The CPI data was released last night. The previous value was 2.9%, the expected value was 2.6%, and the announced value was 2.5% , which was lower than expected. In theory, it is a big positive! At present, the biggest consensus for the Fed's interest rate cut on September 18 is 25 basis points. A few days ago, I saw a 24% probability of betting 50 basis points on the betting website over the weekend, but yesterday it was only 9%, leaving a 90% probability of 25 basis points.

Biden and Harris have reached some compromises on energy issues. Trump actively supports electric vehicles, and Harris has a major change in his attitude towards the traditional oil industry. Harris has also begun to support the development of shale oil. The consensus of both sides is to lower US oil prices.

No matter which side comes to power, it is not good news for oil prices, but it is good news for the crypto!

In the market, after the release of CPI data yesterday, the price fell all the way to US$55,545 and then quickly rebounded to cover the losses. Today, the highest point during the day has reached around US$58,500.

The market is still dominated by shocks, and it is considered a rebound before it breaks through 62000. The short-term pressure level is around 59200, the extreme pressure can be seen around 60500, and the bottom support is around 54800.

Bitcoin's recent surge and plunge is a normal phenomenon

There are two main reasons: one is the uncertainty of US policies. The other is the instability of the current economy , which may cause a hard landing at any time. It is normal to have a big drop or a big rise and a liquidation. Just survive and don't worry too much about other things. Waiting for the results of the 9.18 interest rate cut to be announced, the opportunity is coming!

Reversal or rebound? Let me take a look at the chain analysis

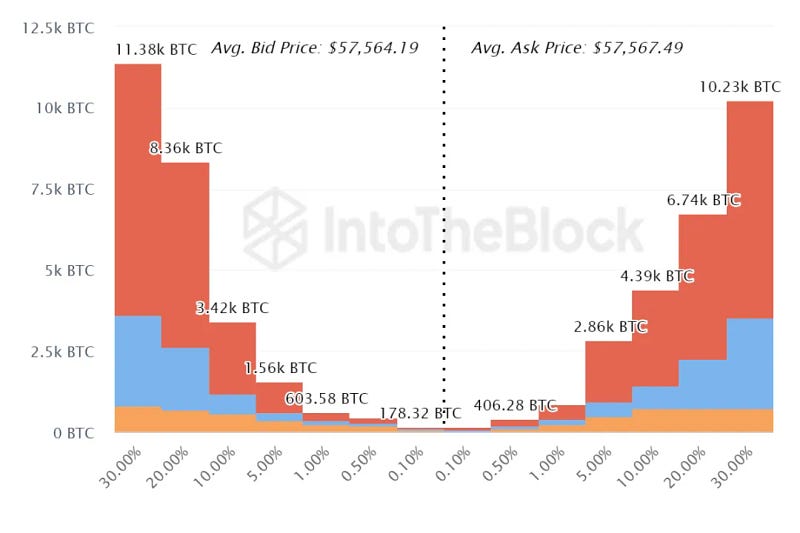

Global inflow/outflow data, which translates investors' average cost into various sectors, reminds us how difficult it is to maintain the $61,335 to $72,500 range during a long period of consolidation. The lack of buyers may cause investors who bought at high levels to give up and sell more shares. Support in the long term is below the $56,000 threshold, which is $49,795.

