Users can trade yield in ways that were not previously available and earn yield from different sources at the same time. At the same time, projects behind the underlying assets can use Pendle to attract more TVL.

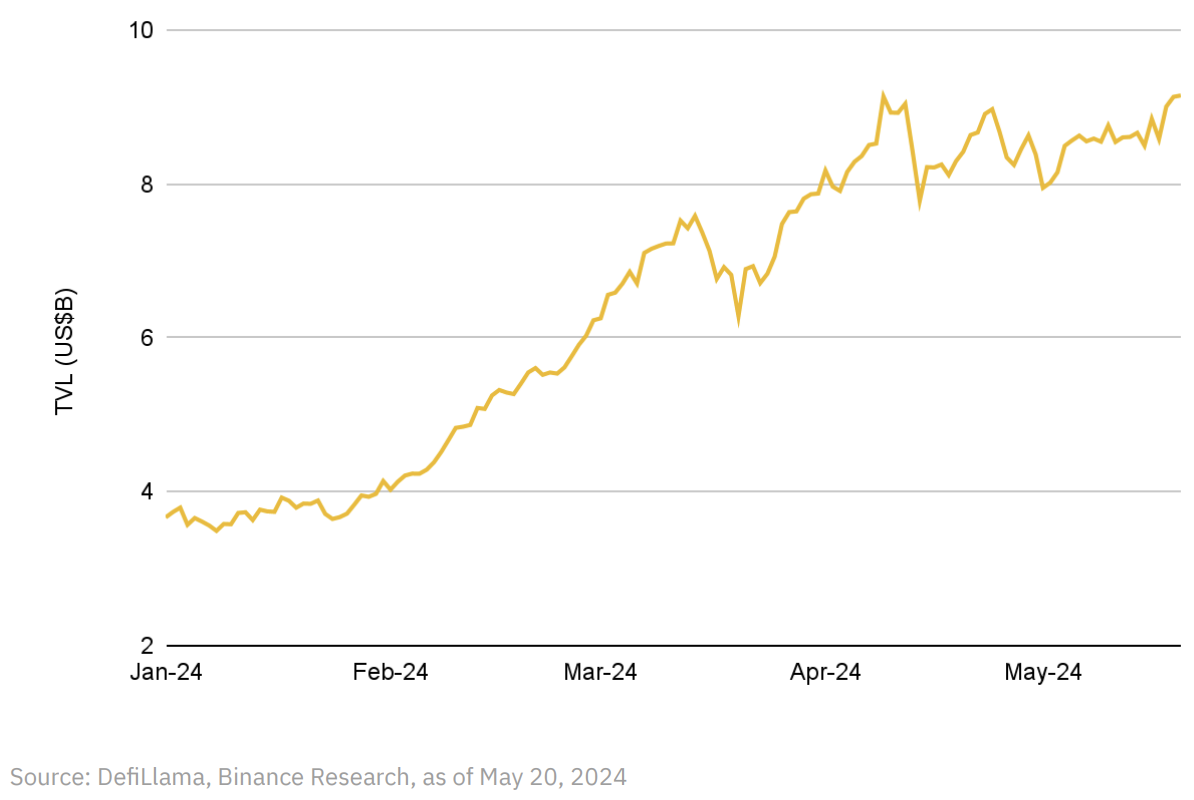

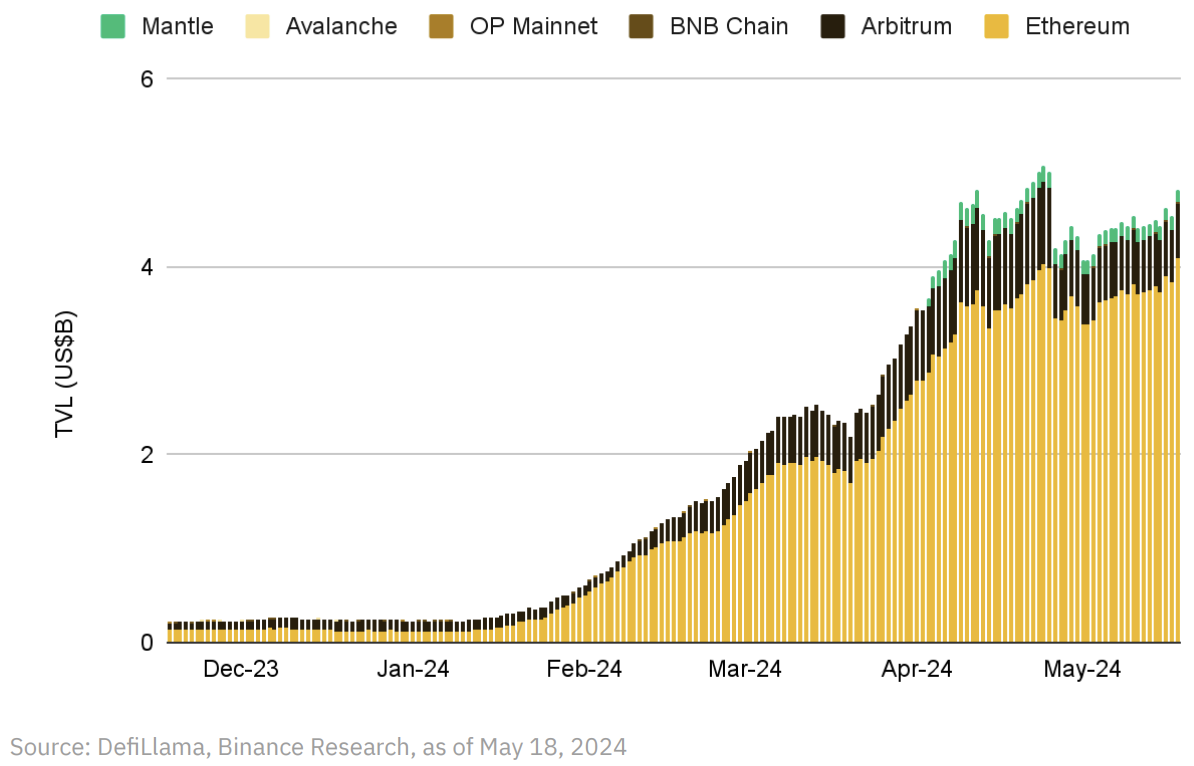

Pendle’s TVL has continued to grow since the beginning of the year, increasing by 1,962% year-to-date to $4.8 billion. This achievement not only makes Pendle the leading yield trading product, but also makes it the seventh-largest DeFi project by TVL (4). While Pendle has primarily achieved success on Ethereum, its multi-chain presence on networks such as Arbitrum and Mantle has also facilitated its growth, embedding its yield trading product and unlocking synergies across multiple DeFi ecosystems .

Figure 5: Pendle has seen significant growth since the beginning of the year, with TVL surging 1,962% to $4.8 billion, firmly establishing its position as a leader in the yield market.

How Pendle breaks down production

By creating an on-chain yield market , Pendle effectively brings users a new way to interact with yield-bearing assets. But how does it do this? Pendle takes a novel approach to segmenting and trading yield-bearing assets while ensuring that the market has sufficient liquidity and incentives. Let's take a closer look at the various components that make up the Pendle solution.

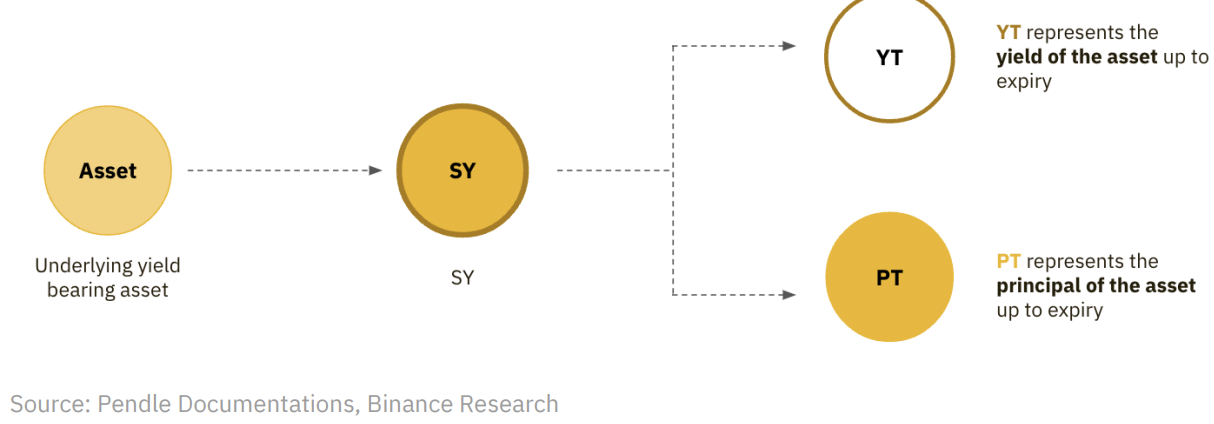

- Tokenizing Yield Rights: Pendle tokenizes yield-producing assets (anything that can generate yield) into Standardized Yield (“SY”) tokens. These SY tokens represent a standardized token format that wraps a variety of yield-producing assets into a common interface that is widely synthesizable (5). Each SY position is then split into two separate parts: the principal token and the yield token. This separation is similar to bond stripping in TradFi (6), enabling users to participate in new fixed-income on-chain strategies or speculate on yield fluctuations.

- Principal Tokens (“PT”) : PT represents the original invested capital. PT represents the original invested capital excluding future returns (7). Holding a PT means you expect to receive your principal back at maturity, but not the returns it may generate over time. Because the value of the return component is segregated, PTs can be purchased at a discount to the underlying asset, thereby obtaining an implied fixed rate of return. PTs are often used in conservative strategies, allowing users to hedge their risk exposure by locking in a fixed rate of return.

- Yield Tokens (“YT”) : YT represents the future yield of the underlying asset until maturity. YT represents the future yield of the underlying asset until maturity, and its value tends to zero as the maturity date approaches (8). Holding YTs means speculating on rising yields, and its returns depend on the fluctuations of the underlying APY. Since YT is usually cheaper than the underlying asset, purchasing YT can generate leveraged returns.

Figure 6: Pendle tokenizes income-generating assets by splitting them into income components and principal components

- Yield Trading : Pendle’s automated market maker (“AMM”) is the primary engine for yield trading (9). It supports the SY token and facilitates trading of PT and YT. Liquidity on Pendle consists of a single AMM pool of PT and the underlying asset. A PT swap involves a trade between two assets in the pool, while a YT swap is accomplished via a flash swap within the same pool. The relationship between PT and YT prices is maintained via:

PT price + YT price = underlying asset price

- The above relationship shows that the sum of PT and YT should be equal to the price of the relevant asset, and the prices of PT and YT are inversely proportional. The specific price ratio of PT and YT is affected by general market forces and DeFi yield fluctuations.

- Liquidity providers ("LPs") are motivated to provide liquidity on Pendle AMM in exchange for swap fees, protocol rewards, and various forms of yield. Pendle V2 brings significant improvements in AMM design and LP experience in particular. It improves the correlation between pool assets and reduces the impact of Impermanent Loss on LPs. Now, instead of depositing YT, which is unstable due to supply and demand, LPs provide PT and related assets, which are closely related.

- Pendle also has an order book system in addition to its AMM, which enables peer-to-peer (“P2P”) trading of PT and YT (10). This system allows users to place limit orders at a specified market price.

