If you only see: $TON The price hit a record high of $8; the number of daily active addresses on the TON chain exceeded that of Ethereum; TON TVL exceeded $500 million, a 20-fold increase in 3 months; 100 million people are playing

@hamster_kombat…These are impressive numbers, but they are just the tip of the iceberg.

In the next six months to a year, a larger wave of TON DeFi revolution, TON NFT explosion, TON content creation revolution, and TON cross-chain ecological explosion are about to or have already quietly erupted!

The most important paths for the crypto market to capture value are, first, relying on information asymmetry, and second, predicting the market in advance. TON Roadmap is like a treasure map of the TON ecosystem, and a lot of valuable information is in it. Whether you are a developer, investor, or ordinary user of the TON ecosystem, it is recommended to pay attention in advance.

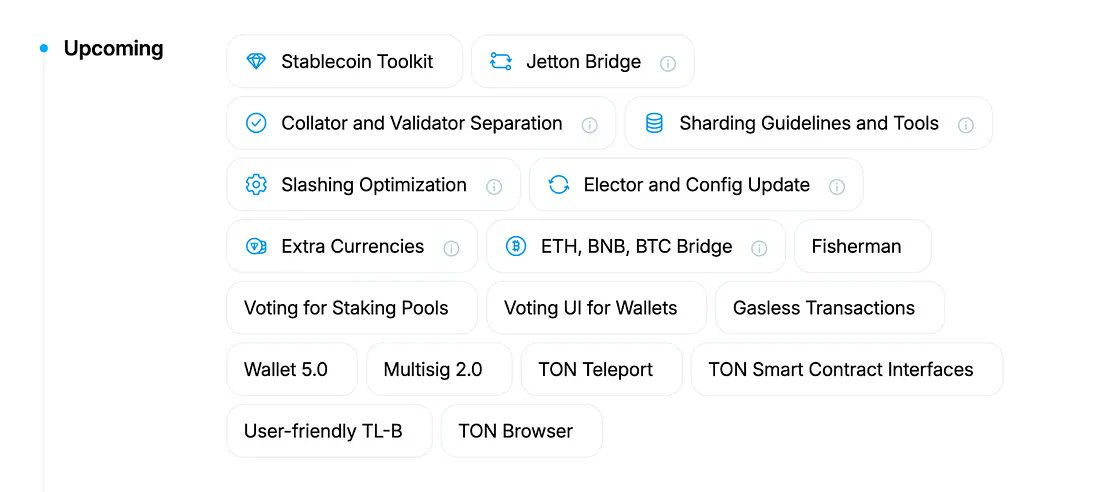

From the 2024 Roadmap officially released by TON, let’s first take a look at the “four major hot spots” of the TON ecosystem in the second half of 2024:

1. Gasless Transactions

This may be the "most eye-catching" milestone in TON's 2024 roadmap. Currently, no other mainstream chain can provide gas-free transactions.

Let's imagine:

- Increased transactions and interactions: Users will take advantage of the cost-free environment to perform more operations, whether it is transfers, transactions or smart contract interactions, which will greatly increase the transaction scale and frequency of TON.

Additionally, due to lower operating costs, developers may be incentivized to develop more DApps on TON, thereby enriching the ecosystem with diverse applications.

- Increase in microtransactions: With the removal of transaction fees, activities involving small financial transactions become economically viable. This will encourage new types of applications, such as micropayments on social platforms or micropayments for content and services.

For example, developers can create platforms for small content payments, such as a single view or listen of an article, video, or music. Users can freely post content, like, and comment without worrying about transaction fees. This may encourage more users to participate in decentralized social media platforms, increase user stickiness and engagement. If you have used content platforms such as Lens Protocol, you will definitely feel it.

For more details, please see: https://medium.com/@tonstakers/ton-roadmap-for-2024-explained-gas-defi-and-staking-f34f0bb6ecaa

2. Official cross-chain bridge (ETH, BNB, BTC)

Although TON already has a third-party cross-chain bridge, the introduction of TON's official cross-chain bridge is of great significance in terms of security, user experience, and cross-ecological connectivity.

Let's imagine:

- For those who already hold BTC, ETH, and BNB, the official bridge provides an easy way to explore the TON ecosystem. This convenience may attract users who would not otherwise consider using TON.

- By issuing major cryptocurrencies as additional currencies, TON can achieve more efficient transaction processing, because such transactions do not require smart contract calls, thereby greatly reducing transaction costs.

3. Stablecoin toolkit

On April 19, 2024, Tether announced the deployment of its stablecoin USDt in the TON blockchain and Telegram wallet. Stablecoin payments in the Telegram wallet are particularly important for individuals in developing countries, who often do not have access to banking services and have to navigate complex crypto user interfaces to store and transfer funds.

Currently, there is no explanation of the specific content of the Stablecoin toolkit except for its name. We speculate that there may be several possibilities:

- Create custom stablecoins: Users can use smart contracts to design stablecoins pegged to the value of traditional currencies such as the British pound, euro, New Zealand dollar, etc.

