Author | Samuel QIN, OKG Research

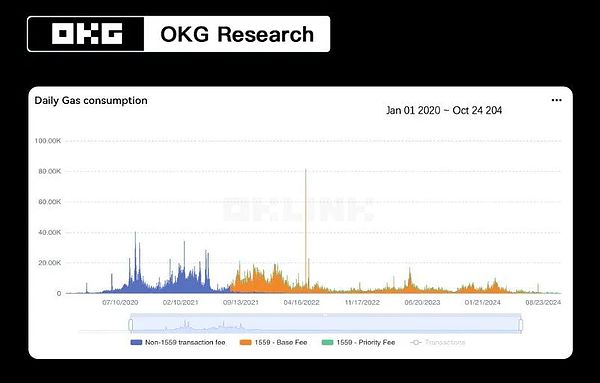

"What's wrong with Ethereum?" This topic has been frequently mentioned in recent industry activities, and there are also many short-selling voices in the market. Ethereum, from the cradle of crypto innovation applications to the saline-alkali land, seems to be separating from the industry hotspots and past value. From the glorious DeFi Summer period, the Ethereum scaling problem has always been a shadow, with the increasingly obvious problems of high transaction fees and congestion, which have put urgent demand on the scalability of public chains.

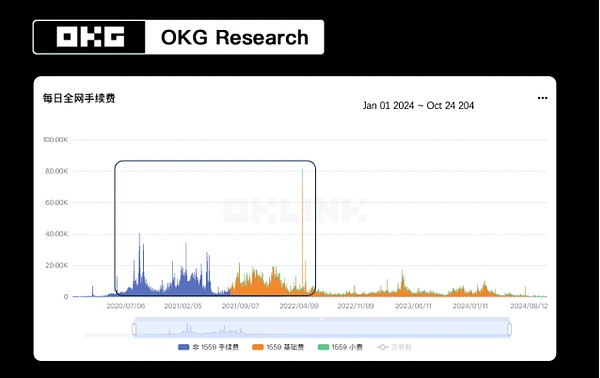

*OKG Research, Data source: Ethereum Gas Consumption from 200101~241024 from https://www.oklink.com/data/

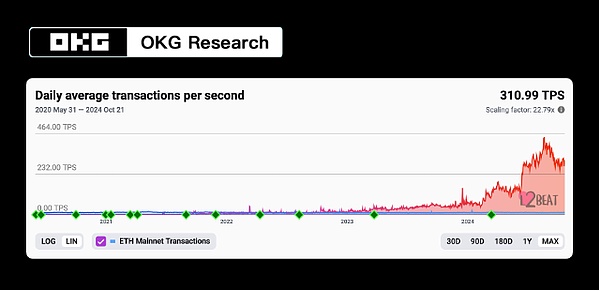

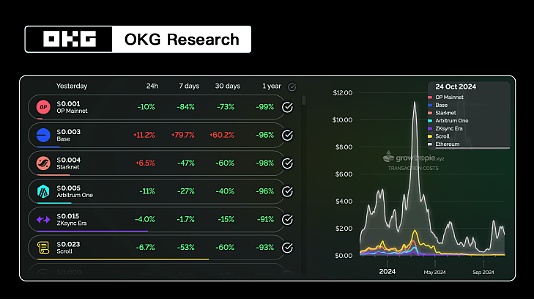

Since the two major scaling camps of OP and ZK around Ethereum have all appeared, relying on the Ethereum mainnet to ensure their own security, from the current data of several major Layer2 public chains, the TPS has been significantly improved, and the L2 transaction fees have dropped significantly.

*OKG Research, Data Source: https://l2beat.com/scaling/activity

*OKG Research, Graph Source: https://www.growthepie.xyz/fundamentals/transaction-costs

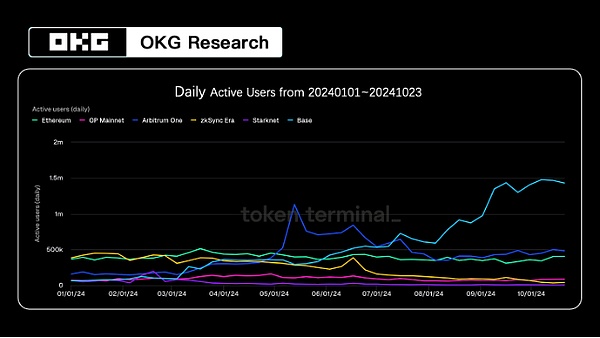

But the two mainstream scaling routes have not really driven a large-scale increase in Ethereum users, with daily active users remaining stable from 2021 to 2024. On the contrary, relying on L2 has also exacerbated the further dispersion of liquidity, and the users of the Ethereum ecosystem have become further separated. Some L2s have absorbed more ecosystem users under the boost of specific tracks, and the competition with the mainnet is becoming more and more obvious.