- Governance: Pendle’s governance model is based on Vote-escrowed Pendle (“vePENDLE”) , which is inspired by Curve’s veTokenomics (10). vePENDLE holders have voting rights, can guide incentives, and receive protocol rewards, LP promotions, and a fair share of Pendle’s revenue and exchange fees (11). This strategy aligns user interests with Pendle’s long-term goals.

- Given that Pendle operates as an AMM and handles a variety of long-tail assets, the vePENDLE model plays a vital role in bootstrapping and incentivizing liquidity . Notably, Pendle has attracted external protocols such as Penpie, Equilibria, and StakeDAO, all of which have acquired assets held by vePENDLE. Similar to what Convex does for Curve, the purpose of these protocols is to accumulate PENDLE in order to gain voting rights and maximize rewards. Overall, these liquidity lockers have made a huge contribution to Pendle's liquidity.

Ultimately, Pendle's architecture enables it to effectively leverage the composability of DeFi without over-reliance on a single project or the associated risks . The protocol can build yield pools on top of almost any source of liquidity. At the same time, Pendle does not obscure TVL or the adoption of underlying projects; instead, it enhances them by tokenizing their yield assets. This process of tokenizing yield rights creates arbitrage and hedging opportunities, opening the door to new types of investors.

Pendle’s ability to adapt to changing market conditions uniquely positions it to capitalize on popular trends. Whether in bull or bear markets, users can leverage Pendle to optimize their yield strategies. As Pendle continues to launch new pools, deploy on different chains, and tokenize new sources of yield, it is becoming a liquidity hub for various sectors, including Liquid Staking Tokens (“LST”), DEX Liquidity Pools, Real-world Assets (“RWA”), and the recently launched Liquid Restaking Tokens (“LRT”).

Leverage Liquidity Staking and Points

In addition to its products, Pendle’s success stems from strategic business development, establishing partnerships with various protocols to adapt to the latest market needs . A recent example is Pendle’s use of LRT and points.

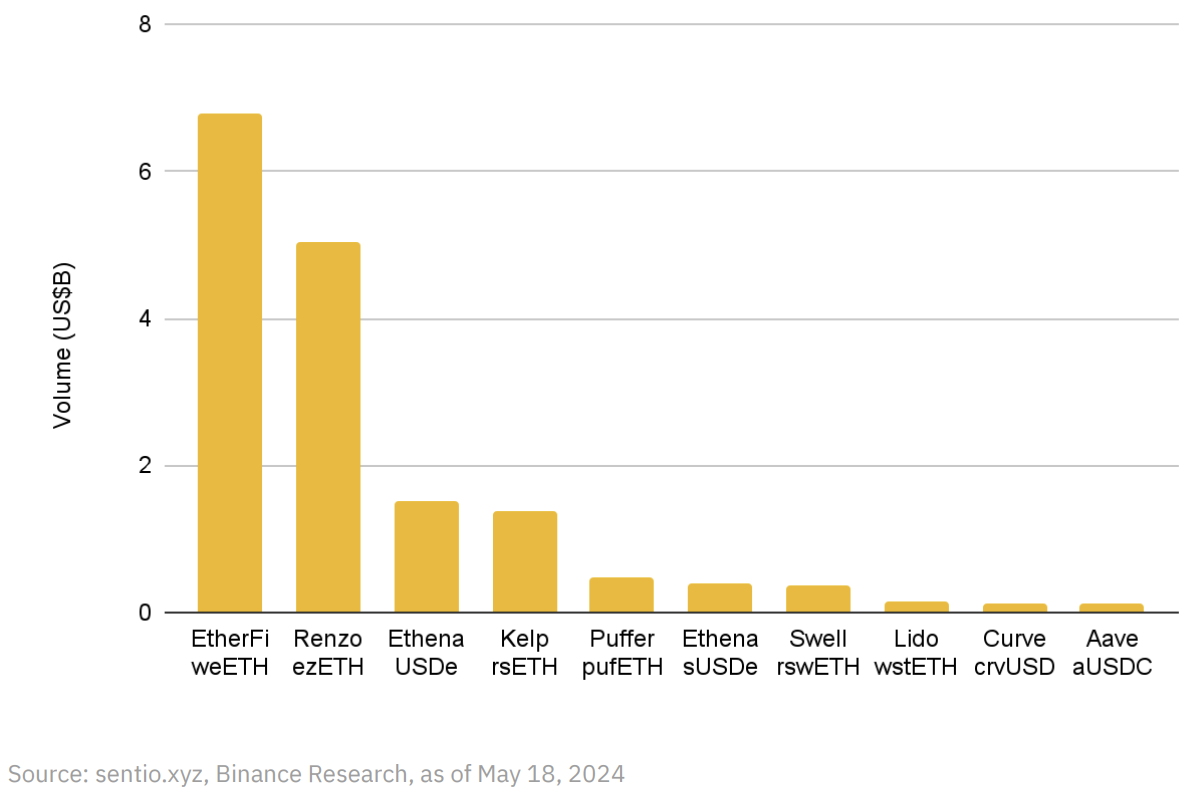

Initially, the yield protocol was primarily focused on stablecoin pools in the money market, generating little to no substantive volume. This changed with the growth of organic on-chain staking yields and LST , enabling Pendle to enter DeFi’s largest TVL market. Subsequently, the growth of restaking and LRT further expanded Pendle’s addressable market size. Earlier this year, Pendle entered the LRT space through EtherFi’s incentivized pool, and the results were impressive: EtherFi’s eETH became the largest pool on Pendle within a week of launch. This success highlighted the market’s desire for LRT yields and the value of Pendle as the primary liquidity destination for LRT. As a result, other restaking projects quickly followed suit and launched their own pools on Pendle.

Figure 7: Four of the top five traffic sources on Pendle Road this year are LRT pools

Leveraging LRTs has been the biggest catalyst, not only providing another market to explore, but also attracting a new user base interested in speculating on airdrops . By supporting a points program for LRTs, Pendle has significantly increased liquidity and trading volume. Their strategy of creating an independent points trading platform shows their ability to take advantage of the latest market trends. Users can speculate on future airdrops by earning points for EigenLayer and LRT, while also benefiting from ETH fixed investment rewards, re-staking income, Pendle rewards, exchange fees, etc. This approach not only attracts users, but also provides additional utility and an additional source of liquidity to the protocol.

Points trading on Pendle is similar to yield trading, but also includes points. Points are handled similarly to the yield section. YT represents the base floating yield plus points, while PT offers a fixed yield in exchange for giving up all floating yields and points. Pendle further strengthens this model by partnering with various protocols to provide point multipliers, providing additional incentives for users to deposit assets into the Pendle pool.

It can be said that Pendle's development trajectory is closely aligned with activity in other market sectors , highlighting its dependence on the broader DeFi landscape. To date, Pendle has relied heavily on the development of LRT. While LRT has huge growth potential, especially with the launch of Active Verification Service (AVS), a negative demand shock could occur once the speculative interest generated by points and airdrop activities subsides. An important consideration for Pendle is whether it can expand its business scope and attract similar levels of liquidity beyond just LRT and points.

Nonetheless, Pendle's ability to meet the needs of the entire yield-bearing asset market positions it well to capture the emergence of other DeFi primitives . The successful adoption of LRT and Points, as well as the liquidity and distribution advantages that Pendle provides to LRT projects, should help attract projects from other ecosystems. Pendle's versatile product design allows it to adapt and thrive in changing market conditions, and continue to provide compelling yield opportunities regardless of the macro environment.

Use cases and opportunities

Pendle's broad addressable market stems from its ability to develop a variety of yield types. While Pendle has excelled in unlocking multiple new use cases, there are still greater opportunities in many areas, including intersections with other DeFi protocols and other blockchains.

- Pendle x Staking : Staking is undoubtedly the largest market for on-chain yields, which is not difficult to understand, and it brings the strongest value and use case to Pendle. The emergence and growth of several layers built on staking (such as liquidity staking and liquidity re-staking) have attracted a lot of capital and become the largest sub-sector in DeFi. This growth has also spread to Pendle as users speculate on the volatility of the yields on their LST and LRT collateral.

- Currently, only ~27% of all ETH is in custody (13), and this number is expected to rise. With a total TVL of $48 billion for liquidity staking, coupled with liquidity resubscriptions, this will continue to represent a huge opportunity for Pendle. Pendle’s TVL represents only modest penetration, with considerable room for growth, especially as the staking market expands on other blockchains such as BNB Chain, Bitcoin, and Solana. Therefore, it can be argued that staking will continue to play a key role in Pendle’s on-chain yield trading.

- Pendle x Points : Pendle has achieved strong product-market fit by enabling users to speculate on points and farming opportunities through YTs airdrops. This ability to leverage speculation to create products that are not entirely based on yield is a significant breakthrough. While demand for point trading comes primarily from LRT tracking, points have been widely used in a variety of projects, including SocialFi and Gaming, as well as non-Ethereum Virtual Machine ("EVM") blockchains such as Solana. This provides an opportunity for Pendle projects to implement point programs on multiple blockchains.

- Pendle x Structured Products : Pendle can leverage unique yield products such as Ethena’s synthetic USD. While Ethena is theoretically classified as a yield-bearing stablecoin due to its USDe offering, its yield comes from a combination of ETH staking yields and perpetual futures funding rates.

- Pendle x Money Markets : Money markets (such as Aave and Compound) offer their own form of annualized yield, often traded through stablecoins (14). The current TVL for on-chain lending is $32.7 billion, providing Pendle with another important sub-sector. In addition, because Pendle's PTs are closely tied to the value of their underlying assets, they can be used as collateral. Projects such as Silo, Stella, Seneca, Dolomite, and Timeswap all accept PT, but Pendle still has untapped PT liquidity. Using PT as collateral to borrow funds while also receiving a fixed-rate return can further embed Pendle into the deeper realms of DeFi.

- Pendle x Liquidity Pool : Liquidity pools, including LP tokens such as the Balancer pool and GMX, are popular in DeFi because they can earn yields. Based on different strategies, each pool has its own interest rate, which naturally creates a demand for changes in trading yields. This constitutes another attractive market for Pendle, especially because almost all DeFi projects have LP token income.

- Pendle x Real World Assets : As interest rates move higher, a variety of yielding stablecoins have emerged that provide on-chain treasury interest exposure. Pendle has demonstrated its ability to create markets for these products, enabling users to trade based on interest rate changes. As tokenization of more types of RWAs increases, Pendle can take advantage of opportunities to integrate more traditional financial products into the on-chain ecosystem.

There are also some key areas of focus for Pendle that are worth paying attention to.

- Promoting Institutional Adoption : Pendle's current demand comes primarily from advanced retail users, who typically use the product for leverage rather than traditional financial purposes such as hedging. However, Pendle is also working to attract larger capital and sophisticated investors through its institutional team . Institutions have greater liquidity and can bring tremendous value to the protocol and benefit from customized investment strategies between fixed and variable income options. This potential depends largely on whether institutions adopt on-chain income assets. An important development to watch is the approval of the spot ETH ETF, which will provide institutions with a way to hold ETH. The next natural step is to stake ETH to earn additional on-chain income. These developments may drive demand for products such as Pendle to hedge risk and smooth the yield curve.

