Highlights of this issue :

1. Bitcoin miners’ selling pressure is declining rapidly

2. After ETF is approved, 1 billion ether will flow into the market every month

01

X Viewpoint

1. Murphy (@Murphychen888): Analyze BTC market trends with on-chain data

We can recall that when the price of BTC fell, was there any negative voice in the market? Some people thought that the bull market was over, some thought that the price had not reached the bottom, or some thought that it was the last chance to escape… In short, it made us think that there would be a deep adjustment, and we lost confidence and handed over our chips. “The price falls when you buy, and rises when you sell” is the true portrayal of the crypto, and it is also the greatest sorrow.

But we don’t need to listen to what the market says, we need to look at what it does:

The above picture shows the realized net profit or loss of BTC, which represents the net profit or loss of all moved BTC, defined by the difference between RP (realized profit) and RL (realized loss). In a bear market, the indicator trend fluctuates downward, from overall net profit to net loss (red). In a bull market, the indicator trend fluctuates upward, gradually changing from overall net loss to net profit (green). Once in a bull market, the indicator usually does not fall below the zero axis (the red circle), and will rebound when it approaches. And every time it approaches the zero axis, the market will have the above-mentioned "noise".

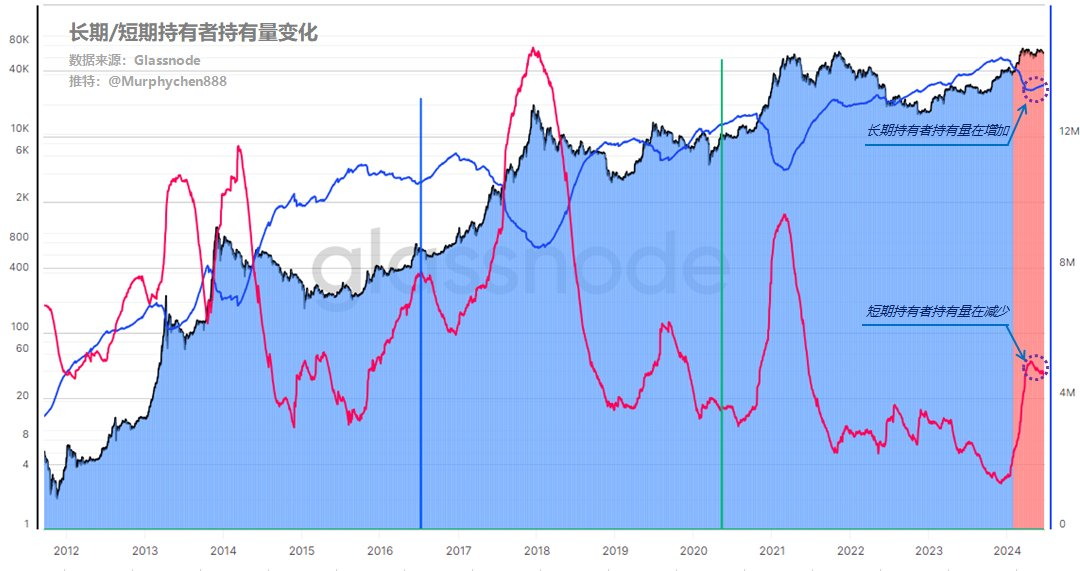

Let's see what the current long-term and short-term holders are doing. As shown in the above figure, short-term holders are constantly handing over their chips, while long-term holders are gradually accumulating chips. This is the truest manifestation of the market. You say no, but your body is very honest.

In each bull market cycle, LTH-RP will experience a round of rapid rise. This is because as the price rises, LTH continues to distribute its chips, and when the newly exchanged chips become long-term chips, LTH-RP will gradually rise. This is a sign of the bull market entering the middle and late stages. As can be seen from the above figure, this situation has not occurred in this round.

We should follow the market's behavior and trends, and do what it does, which will increase our tolerance for error.

2. Bitwu.eth (@BTW0205): Will Bitcoin become an essential reserve for future superpowers?

A look at how governments around the world are disclosing their #BTC holdings - Will Bitcoin become a must-have reserve for future superpowers?

● US Government: Holds over 213,000 #Bitcoins, valued at over $13.1 billion. Has seized and sold at least 195,091 Bitcoins, making over $366 million in profit.