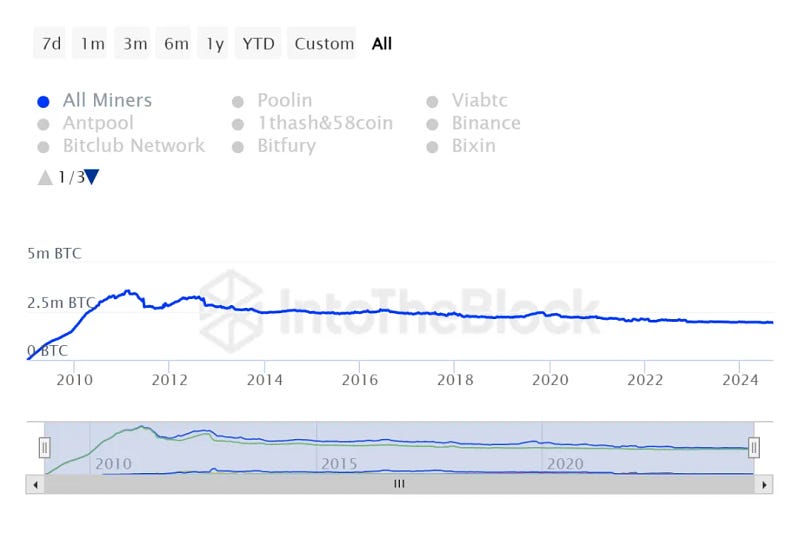

The already recovered miner reserves are falling again. They are down 1.08% in the last 7 days. Considering that it fell from 1.97 million to 1.91 million, this is a pretty big number.

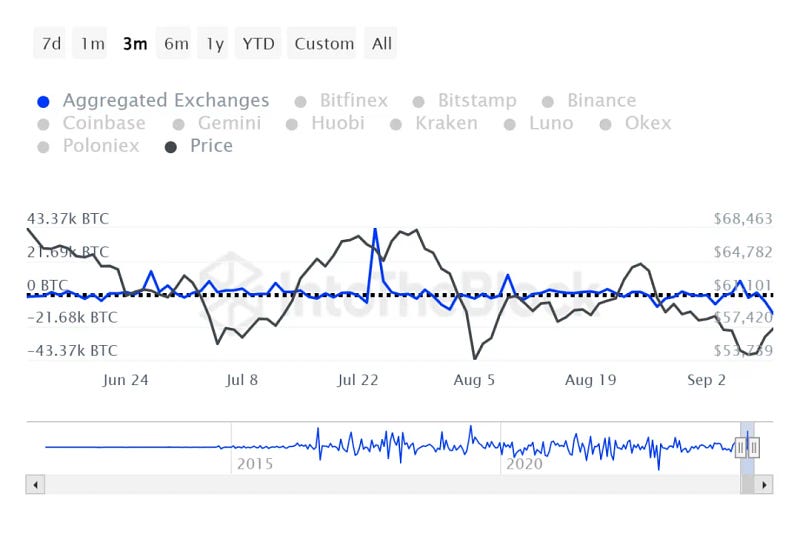

Although the stock market had a positive net inflow on September 6, it was still below neutral. Looking at the 30-day period, exchanges saw a net outflow of 9,600 BTC.

As shown in the chart below, selling liquidity is much stronger on centralized exchanges. In 5% of the market segments, sales are more dominant than buyers. This suggests that every rise is evaluated as a sell-off by investors, a fact that may continue for some time.

Summary: Combining the market trend and on-chain data analysis, large investors do not seem to be so interested in Bitcoin in the current price range, that is, there is a lack of large funds buying. Compared with the strong V-shaped rebound and bull market after the previous rounds of plunges, it is obvious that this price has not attracted large investors. In my personal opinion, I think that the current short-term is just a rebound after a decline and not a reversal!

But there is no need to worry too much, in the long run, the crypto market will definitely rise!

Personally, I expect that the conditions for the U.S. stock market and crypto to resume their upward trend will be: multiple rounds of interest rate cuts (market liquidity will increase significantly) + stabilization and growth of the U.S. economy (employment, GDP and other data need to improve after the interest rate cuts, thereby increasing the risk appetite of hedge funds and money market funds) + a continued wave of AI investment (M7's performance maintains rapid growth). It is predicted that this will start at the end of the fourth quarter of 2024 and the first quarter of 2025.

If you have been chasing ups and downs, often being trapped, and have no latest news in the crypto and no direction, please scan the QR code below. I will try my best to answer any questions you have recently. If you are confused about the future, I will share the strategy layout with the small circle! You are welcome to join us to grasp the next hot spot and maximize the return on investment together!

This is the end of the article. I will do a more detailed analysis in the communication group. If you want to join my circle, please contact me directly through the WeChat below!