- Improving user engagement : While Pendle’s main success comes from a subset of retail users, it is challenging to expand its audience due to the complexity of yield trading. Pendle is working to improve the user experience and enhance user education to lower the barrier to entry. The simplified interface also makes it easier to integrate with other projects and exchanges, including as a plug-and-play module, promoting wider use of Pendle. Initiatives such as Pendle Earn, Pendle Academy, and Pendle Telegram Yield Bot all help simplify the protocol’s offerings.

- Pendle V3 : Building on the success of Pendle V2, which introduced a custom AMM for yield and principal token trading, Pendle V3 is the next product iteration and is expected to be released in late 2024. While specific details have yet to be determined, Pendle V3 is expected to innovate further, introduce new trading tools and on-chain yield margin trading, improve capital efficiency, and further unlock use cases for the yield trading market, including scaled trading.

4. Stablecoin market

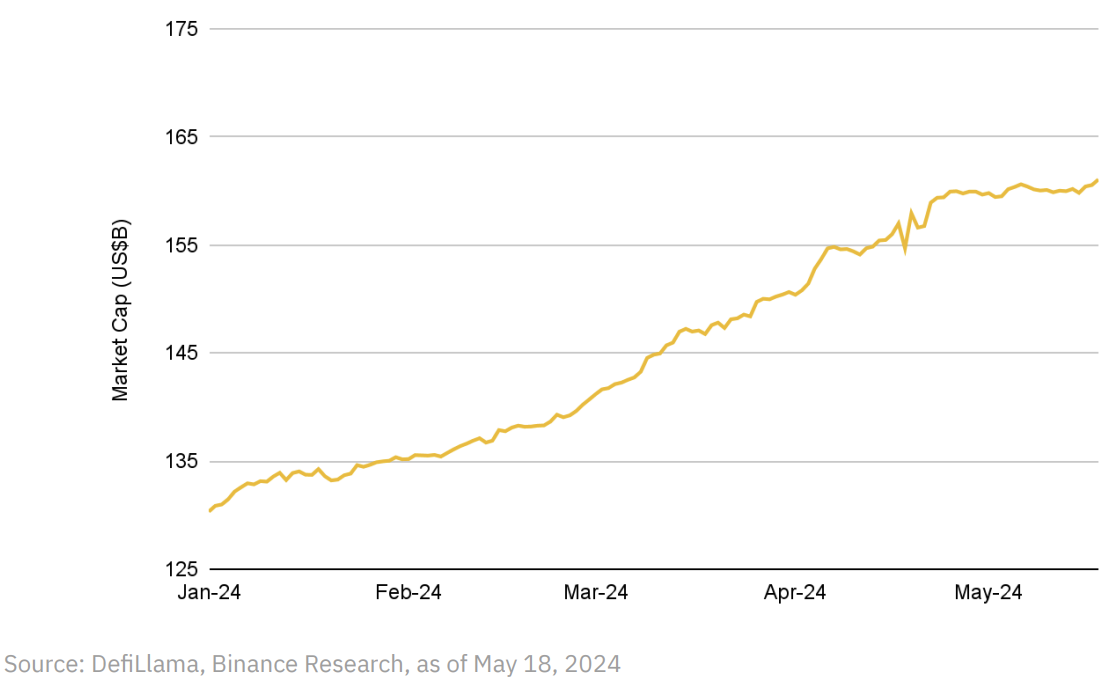

Stablecoins are one of the few DeFi use cases that have achieved meaningful product-market fit. Stablecoins have proven to be effective financial instruments that play a vital role in both DeFi and CeFi. This is evident in the fact that the stablecoin market capitalization has surged to $161.1 billion, a two-year high. This growth shows no signs of slowing down, especially in the current high-interest rate environment, which makes the stablecoin business extremely attractive. Tether’s record profit of $4.5 billion in the first quarter of this year highlights this trend(15). It is no surprise that major players have entered this space, from cryptocurrency pioneer Ripple(16) this year to fintech provider PayPal(17) last year.

Figure 8: The market value of stablecoins has been on an upward trend this year, reaching $161.1 billion, the highest level in nearly two years

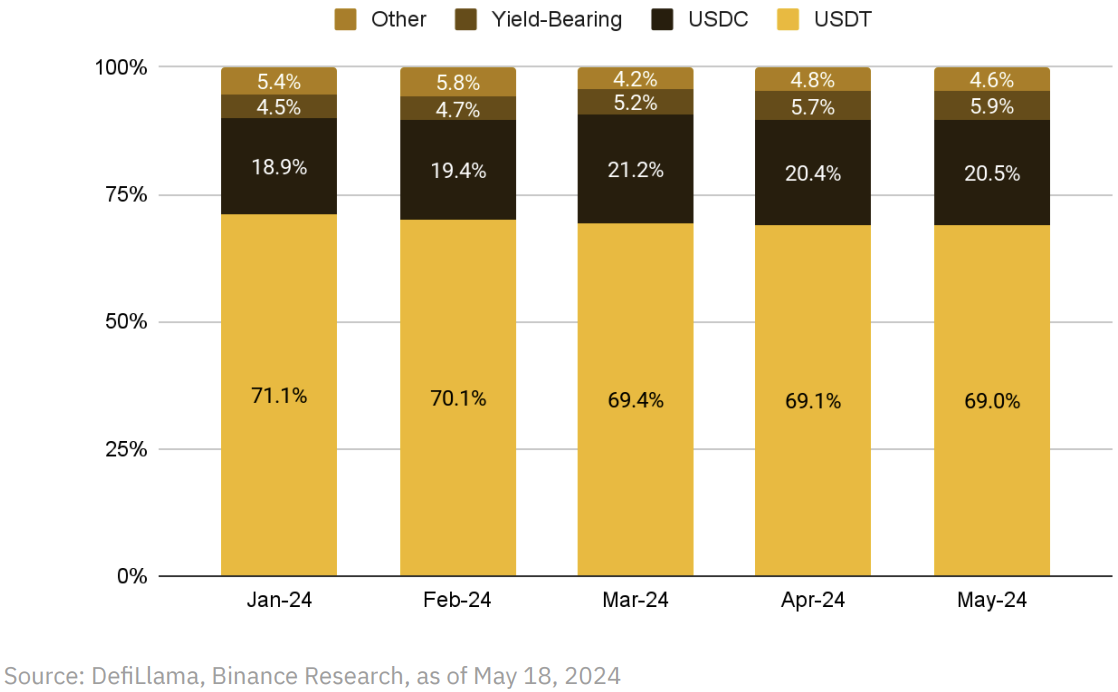

Currently, the stablecoin market is dominated by centralized players, with Tether's USDT and Circle's USDC accounting for about 90% of the market share. Their success is mainly due to first-mover advantage, as well as deep integration and composability with various markets, which has generated a strong liquidity network effect and created a higher barrier to entry for new participants. This shows that despite the large scale of the stablecoin industry, its competition is far from perfect.

First, the majority of market liquidity is controlled by centralized entities, which undermines the concept of stablecoins as true crypto-native assets. Stablecoins like USDT rely on the TradFi infrastructure, which carries inherent censorship risks . At the same time, the interest generated by these stablecoins does not belong to the holders. With the recent market recovery and the increase in risk-free rates, yield is becoming an increasingly important attribute for stablecoin users . Therefore, a more decentralized, higher-yielding stablecoin has long been missing from the market. The growing demand for such assets has been a key factor this year, as evidenced by their increasing market share month by month.

Figure 9: Yielding stablecoins show continued monthly growth, reaching 5.9% market share, but there is still considerable room for growth

To meet this need, the stablecoin model has emerged, particularly those backed by RWAs and collateralized debt positions (“CDPs”). RWA-backed stablecoins are attractive because they offer holders TradFi yields, though their appeal has waned as the market has become saturated with competing solutions and crypto-native yields have begun to exceed Treasury yields. They also come at the cost of censorship resistance. In contrast, CDP-backed stablecoins struggle with over-collateralization, leading to capital inefficiencies and scalability issues.

While these models have attempted to challenge the dominance of centralized stablecoins by introducing TradFi rates on-chain or leveraging DeFi rates in capital-inefficient ways, none of them have been fully successful. This is where Ethena’s novelty lies, addressing the market need for a yield-generating stablecoin that avoids scalability issues.

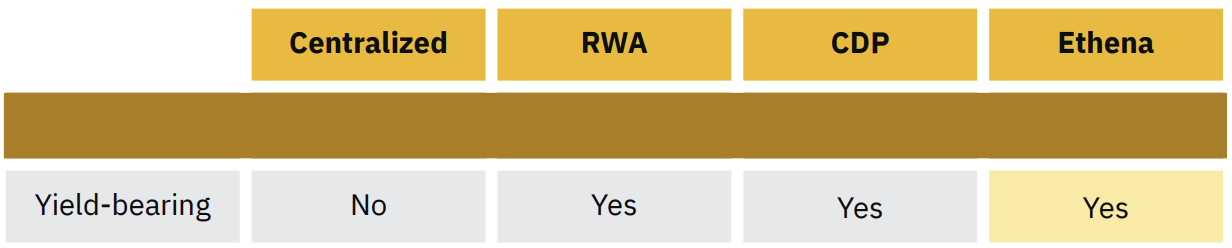

Figure 10: While there are several types of yield-generating stablecoins, including RWA, CDP, or a combination of these, Ethena introduces a new approach

Ethena

Ethena 's stablecoin USDe has rapidly grown to over $2.4 billion in circulation in just a few months, becoming one of the fastest growing stablecoin assets. Its success is directly related to its unique approach to stablecoins as a synthetic dollar protocol. By democratizing delta-neutral trading, Ethena is able to meet the market's strong demand for yield.

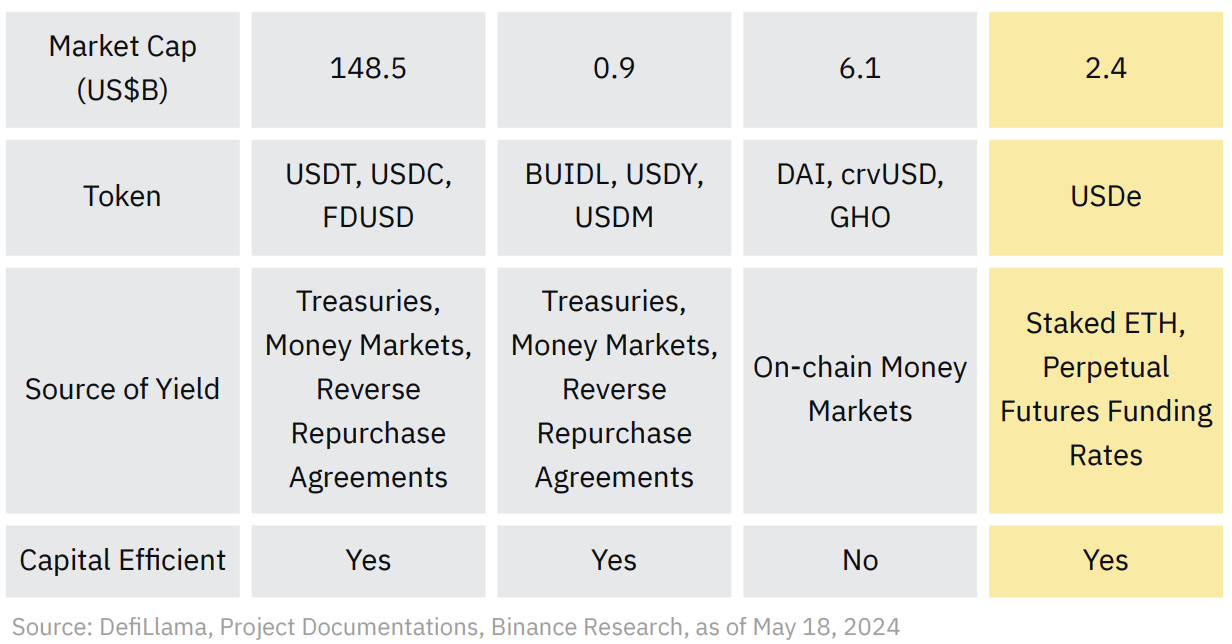

Figure 11: In just a few months, Ethena’s USDe surged 2730.4%, reaching a market cap of $2.4 billion, making it the fifth largest stablecoin

A particular catalyst for Ethena was the effective execution of its airdrop campaign. Ethena uses a points system called shards to incentivize the provision of liquidity for USDe. At the end of Season 1, 5% of the native token supply was allocated to shard holders. With “shards” renamed to “sats,” Season 2 is now underway, which will continue to incentivize users to provide liquidity on Ethena and interact with a variety of on-chain currencies and yield markets . This strategy has helped Ethena maintain a high level of liquidity across the DeFi ecosystem (18).