● Chinese government: holds about 190,000 bitcoins, worth more than US$11.7 billion, and it is still unknown whether it has been sold or not.

● British Government: Holds approximately 61,000 bitcoins, worth over US$3.7 billion, which have not yet been sold.

● German Government: Holds approximately 46,000 bitcoins, valued at over 2.8 billion USD. There have been unusual movements before, with approximately one-fifth of the bitcoins sold.

● Ukrainian government: holds about 46,000 bitcoins, worth more than $2.8 billion. It previously announced the legalization of Bitcoin during the war and accepted donations, which should have been exchanged for airplanes and cannons.

This is only the disclosed amount, and the actual holdings may be even larger than this data. What will happen in the future?

National-level whale can create market anxiety and trigger market panic simply by their holdings and transfers between wallets.

Chuan Jianguo said that he wanted to ensure that the future of cryptocurrency and Bitcoin happened in the United States. The law determines that more wealthy people, institutions and even countries will have to buy and store Bitcoin in the future, and #BTC will become an important reserve for regulating the new financial market.

Again: remember, no matter what, please convert half of your #Crypto funds into Bitcoin when the time is right. One day, you will thank me for my advice!

3. @Bankless: Don’t rush the SOL ETF

VanEck’s SOL ETF filing marks a major step forward for the asset and the industry as a whole. Positioning SOL as a commodity puts the SEC on the defensive, as it previously classified SOL as a security. But it’s important not to rush things — we’re still waiting for an ETH ETF — so in the best-case scenario, it may be a while before we see Solana hit the stock market. That being said, the race is on, and hopefully with another stakeable asset filing for an ETF, it will provide the SEC with more motivation to clarify how exactly staking impacts asset classification.

02

On-chain data

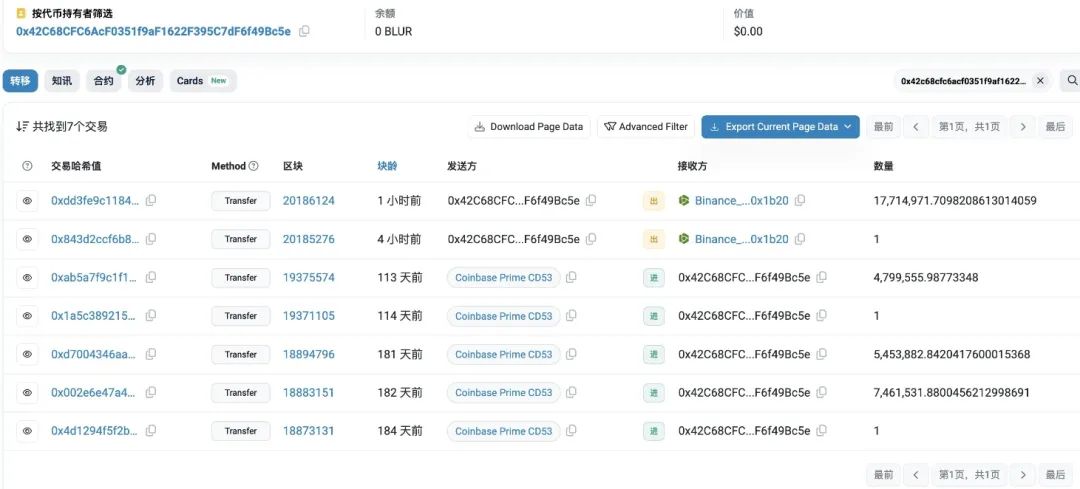

Embers: A whale may be selling BLUR

An address transferred 17.71 million $BLUR ($3.71M) to Binance 1 hour ago. These BLUR were withdrawn from Coinbase Prime at the end of last year and early March this year, and were worth $9.48M (with an average withdrawal price of $0.535). Now it is only worth $3.71M, a loss of $5.77M (-61%).

03

Sector Interpretation

According to Coinmarketcap data, the top five currencies in terms of 24-hour popularity are: Smidge, NOT, BTC, STRUMP, PEPE. According to Coingecko data, in the crypto market, the top five sectors with the highest growth are: Base ecology, Doggone Doggerel, Memes, Real Estate, and Berachain ecology.

Focus: How much will the Mt.Gox compensation drop BTC to? Can the crypto market still stage a five-year-old, six-year-old, seven-year-old comeback?

