Note: This article comes from @Murphychen888 ’s Twitter account. Mars Finance compiled it as follows:

Preface

Since I wrote the article "Using the "God's Perspective" to Discover the Inner Operating Laws of BTC" in February this year, I have not written Twitter threads. On the one hand, I think that if I can explain the simple logic clearly, I don't need to use long articles to increase the reader's fatigue. On the other hand, my busy work makes it impossible for me to calmly think about a complete set of data systems. In particular, I like to express my articles clearly in a way that combines pictures and texts; sometimes the time spent on drawing pictures even exceeds the time spent on typing.

Recently, I often receive private messages from friends asking me to talk about the current stage of the bull market and verify it with on-chain data. In fact, many excellent data analysts have analyzed this. For example, Ni Da @Phyrex_Ni described the most realistic data fundamentals in his article on June 11, combining macro events, on-chain structure, and exchange inventory. The link is as follows:

https://x.com/Phyrex_Ni/status/1800210944188190983

However, I still hope to express some of my personal opinions from different perspectives from the common ones. After a long period of thinking, after two days of writing, drawing, annotating and proofreading, I finally completed this article of nearly 3,500 words. If you are a #BTC holder or a trend trader, I believe that after reading the full text, it can provide you with some different references and ideas.

Without further ado, let's get to the point...

text

The chip structure on the URPD chain can be used as an extremely important reference for trend judgment. It is different from the technical theories we commonly use, such as K-line, volume price, moving average, etc., but through the dense area formed by the movement of chips on the chain to observe who is buying (buying willingness) and who is selling (selling risk), so as to predict which direction the market may run in the next time.

A chip-dense area formed by long-term turnover is often the "springboard" for the next stage. The stronger the chip structure (thickness), the wider the price span (width), and the greater the probability of upward development. " Thickness" means that there is a strong willingness to buy in this range, which can take over the distribution of chips in other low-cost ranges, and due to high expectations for the future, the selling risk generated when prices fluctuate will also be low. "Width" means that the chips are well dispersed and will not generate concentrated selling pressure. As long as there is no sudden black swan event, the chip-dense area will form a "resistance and stickiness" effect on the price, that is, it is not very sensitive to prices and is not easy to be penetrated.

Throughout this cycle, there are two impressive “springboards”:

A. USD 25,000-30,000;

B. USD 41,000-44,000 .

The formation of range A took 220 days from March to October 23, and the formation of range B took 67 days from December 23 to February 24. Therefore, we can see that the formation of a thick price range must be based on "months". During this period, both long and short sides need to experience fierce confrontations before they can finally reach a consensus on the "bottom".

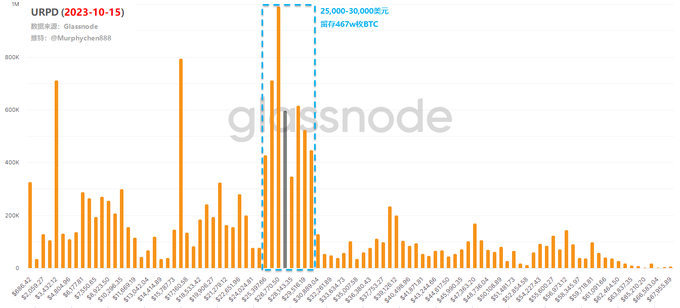

The following figure shows the URPD data on October 15, 2023. After 220 days of turnover, 467w BTC were accumulated in the range of $25,000-30,000, accounting for 24% of the total #BTC circulation at that time. It can be said that this is a very exaggerated data of a huge scale. Almost all the selling risks have been released here, and the next "jump" is a natural result.

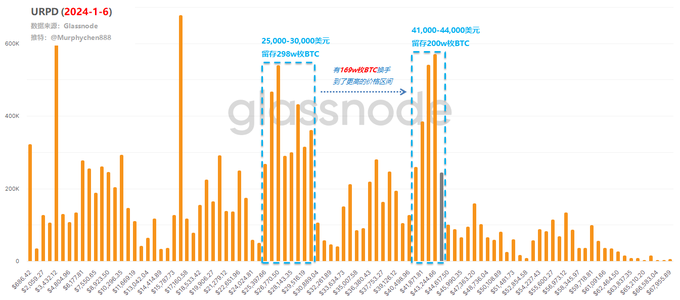

On January 6, 2024, the eve of the approval of the spot ETF, BTC accumulated 2 million BTC at $41,000-44,000 after 67 days of turnover. Among them, 1.69 million BTC were transferred from the A range (i.e., the 25,000-30,000 range). This is a process of exchanging low-priced chips for high-priced chips, allowing short-term chips with favorable expectations of ETF trading to get off the train in advance.

At the same time, there are still 2.98 million chips with firm belief in the A range. This is also the important reason why BTC fell back from 46,000 to 38,000 after the ETF was approved, but did not continue to fall back to the A range. Almost all the chips that can move are in these two ranges. The chips in the low range do not want to be sold, and the chips in the high range are reluctant to be sold, which naturally creates conditions for another jump.

At present, the on-chain chip structure is quietly forming the C range!

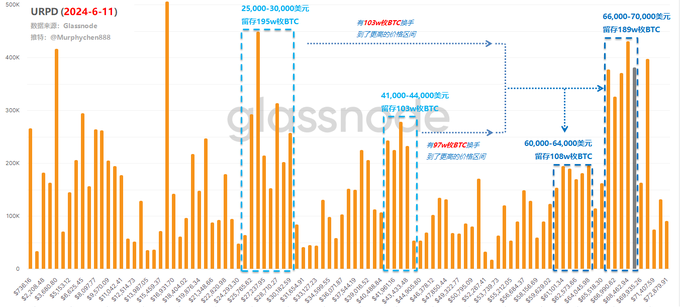

This is a large range from 60,000-70,000 USD, which includes two smaller ranges, namely 60,000-64,000 USD and 66,000-70,000 USD. For the sake of convenience, we will temporarily call them C1 and C2 ranges.

As of June 11, 1.08 million chips were accumulated in the C1 interval and 1.89 million chips were accumulated in the C2 interval (please ignore the chip movement of Mt.Gox here). Among them, 1.03 million chips were transferred from the A interval and 970,000 chips were transferred from the B interval. From the perspective of time span, this process lasted 104 days ( the condition of "month" as a unit has been met ).

If you ask me how long it will take to accumulate, I don't know. But according to the data from the previous times, theoretically, as a "springboard", it should not need a price span as wide as 10,000 US dollars (5,000 US dollars is enough). Therefore, both C1 and C2 are likely to become the bottom ranges for consensus in the future. If it is C1, then we have to wait for the chips in C2 to be gradually digested and slowly transferred to C1 to continue to form a more solid range structure. Or a new accumulation area will be formed between C1 and C2.

Of course, this alone is not enough...