While these incentives have been successful in attracting and retaining users, the true test will come after the campaign ends. At that time, the market will assess the real risks of holding USD without incentives or speculative incentives. One factor to consider is the native functionality of the ENA token, which is currently limited to governance. However, with the recent trend of revenue sharing and buyback/burn mechanisms in DeFi, Ethena may implement similar functionality in the future.

Regardless, if Ethena can successfully embed USDe in as many protocols as possible, the resulting network effects may make USDe adoption resilient even after the incentives end. The uniqueness of Ethena's model and the high yield it offers are also a fairly strong demand driver in themselves. Let's explore Ethena's model in more detail below.

Delta Neutral Strategy

Ethena's basic strategy involves leveraging the perpetual futures market to create an alternative asset that is easily accessible to users. Unlike traditional stablecoin models, Ethena's USDe is backed by a delta-neutral ETH position. This involves holding staked ETH (wstETH) while balancing it with a short position in ETH perpetual futures (ETH-PERP). For example, if the price of ETH falls, the ETH-PERP short position offsets the fall in price. Conversely, if the price of ETH rises, the long ETH position covers the rise in price.

In a recent development, Ethena has also added BTC as an additional form of collateral. To maintain delta neutrality, BTC is combined with an equivalent short position in BTC perpetual futures (BTC-PERP). However, unlike ETH, which can earn additional yield through staking, Bitcoin does not currently offer this benefit, at least for now.

Ethena’s model has several advantages over other yield-yielding stablecoins.

◆Capital efficiency: Ethena is more capital efficient than CDP. USDe's Delta neutrality means that it does not require over-collateralization, and only one dollar of collateral is needed to mint one dollar. This allows Ethena to scale more efficiently than CDP stablecoins such as DAI.

◆ Yield optimization: Ethena combines two very attractive crypto-native yields, namely, the yield from staked ETH and perpetual futures financing rates.

○ Staked ETH: Based on historical averages, the annual return of Staked ETH is 3-4%. Given that liquidity staking is the largest sub-sector in DeFi, it is one of the most attractive sources of on-chain income.

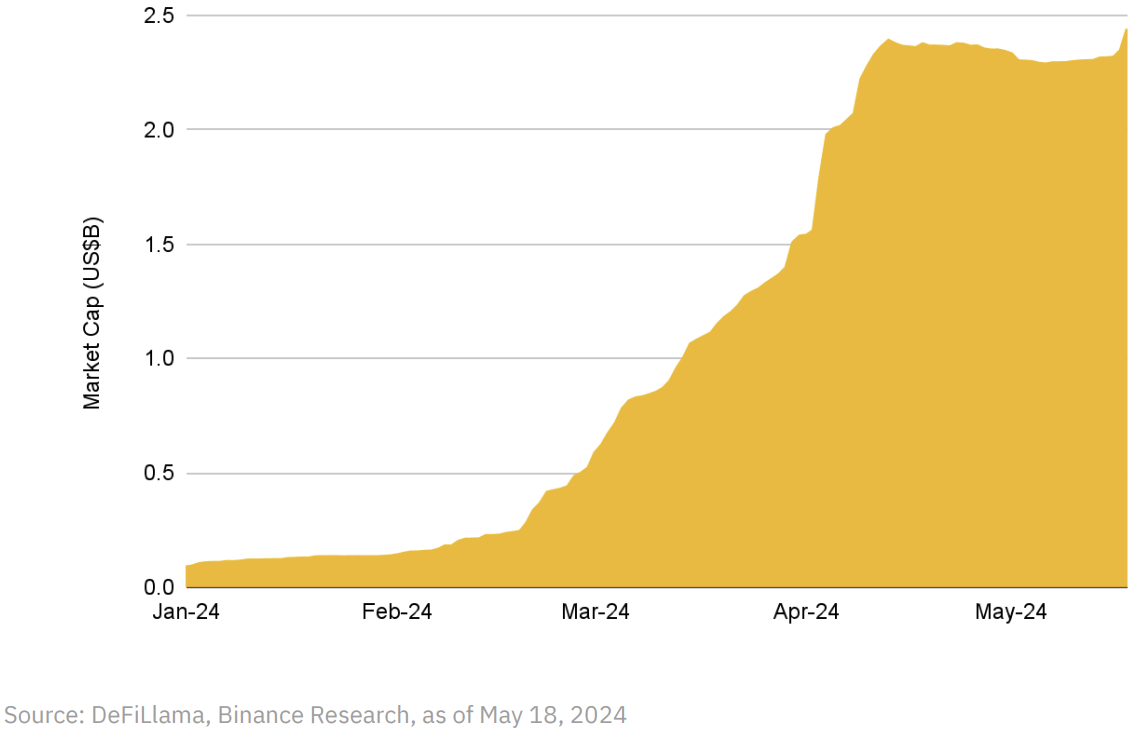

Figure 12: ETH staking yields have trended towards the 3-4% range since last year

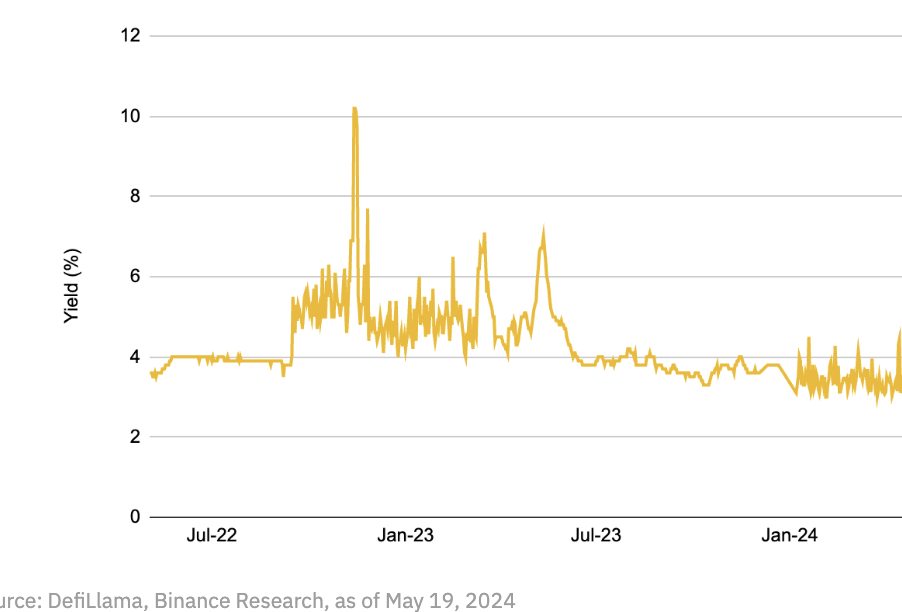

○ Perpetual Futures Funding: Most of USDe’s gains come from short positions in perpetual futures. Since ETH perpetual funding rates are generally positively skewed, those who short this exposure have generated healthy returns.

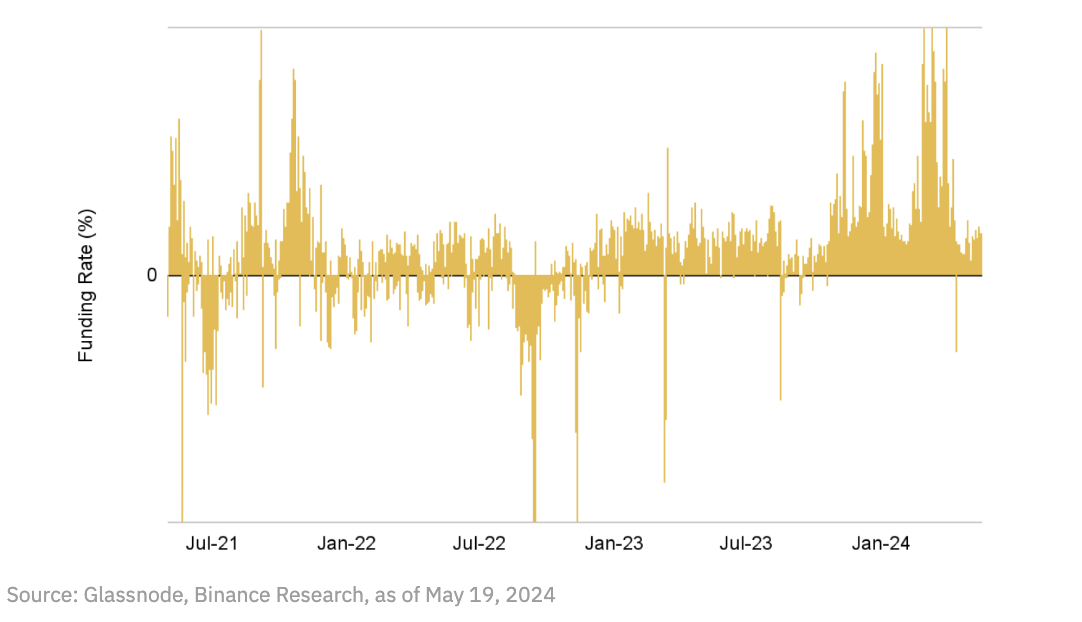

Figure 13: ETH Positive Funding Rate

Mechanism Design

As for Ethena's stablecoin mechanism, it follows the common practice of minting, redemption, and collateralization with some unique twists. Notably, users do not handle the minting and redemption of USDe; this task is reserved for whitelisted authorized participants ("APs"). Users interact directly with Ethena's interface or through liquidity pools, which route and process transactions accordingly. In order to earn the yield generated by collateral, users must stake their USDe through Ethena's platform to obtain sUSDe.

For AP, each transaction provides an arbitrage opportunity to balance the liquidity pool. On the back end, when AP deposits accept collateral, USDe is minted - such as ETH, LST, BTC and other stablecoins - to Ethena. The protocol then uses a swap mechanism to exchange this collateral for collateralized ETH or BTC and matches it with the corresponding short position of perpetual futures on CEX. This mechanism ensures that the liquidity pool always maintains a stable 1:1 swap ratio, making the coinage and redemption process simple for users.

Given its unique approach, Ethena has a fundamentally different risk profile compared to other stablecoins. This distinction has led Ethena and the market to label USDe as a synthetic dollar rather than a traditional stablecoin. This strategic classification allows Ethena to leverage the network effects inherent in being an on-chain liquid monetary asset. At the same time, Ethena is fairly transparent about the associated risks. Below, we highlight some of these risks.