This is the first time that Mt.Gox has repaid in the form of BTC and BCH. The 141,686 BTC (and a similar amount of BCH) it holds account for 0.72% of the total supply of Bitcoin in circulation, worth about $8.54 billion. From the numbers, the selling pressure is huge, but how much impact will it have? Let's analyze it from the perspective of data comparison.

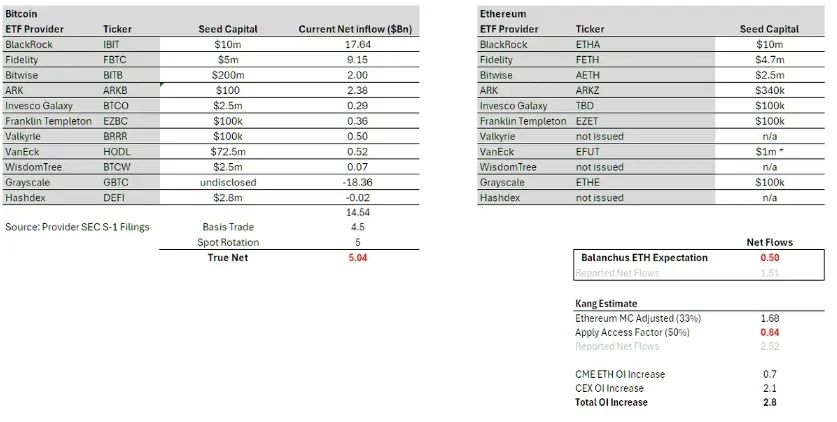

Andrew Kang, co-founder of Mechanism Capital, previously estimated the amount of BTC funds inflows from this round of institutional holdings in an article. Andrew Kang believes that overall, Bitcoin spot ETFs have now accumulated more than $50 billion in AUM (asset management scale). This is a very optimistic number. However, if the capital flow related to GBTC is stripped out, you will find that the net inflow will be reduced to $14.5 billion after calculation. In fact, this number still needs to be further reduced because it still includes many "delta neutral" transactions, especially some "basis trades" (such as buying ETFs while selling futures) and "spot rotations" (i.e. selling spot and buying ETFs). According to CME data and analysis of ETF holders, about $4.5 billion of capital inflows are related to "basis trades"; in addition, some ETF experts have pointed out that large institutions such as BlockOne have carried out huge "spot rotation" operations, and the scale of such transactions is expected to be about $5 billion. Excluding these “delta neutral” trades, we can infer that the actual net inflows into Bitcoin spot ETFs were approximately $5 billion.

In the early morning of January 11th, Beijing time, the U.S. Securities and Exchange Commission (SEC) approved the Bitcoin spot ETF for the first time in history, authorizing 11 ETFs to start trading on Thursday. After the announcement, the price of Bitcoin soared by more than $2,000 and re-entered the $47,000 mark. Subsequently, under the pressure of profit-taking, Bitcoin fell back to around $43,000. After a period of consolidation, BTC started another round of sharp rise, breaking through $70,000.

This means that the US Wall Street institutions may use about $5 billion to push the price of Bitcoin from $43,000 to around $70,000. At present, the BTC compensation value of Mt.Gox is as high as $8.5 billion. If about half of the BTC is sold to the market, the price of BTC will most likely fall to around $47,000.

There is a view in the market that the creditors of this batch of BTC are all old OGs, and the selling pressure may be relatively controllable. But in fact, in 2014, there were many speculators involved in Bitcoin trading, and this article believes that the 80/20 rule is universal. Many people cannot change their speculative mentality by staying long enough. The author has also seen that many old people in the crypto finally gained bleakly, and it is common to come and go during this period. Therefore, when a huge fortune comes, the selling pressure may even exceed 50%, and it will be even more terrible if there is panic selling and serial liquidation.