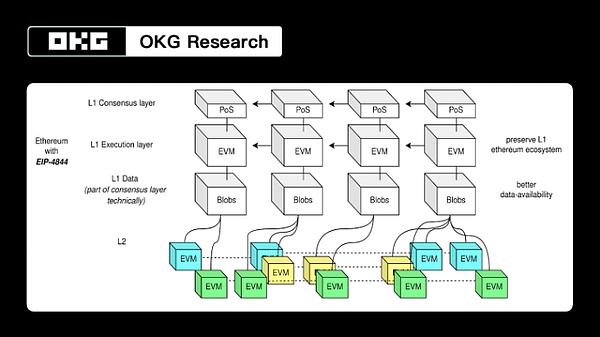

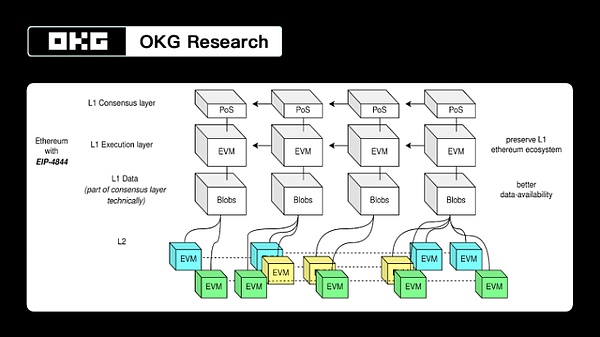

OKG Research, Data Source: https://tokenterminal.com/ Active Users from 240101~241031

This competition has also intensified the interest relationship between L2 and the mainnet. Before the deployment of EIP 4844, L2 needs to send transaction data to the mainnet in the form of call data for permanent storage, and needs to pay a high gas fee to Ethereum. This part accounts for about 70-80% of the entire L2 payment fee. After the launch of EIP 4844, the transaction data only needs to be placed in the block-carrying blob, and can be automatically deleted after a period of verification, greatly reducing the storage cost.

*OKG Research, Graph from https://hackmd.io/@luozhu/SyleCcpti

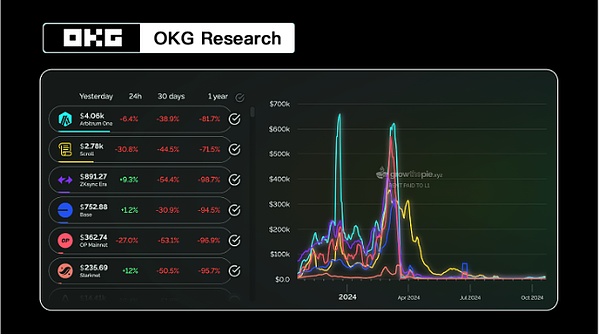

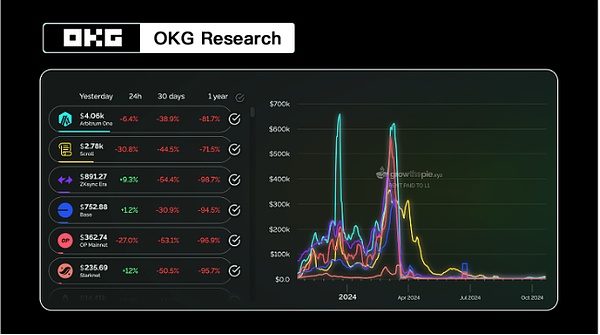

From the chart of Rent Paid to L1, it can also be found that the fees paid by L2 to Ethereum show a significant downward trend, and at the same time, since L2 has taken on the role of transaction execution, the MEV revenue cannot be transmitted to the mainnet, so the staking rights of the mainnet PoS will obviously be weakened by the reduction in fees.