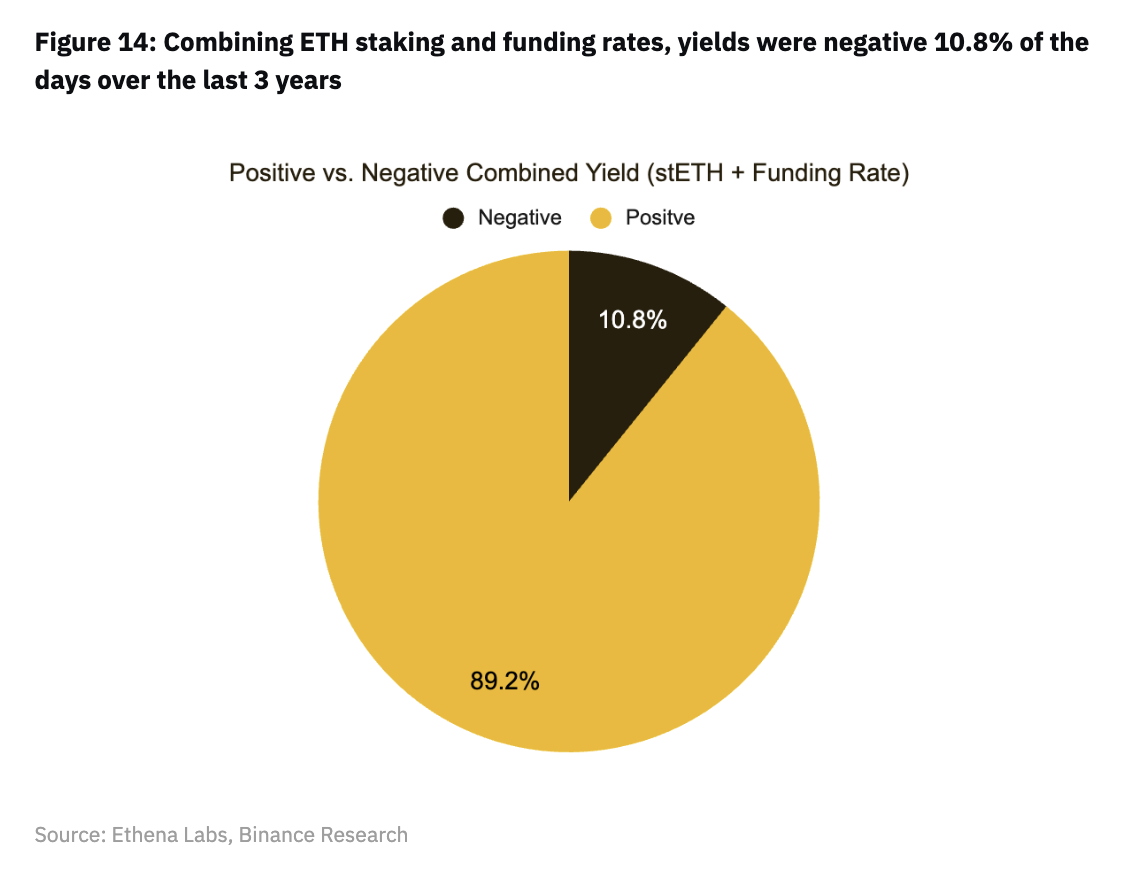

◆Negative funding rates: The biggest risk facing Ethena may be that the funding rate will turn negative. Permanent funding rates in the cryptocurrency market are generally long-term biased, and negative rates have only occurred 20.5% of the time in the past three years. However, since Ethena also uses stETH as collateral, it provides a safety margin to deal with negative interest rates. The yield of the protocol will only turn negative if the combined yield of ETH staking and funding rates turns negative. This means that Ethena only focuses on situations where ETH funds are more negative than stETH yields, and the probability of this happening is about 10.8% when considering the additional buffer of stETH yields.

Figure 14: Combining ETH staking and funding rates, the return over the past 3 years was negative 10.8%

However, past data may not be completely reliable due to the changing market dynamics. As more institutions enter the cryptocurrency space, they may pursue their own delta-neutral strategies, which may have a significant impact on funding rates, including those affected by Ethena itself. In addition, the approval of a spot ETH ETF may change the demand and supply dynamics of Ethereum. Therefore, historical data should not be the sole basis for predicting the true impact of funding rates on Ethena.

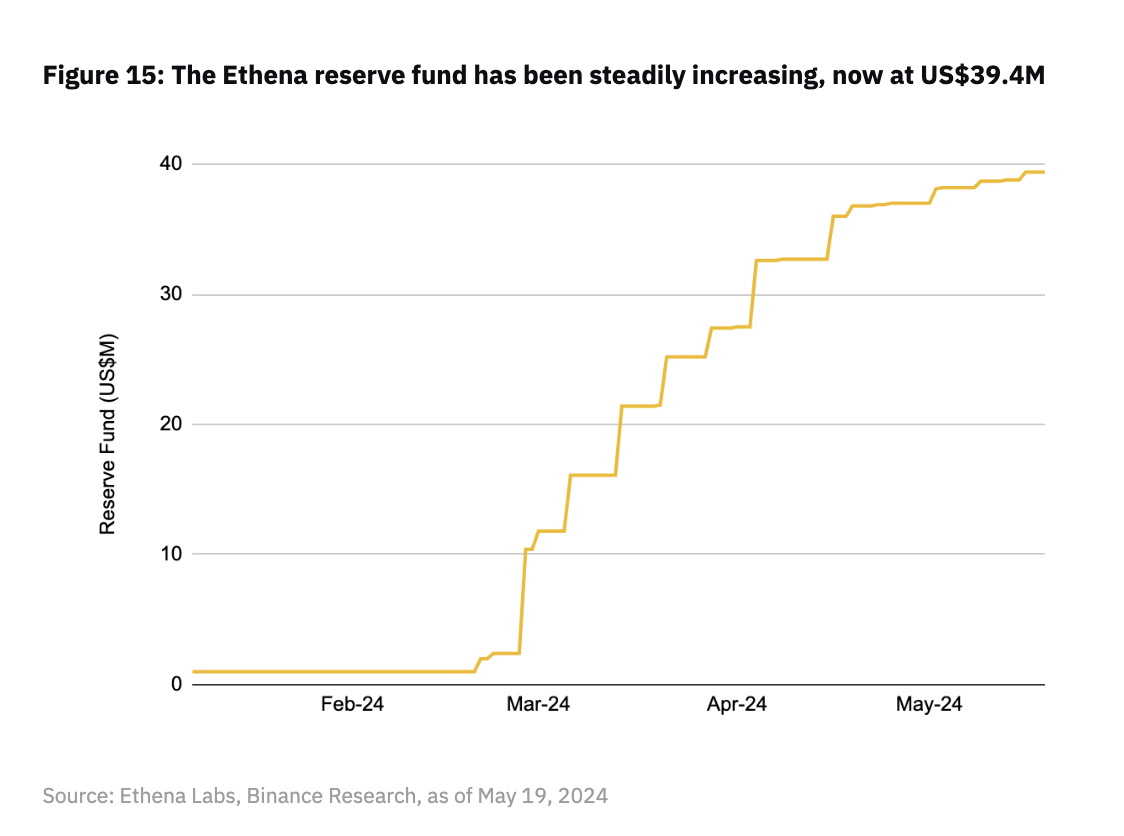

If funding rates do turn negative, Ethena will need to rely on its reserve fund to maintain USDe’s 1:1 USD peg. Questions remain as to whether the size of this reserve will be sufficient, especially if negative funding rates persist for longer than expected. Unfortunately, this is not a hard science; Ethena’s research suggests that every $1 billion of USDe can withstand a $20 million bear market, while Chaos Labs suggests closer to $33 million per $1 billion of USDe.

One positive for Ethena is that it does have a ton of revenue to draw on. As one of the most profitable DeFi protocols, Ethena allocates 80% of its revenue to a reserve fund. While Ethena has performed well in bullish market conditions, its resilience in a prolonged bear market and negative funding rates remains to be seen.

Figure 15: Ethena’s reserve fund has been growing steadily and currently stands at $39.4 million

◆ Custody Risk: Ethena's operating framework relies on CEXes and over-the-counter settlement ("OES") providers to manage transactions and custody its permanent positions and collateral. While the goals of these external parties are generally consistent with those of Ethena, they introduce counterparty risk.

Ethena reduces this risk by diversifying its counterparties and obtaining third-party certification. It is worth noting that this counterparty risk is not unique to Ethena and is also common in stablecoins including USDT and USDC. Unlike these centralized stablecoins, Ethena is not subject to censorship risk because it does not rely on the traditional banking system.

◆Collateral risk: While market volatility may affect the value of Ethena's collateral, especially ETH and BTC, the greater risk comes from the collateral held as LST. LST, which has poor liquidity, may decouple due to a slashing event or liquidity shock. In other words, LST needs to deviate significantly to significantly affect Ethena.

◆Smart contract risk: Although many of Ethena's operations occur off-chain, the protocol is still vulnerable to smart contract attacks like other DeFi protocols. Ethena reduces this risk through multiple audits and bug bounty programs.

◆ Areas of uncertainty: Given Ethena’s innovative and unique attributes, this is always a potential risk associated with new models and technologies. Ethena is not immune to these uncertainties.

USDe’s broader market impact

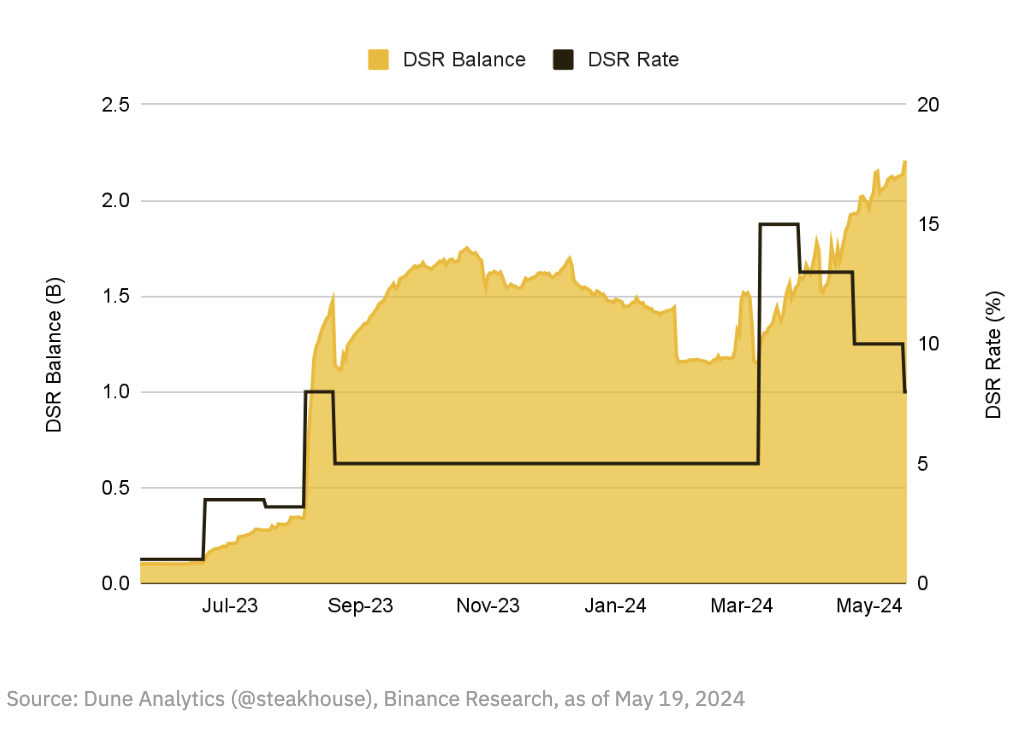

All else aside, Ethena’s model has broader market implications. Historically, these sectors have diverged widely, with significant differences between Treasuries, on-chain money markets like the Dai Savings Rate (DSR), and Delta-neutral trades. Ideally, there would be some form of reconciliation between these rates, but this is not the case. While Treasuries and on-chain money market rates have begun to align with the inclusion of RWAs by MakerDAO and other DeFi protocols, Delta-neutral trades have remained relatively isolated.