04

Macro Analysis

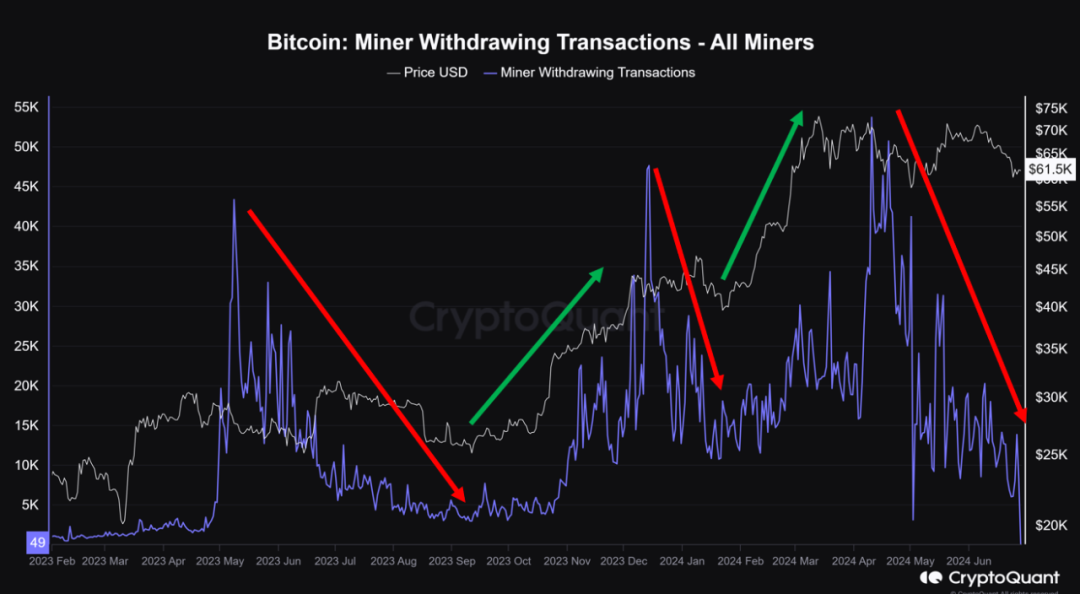

@DanCoinInvestor: Bitcoin miners’ selling pressure is declining

One of the whales that has been causing the cryptocurrency market to fall recently is miners.

After the Bitcoin halving, the mining reward is halved, so older models of mining machines are no longer used because they are no longer cost-effective. As a result, mining activity decreases and miners begin selling Bitcoin on OTC exchanges to cover mining operating costs.

The current market can be seen as being in the process of digesting this sell-off, and fortunately, the volume and amount of Bitcoin sent out by Bitcoin miners from their wallets has been decreasing rapidly as of late.

In other words, selling pressure from miners is waning, and if all their selling volume is absorbed, it could create a situation where an upward rally can be sustained again.

The cryptocurrency market is expected to see a positive trend in the third quarter of 2024.

@Abiodun Oladokun: Once approved, will ETH break 10,000 by the end of the year?

Several exchange-traded funds (ETFs) tracking the spot price of Ethereum (ETH) are expected to begin trading in the first week of July, having been approved in May. Senior ETF analyst Eric Balchunas noted in a recent X post that a spot Ethereum ETF could go live as early as July 2. Another Reuters report said the U.S. Securities and Exchange Commission (SEC) could approve it by July 4.

As the market awaits the launch of these new funds, the expectation is that the leading Altcoin will react in the same way that Bitcoin (BTC) did when the spot Bitcoin ETF launched earlier this year.

Just like Bitcoin in January, when the spot Ethereum ETF launches, there will be a massive influx of funds into the currency.

In a recent analysis, financial services provider Citi found that spot Bitcoin ETFs saw net inflows of more than $13 billion from January 4 (when they launched) to May 20.

These inflows caused BTC’s price to surge, climbing to an all-time high of $73,750 by March 14. According to Citi, for every $1 billion in inflows, the leading crypto asset’s value rose by 6%.

The bank estimates that if investors apply similar market-cap-adjusted flows to Ethereum, inflows could reach between $3.8 billion and $4.5 billion after the ETF launch. This could result in a 23-28% price increase for ETH.

At its current price of $3,450, a 28% gain would mean ETH would be trading at $4,417 by November. Interestingly, this would still be below its all-time high of $4,891 reached in November 2021.

Others believe that the launch of a spot Ethereum ETF will push the token price to $10,000 by the end of the year. Andrey Stoychev, head of top brokerage at Nexo, stated this in a recent interview. According to him:

“An ETH ETF in the U.S. and similar products in Asia could be the driving force behind the asset reaching $10,000 by the end of 2024, matching Bitcoin’s post-ETF performance.”

