Author: Binance Research Source: binance Translation: Shan Ouba, Jinse Finance

Key Takeaways

Stock and cryptocurrency markets have experienced significant volatility in recent days. Macroeconomic, political, geopolitical, and cryptocurrency-specific factors are the main factors.

Despite these challenges, we do not believe this indicates a long-term negative trend for the cryptocurrency market. We highlight some indicators worth watching in the second half of this report.

Market downturn

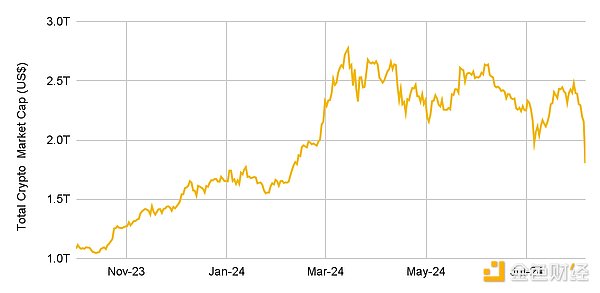

The past 24 hours have been challenging for the cryptocurrency markets, with most major coins seeing double-digit declines across the board. During the same period, the total cryptocurrency market cap has fallen by nearly 20% from $2.16 trillion to $1.76 trillion. This recent plunge is the latest chapter in a broader downward trend that began on Monday, July 29. Since then, the total market cap has fallen from $2.48 trillion to current levels, a 28% drop in a week.

Figure 1: After more than 5 months of range-bound trading, the total cryptocurrency market cap plunged 28% in a week

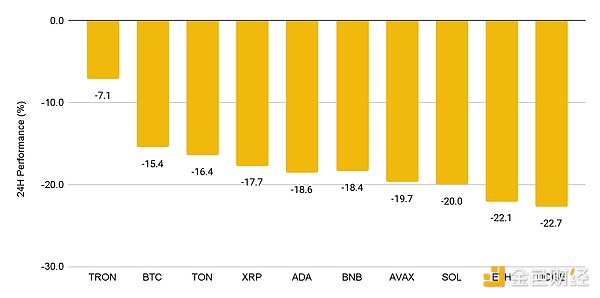

Looking at the performance of the top tokens by market cap, one trend is clear: no token has been immune to the recent decline. Among the top 10 non-stablecoin, non-derivative assets, DOGE had the worst 24-hour performance, down 22.7%. Conversely, TRON had the strongest performance, down 7.1% on the day.

Figure 2: Among the top 10 assets by market cap, DOGE has the largest 24-hour drop of 22.7%

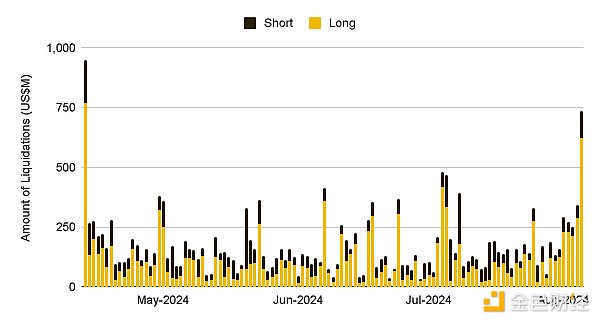

The drop in token prices also triggered massive liquidations. On August 5, traders on major exchanges experienced more than $819 million in liquidations (about $688 million long and $131 million short), the largest single-day liquidation volume since April 13, 2024.

Figure 3: On August 5, traders on major exchanges experienced over $819 million in liquidations

Drivers of market weakness

Several factors could contribute to the market weakness. We summarize some of the key drivers in the next section.

1. Macroeconomic weakness and spillover effects

Global stock market indices have fallen sharply over the past few trading days. Concerns about a hard landing for the US economy and a sharp drop in Tokyo stocks have kept investors on high alert. Risk aversion has spread to the cryptocurrency market, with investors taking a cautious approach and withdrawing their holdings.

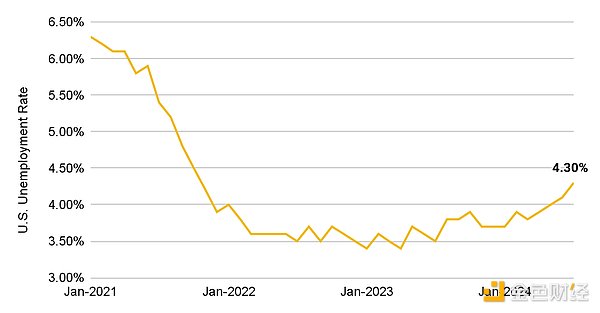

Weaker-than-expected employment data released last Friday sparked fears of a U.S. recession. The unemployment rate rose to 4.3%, the highest level since October 2021, and job growth in June was lower than expected (nonfarm payrolls increased by 114,000, compared with an expected 175,000). This triggered a broad sell-off in U.S. stocks, with the Nasdaq becoming the first major U.S. stock benchmark to enter correction territory, down more than 10% from its all-time high. Overall, the poor data raised concerns among investors that the Federal Reserve might be too slow to cut interest rates to avoid a recession.