This isolation can stem from the higher risk, complexity, and inaccessibility associated with Delta Neutral Basis Trading. Ethena solves this problem by making Delta Neutral Trading more accessible to a wider audience, thereby expanding the user base that can benefit from these gains. This democratization of access has significant implications, especially in recalibrating the baseline interest rate for DeFi, driving other protocols to adapt.

◆DeFi money markets raise interest rates: Ethena’s impact has led to strategic adjustments from DeFi protocols such as MakerDAO. For example, MakerDAO increased its DSR from 5% to 15% to avoid a DAI demand shock and remain competitive with Ethena’s high yield. This adjustment was necessary to maintain incentives for holding and staking DAI. Other protocols, such as Frax, have made similar adjustments, marking an early coordination of interest rates.

◆Increased exposure to USD: Existing stablecoin issuers have sought to leverage Ethena’s yield by managing their own USDe/sUSDe markets through Morpho. For example, MakerDAO initially deployed 100 million DAI to Spark’s sUSDe/DAI and USDe/DAI markets through the Direct Deposit Module (“D3 M”) and later added an additional 100 million DAI. This integration allows users to deposit sUSDe or USDe into these lending pools on Morpho and borrow DAI in return, thereby promoting more demand for DAI and enabling MakerDAO to earn APY from borrowers. While this integration is beneficial, it also exposes MakerDAO to the risks associated with Ethena.

In response to MakerDAO’s increased allocations, other lending protocols, such as Aave, have adjusted their strategies. Aave recently passed a proposal to reduce the DAI liquidation threshold by 1% for every additional 100 million DAI allocated through D3 M. This means that as the risk associated with DAI increases, Aave is reducing its risk accordingly.

5. Money Market

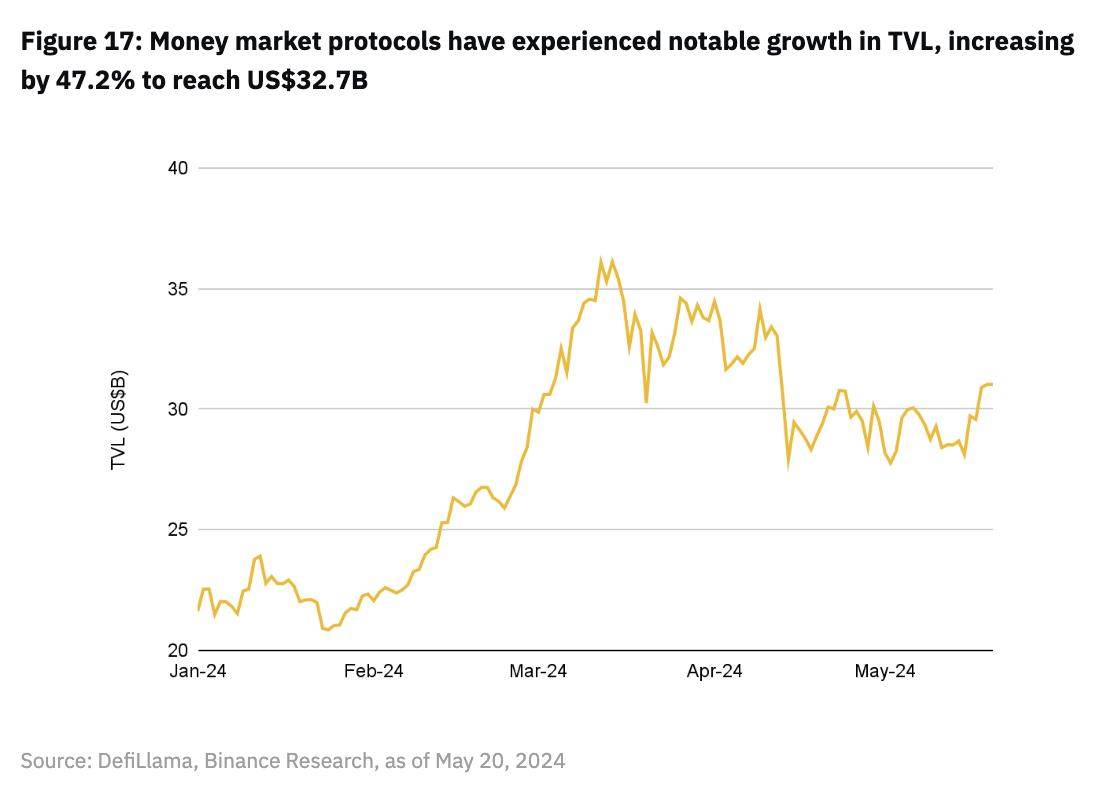

Money markets, including lending, have experienced significant growth since the beginning of the year, with on-chain TVL increasing by 47.2% to over $32.7 billion. These markets are often dominated by a few key players, such as Aave and Compound Finance, as well as protocols that can vertically integrate synergistic products, such as MakerDAO’s SparkLend.

Figure 17: Money market protocols saw significant growth in TVL, up 47.2% to $32.7 billion

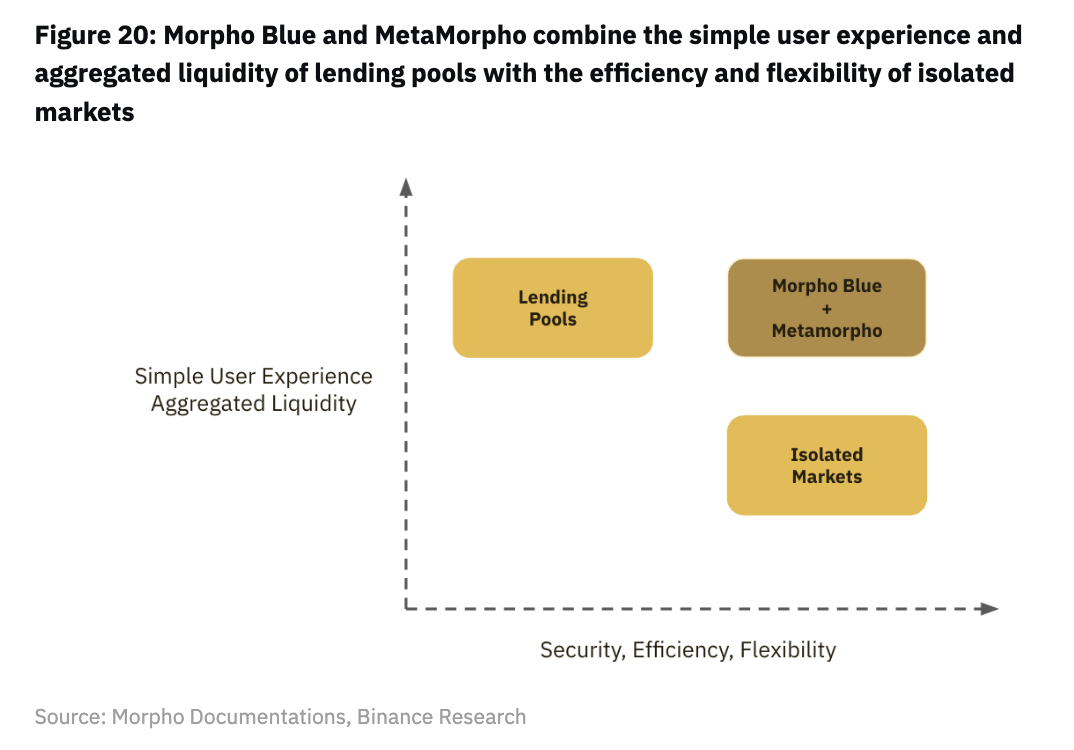

While these major players continue to lead the lending business, changes are taking place that challenge the status quo of on-chain lending. There is a growing demand for a wider range of long-tail assets as collateral, a demand that traditional lending platforms have difficulty meeting. Their underlying models and the large amount of liquidity they handle mean that adding new assets increases the risk of their multi-asset pools. Managing these additional risks requires strict risk management measures such as supply and borrowing caps, strict liquidation penalties, and conservative loan-to-value (“LTV”) ratios, which ultimately subject them to several efficiency and scalability constraints. At the same time, siloed lending pools, while more flexible, struggle to cope with liquidity fragmentation and capital inefficiencies.

This market gap has spurred the rise of modular lending protocols that cater to a wider asset base and allow users to customize their exposure. These new protocols are beginning to challenge the dominance of established players like Aave and Compound.

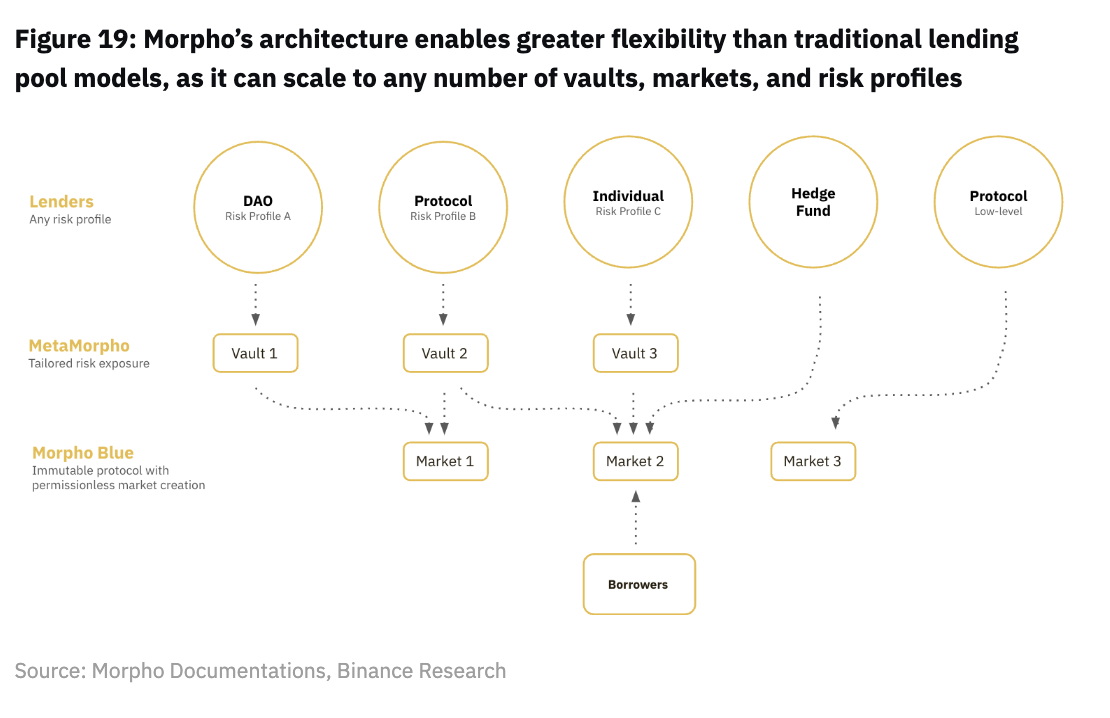

By leveraging its flexible design, the modular lending protocol aims to become a base layer primitive that enables the creation of more user-centric lending products.