05

Research Reports

Galaxy: Ethereum ETF potential inflows to $1 billion per month

1. In the first five months after the ETF was launched, the monthly inflow was about $1 billion

Referring to the situation of Bitcoin ETP, we can roughly estimate the market's potential demand for Ethereum ETP.

Relative size of BTC and ETH ETP markets

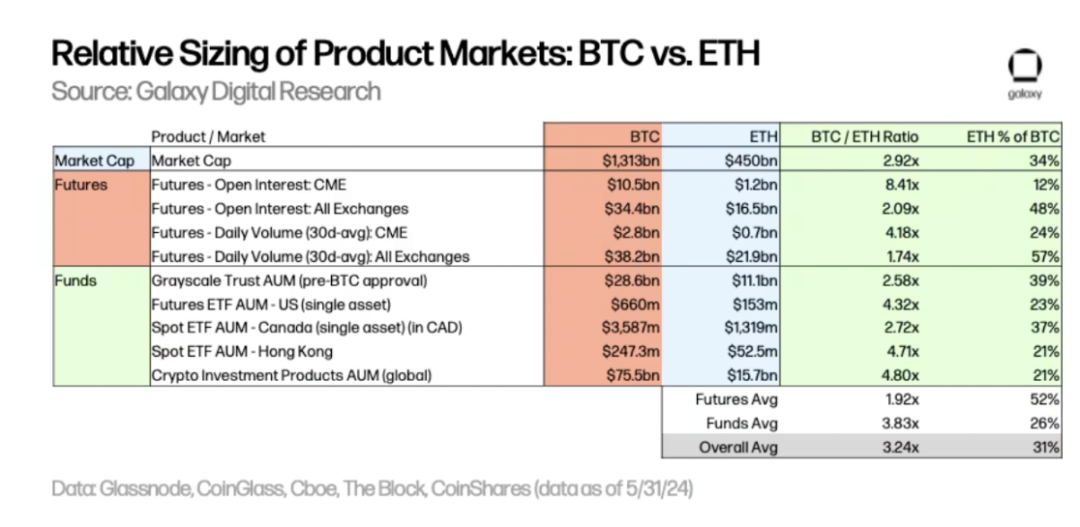

To estimate the potential inflows into an Ethereum ETF, we applied a BTC/ETH multiple to US Bitcoin spot ETF inflows based on the relative asset sizes of multiple markets where BTC and ETH trade. As of May 31:

● BTC’s market capitalization is 2.9 times that of ETH.

● Across all exchanges, BTC’s futures market is about 2x larger than ETH’s based on open interest levels and trading volume. Specifically for CME, BTC’s open interest is 8.4x that of ETH, while BTC’s daily trading volume is 4.2x that of ETH.

● The AUM of various existing funds (broken down by Grayscale Trust, futures, spot, and selected global markets) shows that BTC funds are 2.6x – 5.3x the size of ETH funds.

Based on the above, we believe that the inflow of Ethereum spot ETF will be about 1/3 of the inflow of Bitcoin spot ETF (estimated range 20%-50%).

Applying this data to the $15 billion in Bitcoin spot ETF inflows prior to June 15th implies monthly inflows of around $1 billion in the first five months following the Ethereum ETF’s launch (estimated range: $600 million to $1.5 billion per month).

US Spot Ethereum ETF Inflow Estimation

We are seeing some valuations below our forecasts due to several factors. That being said, our previous report forecasted first-year Bitcoin ETF inflows of $14 billion, assuming the entry of wealth management platforms, but Bitcoin ETFs have seen significant inflows before these platforms entered. Therefore, we recommend caution when predicting low demand for Ethereum ETFs.