*OKG Research, Data Source: http://growthepie.xyz Rent Paid to L1

In addition, in terms of transaction finality, the interoperability between different types of L2 is very weak, and interaction often needs to be achieved through the Ethereum mainnet, which makes the friction cost of user cross-chain interaction remain high, and the user experience is also relatively limited.

This seems to have lost the original vision of using L2 to achieve the integration of Ethereum expansion, and instead has exacerbated the separation between L2s. Although there have been significant improvements in scalability and transaction fees, the liquidity of the L2 network is fragmented into multiple sub-networks, and the friction cost for users to transfer funds between different L2s is high. Various L2s need to copy and paste the existing narratives and applications of Ethereum, lacking truly "breakthrough" new tracks, which limits their ability to attract new user groups with distinctive applications.

While new public chains can avoid this situation in the design of their own technical architecture. Compared to the existing L2 solutions, new L1 public chains, through their unique consensus mechanisms, modular designs, and optimizations for user experience, can better solve the performance bottlenecks currently faced by public chains, such as Aptos and Sui.

These Layer 1 public chains, through their unique consensus algorithms and high-performance node networks, not only show stronger capabilities in scalability, but also have cheaper on-chain interaction costs, and also try to attract users scattered in different public chain ecosystems through high cross-chain compatibility, supporting more application scenarios. Especially for consumer-level applications, they try to integrate more diverse consumer-level application scenarios rather than just financial scenarios. These new features will help promote the popularization of blockchain technology and drive more industry participation.

However, new L1s need to quickly establish their own developer communities and user bases, which often requires a lot of marketing and incentive measures, increasing the initial cost. They also face the pressure of building developer ecosystems and user communities, and need to balance on-chain performance, decentralization, and security levels, such as downtime and block production stoppages, which are also engineering tests they need to face.

With the competitive development of L2 and new L1 public chains, accelerating the expansion of the public chain ecosystem, users are urgently in need of an aggregated "portal" to quickly access the Web3 network, but as mentioned earlier, the technical architectures adopted by different chains are not the same, and they need strong technical backgrounds to provide technical analysis and access services for different chains.

In the future, cross-chain migration and aggregation will become the norm in the blockchain industry, and users will be able to get better interaction experience and transaction security in more choices.

As a chain-based world built on data, multi-chain browsers are an important tool for industry participants to gain insight into the on-chain world, which will need to encompass different dimensions of industry participants such as project parties, developers, and end-users. But the monetization methods of general ecosystem browsers are limited, to a certain extent depending on the support of the ecosystem foundation, and the ecosystem positioning also determines that general ecosystem browsers are often in the form of a single chain. Ecosystem browsers can help users delve vertically to a certain extent, but with the increase in the number of public chains, the lack of platforms that can horizontally aggregate multi-chain data is obviously unable to meet the current user needs.

Looking at the current multi-chain browsers, the presentation form is also more inclined to individual display, and users cannot intelligently locate which public chain through a simple address search, which leads to the fragmentation of on-chain data presentation and the inability to aggregate relevant information through a unified platform. The friction cost of switching also requires users to synchronize account information distributed on various platforms, unable to accurately aggregate the dispersed on-chain information.

At the same time, highly modular technical architectures customized for mainstream public chain ecosystems (EVM-compatible chains, Cosmos ecosystem chains, UTXO, etc.); combined with user needs and market hotspots, more customized heterogeneous chain access is also what users urgently need. But considering the technical cost of public chain access, there is also a certain primary and secondary relationship between different chain data.

The aggregated multi-chain browser represented by OKX Web3 Explorer is trying to aggregate multi-chain information, combining its own positioning with the joint development of various ecosystem, equally open access to various types of public chains, allowing users to access data of 50+ public chains through the same account and portal, greatly reducing the burden on users in terms of multi-chain information aggregation.

The integrated entry is also the best way to widely reach active users, and by providing users with basic information of various chains, it can to some extent stimulate users' curiosity and promote users to try switching to diverse public chain ecosystems, promoting the integration of liquidity and ecosystem applications in different ecosystems.

In the long run, the trend of multi-chain integration will promote the technological progress and application expansion of the blockchain industry, and drive the development of an open and collaborative ecosystem. This not only provides convenience for users' exploration in Web3, but also lays a solid foundation for a more open and inclusive on-chain world as a whole.