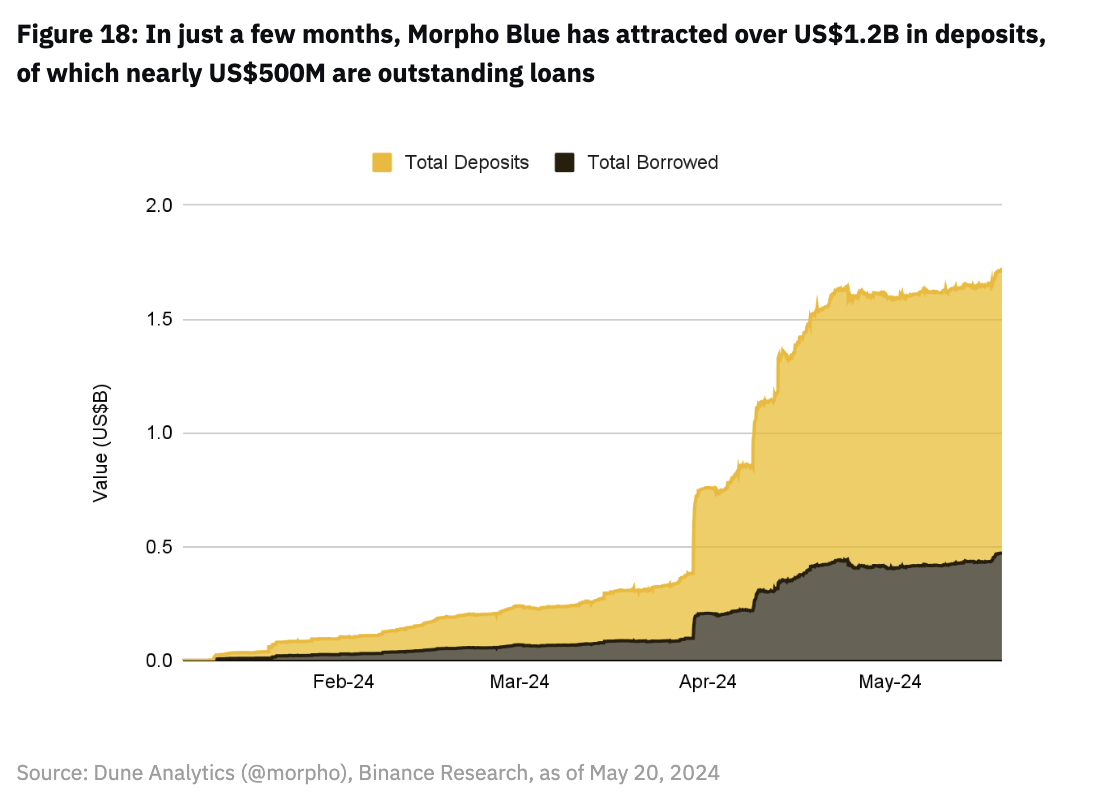

Morpho

Morpho is leading the shift towards modular lending. With over $2.5 billion TVL, Morpho has become the sixth largest on-chain lending platform, with an impressive 76.7% growth YTD. This growth can be largely attributed to the launch of new products Morpho Blue and MetaMorpho in January of this year. In a matter of months, Morpho Blue has received over $1.2 billion in deposits, of which nearly $500 million are outstanding loans. This highlights how highly the money markets value this new primitive. As one of the first modular lending protocols, several notable projects have already integrated Morpho pools into their products.

Figure 18: In just a few months, Morpho Blue attracted over $1.2 billion in deposits, of which nearly $500 million were outstanding loans

Before diving into Morpho Blue and MetaMorpho, it’s important to understand that Morpho has two distinct product iterations. While the focus will be on the recent modular lending product, Morpho initially launched the Morpho Optimizer, a yield optimizer built on top of existing lending pools like Aave and Compound.

◆ Morpho Optimizers: The initial version of the Morpho protocol, called Morpho Optimizer, aims to improve the lending rate matching algorithm through P2P. The algorithm maintains the same liquidity and risk parameters as the underlying lending pool.

◆ Morpho Blue: Morpho Blue represents the latest iteration of the protocol. It is a lending primitive layer that allows for the creation of immutable and efficient lending markets in a permissionless manner. MetaMorpho: MetaMorpho is an open source protocol designed for permissionless risk management based on Morpho Blue.

Morpho Blue: Permissionless Market Creation

Morpho Blue is a trustless and efficient lending primitive that allows the creation of isolated lending markets in a permissionless manner. An isolated lending market refers to a market between two assets - a collateral and a collateralizable asset, each with independent risk management. The main advantage of Morpho Blue is that it allows users to seamlessly deploy isolated lending markets. Users can directly set loan parameters such as loan assets, collateral assets, oracles, liquidation loan value ("LLTV"), and interest rate model ("rate"). Each parameter is selected at market creation time and remains constant, providing flexibility not available in traditional on-chain lending.

Importantly, Morpho allows for the independent creation of fixed parameter markets without extensive governance oversight. Only LLTV and LLTV must be selected from a limited selection approved by Morpho Governance. This marks a departure from existing lending protocols like Aave and Compound, which require governance approval for asset listings and parameter changes. These protocols also pool assets into a single lending pool, thereby sharing risk. Let’s explore in further detail how Morpho Blue differentiates itself from traditional lending markets.

◆Liquidation Mechanism: Like all lending protocols, Morpho has a liquidation mechanism to mitigate default risk and protect lenders' capital. When an account's LTV ratio exceeds the market's LLTV, the account's position can be liquidated. On Morpho Blue, anyone can liquidate by paying off an account's debt in exchange for an equal amount of collateral, plus a reward.

What is interesting is how Morpho calculates and realizes bad debts. In traditional loan pool designs, accrued bad debts remain on the market indefinitely until manual intervention is required to pay them off. However, Morpho handles it differently, sharing losses proportionally among all lenders in the pool. This practice of realizing losses immediately helped prevent a liquidity run, which also affected other loan pools.

◆Oracle-agnostic pricing: Effective lending protocols require accurate market pricing for collateral and loan assets to manage liquidation and lending capacity. Many protocols rely on specific oracle services, such as Chainlink, but they are limited by the assets and prices provided through their chosen oracles, which constrains their asset listing process. Instead, some protocols take an oracle-free approach, relying on internal trading markets. This approach introduces its own complexities, such as increasing gas consumption and affecting crystallizability.

However, Morpho Blue is oracle agnostic. This means that Morpho has no single oracle or built-in trading mechanism, allowing for greater flexibility. This approach supports a wider range of assets from the outset, enhancing Morpho's permissionless lending capabilities.

◆Interest Rate Model (abbreviated as "interest rate model"): Interest rate models play an important role in loan agreements because they define the interest paid by borrowers in a given market. Morpho Blue is an approved set of models. Currently, the set only includes a single model in AdaptiveCurveMonitoring, which aims to maintain a target utilization rate of 90% by adjusting the interest curve in response to market dynamics.

◆Incentives: Unlike traditional lending pools, Morpho Blue allows targeted incentives. Projects can incentivize specific asset pairs to drive its token Universal Rewards Distributor (“URD”) to power this mechanism, which enables the distribution of multiple ERC20 tokens through a gas-optimized, off-chain Merkle tree.

◆Singleton Contract: Morpho Blue runs as a singleton contract, meaning all markets exist in a single smart contract. This simplifies user interaction, cross-market usage, and reduces gas consumption compared to other platforms.

◆Callbacks: Callbacks enable developers to execute custom logic during transactions on Morpho Blue. This is particularly useful for more sophisticated users, who can perform advanced operations without having to deal with repetitive back and forth operations.

◆Flash Loans: Flash loans are loans that can be obtained without any collateral, where the borrowed assets are repaid in the same transaction. Morpho Blue offers free flash loan, allowing users to borrow from all markets at the same time, thanks to its single contract, which facilitates easier liquidations, collateral swaps, and on-chain arbitrage opportunities.

◆Account Management: Morpho Blue’s authorization system allows users to authorize other addresses to borrow and withdraw on their behalf. This system is particularly useful in bundling transactions and implementing custom management systems for externally owned accounts (“EOAs”).

◆ Externalized risk management: Traditional protocols rely on native token holders for governance and risk management, which may not always represent the best interests of users. Morpho Blue separates risk management from the scheme, and users are free to decide to create markets with any assets and risk parameters. This minimizes governance involvement and supports a wider range of risk preferences and use cases. While this approach provides more flexibility for senior lenders, it can be complex for ordinary users who are usually accustomed to having risk management handled for them. Fortunately, Morpho Blue is designed so that additional layers can be built on top to address these limitations.

MetaMorpho: A permissionless lending vault

Given the complexity of Morpho Blue, MetaMorpho was developed to provide a better experience for end users, especially passive lenders. Managing risk in the Morpho Blue market involves multiple factors, such as collateral assets, liquidation LTV, oracles, IRM, which makes it more complex than traditional platforms such as Aave and Compound, where governance makes these decisions on behalf of users.

MetaMorpho is a permissionless risk management protocol designed to facilitate the creation of lending vaults on the Morpho Blue marketplace. MetaMorpho vaults provide liquidity to the Morpho Blue marketplace, allowing users to delegate risk management to the vaults. This delegation automates decision making, providing a more passive experience similar to traditional lending platforms. Let’s explore the key components of MetaMorpho’s design.

◆Risk Management: Each MetaMorpho vault can be customized to reflect different risk profiles based on the vault’s goals and value proposition, enabling users to choose personalized risk exposure. This approach addresses an important limitation of multi-asset lending pools, which forces all users to adopt a one-size-fits-all risk model regardless of their risk tolerance. For example, a risk-averse lender can avoid certain asset risks by depositing funds in a vault that matches their preferred balance between risk and return, thereby reflecting their personal risk preferences. This degree of customization is not possible with traditional lending platforms, which give users exposure to all assets listed in the pool.

Figure 19: Morpho’s architecture offers greater flexibility than traditional lending pool models as it can scale to any number of vaults, markets, and risk profiles

◆Timelock Mechanism: The timelock mechanism introduces a delay before certain actions can be performed, adding a layer of security. This feature allows users to use the MetaMorpho vault's time to review and respond to proposed changes, preserving the non-custodial nature of the MetaMorpho vault. It ensures that users maintain control of their assets and can withdraw their assets at any time if needed.

◆Amplifying Liquidity for Lenders: MetaMorpho vaults can aggregate and amplify extractable liquidity, providing lenders with better liquidity than multi-asset lending pools. Providing loans to isolated markets through MetaMorpho vaults avoids the liquidity fragmentation seen in other isolated lending markets. Liquidity funds from each market are aggregated at the vault level, providing users with the same withdrawal liquidity as multi-asset lending pools, while the underlying markets remain isolated. This aggregation occurs because the liquidity of each vault on Morpho Blue is shared by anyone lending to the same market. This "liquidity amplification" effect increases with the number of vaults, resulting in higher liquidity, efficiency, and scalability.