2. Some structural/market differences between BTC and ETH will affect ETF flows:

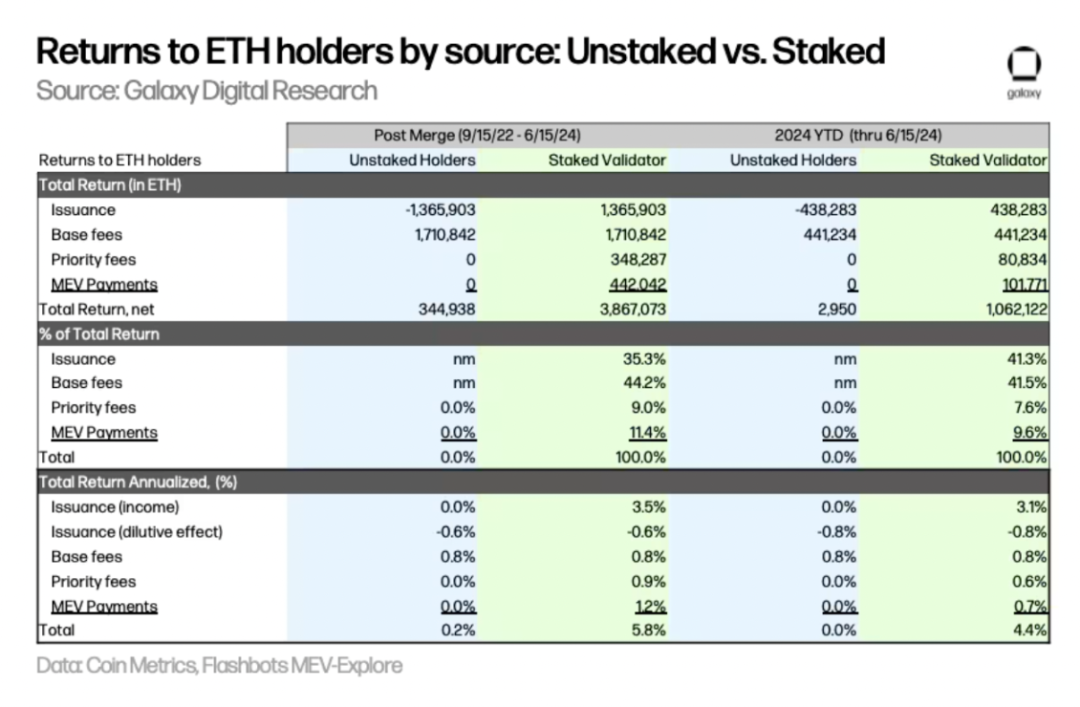

Due to the lack of staking rewards, demand for spot Ethereum ETFs may be affected. Unstaked ETH has the opportunity cost of forgoing (i) inflation rewards paid to validators, (ii) priority fees paid to validators, and MEV income paid to validators via relayers. Based on data from September 15, 2022 to June 15, 2024, we estimate the annualized opportunity cost of forgoing staking rewards to be 5.6% for spot ETH holders (4.4% using year-to-date data), which is a significant difference. This would make spot Ethereum ETFs less attractive to potential buyers. Note that ETPs offered outside the United States (such as Canada) provide holders with additional yield through staking.