- Algorithmic stablecoins: Toolkits may include functionality to maintain a peg algorithmically, allowing developers to automatically adjust the supply of stablecoins based on demand or changes in the price of the pegged currency.

- Integration Tools: It can provide developers with application programming interfaces and other integration tools to seamlessly integrate these stablecoins into existing applications, improving the practicality of online markets, financial services, and cross-border transactions.

4. Staking improvement

With the upgrade of Collator and Validator Separation, both collators and pledgers will receive staking rewards, and the load and risk of each node will be effectively distributed. This is a major improvement in the TON blockchain architecture in supporting scalability.

It is essential to handle the expected influx of users on platforms such as Telegram. Imagine if there are 5, 10, or even 100 @hamster_kombat-like platforms, TON needs to maintain a robust, scalable, and secure blockchain environment. This is also the core foundation for TON to move towards massive adoption and achieve 500 million users by 2028.

Based on the above roadmap, if we expand our imagination, we predict that the TON ecosystem will have the following five major trends:

1. Black hole effect: Telegram will continue to devour the living space of upstream, midstream and downstream companies in the crypto ecosystem

WeChat started out as an instant messaging tool, but quickly expanded into a comprehensive platform that integrates social networking, payment, service subscriptions, mini-programs, and other functions. The combination of Telegram and TON is replicating this path.

- Upstream (Infrastructure and Development Platform): TON provides developers with powerful infrastructure, as well as development tools and software development kits (SDKs) to build and deploy decentralized applications (DApps), which will directly absorb a lot of L1/L2 development resources, making their already deserted development ecosystem even more deserted;

- Midstream (application layer and services): Whether it is customized stablecoin solutions, micropayment systems, and more services that rely on small and fast transactions, or through the construction of official cross-chain bridges, TON will be able to seamlessly access mainstream crypto assets (such as BTC, ETH, and BNB) to provide users with a one-stop asset management and trading platform. Telegram users can easily purchase cryptocurrencies and other financial products without switching to other applications or platforms.

- Downstream (user adoption and market expansion): Telegram's broad user base provides TON with a direct market access point, and this built-in user base is an advantage that other blockchain platforms cannot match. By establishing relationships with partners in different industries, such as financial institutions, media companies, and retailers, Telegram can integrate encryption technology into a wider range of economic activities.

After the explosion of WeChat Mini Programs, it is almost impossible to find applications without Mini Programs. In many cases, even apps do not need to be developed. In the future, all encrypted applications may use Telegram Mini Programs as the most important entrance to serve users.

Will Binance's flash exchange portal and OKX's contract copy be implemented in a simplified manner through Telegram?

2. No regulatory barriers + the fastest public chain + user flywheel effect: TON ecosystem may have no ceiling

TON can provide services globally and without barriers, without being restricted by financial regulation in a specific country or region. Moreover, as more and more users join the TON ecosystem, its value and appeal will grow exponentially.

He who controls the traffic controls the world. Telegram’s traffic monetization will be very, very objective.

As a decentralized market on the TON network, Fragment has facilitated over $350 million in sales of custom usernames and virtual phone numbers. In the near future, the 730 billion Telegram stickers that have been sent can be converted into NFTs, which will be bought and sold through the TON blockchain. This is definitely a huge blue ocean market.

By the same logic, mini apps on TON will soon give birth to a batch of Web3 projects with monthly revenues exceeding 10 million US dollars. After all, for a crypto project with 10 million DAU, it is not difficult to receive 1 US dollar from each user every month.

3. The demonstration effect of the approval of BTC/ETH spot ETFs, global financial giants may join the TON ecosystem on a large scale

As the TON platform matures and its cross-chain functions are realized, it may attract more traditional financial institutions to explore blockchain technology. For example, large banks and payment companies may consider migrating some of their services to TON or cooperating with TON to take advantage of its low cost and high efficiency to attract a new generation of financial service consumers.

If JPMorgan Chase, Goldman Sachs, PayPal, HSBC, and others announce cooperation with TON, will it soon be possible to develop loans, insurance products, investment products based on the TON blockchain, or even create stablecoins pegged to specific assets?

4. Redefine the investment logic of the primary market: tokens become a non-essential option for TON ecological encryption projects

As the TON ecosystem technology matures, the tools and services provided by the TON ecosystem will encourage developers to build solutions that truly address market needs without having to rely on token economics as the main attraction.

Projects may no longer need tokens to incentivize network participation or guarantee network security, but can rely on more mature technologies and business models; investors are increasingly paying attention to the long-term sustainability and practical application potential of projects, rather than just short-term token speculation. Moreover, projects that choose not to issue tokens may find it easier to adapt to the regulatory environment and avoid potential legal risks.

In the future, the investment analysis of TON ecosystem encryption projects will be more similar to Internet projects, and will depend on real data such as DAU/7-day retention/ARPU, etc.

Investment institutions also prefer equity (to enjoy dividend income) or equity + token warrants, and will no longer focus on details such as token unlocking, release, and allocation as important indicators for judging whether to invest in a project (in the current Web3 primary market, if a project is not listed or unlocked within the next year, it is estimated that 90% of institutions may not consider investing).