Figure 4: U.S. unemployment rate rises to highest level since October 2021

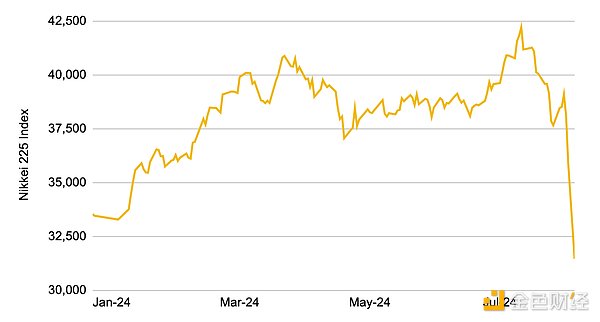

Asian stocks suffered a similar plunge, with the MSCI Asia Pacific Index falling 6.7%, erasing most of its gains for the year. Notably, Japan's stock market became the center of the sell-off after entering a bear market, with the Nikkei 225 index plunging 12.4% on Monday, its biggest one-day drop since 1987.

Figure 5: The Nikkei 225 Index fell 12.4% in a single day, the worst performance since "Black Monday" in 1987

Tokyo stocks were hurt by stronger currencies, as the yen has appreciated about 12% since mid-July. This comes after the Bank of Japan raised interest rates, which effectively caused a lot of pain for investors engaged in the "carry trade" strategy (borrowing yen at a lower interest rate and then reinvesting the proceeds in a currency with a higher return, such as the dollar). The stronger yen also led to selling pressure from the aforementioned investors to repay their yen debts, a factor that contributed to the decline in U.S. stock prices.

Figure 6: The Yen Has Appreciated Nearly 12% Against the U.S. Dollar Since Mid-July.

2. Resistance from the United States

In political news, U.S. Vice President Kamala Harris is gaining ground among voters as a potential candidate for the upcoming U.S. election. Decentralized prediction platform Polymarket currently predicts a 44% chance of Harris winning, up from about 30% when incumbent President Biden dropped out and endorsed her as his successor. Harris has yet to live up to Trump's recent pro-cryptocurrency rhetoric. This could be a factor that worries investors.

In addition, the latest filings show that Warren Buffett's Berkshire Hathaway sold nearly half of its Apple shares and other stocks last quarter, bringing its cash reserves to a record $276.9 billion. The "Oracle of Omaha"'s decision to increase cash holdings may make some investors concerned about the future price trend of stocks, especially technology and growth stocks.

3. Geopolitical tensions

Tensions in the Middle East appear to be rising, with the conflict between Iran and Israel in the spotlight.

Market participants will no doubt be concerned about the macroeconomic and geopolitical impacts the standoff could have. Shares of defense manufacturer Lockheed Martin are said to have risen about 20% over the past month as investors anticipate further escalation in tensions.

Growing fears and geopolitical uncertainty could prompt investors to remain cautious on risky assets, further contributing to the market downturn.

4. Large-scale on-chain transactions

In addition to the above-mentioned, mostly macroeconomic and political factors, there are also some cryptocurrency-related tensions in the market.

Reports are circulating that Jump Crypto, the cryptocurrency arm of Jump Trading, is in the process of liquidating many of its positions, especially ETH. There have been rumors that Jump may be exiting the crypto market making business, and as such has been slowly unwinding its positions. While these rumors have yet to be confirmed, their on-chain wallets (marked by Arkham) show a lot of activity, including the sale of around $300 million in staked ETH from just one wallet.

The performance of the US spot ETH ETF has also been relatively flat since its launch, with only three trading days out of nine trading days seeing inflows and a total net outflow of US$511 million.

Given Jump Crypto’s size and market influence, these factors may have exacerbated market volatility, especially news about Jump Crypto. Since these news are also centered around ETH, they may also have caused ETH to underperform relative to other major tokens.

With stocks falling sharply and economic data coming in weaker than expected, attention is focused on the next monetary policy decision in the United States. Markets are currently pricing in multiple rate cuts for the rest of the year, including a possible 0.50% cut in September, a dynamic that is a sharp departure from expectations at the Fed meeting in July. In addition, bond market data shows that more and more traders are betting on an emergency rate cut, with a 60% chance of a quarter-point cut as early as next week. Regardless, sentiment towards risky assets such as stocks and cryptocurrencies is likely to remain fragile as markets anticipate an imminent rate cut and weigh the prospect of a soft landing and recession in the United States.

Outlook and Conclusion

Asset prices in both traditional and crypto markets have seen rapid, painful and massive declines. As we are still in the early stages of this market crash, we expect continued market volatility. We will continue to monitor the following:

Stock Market Performance: The correlation between global stock market indices and the cryptocurrency market has increased. If global financial market conditions do not recover, it may be difficult for crypto assets to make a comeback. Similarly, a stronger stock market is good for risk assets such as cryptocurrencies.

Central Bank Policy: The next Fed policy meeting is scheduled for September, but it will be interesting to watch how much the Fed will cut. The likelihood of a 0.50% rate cut has increased in recent days (rather than a 0.25%). Some market participants are also speculating that the Fed could hold an emergency meeting before September.

On-chain movements of whale: Large players have the power to move the market. Any purchase or sale can have a considerable impact on the price and can also be an indicator of their view on the market.