Modular Loan Market Basics

Morpho Blue and MetaMorpho bring the two together to form Morpho's unique modular on-chain lending approach. They represent a new foundation for DeFi lending, combining the benefits of isolated markets with the benefits of multi-asset lending pools. At the base layer, Morpho Blue provides efficient, secure and flexible isolated markets. On top of this, the MetaMorpho Vault acts as an abstraction and aggregation layer, simplifying the lending user experience and aggregating liquidity.

Figure 20: The Morpho Blue and MetaMorpho combine the simple UX and aggregated liquidity of lending pools with the efficiency and flexibility of independent marketplaces

Morpho's modular design clearly offers significant advantages in terms of flexibility and capital efficiency. However, we have yet to see liquidity growth and utilization on these protocols significantly outperform traditional multi-asset lending pools. While lending platforms like Aave remain dominant, Morpho's unique approach should be well positioned to capture user interest and liquidity. As the market continues to rise, competition is expected to intensify and it will be critical to maintain its growth momentum. In the short term, though, Morpho's main competitors may not be the larger traditional players.

Other modular lending products, such as Silo and Ajna, are also active in the market, but have limited growth compared to Morpho. Morpho will likely compete with other modular lending products first before overtaking traditional lending platforms. It will be interesting to observe which modular lending protocols are able to attract liquidity and user demand in the interim. Mechanism design, business development initiatives, and token incentives will all play a key role here.

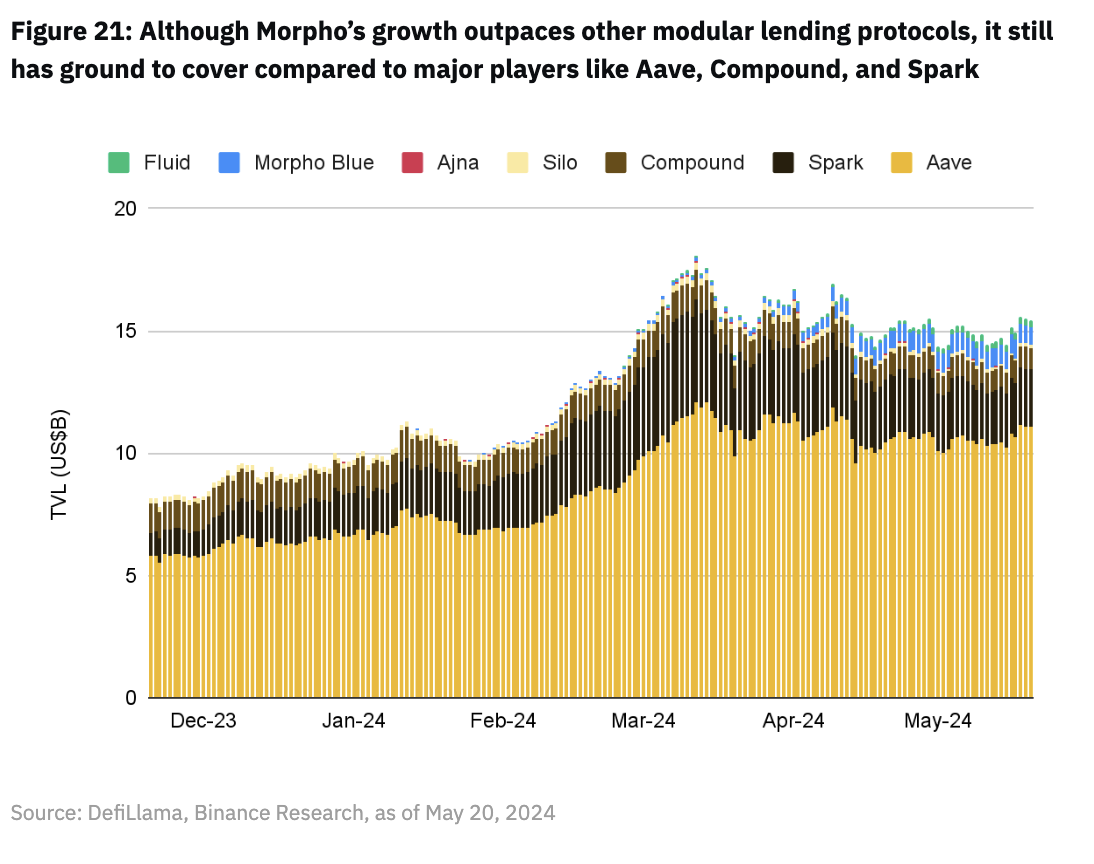

Figure 21: Although Morpho’s growth has outpaced other modular lending protocols, it still lags far behind major players such as Aave, Compound, and Spark.

6. Prediction Market

Prediction markets are derivatives markets where users can trade and speculate on the outcomes of future events. While an interesting concept, they have not received the attention they deserve, primarily because these markets have not attracted the same level of capital or trading volume as some of the other markets discussed in this report. This is partly due to upcoming regulatory hurdles, as well as the fact that many existing projects have yet to find their footing and achieve the right product-market fit.

However, prediction markets have long been touted as a breakthrough on-chain use case. Given the massive size of the betting market, it’s no surprise that there is optimism about protocols that enable a broad class of speculation through decentralized prediction markets. Since the beginning of 2024, these markets have gained momentum, reaching all-time highs across multiple metrics, suggesting that we may finally be seeing a turn in this cycle.

Figure 22: Prediction markets reached a record high of $55.1 million in TVL, up 57.7% year-over-year

The occurrence of events is an important demand driver for prediction markets, as these events create opportunities for speculation. Prediction contracts can be created for almost anything, allowing users to build portfolios on some of the world's most controversial topics and earn returns if they are correct. Therefore, major events may promote the growth of prediction markets. This year, 8 of the world's ten most populous countries are holding elections, including the much-anticipated US presidential election, which has attracted a lot of speculative interest.

Furthermore, prediction markets operate on the principle of collective wisdom, adding another layer to their value proposition. They can aggregate predictions from a broad user base and are economically incentivized to reduce information asymmetry. Assuming that the market is efficient, thousands of people use their information advantage to bet on the likelihood of outcomes, which theoretically means that probabilities in prediction markets tend to converge with actual events. Therefore, prediction markets have the potential to become an effective subset of curation markets, providing insights into collective expectations of future events. With sufficient volume, prediction markets improve data quality, news accuracy, and public discourse by gamifying the truth.

Polymarket

Polymarket is built on Polygon and is currently the leading on-chain prediction market. With the modest recovery in prediction markets this year, it is no surprise that Polymarket has been a major contributor to recent growth. This is evident from the significant uptick in trading activity on Polymarket, with an average of over $42 million per month since the beginning of the year. Proof of their growth, Polymarket recently closed a $45 million Series B round, which included notable investors such as Peter Thiel’s Founders Fund and Vitalik Buterin, bringing their total funding to $70 million.

Figure 23: Polymarket sees a significant recovery in activity, with average monthly volume increasing from $6.1 million in 2023 to $42 million in 2024

The continued growth in numbers over the past few months suggests that the growth may not be just temporary. Polymarket's active user base has also grown significantly, with more traders participating in the platform. The number of monthly active traders has risen from 1.6K at the end of 2023 to 3.8K, indicating that Polymarket's user engagement is increasing.

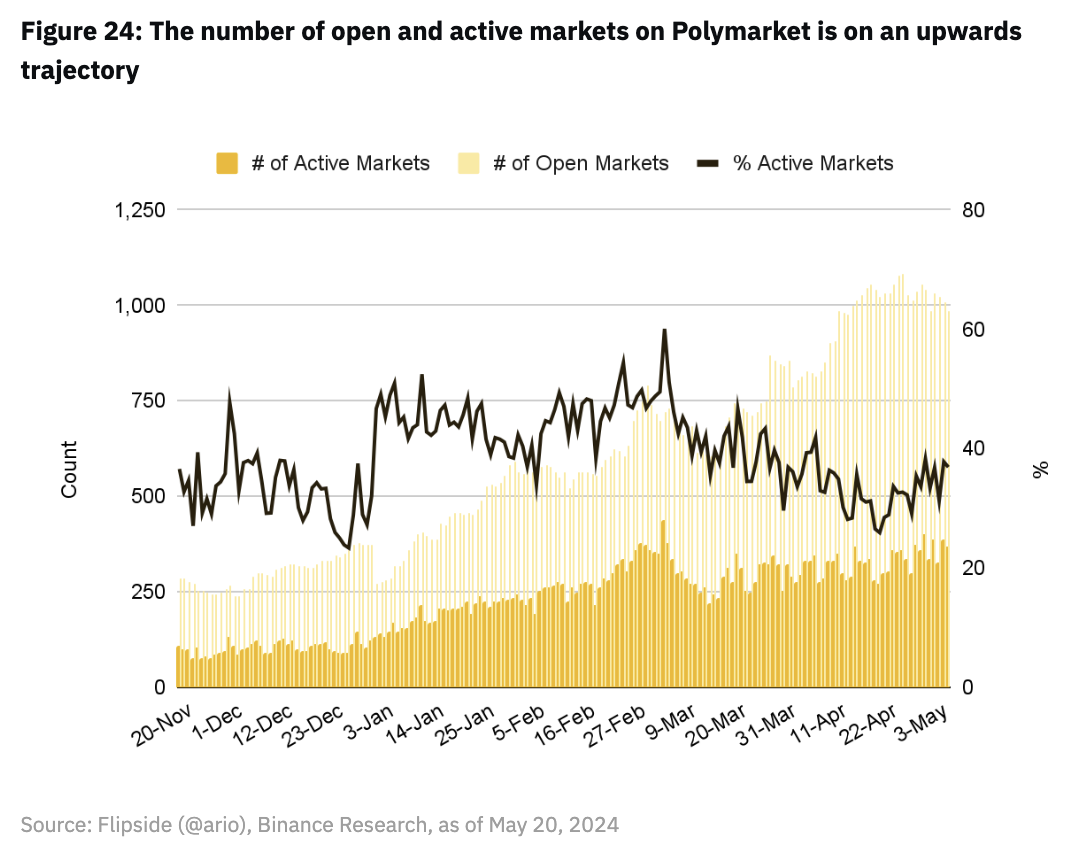

Polymarket claims to be the leading prediction market not only based on the capital flowing through its platform, but also based on the wide range of markets it covers. Users can speculate on future events in a variety of hotly debated topics, including sports, politics, and pop culture. This growth in participation is further reflected in the increase in the number of open markets, with the percentage of active markets rising from 0.32% to 0.37% this year.

Figure 24: The number of open and active markets on Polymarket is on an upward trend

With the current market rally bringing in more users and liquidity, this creates a solid foundation for growth, especially as major events approach. Polymarket has historically performed well during political events, amassing over $50 million in volume from the market based on the last US election. With the election approaching later this year, Polymarket already has over $128 million in bets placed on the upcoming election, so is well-positioned to capitalize on this again.

How Polymarket democratizes prediction

Polymarket provides a versatile platform where users can trade on event outcomes, create new events, provide liquidity, or participate in event outcome reporting. It leads the prediction market space due to its continuous user experience improvements and expansion of event categories. However, as competition intensifies, the focus may go beyond user experience improvements to include the underlying design mechanisms, liquidity, and incentives. Let's dive into the details behind Polymarket.

◆Binary Markets: Polymarket operates on binary events, such as a coin toss, where the outcome can only be "yes" or "no." The outcomes are held on