Sources of income for unstaked and staked ETH holders

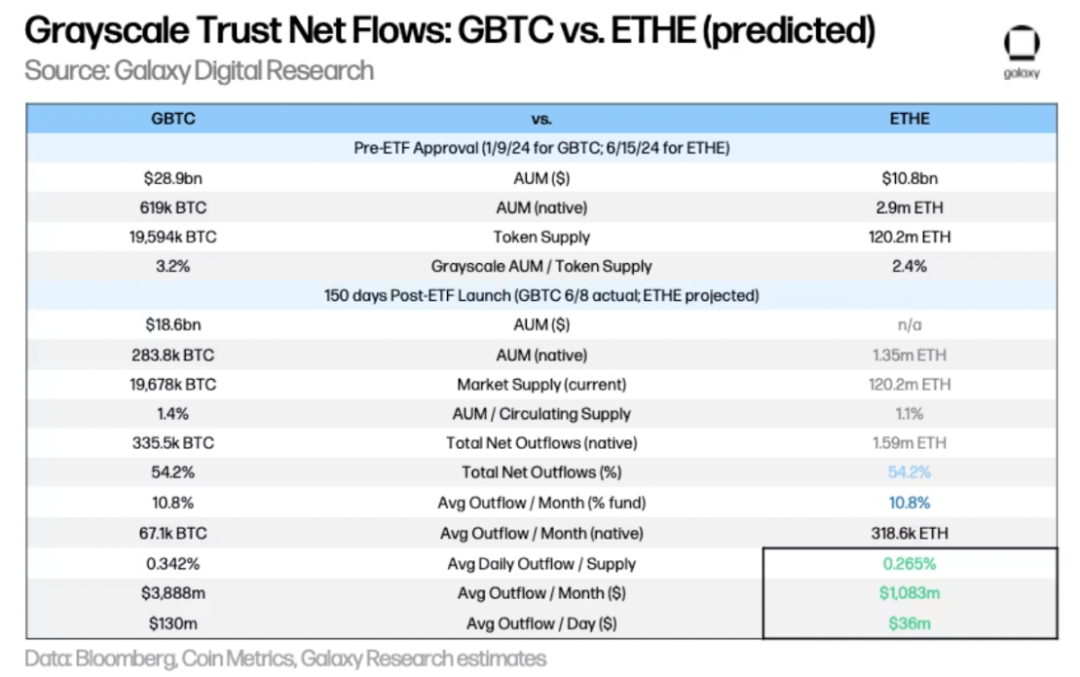

3. Grayscale’s ETHE could drag down Ethereum ETF inflows

Just as the GBTC Grayscale Trust experienced significant outflows in its ETF conversion, the ETHE Grayscale Trust conversion to an ETF will also result in outflows. Assuming that the outflow rate of ETHE matches the outflow rate of GBTC in the first 150 days (i.e., 54.2% of the trust supply is withdrawn), we estimate that ETHE's outflows will be approximately 319,000 ETH per month, which will reach $1.1 billion per month or $36 million per day at the current price of $3,400. Note that the percentage of tokens held by these trusts as a percentage of their respective total supply is: BTC 3.2% and ETH 2.4%. This suggests that the ETHE ETF conversion will put less pressure on the price of ETH than GBTC. In addition, unlike GBTC, ETHE will not face forced sales due to bankruptcy cases (such as 3AC or Genesis), which further supports the view that the selling pressure associated with the Grayscale Trust will be relatively less than that of BTC.

GBTC and ETHE (forecasted) net flows

4. Basis trading may be driving hedge fund demand for Bitcoin ETFs

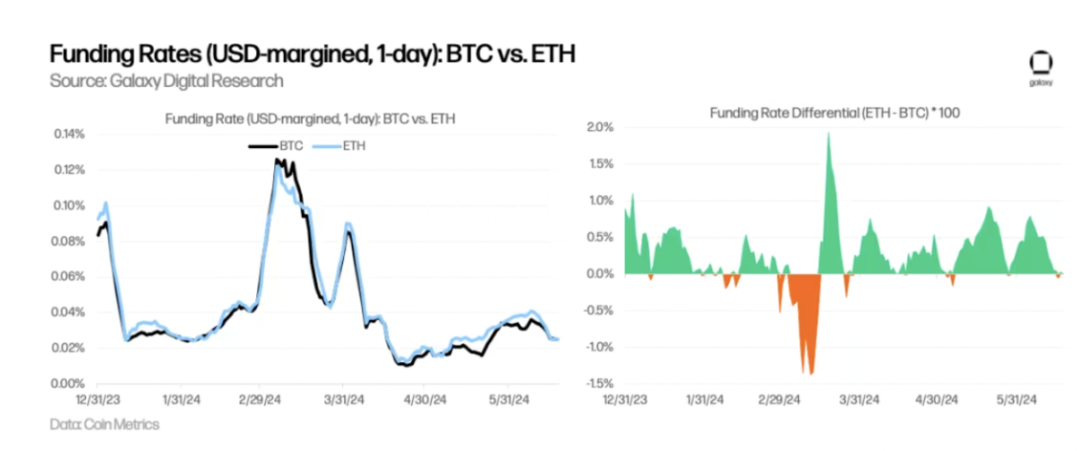

Basis trading may have driven demand for Bitcoin ETFs from hedge funds that want to arbitrage the difference between Bitcoin spot and futures prices. As mentioned earlier, 13F filings show that as of March 31, 2024, more than 900 U.S. investment firms held Bitcoin ETFs, including some well-known hedge funds such as Millennium and Schonfeld. Throughout 2024, ETH's funding rate on exchanges averaged higher than BTC, indicating that (i) there is relatively large demand for long ETH and (ii) a spot Ethereum ETF may bring more demand from hedge funds that take advantage of basis trading.

Funding rates for BTC and ETH